Why Interest Rates Are the Most Powerful Force in Forex

If you ask any seasoned trader, they will say that interest rates are the heartbeat of the forex market. That’s because they influence nearly every aspect of currency trading – from massive global capital flows to the day-to-day central bank decisions. In this piece, we will explore why interest rates are the most powerful force in forex, and how even a small change can have a ripple effect on currencies.

Interest rates determine the “reward” for holding a currency. If a country offers a higher interest rate than another, it tends to attract investment. This means interest rates have a direct impact on currency demand on a global scale. It’s no wonder they’re often called the single biggest driver of long-term forex trends.

How Interest Rates Drive Currency Value

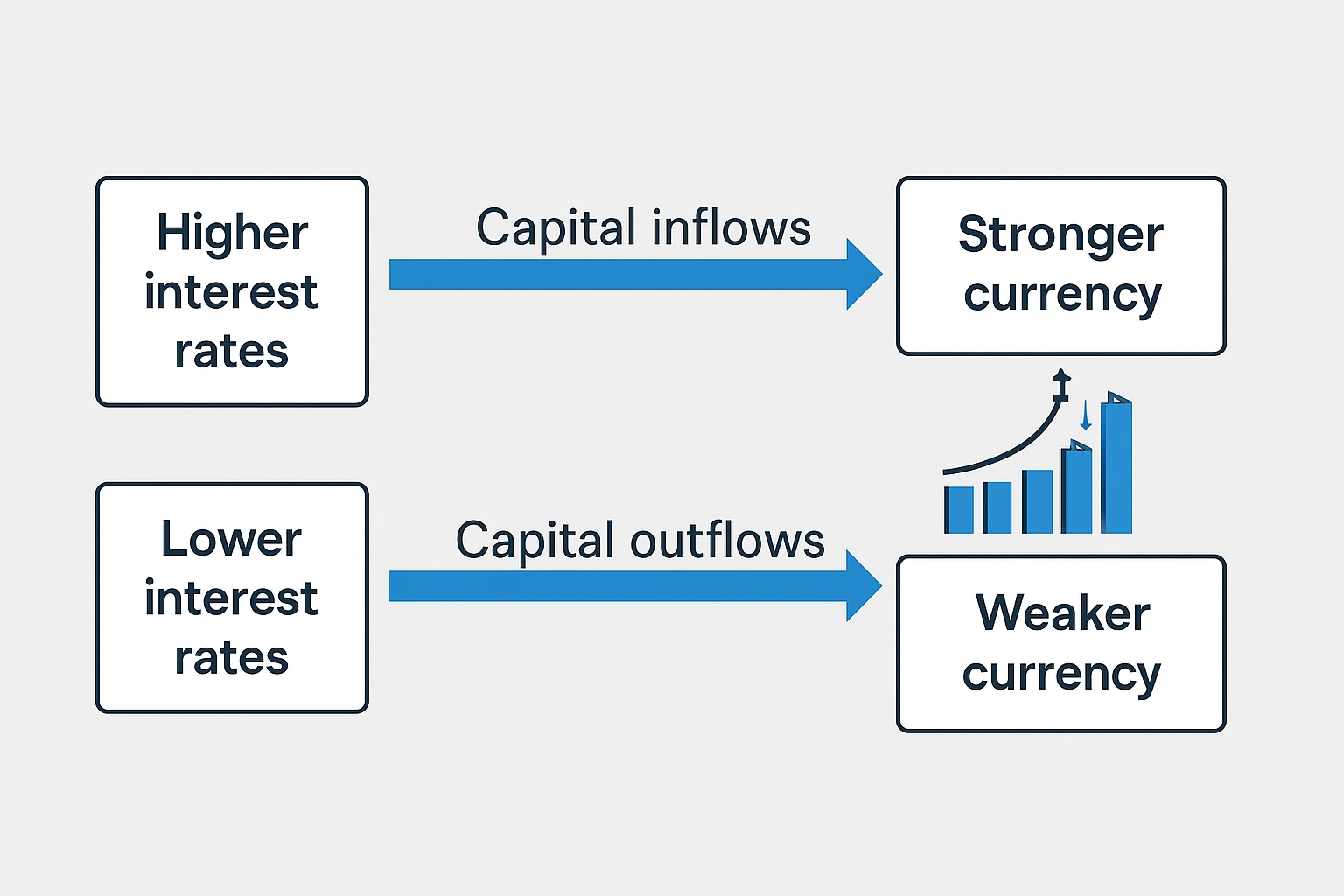

In the forex market, a currency’s value boils down to supply and demand. And, interest rates directly influence both. When a country’s interest rates rise, holding that currency is more rewarding as investors earn more interest on deposits or bonds. Money flows in from other countries to chase those higher returns (in the form of higher rates), increasing demand for that currency and pushing its price up. As BoE explains, if interest rates go up, the currency typically strengthens because investors demand more of it.

Conversely, when interest rates fall, the opposite happens. A rate cut makes a currency less attractive to hold (lower return on investments) and easier to borrow, so people have less motivation to keep their money in that currency. Investors might pull funds out in search of better yields elsewhere. This increase in supply and drop in demand usually weakens the currency’s value.

Central Bank Decisions and Market Reactions

Central banks set the interest rates, so their policy meetings and announcements are huge events for forex traders. In fact, traders around the globe mark their calendars for these decisions, because a single surprise move can send a currency soaring or tumbling within minutes.

Often, markets anticipate rate changes in advance. If everyone expects a hike, a currency may already have inched higher beforehand. But it’s the surprises that pack the biggest punch. If a rate hike or cut catches the market off guard, the reaction in the exchange rate can be explosive.

In 2022, the Fed’s rapid series of rate hikes made the US dollar surge in value. The dollar index hit a 20-year high as investors poured into USD for its higher yield. Similarly, hints of higher rates in the UK often give the British pound a lift, while talk of rate cuts can send the pound or euro slipping. It’s not just the actual rate change that matters, but whether it meets or defies expectations. A smaller hike than expected can weaken a currency, whereas a surprise hike can strengthen it sharply. This is why traders obsess over every central bank press conference and watch economic indicators that might foreshadow policy changes. The Bank of England’s Monetary Policy Committee and the Fed’s FOMC hold regular meetings to decide on rates – and forex markets often gyrate in the lead-up and aftermath of these announcements.

Beyond Forex: Ripple Effects of Rate Changes

Interest rate changes don’t just move currencies – they ripple through almost every market. Bond prices, for example, typically fall when interest rates rise (since new bonds will pay higher yields), and stock markets can react to rate changes as well. Even commodities feel it: gold, for instance, often dips when rising rates make interest-bearing assets more appealing. However, in forex the effect of interest rates is paramount. Rates are arguably the single strongest long-term driver of currency trends, acting as a sort of gravitational force that other factors orbit.

Bottom Line: Interest Rates Are the Heartbeat of Forex

At the end of the day, interest rates are the heartbeat of the forex market. They encapsulate investors’ outlook on an economy and dictate where money flows. For traders and investors, the takeaway is clear: pay close attention to interest rates. Follow the calendars of major central banks, and keep an eye on key data like inflation and employment figures that central bankers watch. By anticipating how those factors might influence rate decisions, you can often get ahead of the next big currency move.

Why are interest rates the most powerful force in forex? Because they influence virtually everything else – from growth and inflation to investor sentiment – ultimately determining the appeal of one currency versus another. Understanding this connection is like having a map to future forex trends. So if you’re trading or just learning about currency markets, make interest rates a focal point of your analysis. They truly are the FX market’s heartbeat, and learning to read that will help you navigate the forex world with greater confidence and clarity.