Inflation Data and Geopolitics Drive Markets | Weekly Recap: 11 Aug – 15 Aug 2025

Economic Overview

Inflation was the main theme this week. In the US, consumer prices rose 0.2% in July, bringing the annual rate to 2.7%, in line with expectations. What stood out was core inflation, up 0.3%, the fastest pace in six months. Producer prices also surged nearly 1%, the biggest increase in three years, raising concerns that tariffs could be lifting costs for consumers.

Retail sales provided a brighter note, boosted by auto purchases and extended Amazon promotions, but consumer confidence softened. Investors still expect the Fed to cut rates in September, though the stronger inflation readings make the decision less straightforward.

The UK economy looked steadier. GDP grew 0.3% in Q2, unemployment stayed low, and wages continued rising. Having just cut rates, the BoE may now pause. Sterling gained nearly 0.7% on the week.

The Eurozone saw weak growth but cooling inflation at 2%, giving the ECB room to hold policy steady. Market sentiment improved on news of a US-EU trade truce, talk of a possible US-Russia ceasefire, and Germany’s €100bn investment plan.

China remained under pressure. Factory activity slowed, shoppers spent less, and housing prices fell. Small-scale support measures disappointed investors, and markets expect further rate cuts.

Geopolitics stayed in focus. The US and China extended their tariff truce for 90 days, while Trump’s meeting with Putin briefly lifted sentiment in Europe. Oil markets remained cautious but stable, with no fresh supply shocks.

Equities, Bonds & Commodities

Despite the mixed data, equities squeezed out more gains. The S&P 500 briefly touched a fresh record near $6,470 on Thursday before easing. The Dow fared better thanks to news of Warren Buffett building a stake in UnitedHealth. Tech was choppier – retail-linked names rallied, but higher yields clipped some of the momentum in growth stocks.

In Europe, the STOXX 600 rose approx. 1%, helped by banks and industrials. Japan’s Nikkei extended its run, with GDP strength and a weaker yen fuelling exporters. Chinese markets wobbled. Their macro data dragged early in the week, but hopes of new policy support steadied things by Friday. Emerging markets caught a bid from a softer dollar and steadier risk appetite.

Bonds felt the inflation pinch. The US 10-year yield jumped to 4.33% after PPI, then settled near 4.30%, still about 10bps higher on the week. Gilts hovered around 3.9% as investors weighed the BoE’s “hawkish cut.” Bund yields ticked up slightly to 2.1%.

Commodities diverged. Brent crude slipped another 1.1% to $65.85, pressured by China’s slowdown and hopes that US-Russia talks might soften oil sanctions. WTI closed at $62.80. Gold lost ground, down almost 2% to $3,337 an ounce, with higher yields eating into safe-haven appeal.

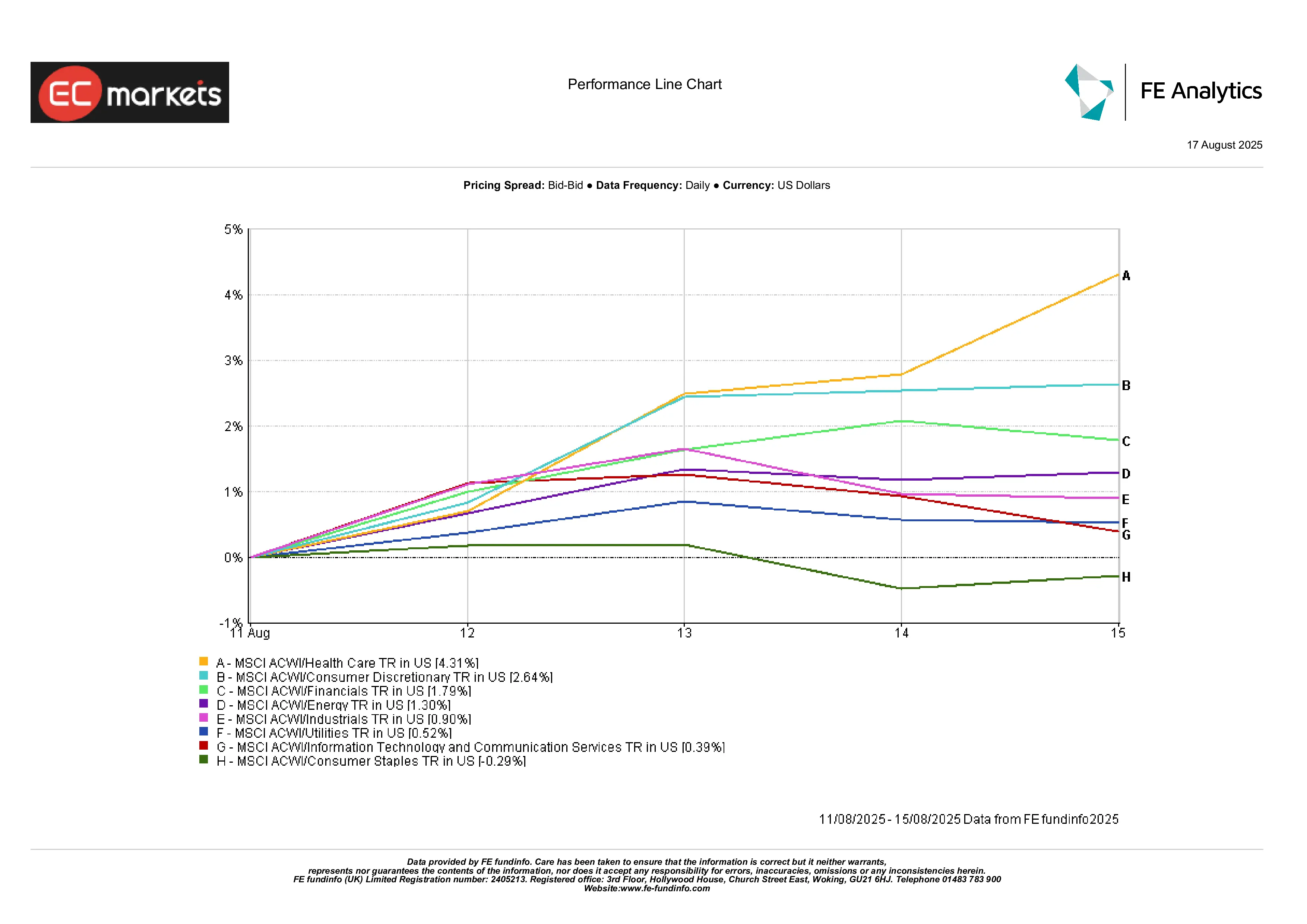

Sector Performance

Defensives took the spotlight. Healthcare led with a 4.3% gain, lifted by pharma and biotech, plus Buffett’s UnitedHealth play. Consumer discretionary climbed 2.6%, thanks to stronger retail sales and upbeat guidance. Financials rose 1.8%, as a slightly steeper yield curve offered some relief for banks.

On the other side, consumer staples slipped 0.3% as defensive demand eased. Utilities managed just 0.5%, their yield appeal fading with rising rates. Technology cooled, up only 0.4% after a strong run earlier in the month.

Overall, investors leaned toward quality and defensives, leaving commodity-linked names and rate-sensitive growth stocks behind.

Sector Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 15 August 2025.

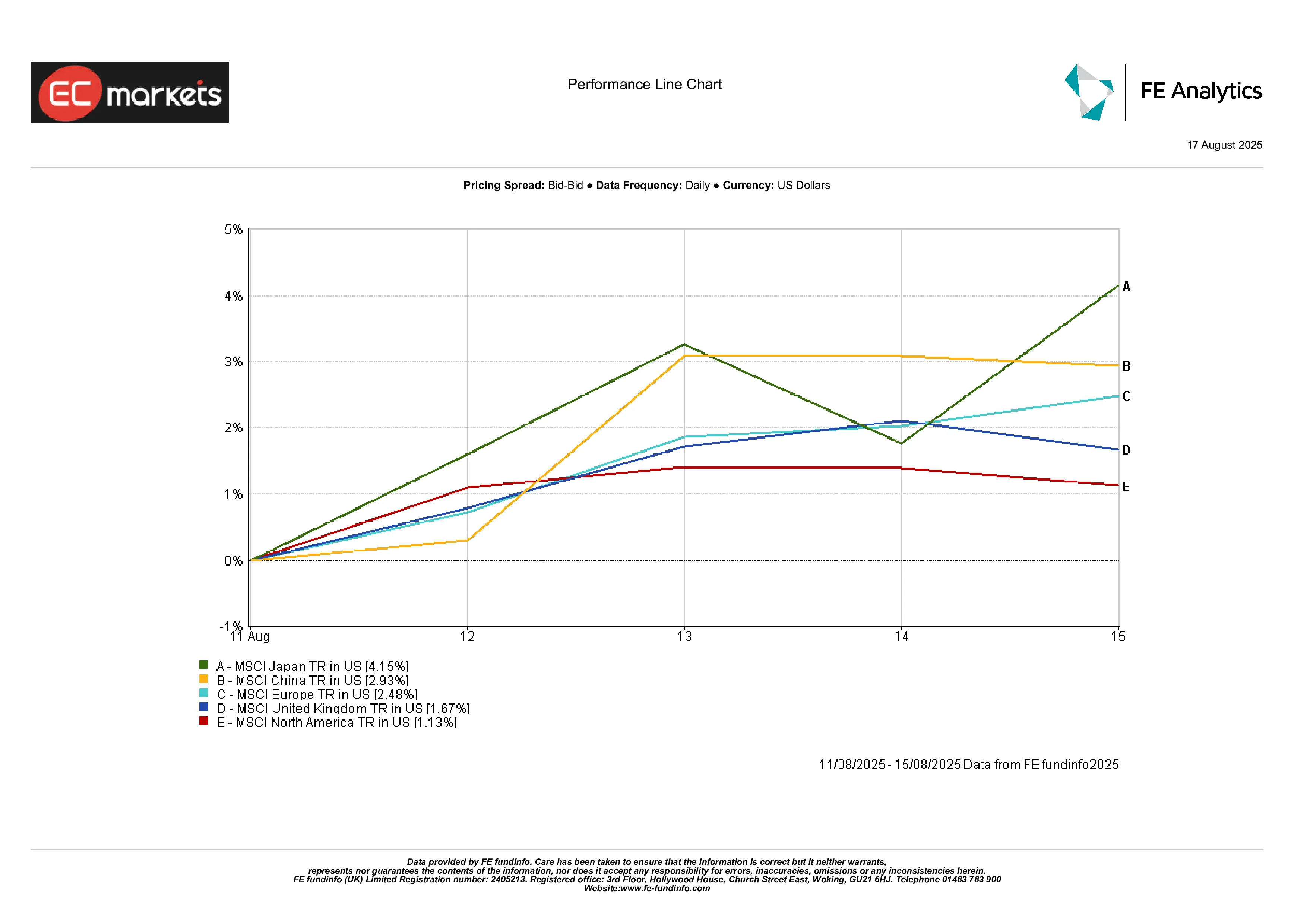

Regional Markets

Japan outperformed, jumping 4.1% on growth and currency support. China’s late-week rebound left it up 2.9%. Europe added 2.5%, helped by ceasefire optimism and resilient earnings. The UK climbed 1.7%, though sterling strength capped local returns. North America lagged with a 1.1% gain, taking a breather after weeks of leadership.

In short: Japan stole the show, North America took a back seat.

Regional Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 15 August 2025.

Currency Markets

The dollar eased again, with the DXY down about 0.4% for the week. The softer CPI kept September cut hopes alive, though PPI gave the greenback a temporary lift mid-week.

EUR/USD added 0.5% to 1.17, helped by ceasefire headlines and steadier Eurozone sentiment.

GBP/USD gained 0.7% to 1.35 on better UK GDP and the BoE’s cautious tone.

USD/JPY slipped 0.4% to 147.2, helped by Japan’s strong GDP and some safe-haven buying.

Outlook & The Week Ahead

Looking to 18-22 August, eyes turn to housing data in the US – starts, permits, sales – plus the Fed’s July minutes. But the real highlight is Jerome Powell’s speech at Jackson Hole on Friday. Markets will hang on every word about inflation, wages, and tariffs.

In China, the Loan Prime Rate decision could bring a small cut. The UK releases CPI mid-week and retail sales Friday. The Eurozone posts flash PMIs Thursday.

Geopolitics stays a wildcard. Any movement in Trump-Putin talks or US-China tariff negotiations could shift sentiment quickly. Oil traders will also watch OPEC+ commentary after recent weakness.

With equities perched near record highs, expectations are elevated. A hawkish central bank signal or another inflation surprise could raise confidence. On the other hand, a steady flow of tame data might just keep the summer rally alive.