What Is Leverage in Trading and How Much Is Too Much?

Leverage in trading can feel like a secret superpower, letting you do more with less. But what exactly is leverage? It simply means borrowing funds from your broker to better your trading position beyond what your own cash could fund. Leverage is powerful because it magnifies both gains and losses, so it’s vital for traders to use it wisely.

What Is Leverage in Trading?

Leverage lets you trade with money you don’t have upfront. Imagine you don’t have the funds to purchase something, and you use your credit card. By using borrowed capital, you can control a larger position than your deposit (or margin) would normally allow. For example, at 100:1 leverage, a £1,000 investment gives you exposure to £100,000 worth of assets. This is similar to paying a small deposit on a house and borrowing the rest – you gain the upside on the entire property’s value, but also shoulder the downside. If the house price rises, your percentage return on the deposit is much higher than if you paid in full; if it falls, losses are similarly amplified. In trading, leverage works the same way: it multiplies the outcome of every price movement, for better or worse.

The Pros and Cons of Leverage

Leverage amplifies your buying power. It allows you to take bigger trades and potentially earn higher profits with a relatively small amount of capital. It’s an efficient use of funds – you don’t need to tie up the full value of a position. Even tiny market moves can translate into notable gains when you’re leveraged.

On the other hand, leverage is often called a double-edged sword. While it boosts profits, it equally amplifies losses. A bad trade can quickly wipe out your account. High leverage can trigger margin calls (your broker asking for more funds) or forced trade closures. In fact, many retail traders lose money in leveraged markets, and misuse of leverage is a top reason why. Good risk management – like using stop-loss orders and risking only a small portion of your capital per trade – is essential when trading with leverage.

How Much Leverage Is Too Much?

How much leverage is “too much” depends on your experience and risk appetite. As a rule, higher leverage means higher risk. Regulators often impose limits. For example, the UK’s Financial Conduct Authority caps retail forex leverage at 30:1 to protect traders. If you’re just starting out, even lower leverage like 5:1 or 10:1 might be wise.

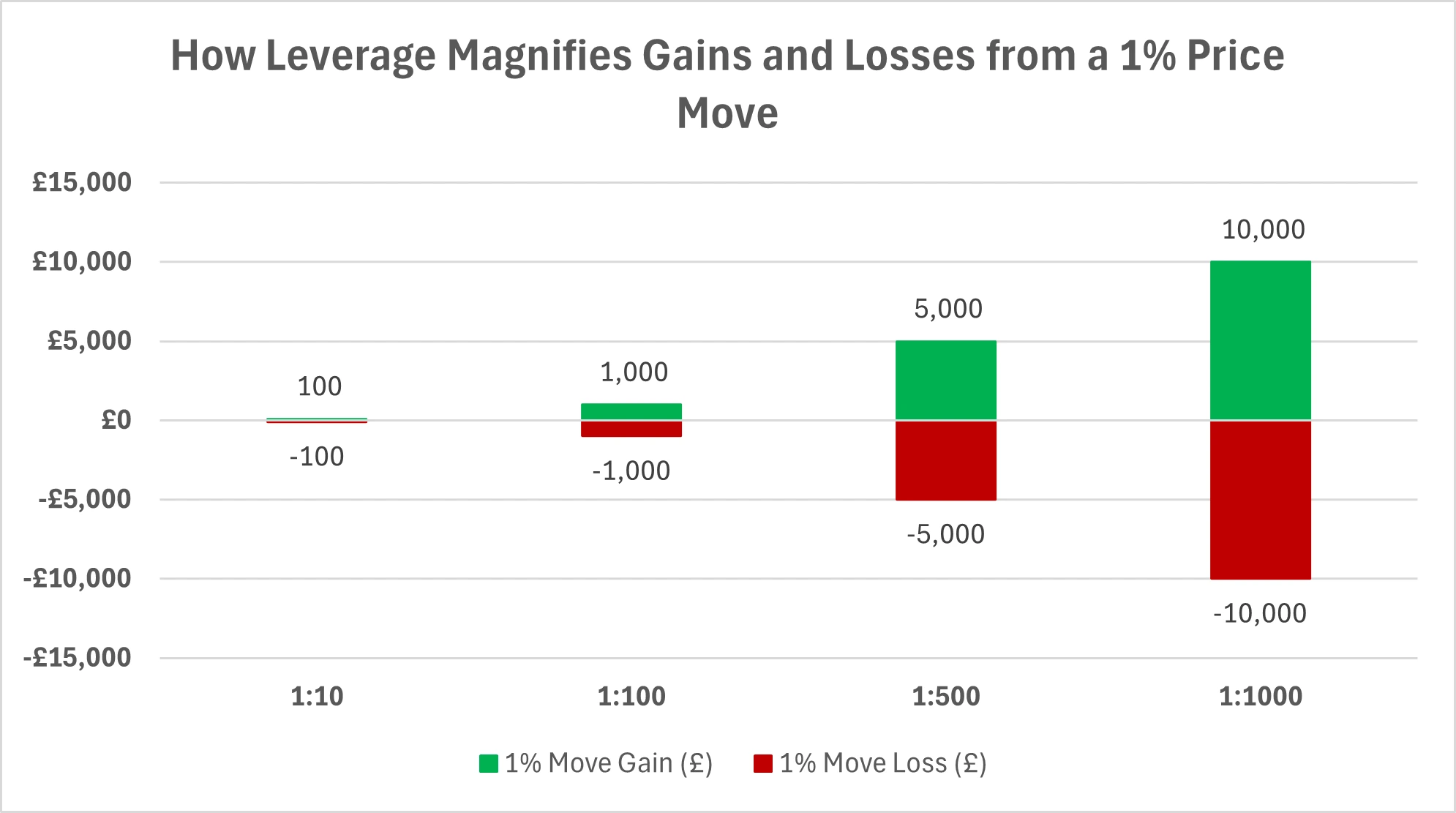

Consider this: with 100:1 leverage, a 1% adverse price move can result in a 100% loss of your capital. At 1000:1, just a 0.1% move against you could wipe out your account. There’s virtually no room for error at such extremes. That’s why experienced traders often stick to moderate leverage levels and never risk more than they can afford to lose. The right amount of leverage is one that still lets you sleep at night. If a certain level makes you nervous, it’s probably too much!

The chart below shows how a 1% price move can affect a £1,000 account at different leverage levels. As leverage increases, both potential gains and losses rise dramatically – a clear reminder of how “too much” can quickly become dangerous.

Managing Leverage with EC Markets

At EC Markets, you can access leverage up to 1:1000 on certain trading instruments. This high limit gives you the flexibility to trade large positions if needed. But remember, you don’t have to use the maximum. EC Markets allows you to choose a lower leverage level from your account settings if you prefer a safer approach. You can also simply trade smaller position sizes to effectively reduce your leverage exposure. The platform’s risk controls (such as margin requirements and automatic stop-outs) help manage extreme market moves, but the onus is on you to leverage responsibly. Use the available tools (like placing stop-loss orders), and increase your leverage gradually as you gain experience and confidence.

Bottom Line

Leverage is a powerful tool – not a guaranteed shortcut to riches! It can dramatically boost your profits and your losses, so the key is to use it wisely and sparingly.

The bottom line on what is leverage in trading and how much is too much? It boils down to managing your risk. Never take on more leverage than you can handle. Start low, gain experience, and remember: trading is a marathon, not a sprint. With a cautious approach, leverage can work for you, not against you.