Advantages of Forex Trading and Managing Trading Risks

Forex trading is an extremely popular market among retail traders for its ease of access and potential to make significant profits. However, it does also come with significant risks, especially when leverage in involved. That is why the most successful traders are those who are highly skilled in managing trading risks. This article will cover two core concepts: the advantages of forex trading, and forex risk management. We'll uncover what makes forex trading so popular, as well as its potential downsides and the importance of risk management in trading. It is key for beginner traders to understand that profitability and proper trading risk management go hand-in-hand. The risks that come with forex trading can be avoided, and avoiding them consistently is what allows traders to reap the benefits that the forex market has to offer.

What Is Forex Trading?

Forex is short for 'foreign exchange' and it is the process of buying and selling currencies with the goal of profiting from the movements of currency prices. The forex market operates 24 hours a day, five days a week, unlike stock markets which have certain trading hours each day. Forex trading can be highly lucrative. However, without effective trading risk management, losses can quickly accumulate. Strong forex risk management is a key factor that separates successful traders from the poor performers. But why is forex trading so popular? Let’s take a look at the main advantages of forex trading that attracts retail traders worldwide.

Advantages of Forex Trading

High Liquidity

The forex market has a daily trading volume that exceeds $7 trillion. That makes it the world’s largest and most liquid financial market. Because of this, traders are generally able to execute trades very quickly with minimal slippage which ensures that orders are filled at or very close to intended market prices.

Accessibility

The forex market can be accessed from almost anywhere with an internet connection, which is what makes forex trading so popular. In addition, having a large amount of capital is not a requirement to trade forex, as many brokers offer low minimum deposits, which makes it possible for traders with various sizes of capital to participate.

Leverage

Leverage allows you to control larger position with a smaller amount of capital, increasing the potential profit you can gain from a trade. At the same time, leverage increases the potential losses should the market move against you, which is why disciplined forex risk management plays a crucial role in protecting your capital.

Variety of Trading Options

Traders can choose from a variety of currency pairs, including major, minor and exotic pairs. Different pairs tend to suit different trading styles; some traders prefer more stable pairs, while others may prefer to trade the larger price swings of more volatile pairs. The variety of options gives traders more flexibility to find opportunities that match their strategy and risk appetite.

Profit Opportunities in Rising and Falling Markets

In forex, it is possible to trade in both directions; you can profit from either rising or falling markets. Traders can go long (buy) to profit from a rise, or go short (sell) to profit from a fall.

Now that we’ve looked into some of the greatest advantages of forex trading, let’s look at some of the risks, including the importance of risk management in trading.

Managing Trading Risks

Although the advantages of forex trading presents many opportunities, strong forex risk management is crucial to ensuring the protection of your capital for long term success. Here are some keys to being success for effective risk management in trading:

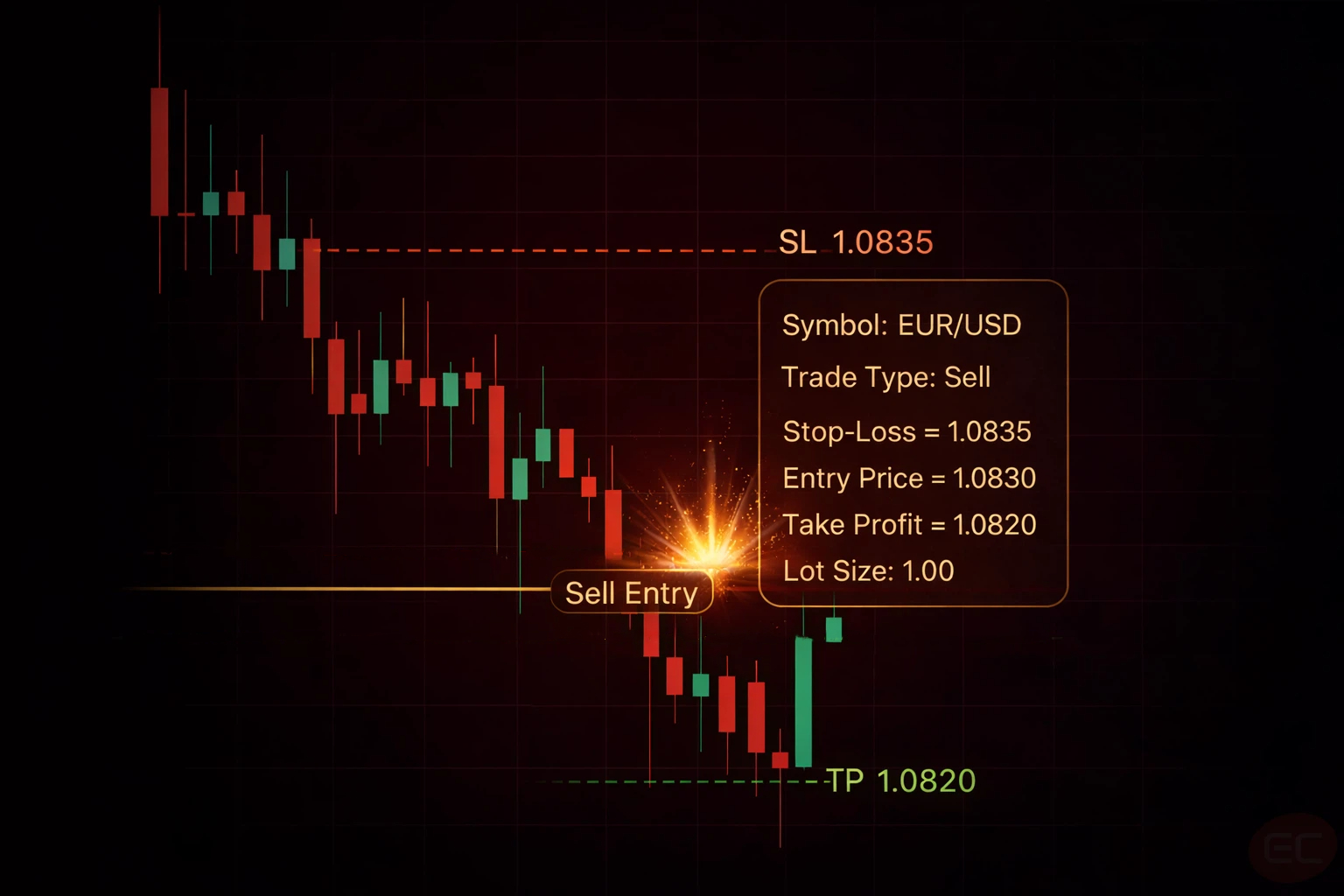

Implement Stop-Loss Orders

A stop-loss order is a great tool to use in highly volatile markets because they are a way of limiting your losses. When you place a stop-loss order, you set a predetermined price level and if the price of a currency pair hits that level, your trade will automatically close at the best available market price. It is always important to ensure that the price level you set aligns with your overall forex risk management strategy.

Manage Your Position Sizing

Size each position based on your total account equity and how much risk you are comfortable taking. To be profitable long-term, it is important to avoid over-leveraging or risking a significant percentage of your capital on a single trade. Maintaining a consistent approach in your position sizing is one of the most important aspects of risk management in trading and it is key to surviving the ups and downs of the market.

Portfolio Diversification

Diversifying your portfolio means to spread your trades across a variety of currency pairs with low correlation, so that your results aren’t reliant on the movements of one currency. Also, be mindful of overlapping your exposure to a single currency, such as trading GBP/USD, AUD/USD and EUR/USD which concentrates your risk around the US dollar.

Stay Informed About Market Conditions

Keep up with current affairs, geopolitical events and other news that can impact market volatility. Staying informed enables you to make educated decisions and supports risk management in trading.

Start with a Demo Account

Even the best traders start with a demo account, especially when testing out a new strategy. This is crucial to managing trading risks as it exposes any holes in your strategy. Avoid using real money until you are confident in your skills, trading strategies and have a solid forex risk management plan.

Develop a Trading Plan for Managing Trading Risks

The fear of missing out is a trap too many traders fall victim to, which is why a well-structured trading plan is something every forex trader must have to prevent this from happening. A trading plan provides a clear framework for trading in the forex market. In it, you should specify your goals, risk tolerance, trading risk management rules as well as entry and exit strategies. Having a clear plan can help minimise emotion-based decisions and supports consistency in your performance.

Here are some key elements that a trading plan should cover:

- What currency pairs you will trade.

- Decide on the time frame you will use.

- Plan your entry and exit rules.

- Determine the percentage of capital you are willing to risk per trade.

Goal Setting in Forex Trading | Managing Trading Risks

The most essential part of a trading plan is to set a realistic goal. The keyword is "realistic", because setting an unrealistic goal can encourage excessive risk-taking and makes risk management in trading much more difficult. For instance, let’s say that you set a goal of doubling your account within the first week. By being overly ambitious, you may fall into the trap of overtrading, ignoring trading risk management and ultimately suffer unnecessary losses. Instead, start small and work your way up. For example, you can aim for a 1-2% monthly gain, ensuring proper trading risk management rather than chasing one big win. This may not be the most exciting approach, but it separates the gamblers from the real and successful long-term traders.

So when setting a goal, ask yourself the following questions:

- What is a realistic return on investment for my first month?

- How much am I willing to lose per trade?

- Can I maintain my trading performance over a long period of time?

- At what level of total monthly drawdown will I stop trading to re-evaluate my strategy?

Always focus on steady progress over quick gains. Taking this approach supports following a trading risk management plan, which will help you to protect your capital.

Building on what we've covered with optimising risk management in trading, let’s take a closer look at one of the most powerful trading tools: leverage.

Leverage in Forex Trading | Managing Trading Risks

Forex tends to attract traders because of leverage. Leverage is one of the key advantages of forex trading because it can amplify gains, but it can also do the same to losses. That's why in leveraged markets, risk management in trading becomes critical.

Leverage enables traders to control a larger position in the market with a lower initial investment. For example, with 100:1 leverage, you can control $10,000 with a margin of $100. This is where being strategic with position sizing and setting stop-loss rules is important in ensuring proper trading risk management. While the potential of dramatically increasing your profits is attractive, it is equally as important to put measures in place to limit losses. Traders without a disciplined forex risk management plan often make the mistake of over-positioning. If you use high leverage to open a position that is too large relative to your account equity, even a small market move can trigger a stop-out and deplete your capital. Using leverage conservatively is crucial to managing trading risks. Most professional traders use far less leverage than what is available, often sticking to 5:1 or even lower. Any strong trader understands that staying in the game is more important than trying to hit a single jackpot.

It is normal for mistakes to be made. However, let these mistakes be made in a demo environment. In the world of forex trading, many mistakes happen due to of a lack of effective trading risk management. Let's now dive into some common mistakes that forex traders make.

Common Mistakes to Avoid | Managing Trading Risks

It is always handy to make yourself aware of some of the common mistakes made by traders so that you don't make them at all. Let's take a look some common mistakes that are completely avoidable and will save your trading capital.

- Ignoring stop loss orders.

- Risking too much capital on a single trade.

- Chasing losses by increasing position size.

- Trading without a clear and predetermined trading strategy.

- Allowing emotional trading to dictate trading decisions.

Conclusion | Advantages of Forex Trading and Managing Trading Risks

The advantages of forex trading offer great opportunities for profit, financial growth and wealth building, but these gains are majorly dependent how well a trader implements forex risk management. The most successful traders understand that success comes from managing trading risks and aiming for consistent wins over the long-term, rather than chasing massive short-term gains. Only by setting realistic goals and developing a robust trading risk management plan can traders avoid losing significant capital and build a successful long-term trading journey.

Next steps:

Start with a trading plan. Follow the steps outlined above; start small, prioritise consistency and strengthen your forex risk management skills.

We hope you enjoyed this course on the advantages of forex trading and managing trading risks. By now, you should have a better understanding of why risk management in trading is essential for success. Continue learning with EC Academy to unlock more key topics to assist you in your journey!