Gold Smashes Through $3,500 – Here’s What’s Really Going On

Gold has had plenty of big moments over the years, but crossing the $3,500 mark this week feels different. On 2 September, prices briefly touched $3,530 an ounce, making headlines everywhere. That’s a 34% jump since January. For something that usually moves at a snail’s pace, this is more like a sprint. So, what’s pushing it higher?

The simplest answer: interest rates. Traders are betting the US Fed will cut rates this month, probably on 17 September. Some even think a weak jobs report on Friday could open the door to a bigger cut. Lower rates mean bonds and savings accounts earn less, which suddenly makes a non-yielding lump of metal look… well, not so bad! Throw in a softer dollar, and you’ve got some extra push for gold’s rally.

Then there’s inflation. Yes, it cooled off from the harsh peaks of 2022, but it hasn’t fully gone away. The UK, for example, saw consumer prices jump back to 3.6% in June. Those frightened investors. People buy gold when they’re nervous that prices will eat into their savings. It doesn’t generate cash flow, but it holds its value over time. Think of it as an insurance policy you hope you don’t need.

Who’s Behind the Buying?

It’s not just nervous investors. Central banks, the big buyers that set the tone, have been piling in too. For the first time since the mid-90s, foreign central banks actually hold more gold than US Treasurys. That says a lot about where confidence is heading. And the big gold ETF (SPDR Gold Trust) is filling up again, hitting its highest holdings since 2022. When both official institutions and everyday investors are on the same side, momentum builds quickly.

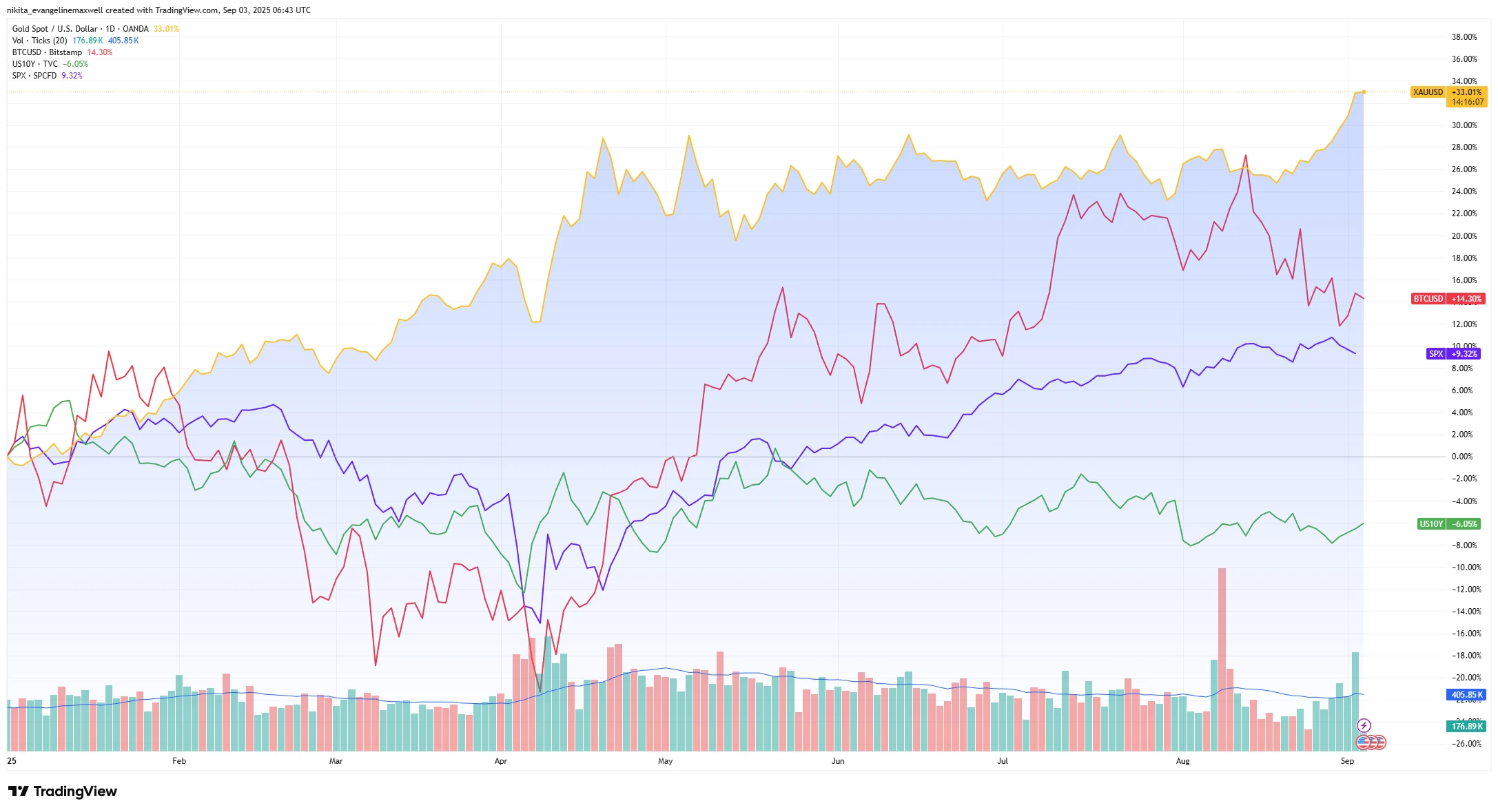

Gold Outpaces Stocks, Bonds and Bitcoin in 2025

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 3 September 2025.

Gold has surged nearly 34% this year, far ahead of the S&P 500 (+9%) and Bitcoin (+14%), while US Treasury yields have slumped. The chart highlights why investors see bullion as the standout performer in 2025.

Politics, Geopolitics… and Nerves

Add in the usual mix of global events: trade disputes, messy fiscal debates in Washington, and broader geopolitical tensions. Every flare-up pushes a little more money into gold. It’s almost automatic now, when other assets wobble, gold benefits.

Bottom Line

So then what’s next? Some forecasters see gold climbing toward $3,700 over the next year if central banks keep buying and the Fed turns more dovish. That said, after a one-third rally this year, nothing goes up in a straight line. If the Fed surprises with a smaller cut or markets calm down, prices could easily stall or dip.

Gold’s breakout above $3,500 isn’t random. It’s the product of lower-rate bets, lingering inflation fears, strong buying by central banks, and a general sense of unease. Whether it keeps running or takes a breather, gold is once again the market’s mood ring.