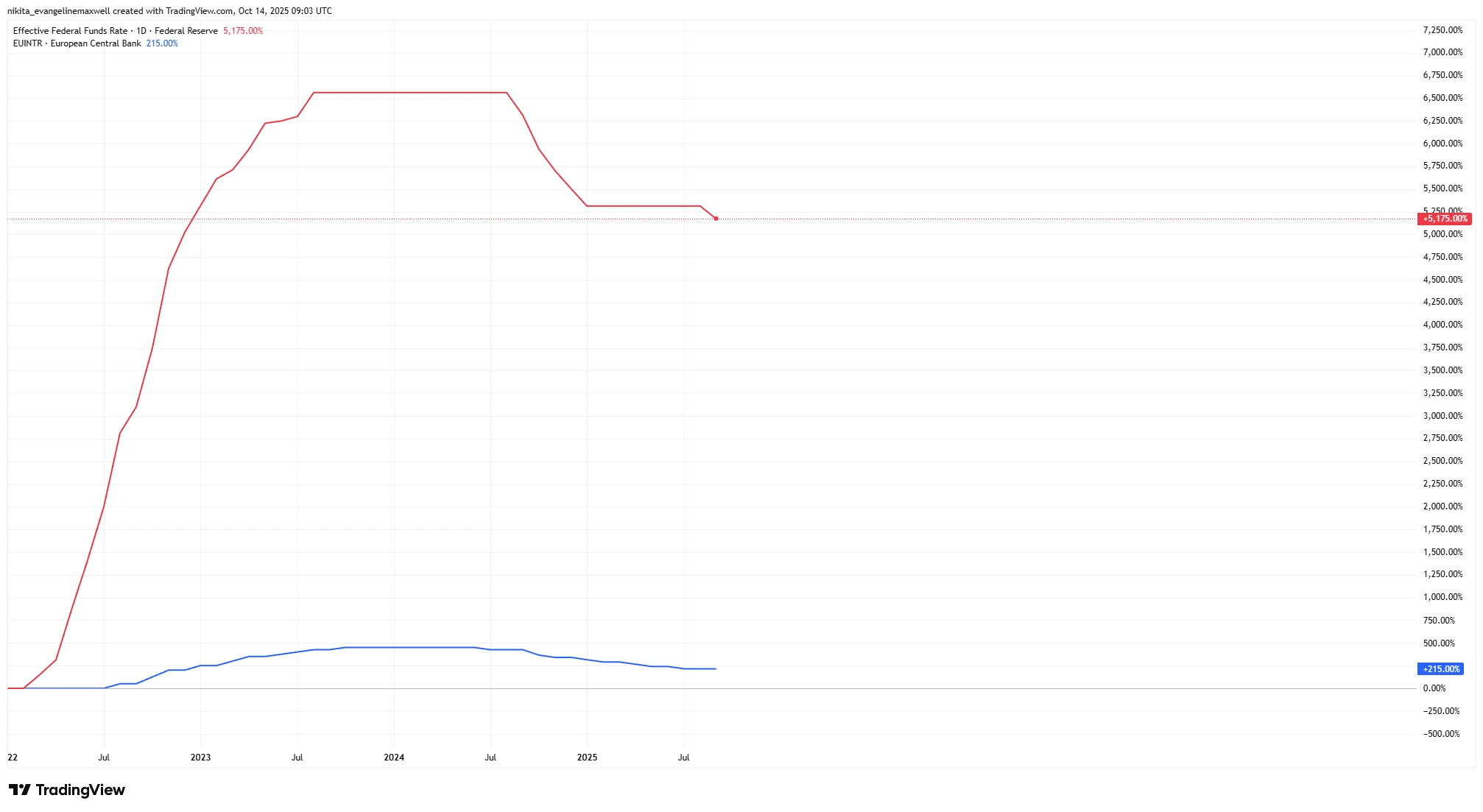

From Tightening to Easing: What Happens to Global Equities After the First Cut?

After two years of rapid interest rate hikes, central banks are finally shifting gears. In 2025, ECB has already slashed its benchmark rate from nearly 4% down to about 2%. The US Fed is also stepping off the brake, delivering its first 0.25% rate cut from a much higher peak and indicating more to come by the end of the year. Not to forget, even BoE has begun trimming rates.

This global turn from tightening to easing leaves investors with a pressing question: what tends to happen to stock markets after that first interest rate cut of a cycle? History can’t predict the future with certainty, but it offers some clues – and they’re actually pretty encouraging, with a few important caveats.

Key Drivers

One key driver is whether the economy is headed for a soft landing (which is the narrative now) or a hard one. If central banks start cutting rates without a recession taking hold, equities have often responded positively. For example, since 1980, the S&P 500 has averaged a +14% return in the 12 months after the Fed’s first rate cut. In cases where the economy avoided recession altogether, stocks did even better – over +20% on average in the following year.

Policy Rate Path (2022-2025): Fed vs ECB

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 14 October 2025.

However, rate cuts prompted by recession fears can tell a different story. When cuts happen amid an unfolding downturn, stocks have been more volatile and sometimes initially weaker.

Rate cuts also influence liquidity and sentiment. They typically lower bond yields and savings rates, encouraging a shift into equities. Cheaper credit boosts corporate investment. These are classic positives for equities when confidence is high. But it all depends on why rates are being cut.

YTD 2025 Equity Performance: S&P 500 vs STOXX 600

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 14 October 2025.

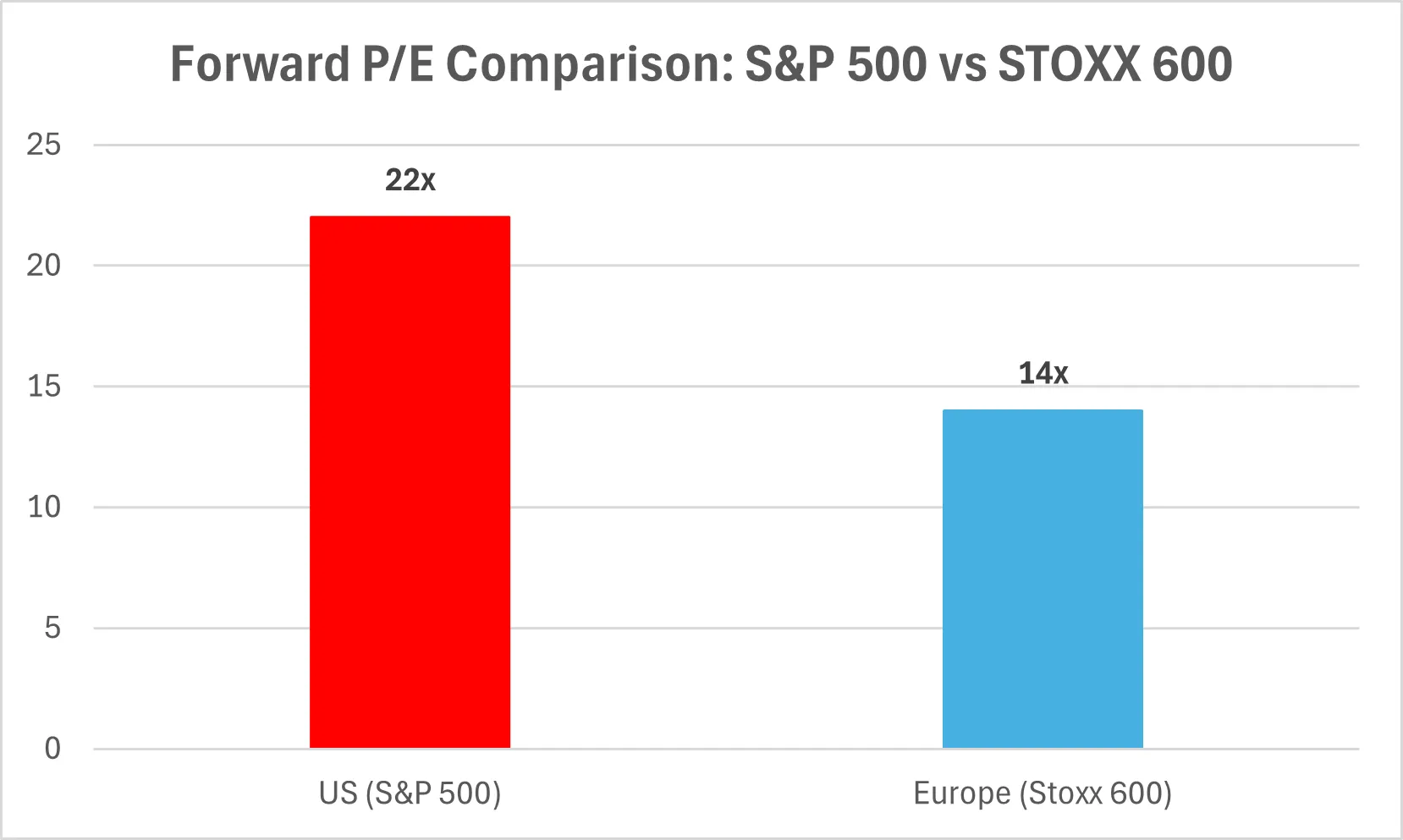

Fundamentals (Valuations, Earnings, Balance Sheets)

From a fundamentals standpoint, valuations and profits set the tone. Right now, they look stretched – the S&P 500 trades near 22× forward earnings, among its priciest levels in decades. That sounds rich, but high multiples alone don’t kill a rally. We’ve seen that before: 1999, 2021 – both featured lofty valuations and strong markets because earnings held up and policy stayed loose.

Corporate balance sheets remain solid. Many firms refinanced during the cheap-money years and built cash buffers. That gives them wiggle room – to invest, buy back shares, or simply wait out a soft patch. The weak spots are mostly in highly leveraged sectors or companies that thrived on higher rates – those could struggle as the landscape flips.

Forward P/E Comparison: S&P 500 vs STOXX 600

Macro Tailwinds

Easier monetary policy itself is the biggest tailwind. When central banks cut rates, bond yields fall and equities look relatively attractive. Lower borrowing costs stimulate spending and investment. If inflation stays near target – and in Europe it’s around 2% – central banks have room to ease further.

Another tailwind is potential globhttps://www.bankofengland.co.uk/monetary-policyal growth recovery. While growth has been below trend, fiscal policy is cushioning the slowdown through infrastructure and green investment programs in the US and fiscal support in Europe. These, combined with easier monetary conditions, make for a friendlier backdrop than the rate-hike years. Improving liquidity – as central banks pause or reverse balance sheet runoff – could also support equity prices.

Macro Headwinds

That said, it’s not all smooth sailing. Growth in Europe is still weak, with flat loan demand and near-zero GDP momentum. The US looks sturdier, but the lag from prior tightening hasn’t fully played out. Central banks often start cutting because they see trouble ahead – meaning the market’s first reaction can still be choppy.

Volatility tends to pick up around these turning points. Inflation could easily flare up again if oil or commodities spike. And policy divergence – say, the Fed cutting faster than the ECB – could whipsaw currencies, helping some exporters but hurting others.

Certain sectors also remain fragile. US regional banks and commercial real estate still carry scars from higher rates. Europe faces its own stress points, from small-business loans to energy costs. And China’s slower growth looms in the background, weighing on global trade and commodities.

Risks

The biggest risk is a full-blown recession. If the “first cut” is a warning rather than a relief, equities could stumble before recovering. Past cycles show that when rate cuts respond to crises – like 2001 or 2008 – markets fall sharply before bottoming out.

Another risk is policy error. Central banks could cut too slowly, or too quickly and reignite inflation. Geopolitical and regulatory risks remain: renewed trade tensions, political shifts, or windfall taxes could easily shake markets. Not all sectors benefit equally either – banks often see margins squeezed, while tech and real estate tend to thrive when borrowing costs fall.

Final Takeaway

For global equities, the first rate cut is often the start of better times – but not an instant fix. Historically, stocks tend to be higher a year later, especially if a recession is avoided. Central banks are turning friendlier, inflation is cooling, and company balance sheets are strong. Still, the next few quarters could be volatile as markets transition.

The Fed’s easing lifts global sentiment, but Europe and the UK have their own dynamics. US stocks may have a slight edge thanks to stronger profitability, yet international markets have caught up in resilience. The smarter approach may be a balanced one – holding quality names across regions to ride through the turbulence.