Thin Liquidity, Firm Trends as Markets Close Out 2025 | Weekly Market Recap: 22-26 December 2025

Economic & Macro Overview

Markets traded through a holiday-shortened and liquidity-constrained week, with price action driven more by positioning, macro expectations and year-end flows than by fresh data surprises. Several major exchanges were closed for Christmas, while others operated on shortened hours, amplifying moves in otherwise thin conditions.

Expectations around US monetary policy in 2026 remained a central influence. The Federal Reserve’s cumulative 75bp of rate cuts in 2025, combined with a cooling labour market and easing inflation momentum, continued to weigh on the US dollar. Markets increasingly priced the likelihood of two further rate cuts next year, with sensitivity around the timing of the first move.

Political uncertainty also lingered, with investors awaiting President Donald Trump’s nomination of the next Fed Chair, adding another layer of uncertainty to the forward policy outlook.

In Europe, the ECB’s decision to hold rates steady and limited expectations for near-term easing helped underpin the euro. In Japan, markets continued to reassess the implications of policy normalisation, with attention on inflation dynamics and central bank communication rather than hard data.

Overall, the macro backdrop remained consistent with late-2025 conditions: slowing but resilient growth, easing financial conditions, and rising dispersion across assets.

Equities, Bonds & Commodities

Global equity markets were little changed overall, but underlying trends remained constructive despite light volumes.

In the US, equities consolidated near record levels. The S&P 500 closed just below 6,930, sitting around 1% shy of the 7,000 milestone, while the index remained on track for its eighth consecutive monthly gain, its longest winning streak since 2017-2018. The Nasdaq Composite held near 23,600, while the Dow Jones Industrial Average ended the week close to 48,710. Gains were modest, but the broader tone remained firm as markets entered the traditional Santa Claus rally window.

Bond markets were largely range-bound. US Treasury yields moved little amid the lack of new macro catalysts, while European yields remained anchored following recent central bank decisions.

Commodities were the standout. Gold surged to fresh record highs, with spot prices reaching $4,549.71/oz intraday before settling around $4,531/oz, up over 1% on the week. The metal remains on course for its strongest annual gain since 1979, supported by Fed easing, central bank demand, ETF inflows and de-dollarisation trends.

Silver was even more volatile, breaching $77/oz for the first time, hitting an all-time high of $77.40/oz, and posting a 7.5% daily gain at one point. Silver is now up roughly 167% year-to-date, driven by supply deficits, its designation as a US critical mineral and strong investment inflows. Platinum and palladium also recorded sharp gains, with platinum posting its strongest weekly rise on record.

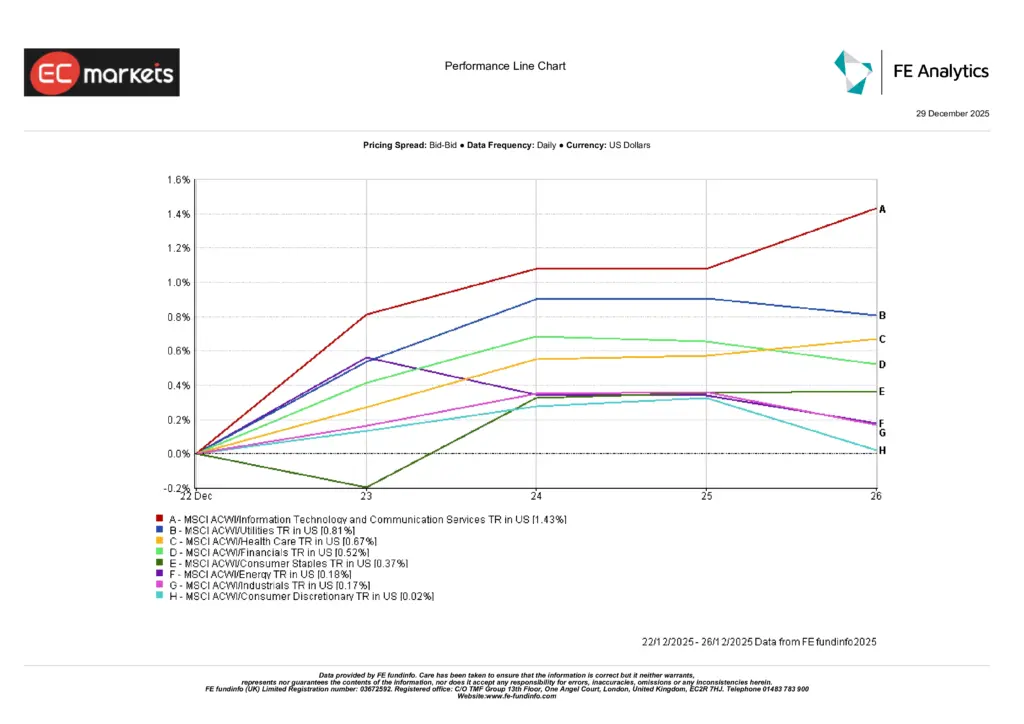

Sector Performance

Sector performance reflected broad but shallow participation, consistent with a holiday-shortened week characterised by thin liquidity and muted conviction.

Information Technology & Communication Services led gains, rising 1.43%, as large-cap growth stocks benefited from year-end positioning and ongoing confidence in structural growth themes. Utilities advanced 0.81%, supported by defensive demand, while Health Care gained 0.67%, reflecting its stable earnings profile in low-volatility conditions.

Financials rose 0.52%, aided by stable yields, and Consumer Staples added 0.37%, reinforcing the defensive tilt. Energy (+0.18%), Industrials (+0.17%) and Consumer Discretionary (+0.02%) posted more modest gains, reflecting limited cyclical conviction rather than outright weakness.

Overall, sector performance underscored a market characterised by selective leadership and modest gains, rather than broad-based risk appetite, with returns driven more by positioning than by fresh macro catalysts.

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 26 December 2025.

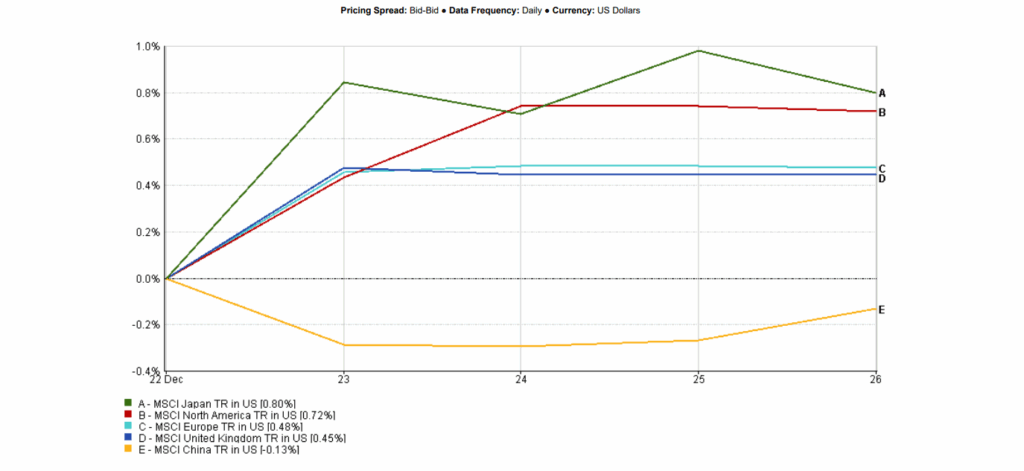

Regional Markets

Regional equity performance was mixed but generally positive, reflecting selective participation in a holiday-shortened week.

Japan led regional gains, with the MSCI Japan up 0.80% (USD), as equities remained resilient despite ongoing reassessment of the Bank of Japan’s policy trajectory. North America followed, rising 0.72%, supported by US equities consolidating near record highs amid year-end positioning.

Europe ex-UK gained 0.48%, underpinned by euro strength and policy stability, while the United Kingdom rose 0.45%, posting modest gains in thin trading conditions.

China underperformed, with the MSCI China down 0.13%, reflecting persistent domestic demand weakness and cautious investor sentiment.

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 26 December 2025.

Currency Markets

Currency markets reflected renewed US dollar softness and ongoing policy divergence, with moves amplified by thin holiday liquidity.

The euro strengthened, with EUR/USD trading up to the 1.1775 area during the week, supported by expectations for further Federal Reserve easing in 2026 and limited pricing for ECB rate cuts. Money markets continued to assign less than a 10% probability of an ECB rate cut in early 2026, helping underpin the single currency.

The US dollar index weakened over the week, enhancing demand for dollar-denominated commodities, particularly precious metals. In Japan, yen moves were mixed, as FX markets remained sensitive to policy communication and positioning rather than strong directional conviction amid the holiday-shortened trading environment.

Outlook & The Week Ahead

With just a handful of trading sessions remaining in 2025, markets are increasingly focused on how the year ends rather than new catalysts.

Key themes into early January include:

- The durability of the Santa Claus rally

- Continued reassessment of Fed easing expectations for 2026

- Follow-through in precious metals, where trends remain strong despite overbought conditions

- Rotation beneath the surface of equity indices as valuation discipline persists

As liquidity normalises in the new year, the elevated dispersion seen across regions, sectors and assets may translate into renewed volatility and clearer leadership trends.