USD/JPY: What’s Really Going On Behind the Market Moves?

Why the recent swings are less about charts and more about strategy.If you’ve been watching USD/JPY recently, you’ll have noticed something unusual. After months of a relentlessly strong dollar and a yen that seemed stuck in permanent decline, the pair suddenly reversed course. The yen strengthened sharply, the dollar slipped, and traders everywhere started whispering the same question: “Is someone stepping in behind the scenes?”

USD/JPY: From Multi‑Month Highs to Sharp Yen Strengthening

Source: TradingView. Past performance is not a reliable indicator of future performance. Data as of 5 February 2026.

USD/JPY pulls back sharply from its recent highs near 160 as yen strength accelerates. This chart shows the strong rally in USD/JPY throughout late 2025, followed by a swift reversal as intervention warnings, rate‑check reports, and narrowing yield spreads triggered rapid yen appreciation.

In foreign exchange, big moves like this often signal a change in fundamentals; but sometimes they tell a bigger story. And this time, the story is about two major economies quietly trying to solve their own problems… and discovering they can only do that together.

America’s Challenge: When a Strong Dollar Stops Being Helpful

At first glance, a strong dollar sounds great. It shows confidence in the American economy, attracts global investment, and keeps inflation down. But there’s a point where “strong” becomes “too strong,” and that’s where things get tricky.

The US now carries over $38 trillion in national debt, and the cost of servicing that debt is rising fast. Higher interest rates mean higher repayments, and a stronger dollar pushes those rates even higher. In fact, recent projections show that interest payments alone may reach $1 trillion by 2026. A strong dollar also makes American exports less competitive. In 2024, the US exported $3.2 trillion but imported $4.1 trillion (a sizeable deficit). When the dollar climbs, US products become more expensive abroad, and foreign goods become cheaper for American consumers.

So while financial markets may enjoy a strong dollar, Washington doesn’t necessarily want one right now.

Japan’s Dilemma: Inflation, Bonds, and a Weak Yen That Went Too Far

Japan has been battling a yen that has become too weak, making everyday life more expensive. A weak yen inflates the cost of importing basic goods like fuel, food, raw materials, and puts pressure on households.

For the first time in decades, Japan is dealing with rising wages and a real pick‑up in inflation. This gave the BoJ enough confidence to raise interest rates to around 0.75%, which is a major shift after years of ultra‑low rates. Its government bond market is enormous, and even small increases in interest rates can push bond prices down. If bond prices fall too quickly, it risks unsettling banks, pensions, and the broader financial system.

Japan needs a stronger yen, but not at the expense of financial stability.

A Coordinated Move? It Wouldn’t Be the First Time

This is where the US and Japan’s interests begin to align.

Japan needs the yen to strengthen. The US needs the dollar to ease off the highs. Neither wants dramatic volatility. So what happens? Markets increasingly behave as if policy interests are aligning.

We’ve seen it before. In 1985, during the Plaza Accord, the US, Japan, and European nations worked together to pull down an overly strong dollar. Today, nobody is announcing anything publicly. But the signs feel similar: sudden yen strength, reports of US rate checks, Japan openly warning about currency levels, and market moves that are too orderly to be accidental.

The Quiet Giant in the Background: The Yen Carry Trade

For years, investors borrowed yen at very low interest rates and used it to buy higher‑yielding assets elsewhere. This strategy, known as the carry trade, kept the yen weak and supported risk‑taking around the world.

But when the yen strengthens suddenly, the carry trade comes under pressure. Borrowing in yen becomes more expensive, leverage costs rise, and some investors are forced to unwind their positions. Unwinding means buying back yen, and buying yen pushes it up even further.

This creates a self‑reinforcing loop of yen strength. Weakening the carry trade helps Japan regain control over monetary policy and reduce imported inflation.

So What’s Really Driving USD/JPY Right Now?

USD/JPY reflects US concern about the cost of debt and an overly strong dollar, Japan’s need to stabilise inflation and strengthen the yen, a shared desire to prevent disruptive volatility, and the unwinding of the yen carry trade.

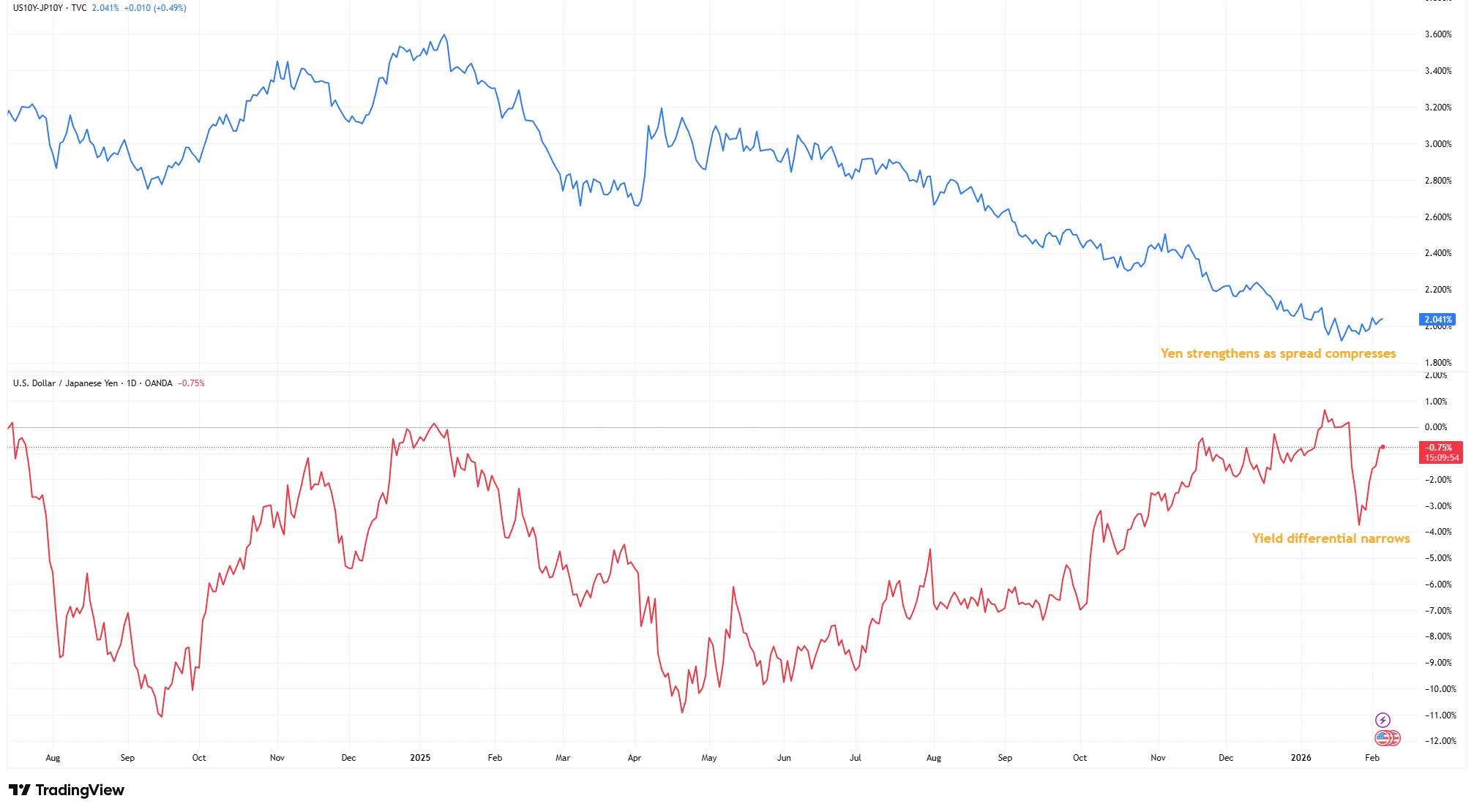

US-Japan Yield Spread vs USD/JPY

Source: TradingView. Past performance is not a reliable indicator of future performance. Data as of 5 February 2026.

As the US-Japan yield differential narrows, yen strength accelerates. The top line shows the US 10‑year minus Japan 10‑year yield spread steadily compressing through late 2025 and early 2026. The bottom line tracks USD/JPY declining in tandem, illustrating how tighter rate differentials reduce the incentive for carry trades and support yen appreciation.

This isn’t just a currency pair adjusting to new data. It’s two countries quietly realigning policy in ways that benefit both sides. And when the US and Japan move in sync, markets tend to follow.