Fed Signals Easing as Trade Tensions Return | Weekly Recap: 6-10 Oct 2025

Economic Overview

Markets entered October balancing two competing forces – a Federal Reserve that sounded increasingly open to further easing, and a sudden revival of trade tensions between the world’s largest economies.

The US government shutdown rolled into its second week, freezing major data releases including the September jobs report. With official numbers off the table, traders focused on what the Fed would do next.

Most Fed officials kept their tone cautious, signalling that another cut remains likely but not imminent. Futures still price in one more move before year-end, reinforcing the sense that policy is easing but not in a rush.

Across the Atlantic, the BoE and ECB struck familiar notes – steady rates, no hurry to pivot. UK inflation remains sticky near 3.8%, while eurozone CPI holds around 2.2% with PMIs just above 51. Both banks see little reason to move soon.

The macro picture, in short, hasn’t shifted much since last week. What’s changed is sentiment: with trade tensions resurfacing and Washington’s shutdown dragging on, investors are less focused on data and more on how policy can cushion the fallout.

Beyond macro data, geopolitics crept back into the mix. OPEC+ agreed to a modest output rise of 137,000 barrels a day for November, a smaller bump than expected, while progress on Middle East ceasefire talks trimmed the war-risk premium in oil prices. That calm was short-lived: by Friday, fresh US-China tariff threats reignited trade worries, cooling sentiment just as investors had grown comfortable with the idea of a gentler Fed.

Equities, Bonds & Commodities

Equity markets started the week upbeat but lost steam after fresh trade headlines unsettled sentiment. The S&P 500 briefly set another intraday record before reversing to finish down 2.4%, while the Dow Jones and Nasdaq slipped 2.7% and 2.5%, respectively, as profit-taking hit high-growth tech names. What began as optimism about policy easing turned defensive once tariff risks resurfaced and investors reassessed global supply chains.

Europe followed a similar path. The STOXX 600 touched record highs mid-week but ended about 1% lower as autos and industrials sold off. The FTSE 100 fared better, easing only 0.7% thanks to its defensive mix of energy, miners, and staples – sectors that typically cushion volatility.

Asia proved to be steadier. Mainland Chinese shares inched higher after reopening, supported by state-linked financials and firm tech sentiment. Japan’s Nikkei was flat overall: yen weakness helped exporters early on, but political uncertainty and fiscal chatter capped gains.

Bond markets turned defensive as the week wore on. US 10-year yields fell to 4.05% and 2-year yields to 3.45%, a modest steepening but still an inverted curve – signalling confidence in further easing yet caution on growth. German Bunds slipped to 2.3%, U.K. gilts near 4%, while Japan’s 10-year JGB brushed its 1.0% ceiling on fiscal-spending speculation.

Commodities diverged. Brent crude slid 5% to $64 a barrel amid softer demand and easing geopolitical risk. Gold, meanwhile, extended its rally, briefly topping $4,000 and closing near $3,990 on safe-haven flows and lower real yields.

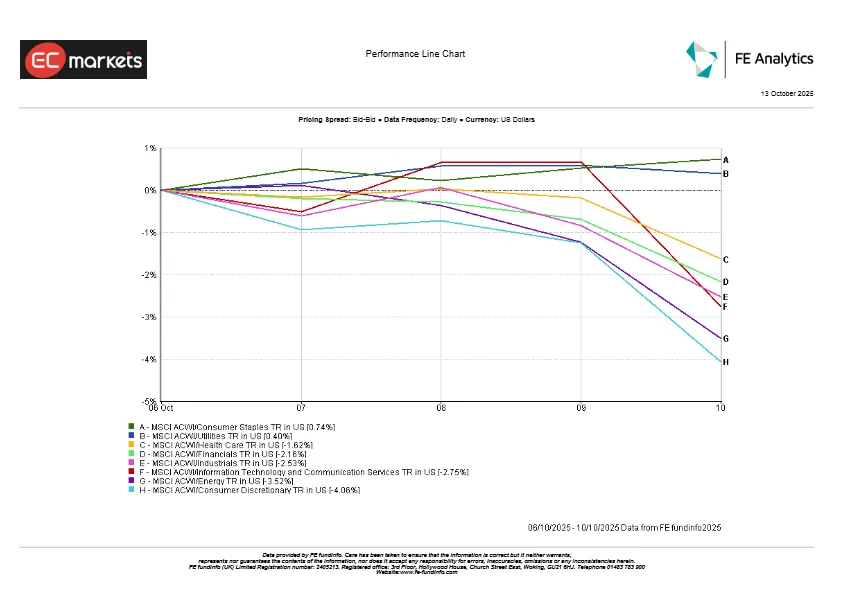

Sector Performance

The tone across sectors shifted back toward safety. Utilities and Consumer Staples led globally as lower yields and renewed volatility steered investors into defensive corners. In Europe, utilities logged their best performance in over a month, while major food and beverage names gained on consistent earnings and stable demand.

Sector Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 10 October 2025.

Cyclicals bore the brunt of the reversal. Consumer Discretionary fell sharply as automakers and retailers faced the brunt of tariff chatter. Technology, which had led most of 2025, slipped late in the week as semiconductor and AI-exposed stocks were hit by renewed trade risk. Energy also lagged after crude’s drop dragged integrated oil majors lower. Financials were mixed: banks weakened as yields retreated, but insurers and asset managers held steady.

By Friday, the market narrative had turned defensive – a quick rotation from chasing growth to seeking stability.

Regional Markets

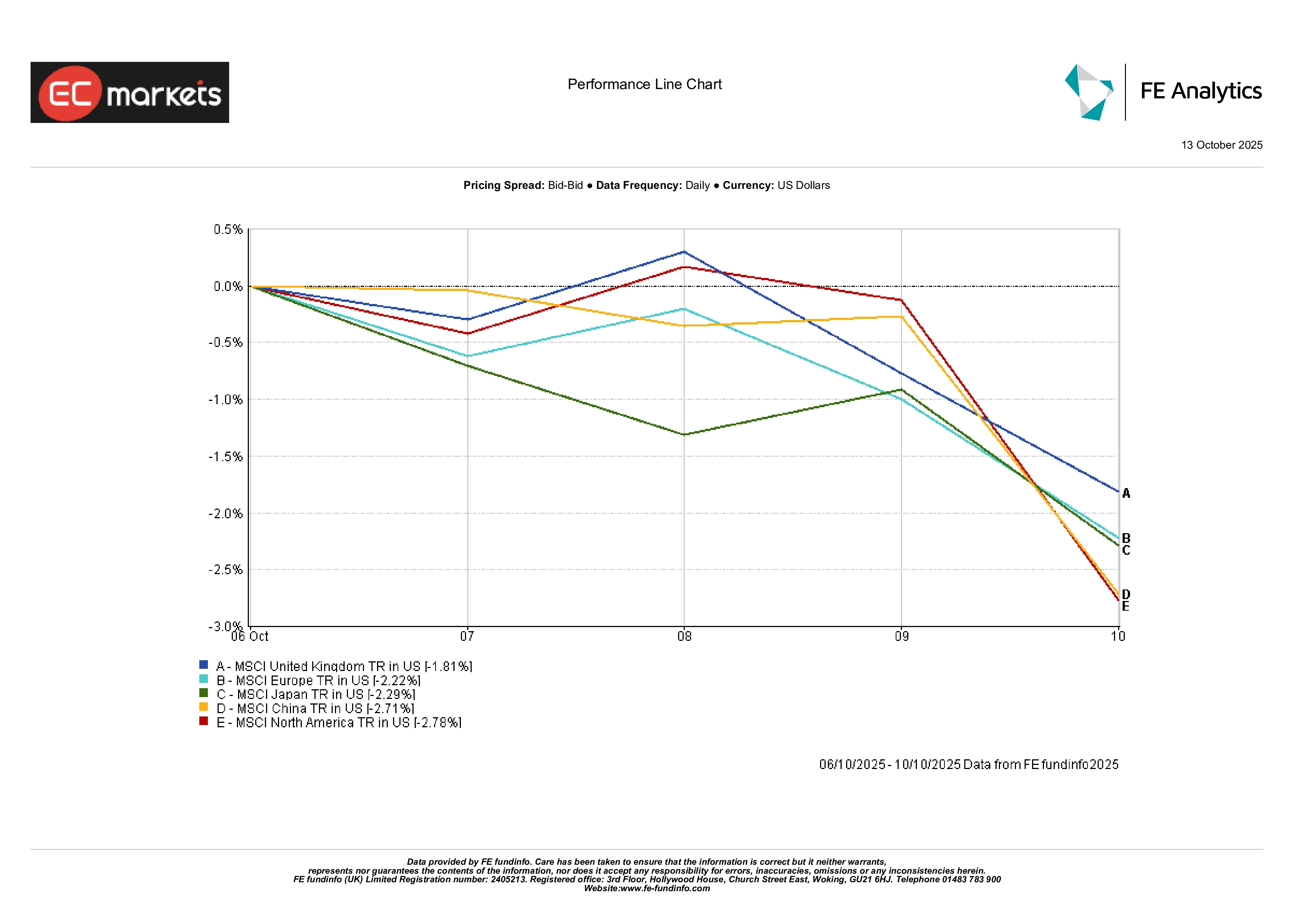

Regional performance showed a mixed picture but leaned negative overall.

North America led the declines, with the MSCI North America index down about 2.8% as tech weakness dragged broader markets lower. China followed closely, slipping 2.7% despite earlier optimism around policy support. Japan lost roughly 2.3%, weighed by political uncertainty, while Europe fell around 2.2%, cushioned slightly by its value bias and softer euro. The UK held up best, easing just 1.8% thanks to its defensive tilt in energy, mining, and consumer staples.

Regional Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 10 October 2025.

Currency Markets

Currency markets were choppy through the week, moving in step with shifting yields and changing risk appetite. The US dollar started strong, lifted by higher Treasury yields, but gave back its gains as investors turned cautious. The DXY index ended roughly flat, showing that sentiment was more about nerves than direction.

The standout was the yen. The dollar briefly climbed to 152 yen – the highest in over a year – before easing slightly to 151.7. The contrast between Japan’s patient central bank and the Fed’s softening stance kept pressure on the yen.

Sterling cooled after its recent rally, slipping to around 1.335 as UK data softened and risk appetite faded. The euro also wobbled, falling toward 1.155 mid-week before recovering to 1.163 once the dollar eased.

Outlook & The Week Ahead

Looking ahead to 13-17 October, attention remains on Washington’s shutdown saga. If departments reopen, the release of US CPI and retail sales will dominate focus, offering a clearer read on whether inflation is continuing to cool. A benign set of numbers would reinforce expectations of another Fed cut before year-end, while any upside surprise could test that view. Several Fed speakers, including Chair Powell, are due to comment through the week – their tone will likely guide market mood more than data.

China’s post-holiday credit and trade figures are due, shedding light on whether stimulus efforts are beginning to stick. In Europe, final September inflation data and sentiment indicators will help confirm whether the ECB and BoE can maintain their steady-for-longer approach.

Oil markets remain sensitive to OPEC+ headlines and Middle East developments, while the IMF-World Bank meetings in Marrakech may deliver new global growth forecasts.

All told, markets step into mid-October walking that familiar line – cautiously hopeful that central banks will keep easing bias intact, yet alert to any shock – whether data-driven or geopolitical – that could quickly change the tone.