Markets Extend Modest Gains as FX Trends and Regional Divergence Persist | Weekly Recap: 5-9 January 2026

Economic Overview

The first full trading week of 2026 unfolded with a steady macro backdrop and limited change in central bank expectations. Policy signals across major economies remained broadly consistent with late-December messaging, reinforcing a sense of continuity rather than transition. Inflation trends continue to ease gradually, while growth indicators point to moderation rather than deterioration, keeping investors positioned cautiously but constructively.

In the US, Fed communication offered little deviation from the year-end stance. Policymakers continued to emphasise data dependence, with no urgency to adjust policy following recent disinflation progress. In Europe, the ECB’s position remained relatively firm, with inflation tracking close to target and growth holding up better than feared. The BoE, meanwhile, remained on a gentler path, as slowing activity and easing price pressures continue to shape expectations for eventual policy easing later in the year.

Japan’s policy outlook remained supportive of gradual normalisation, though BoJ guidance continued to limit expectations for aggressive tightening. In China, sentiment softened slightly after a stronger end to December, as investors reassessed the pace of recovery and the impact of recent policy support from the PBoC.

Overall, the macro environment remained stable, with reduced uncertainty but limited conviction, leaving markets driven more by relative positioning than by new macro catalysts.

Equities, Bonds & Commodities

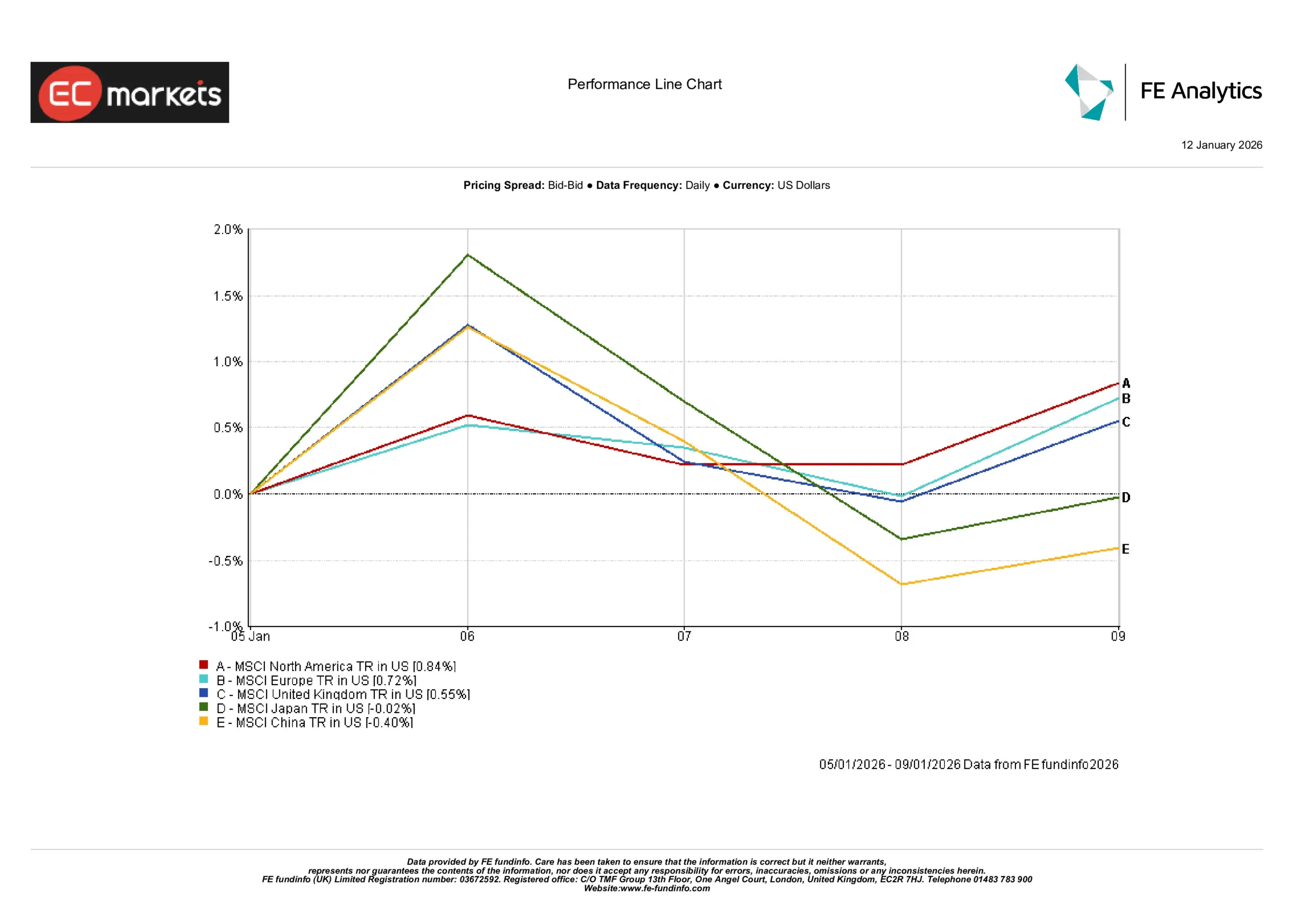

Global equity markets posted modest gains over the week, though performance varied meaningfully by region. As shown in the chart below, North American equities advanced by around 0.8% in US dollar terms, while European equities gained approximately 0.7%. UK equities also finished higher, rising by roughly 0.6%.

By contrast, Japanese equities were broadly flat over the period, ending close to 0.0%, while Chinese equities declined by around 0.4%, making China the weakest-performing major region during the week. The divergence highlights a continuation of selective risk-taking rather than broad-based equity strength.

Fixed income markets were relatively subdued. Government bond yields moved within narrow ranges, reflecting stable inflation expectations and the absence of significant policy surprises.

Commodity markets also saw limited movement, with energy prices broadly steady and precious metals remaining supported by expectations that global policy rates are near their peak.

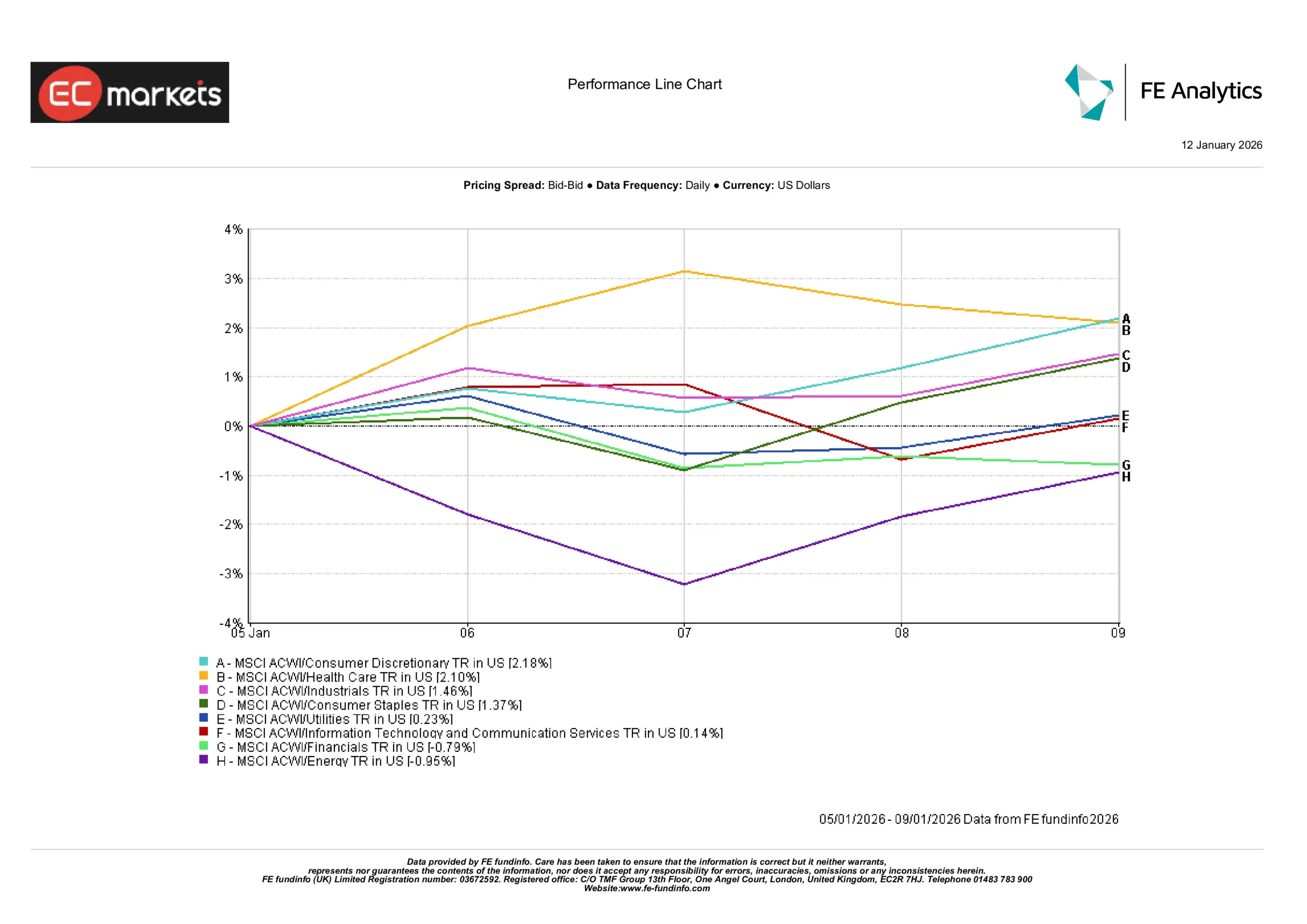

Sector Performance

Sector performance showed clearer differentiation, with leadership driven by consumer resilience and demand for earnings visibility rather than broad risk-taking. Consumer Discretionary led, up +2.18%, as sentiment toward consumer-facing names stabilised after late-December softness. Health Care rose +2.10%, continuing to benefit from its defensive earnings profile in a still-uncertain macro environment.

Consumer Staples gained +1.37%, indicating that investors were broadening exposure without rotating away from defensives. Industrials advanced +1.46%, reflecting confidence that activity is holding up rather than accelerating. Utilities rose a modest +0.23%, suggesting limited demand for pure defensives.

Performance was weaker in rate- and commodity-sensitive sectors. Financials fell -0.79%, likely reflecting ongoing pressure on margins as expectations for future rate cuts persist. Energy declined -0.95%, giving back some late-December gains as commodity prices stabilised. Information Technology and Communication Services were broadly flat at around +0.14%, pointing to consolidation rather than renewed growth leadership.

Sector Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 09 January 2026.

Regional Markets

Regional performance continued to diverge. North America led gains, rising by close to 0.8%, supported by stable economic expectations and steady sentiment. European equities followed with gains of around 0.7%, extending their recent run of relative strength. UK equities advanced by just over 0.6% in US dollar terms, holding up well but lagging peers slightly.

Japan underperformed developed market peers, finishing the week broadly flat at around 0.0%, despite continued weakness in the yen. China was the clear laggard, declining by approximately 0.4%, reversing part of the rebound seen in the prior week.

The regional picture reinforces the theme of selectivity, with investors favouring markets perceived as more stable while remaining cautious toward regions facing greater policy or growth uncertainty.

Regional Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 09 January 2026.

Currency Markets

Currency markets delivered clearer trends than equities. The US dollar strengthened further against the Japanese yen, with USD/JPY rising by around 1.4% over the week to trade near the 158 level. Sterling edged higher against the dollar, with GBP/USD gaining approximately 0.4%, while GBP/JPY advanced by close to 1.8%, reflecting both pound strength and yen weakness.

The euro softened modestly. EUR/USD declined by around 0.7%, drifting from the mid-1.17 area toward the mid-1.16 range, as relative policy expectations continued to favour the dollar.

Outlook & The Week Ahead

Looking ahead, attention is likely to remain on upcoming inflation and labour market data, particularly in the US, as investors assess the timing of potential rate cuts. Central bank commentary from the Fed, ECB and BoE will continue to be monitored for nuance rather than policy shifts, while earnings season later in January may begin to introduce more company-specific drivers into markets.

For now, the tone remains calm and controlled. With uncertainty reduced but conviction still limited, markets appear content to extend trends gradually rather than shift positioning aggressively.