Shutdown Ends, Uncertainty Lingers | Weekly Recap: 10-14 November 2025

Economic Overview

The biggest story this week was the end of the US government shutdown. Congress approved a continuing funding resolution late Wednesday, allowing federal agencies to reopen and workers to be paid back wages. The backlog of missing data also comes into focus: only September’s CPI was released during the shutdown, and October jobs and inflation reports may never see the light of day. Policymakers are proceeding with caution. Fed officials have downplayed another imminent rate cut, and Chair Powell explicitly said a December move isn’t “a foregone conclusion” amid the data fog.

In Europe, ECB Vice‑President reiterated that inflation running just above target is no reason to rush rate cuts – the ECB remains comfortable with current policy and sees any dip below 2% as temporary.

Geopolitically, tensions in the Middle East were a background concern, supporting oil and safe-haven assets early in the week (before ending lower on Friday’s end‑of‑week rally).

Overall, central banks held steady and focused on data: with US data stalled by the shutdown, attention shifts to UK and China reports (as detailed below) and the final stretch of US earnings season.

Equities, Bonds & Commodities

US stocks fell on balance during the week, as technology shares led a pullback. The S&P 500 ended the week roughly 1.4% lower and Nasdaq was off around 1.5%. The Dow Jones was relatively resilient, down only about 1.5%. Treasury yields moved higher: the 10‑year US yield rose toward ~4.15% by Friday. This reflected both end‑of‑week positioning and comments from Fed officials, which trimmed market odds of early cuts. In Europe, markets also drifted. The STOXX Europe 600 briefly hit record highs midweek but ended Friday down ~1% (banks were among the weakest sectors).

In commodities, Brent crude oil held in the mid-$60s. By Friday Brent was around $64–65/barrel. Prices were supported early by geopolitical risk, then retraced as risk sentiment improved. US crude (WTI) traded near $60. Gold prices dipped sharply: gold futures fell about 2-3% on the week to roughly $4,090/oz by Friday, as a firmer dollar and tech sector sell‑off weighed on the usual safe‑haven demand.

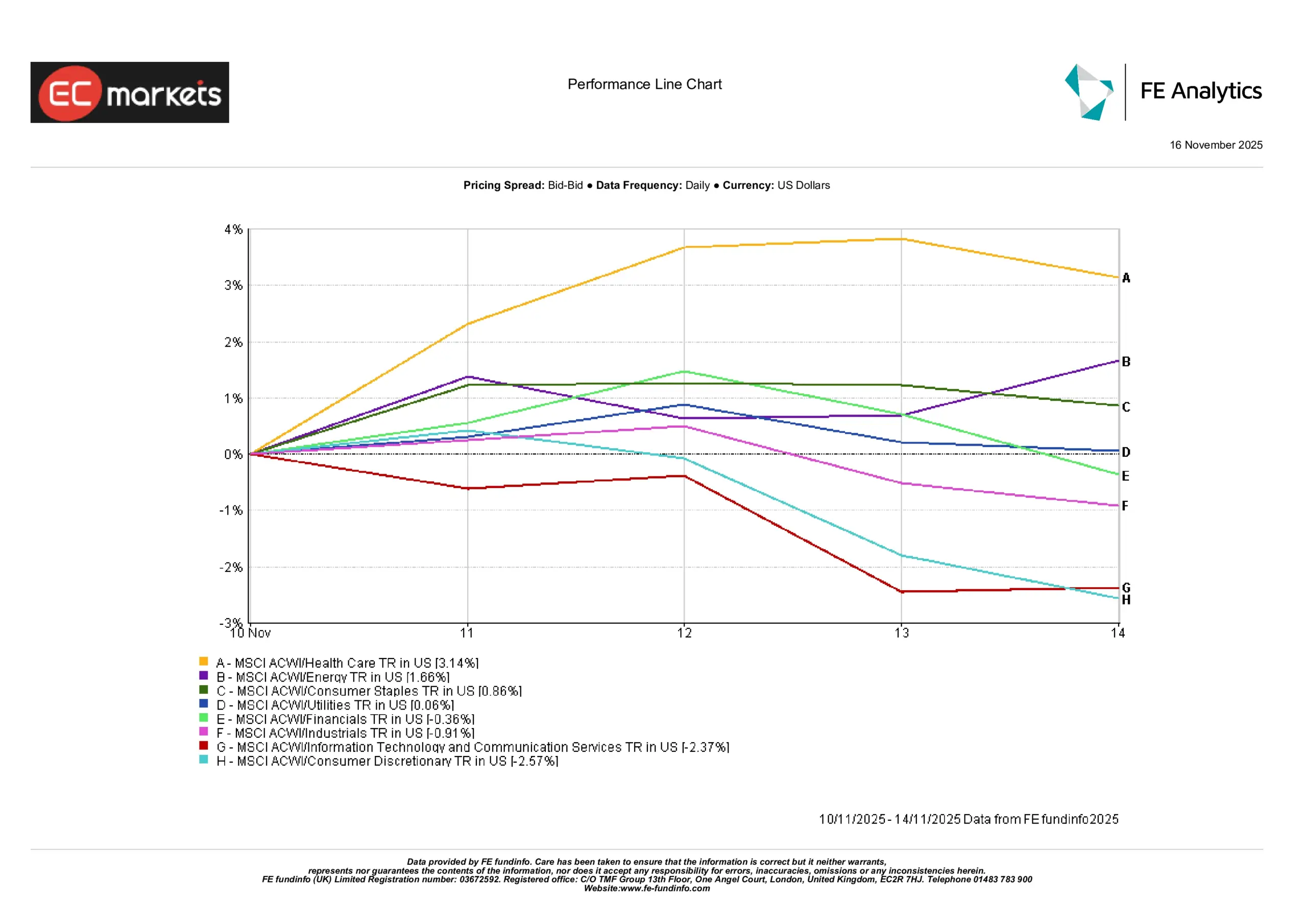

Sector Performance

Technology‑heavy sectors (information technology and consumer discretionary) were the weakest performers this week, extending a rotation out of richly valued tech names. In contrast, energy, healthcare and materials were among the best performers. For example, energy companies benefited from oil’s bounce, and healthcare and materials stocks outperformed as investors sought defensive qualities and value. Notably, so‑called “AI” sectors have cooled after a strong rally. Tech/AI sectors have underperformed in November so far, while sectors like healthcare, energy and materials have outperformed.

Overall, investors shifted toward cyclicals and defensives and away from growthier groups. (Sector drivers included strong oil and commodity producers boosting energy and materials groups, and solid earnings from some healthcare firms; conversely, high‑multiple tech firms saw profit-taking.)

Sector Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 14 November 2025.

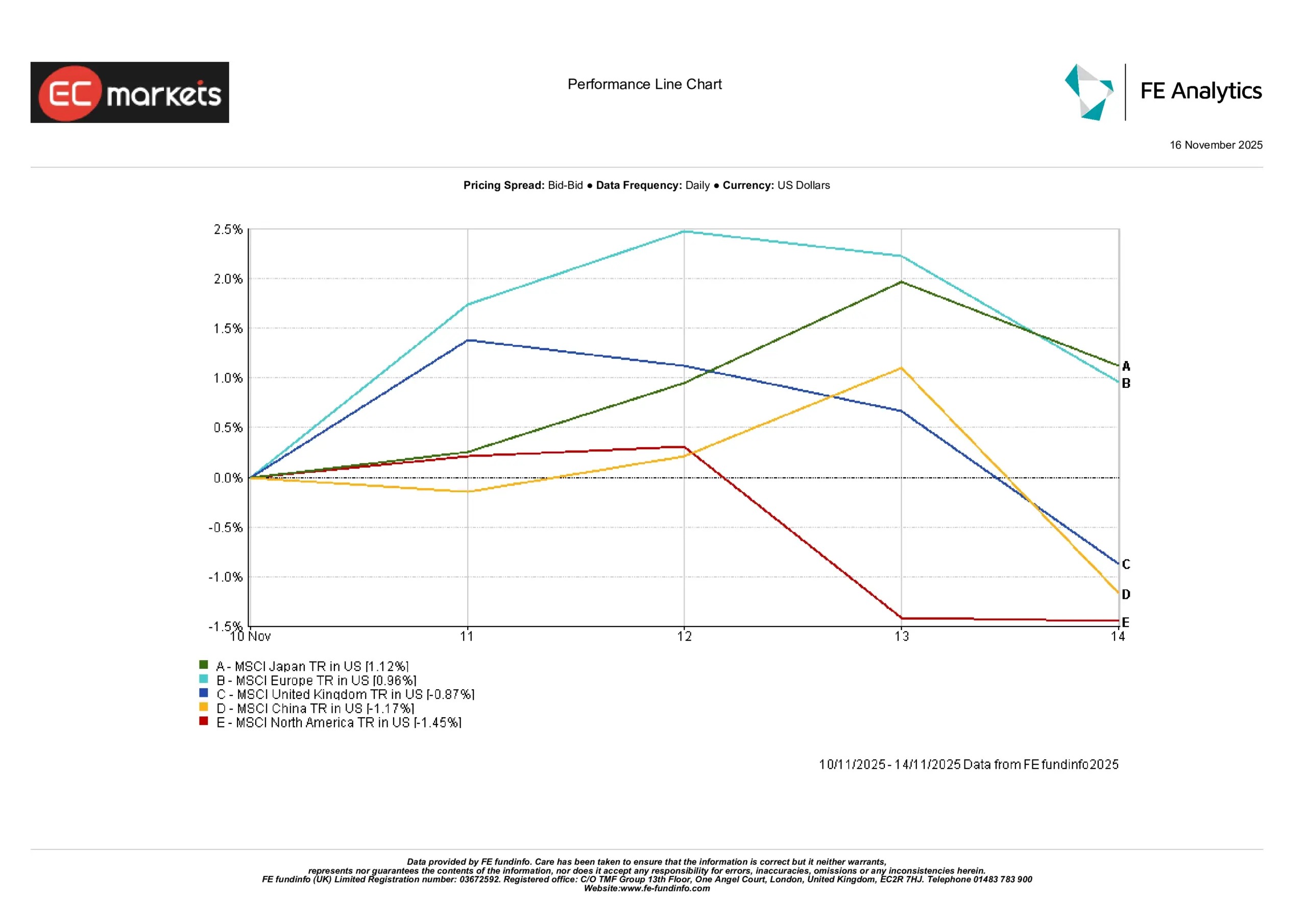

Regional Markets

In the US, markets gave back some of last week’s gains. The S&P 500 closed Friday around 1.4% below its level on Monday. The Nasdaq underperformed markedly, whereas the Dow held up better. In Europe, after mid-week optimism on the US situation, major indexes slipped. The STOXX Europe 600 fell about 1% on Friday, but still posted a small net gain for the week (its best weekly performance since late September). UK equities lagged – the FTSE 100 ended down ~1.1% on Friday – as a late-week surge in gilt yields dampened sentiment. In Asia, trends were mixed. Japan’s market was modestly higher, helped by a softer yen. Hong Kong’s Hang Seng index actually rose roughly 1.3% on the week, as it found technical support and some positive Chinese inflation data offset sluggish mainland China numbers. Mainland Chinese stocks were otherwise subdued.

Overall, North America underperformed, Europe was nearly flat to slightly down on the week, and Asia (ex‑Japan) saw modest gains, driven largely by the rebound in Hong Kong equities.

Regional Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 14 November 2025.

Currency Markets

The US dollar was firm early in the week but softened into the close on Thursday and Friday as the shutdown ended. GBP/USD initially fell after weak UK GDP and political uncertainty, but rebounded as the dollar eased. By mid-Friday the pound found support after reports the UK government abandoned planned tax rises, which had pushed gilt yields up. EUR/USD early in the week dipped toward 1.147, then rallied as the euro stabilized. The dollar’s pullback also pushed USD/JPY down. The yen’s recent weakness paused after the Fed comments, so USD/JPY traded roughly flat for the week. Likewise GBP/JPY moved in line with cable moves, ending the week around ¥192.

In sum, the dollar was relatively flat overall: it lost some ground against the pound and euro late-week but remained strong against many emerging currencies. Sentiment and central‑bank cues (BoE cut bets rising, Fed pause bets rising) were the main drivers of the moves.

Outlook & The Week Ahead

With the US shutdown over, the market focus shifts to what was delayed and what lies ahead. In the US, the backlog of October data is likely to roll out next week: housing starts, building permits and existing home sales data are due, as are final S&P PMI surveys and a handful of Fed speeches. (Notably, October nonfarm payrolls will return without an unemployment rate.) Investors will watch these for clues on growth and inflation. In the UK, attention turns to Tuesday’s unemployment figures and Thursday’s Q3 GDP – the BoE will pore over those to gauge when to cut rates. China reports October industrial output and retail sales on Friday, after already‑weak PMI readings; those data will indicate whether more stimulus is needed. Finally, the US corporate earnings season is winding down but some big names will still report, and any guidance will be scrutinized.

Overall, investors enter late November cautiously. The tone is one of relief that the shutdown ended, but uncertainty remains high given missing data and policy shifts. Many are looking for clear signals from the incoming economic reports. If China shows more weakness or US data disappoints, markets could test lower levels. Conversely, any signs that inflation is stabilizing at target (or that governments will avoid austerity) could spark a modest rally. In short, next week’s data (and central-bank speeches) will be key to setting the narrative for the rest of Q4, with sentiment likely remaining tentative in the meantime.