AI Hype Meets Data Drought | Weekly Recap: 3-7 November 2025

Economic Overview

Markets grappled with mixed economic signals and missing data last week as an ongoing US government shutdown delayed key reports. Investors saw conflicting readings on the labour market – private payrolls rebounded by +42,000 in October according to ADP, but a separate survey showed layoffs surging to 153,000, the highest monthly total since 2003. The lack of official nonfarm payrolls or inflation releases due to the shutdown left participants “flying blind” and heightened uncertainty.

Meanwhile, central banks struck a cautious tone. The US Federal Reserve had just delivered a 0.25% rate cut, its first pivot, bringing the policy rate to 3.75-4.00%. Fed officials spent the week emphasizing a data-dependent outlook – several governors warned that cutting too fast could leave inflation above target, even as others argued for additional easing to support a cooling jobs market.

In the UK, the BoE held rates steady (4.00%), with a dissenting minority favouring an immediate cut amid receding inflation. This divergence in views underscores that policymakers are balancing progress on disinflation against still-uncertain growth.

In short, the policy pivot has begun, but a dearth of data kept markets guessing whether the economy can navigate a soft landing.

Equities, Bonds & Commodities

Equity markets retreated to start November as investors reassessed tech valuations. The S&P 500 dropped 1.6%, its worst week since August, while the Nasdaq fell ~3.0% amid profit-taking in AI-linked stocks. Despite this pullback, corporate fundamentals remained strong. 85-90% of S&P companies have reported Q3 earnings, with over 80% beating estimates and year-on-year profit growth topping +12%. Still, valuation concerns triggered volatility.

US Treasury yields fluctuated, with the 10-year briefly touching 4.17% mid-week before settling near 4.10%, flat on the week. The 2-year held steady at 3.55%. Bond markets appear cautious, pricing in the Fed’s plan to halt quantitative tightening by December 1 but uncertain about the pace of future cuts, especially if inflation proves sticky.

Commodities were mixed. Oil prices steadied: Brent hovered in the mid-$60s as OPEC+ paused new supply hikes. US crude inventories rose unexpectedly mid-week, briefly pressuring prices, but cartel discipline helped stabilize the market. Gold held firm near $2,000 an ounce as investors sought safety through central bank buying and geopolitical hedges. Industrial metals showed little change, while natural gas surged on seasonal demand, making it one of the week’s top performers.

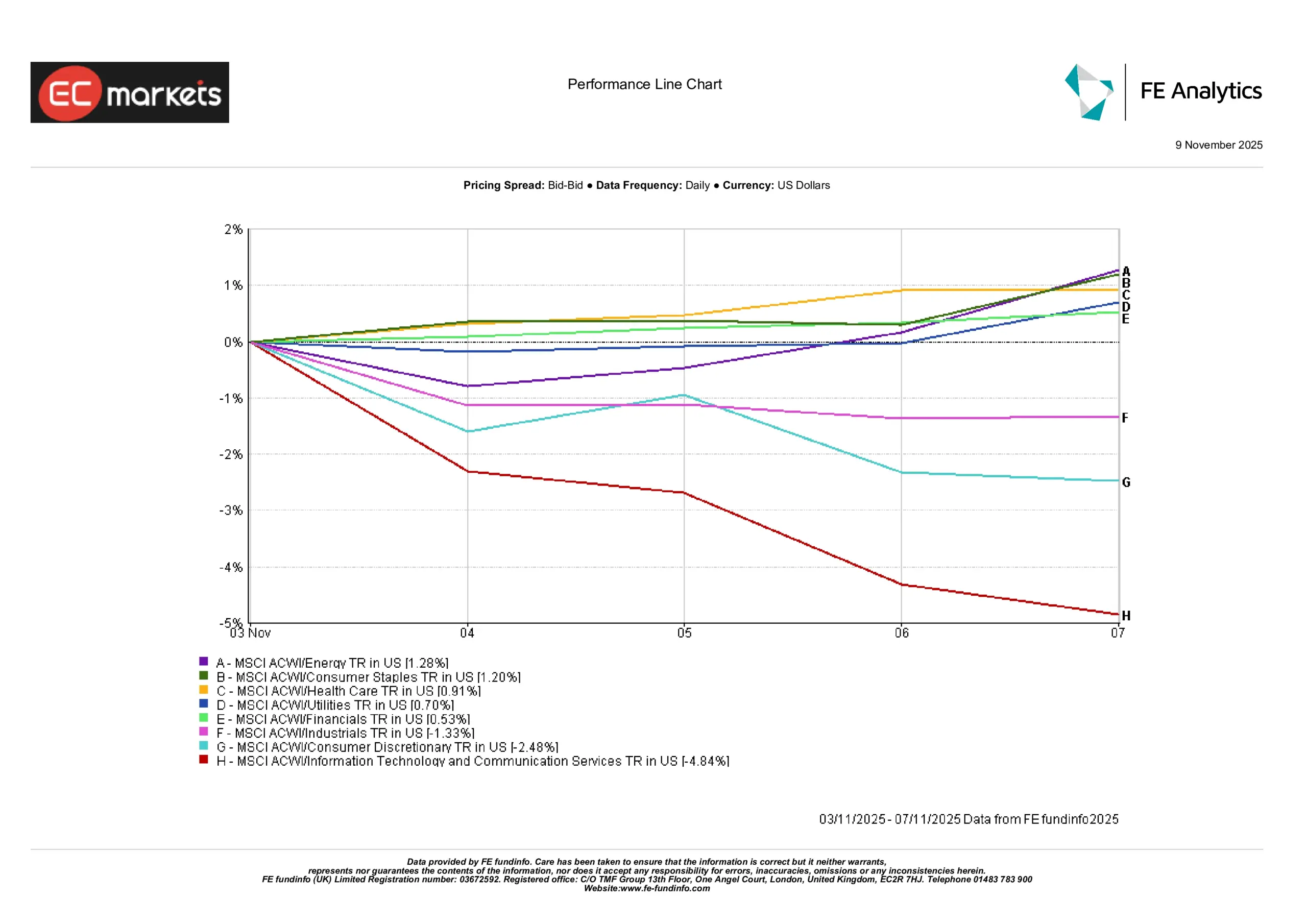

Sector Performance

Sector rotation was a dominant theme as investors retreated from growth-heavy industries and sought shelter in defensives. The MSCI ACWI Energy index led gains with a +1.28% return, helped by stable oil prices and supply discipline from OPEC+.

Consumer Staples (+1.20%), Health Care (+0.91%), Utilities (+0.70%), and Financials (+0.53%) all posted solid performances, underscoring a market shift toward value and income-generating sectors.

In contrast, Industrials (-1.33%), Consumer Discretionary (-2.48%), and especially Information Technology and Communication Services (-4.84%) suffered steep declines. The tech-heavy cohort endured sharp mid-week drawdowns, highlighting profit-taking in overextended AI and chip stocks.

The wide dispersion in weekly returns illustrates a decisive rotation out of long-duration growth names and into defensive havens. Investors appeared increasingly sceptical of high valuations in tech and sought earnings resilience in more stable, cash-generative sectors.

Sector Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 7 November2025.

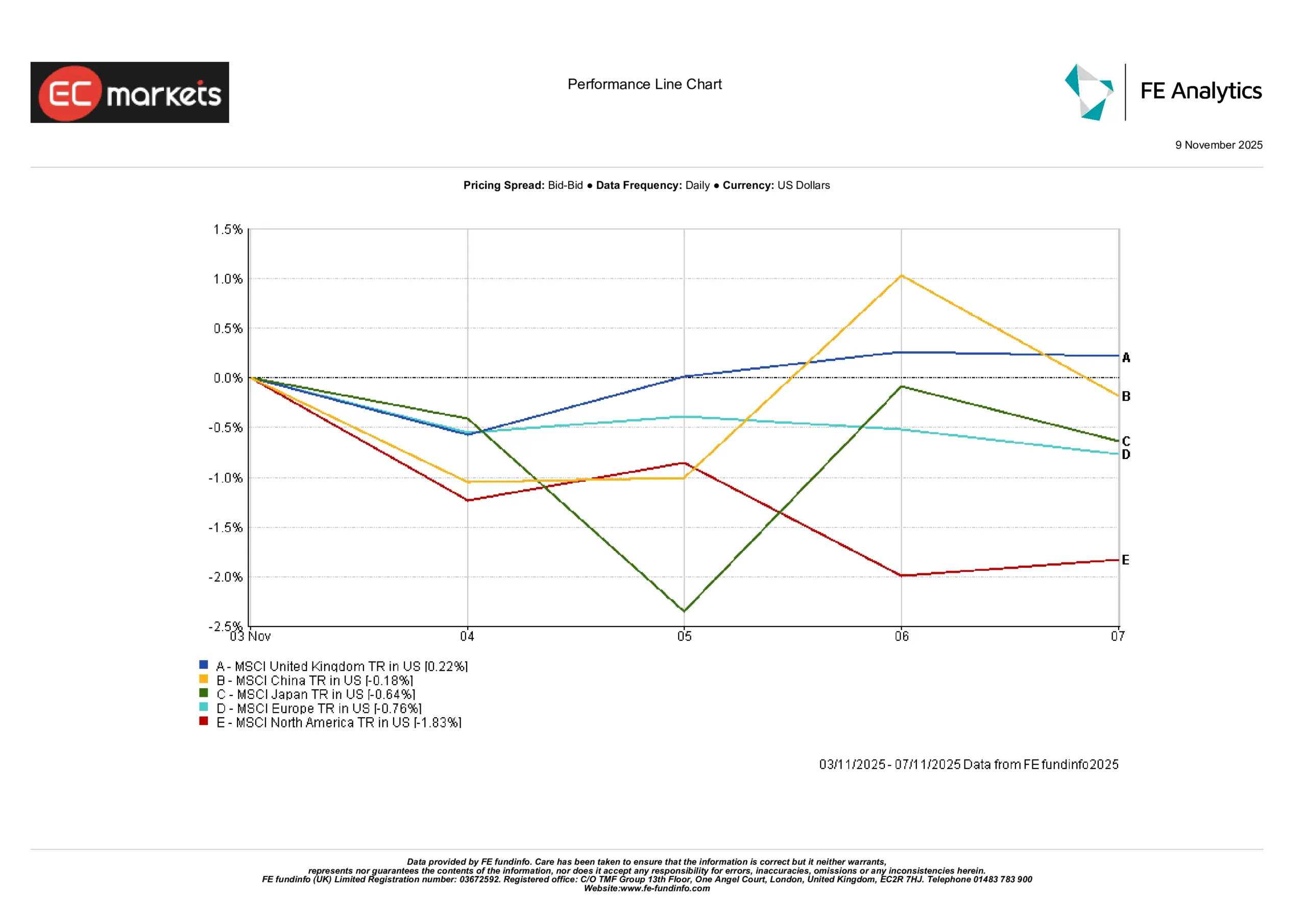

Regional Markets

Global equities delivered mixed returns during last week, with notable divergence across regions. The MSCI United Kingdom index stood out with a modest gain of +0.22%, outperforming peers as UK equities found support amid a cautious macro backdrop and resilient defensives.

China ended the week nearly flat at -0.18%, recovering from early-week losses thanks to late-week optimism surrounding potential policy support for the domestic tech sector. Japan closed at -0.64%, posting mid-week volatility and a partial rebound, possibly tied to yen movements and mixed economic sentiment.

Europe slipped -0.76%, weighed down by weak corporate earnings and broader investor caution following the ECB’s wait-and-see approach.

And North America underperformed sharply, falling -1.83%, as the US tech sector drove broader indices lower amid valuation pressures and a retreat in AI-linked momentum.

The regional spread reflects diverging investor sentiment: while UK and Chinese equities found near-term footing, US and European markets faced heavier selling pressure, especially in growth-oriented sectors.

Regional Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 7 November2025.

Currency Markets

Currency trading reflected risk sentiment and central bank cues.

The US dollar gained for a third straight week despite equity volatility, while the euro slipped to near $1.07 on soft Eurozone data and fading ECB tightening prospects. Sterling dipped mid-week on UK fiscal uncertainty but steadied near $1.22 after the BoE held rates. The yen swung but weakened back above ¥150 as the BoJ stayed passive. Meanwhile, China’s yuan stayed under pressure from capital outflows, and commodity currencies held steady as oil stabilised.

Outlook & The Week Ahead

In this week, investors will look for clarity on delayed data and policy direction. If the US government shutdown ends, focus will turn to October’s CPI and PPI prints, both key to gauging the Fed’s next move. If this continues, markets may rely on alternate datapoints. In the absence of official payrolls, private employment trackers or corporate layoff announcements could determine people’s sentiment.

Earnings season is now winding down. Reports from Walt Disney, Applied Materials, and Cisco Systems will be closely watched for their tone amid high rates. Later in the week, results from Japan’s SoftBank and European corporates such as Siemens and Deutsche Telekom may influence regional markets.

On the policy front, Fed speakers will remain in focus. Markets will parse any comments for signs of a December rate cut versus a continued pause, especially following the recent dovish pivot. In Asia, China’s October trade and inflation data are also expected. Any upside surprises in exports or signs of easing deflation would be welcomed by investors watching global demand.

Oil markets may take cues from the OPEC+ monitoring meeting mid-week as traders assess production discipline heading into 2026. In Europe, attention turns to the European Commission’s latest forecasts and potential updates on the UK’s Autumn Statement.

In short, markets are seeking for a reassurance. A resolution to US data delays or upbeat earnings could revive risk appetite. But if uncertainty drags on, trading may stay choppy though constructive. The week’s lighter docket offers a brief pause, but focus will quickly shift back to inflation data and consumer strength as markets try to gauge whether the “Goldilocks” narrative can hold through year-end.