Gold Finds Support as Venezuela’s Struggles Keep Safety in Focus

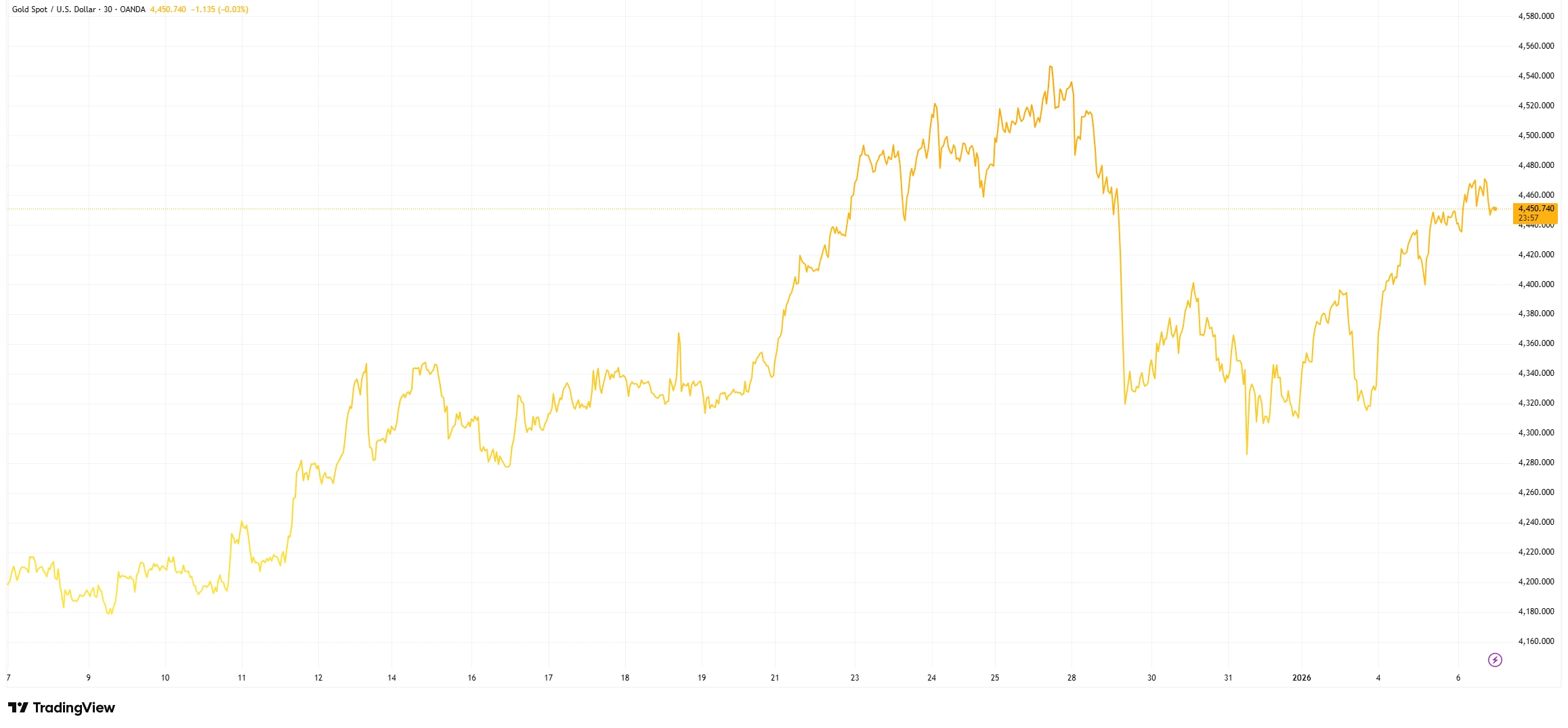

Gold Prices Hold Near Recent Highs (30-Day View)

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 06 January 2026.

Gold prices have remained well supported in recent sessions, not because of a single headline or sudden shock, but due to a steady build-up of uncertainty across global markets. One of the quieter contributors has been Venezuela, where economic and political strain continues to remind investors why gold still matters when confidence starts to weaken.

Rather than making sharp moves, gold has been holding close to recent highs. That stability is important. It suggests investors are not chasing short-term gains, but are using gold as protection at a time when the outlook feels uneven. Even with higher borrowing costs and tighter access to money, demand for the metal has not faded in the way some expected.

Venezuela’s situation helps explain part of that mindset. The country continues to face deep economic challenges, including persistent inflation, a weakening currency, and an economy that relies heavily on oil exports. Years of pressure on production and limited access to global markets have made recovery difficult, leaving households and businesses exposed to rising costs and shrinking purchasing power.

In that environment, holding local currency becomes risky. Gold, by contrast, offers something more stable. For many people in Venezuela, it is not viewed as an investment or a trading opportunity, but as a practical way to preserve value when trust in money erodes. That reality may be local, but the message it sends travels much further.

Venezuela alone is not large enough to move global gold prices. What matters more is the signal it sends. When economic stress resurfaces in vulnerable economies, it reinforces a broader sense of caution. Investors elsewhere take note, especially at a time when debt levels are high, long-term inflation concerns remain unresolved, and geopolitical tensions are never far from the surface.

This helps explain why gold has struggled to fall back meaningfully, even as markets continue to debate interest rate paths. Confidence in traditional currencies is not evenly distributed, and events like those unfolding in Venezuela add to the case for holding assets that are not tied to any single government or financial system in the current global environment today.