Fed Delivers as Markets Rotate Sharply on Policy Shift | Weekly Recap: 8–12 December 2025

Economic & Macro Overview

Markets entered the week focused squarely on the Federal Reserve, and the outcome delivered little surprise but meaningful consequences. On Wednesday, the FOMC implemented a widely expected 25bp rate cut, lowering the federal funds target range from 3.75%-4.00% to 3.50%-3.75%, formally ending the 4% policy-rate era.

While Chair Powell’s messaging was largely neutral, investors interpreted the move as confirmation that the Fed has transitioned decisively into an easing phase. Updated projections pointed to lower rates in 2026, reinforcing expectations that monetary policy will now prioritise cushioning a slowing economy.

Not all policymakers agreed. Chicago Fed President Austan Goolsbee dissented, arguing inflation remains too elevated and labour market conditions do not yet justify urgency. His comments highlighted the uncertainty facing policymakers, particularly after the extended Bureau of Labor Statistics shutdown left the Fed operating with incomplete data.

Overall, the macro environment improved modestly, but the rate cut amplified rotation rather than broad risk-on behaviour, as investors reassessed positioning across assets and regions.

Equities, Bonds & Commodities

US equity markets responded positively, though performance diverged sharply beneath the surface. The Dow Jones Industrial Average surged to consecutive all-time highs, closing the week at a record 48,886, driven by inflows into industrials, financials and traditional value names.

In contrast, the Nasdaq fell roughly 2% following the cut, as investors rotated away from long-duration growth and richly valued technology stocks. The S&P 500 finished modestly higher, masking the underlying shift in leadership.

Bond markets were comparatively calm. Front-end Treasury yields declined in line with the rate cut, while longer-dated yields remained anchored as investors weighed easing financial conditions against persistent inflation risks.

Commodities were volatile. Gold climbed to seven-week highs near $4,350/oz, supported by lower real yields and renewed demand for inflation hedges. Silver experienced sharp profit-taking, falling nearly 4% after hitting a record $65, though it still ended the week up 6% and has risen 23% since late November. Oil prices were broadly stable, supported by OPEC+ discipline but capped by demand concerns.

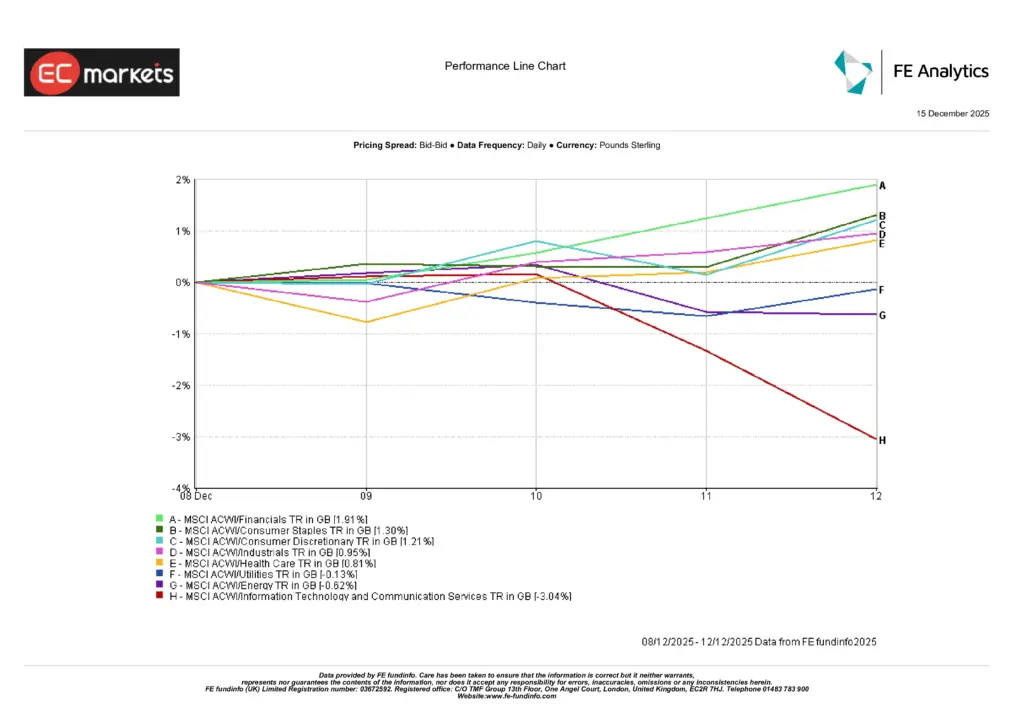

Sector Performance

Sector performance underscored the week’s dominant theme: rotation, not rally.

Financials led gains, rising 1.91%, as easing policy and improved risk sentiment favoured value-oriented sectors. Consumer Staples advanced 1.30%, reflecting renewed demand for defensive income, while Consumer Discretionary gained 1.21%, supported by expectations that lower rates may help stabilise household spending into 2026.

On the downside, Information Technology and Communication Services underperformed sharply, falling 3.04%, as investors reduced exposure to long-duration growth assets following the Fed decision. Energy declined 0.62%, weighed down by range-bound oil prices, while Health Care slipped 0.81%. Utilities were broadly flat (–0.13%).

The dispersion highlights an increasingly selective market environment, with leadership shifting towards defensives and value as growth sectors face valuation pressure.

Source: FE Analytics. All indices total return in GBP. Past performance is not a reliable indicator of future performance. Data as of 12 December 2025.

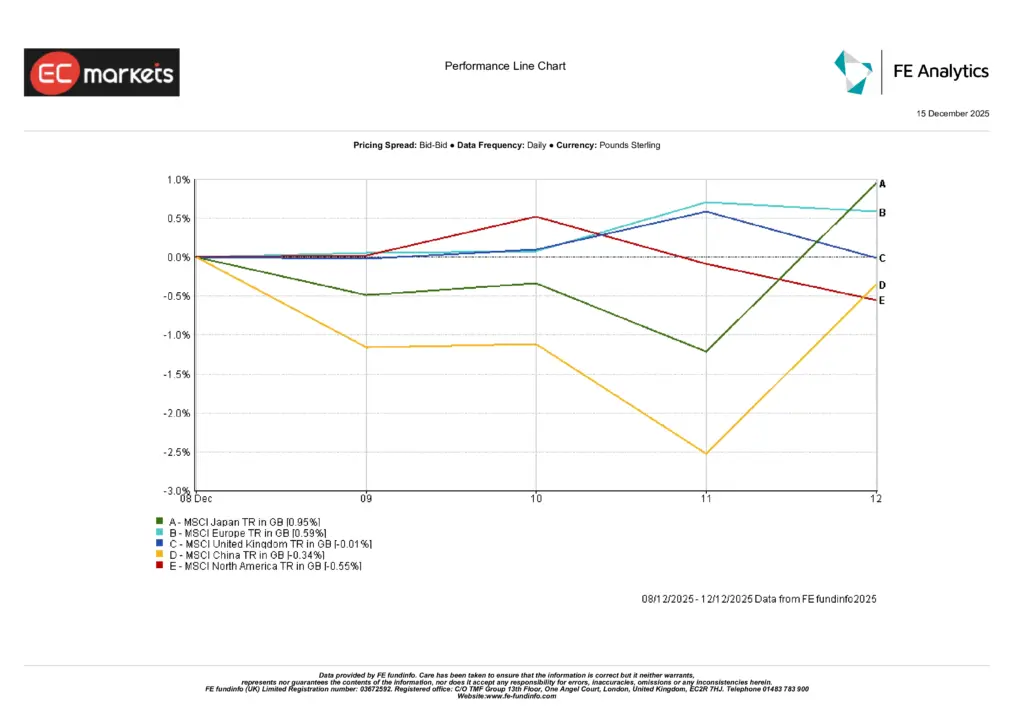

Regional Markets

Regional equity performance was mixed, reflecting widening policy divergence and post-Fed repositioning.

Japan led regional returns, with the MSCI Japan up 0.95% (GBP), supported by yen strength and growing expectations that the Bank of Japan may deliver a rate hike. Europe ex-UK followed, gaining 0.59%, as investors cautiously positioned ahead of the ECB’s final meeting of the year.

The UK market was effectively flat, with the MSCI United Kingdom up 0.01%, constrained by weak growth expectations despite easing inflation. China underperformed, with the MSCI China down 0.34%, reflecting persistent domestic demand weakness and limited stimulus momentum.

North America declined 0.55%, as rotation away from technology-heavy exposures offset gains in industrial and value-oriented sectors.

Source: FE Analytics. All indices total return in GBP. Past performance is not a reliable indicator of future performance. Data as of 12 December 2025.

Currency Markets

Currency markets reacted decisively to the Fed’s move. The US dollar weakened sharply, despite Powell’s neutral tone, as investors focused on confirmation of an easing cycle and lower forward rate projections.

The Japanese yen extended gains, pushing USD/JPY towards the 155 level, driven by rising confidence in a near-term BoJ hike and continued unwinds of yen-funded carry trades. Sterling and the euro both benefited from dollar weakness, though gains were capped ahead of upcoming central bank meetings.

Cryptocurrency markets consolidated after recent strength, with flows stabilising as investors reassessed risk following the Fed decision.

Outlook & The Week Ahead

Attention now turns to a data-heavy and policy-driven week ahead.

In Asia-Pacific, markets will digest Japanese manufacturing data, retail sales, New Zealand business surveys and New Zealand GDP, before Thursday’s highly anticipated Bank of Japan rate decision. Markets are pricing roughly a 75% probability of a BoJ hike, setting the stage for elevated volatility in yen crosses.

In Europe and the UK, focus shifts to UK employment data, PPI and RPI inflation, and the Bank of England rate decision, where a 25bp cut is largely expected. The ECB will also deliver its final decision of the year, with no change anticipated but close scrutiny on guidance for 2026.

In North America, markets will refocus on hard data as US Non-Farm Payrolls (16 December) and CPI (18 December) return following the data shutdown. Canadian CPI will also be released, alongside remarks from Governor Macklem.

With policy divergence increasing, liquidity thinning and sentiment turning increasingly data-dependent, markets appear poised for heightened volatility into year-end.