Calm Signals from the Fed, Mixed Signals in Markets | Weekly Recap: 26-30 January 2026

Economic Overview

Markets spent the week juggling two familiar forces: what central banks are willing to say, and what the data is quietly implying. The key anchor was the Fed’s January decision, where policymakers kept the policy rate unchanged at 3.50% to 3.75%. In its statement, the Fed repeated that growth has been “expanding at a solid pace”, noted that job gains have “remained low” with the unemployment rate showing “some signs of stabilisation”, and said inflation remains “somewhat elevated”.

Chair Powell’s accompanying remarks reinforced the idea that policy is now more about patience than momentum. He described an economy coming into 2026 on “a firm footing”, while acknowledging that inflation is still above target and that uncertainty remains elevated. In practical terms, that combination tends to keep investors sensitive to every incremental shift in yields and in risk appetite, because the next move is less pre-committed and more dependent on what the next run of inflation and activity prints look like.

Away from the Fed, the tone of the week was also shaped by the broader push and pull between earnings headlines and the rates backdrop. Some sessions felt constructive early on, but confidence was not especially sticky, and price action suggested investors were still willing to trim risk when news flow turned less comfortable. That is not unusual for late January, when positioning and reporting season can amplify day-to-day swings, even if the macro story itself has not changed dramatically.

Equities, Bonds & Commodities

In equities, US indices finished the week mixed. The S&P 500 rose 0.3%, while the Nasdaq Composite fell 0.45%. The Dow Jones Industrial Average slipped 0.2%, and the Russell 2000 dropped about 2.0%, highlighting a softer week for smaller companies. In global markets, and MSCI EAFE gained 1.6%.

In rates, US Treasury yields ended the week a touch higher at the longer end and broadly steady at the front end, a pattern consistent with investors treating the Fed as patient rather than imminently easing. By Friday’s close, the 2-year yield was around 3.52%, the 10-year yield around 4.26%, and the 30-year yield around 4.87%. With the Fed holding the funds rate steady and reiterating its data-dependence, it was not a week where bonds found a single dominant narrative. Instead, yields shifted in response to changing risk sentiment and to how investors interpreted the Fed’s stance between inflation and employment.

Commodities were more directional. Oil rose over 7.0% over the week, while gold fell over 5.0%. Silver was sharply lower, down around 20.0%, which stood out even by the standards of a volatile market. The main takeaway here is simply that commodity performance diverged: energy strengthened meaningfully, while precious metals, particularly silver, gave back a notable part of their earlier gains.

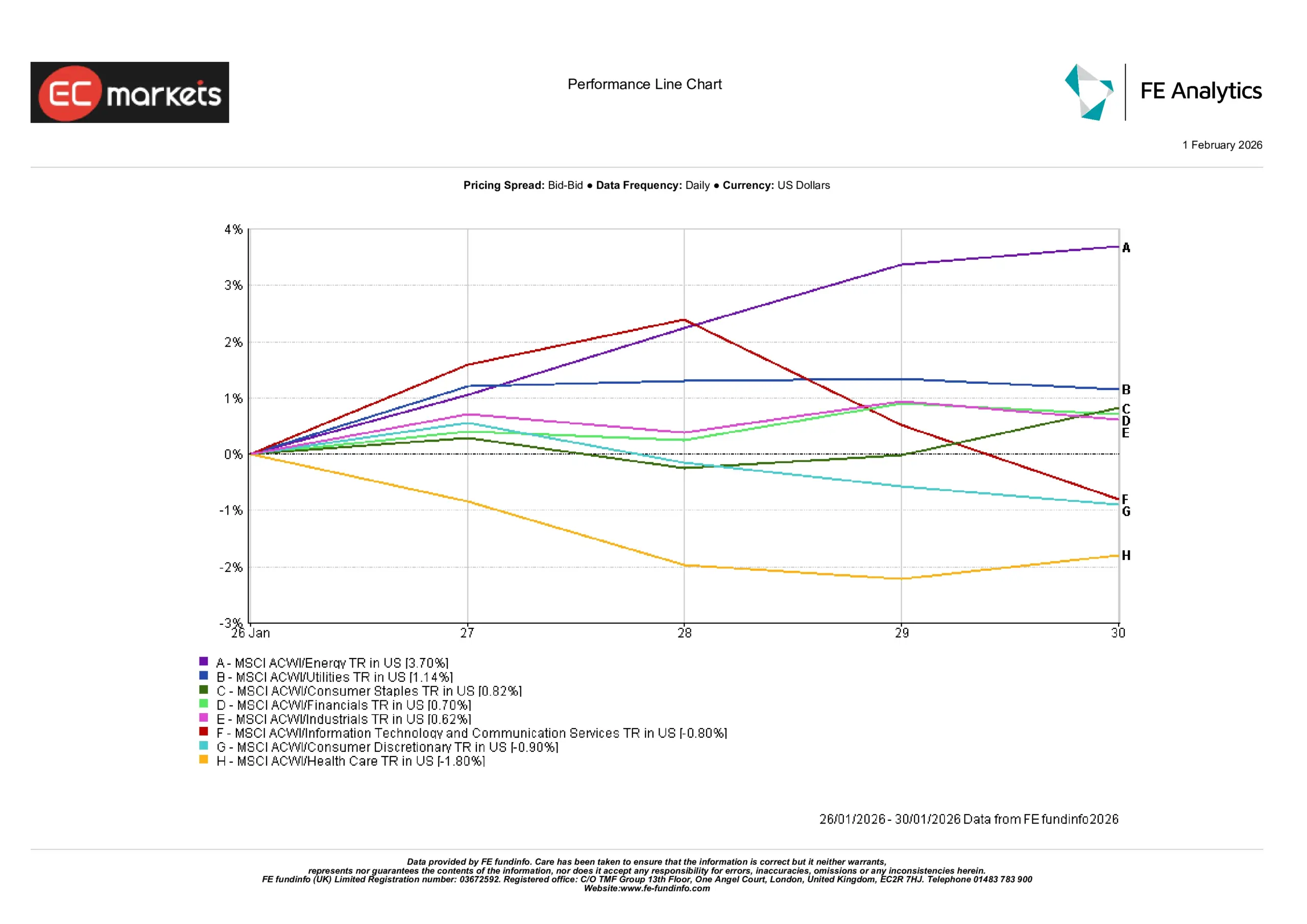

Sector Performance

Energy was the clear leader, up 3.70% for the week. Utilities also advanced, rising 1.14%, and Consumer Staples gained 0.82%, pointing to a slightly more defensive tilt underneath the surface. Financials added 0.70% and Industrials rose 0.62%, both solid but less eye-catching than Energy’s move.

On the weaker side, Communication Services and Information Technology were down 0.80%, while Consumer Discretionary fell 0.90%. Health Care lagged most, down 1.80%.

In plain terms, the week rewarded areas linked to firmer oil prices and steadier cash-flow sectors, while the more growth-sensitive and consumer-linked parts of the market were more vulnerable as yields stayed firm and earnings headlines created pockets of uncertainty.

Sector Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 30 January 2026.

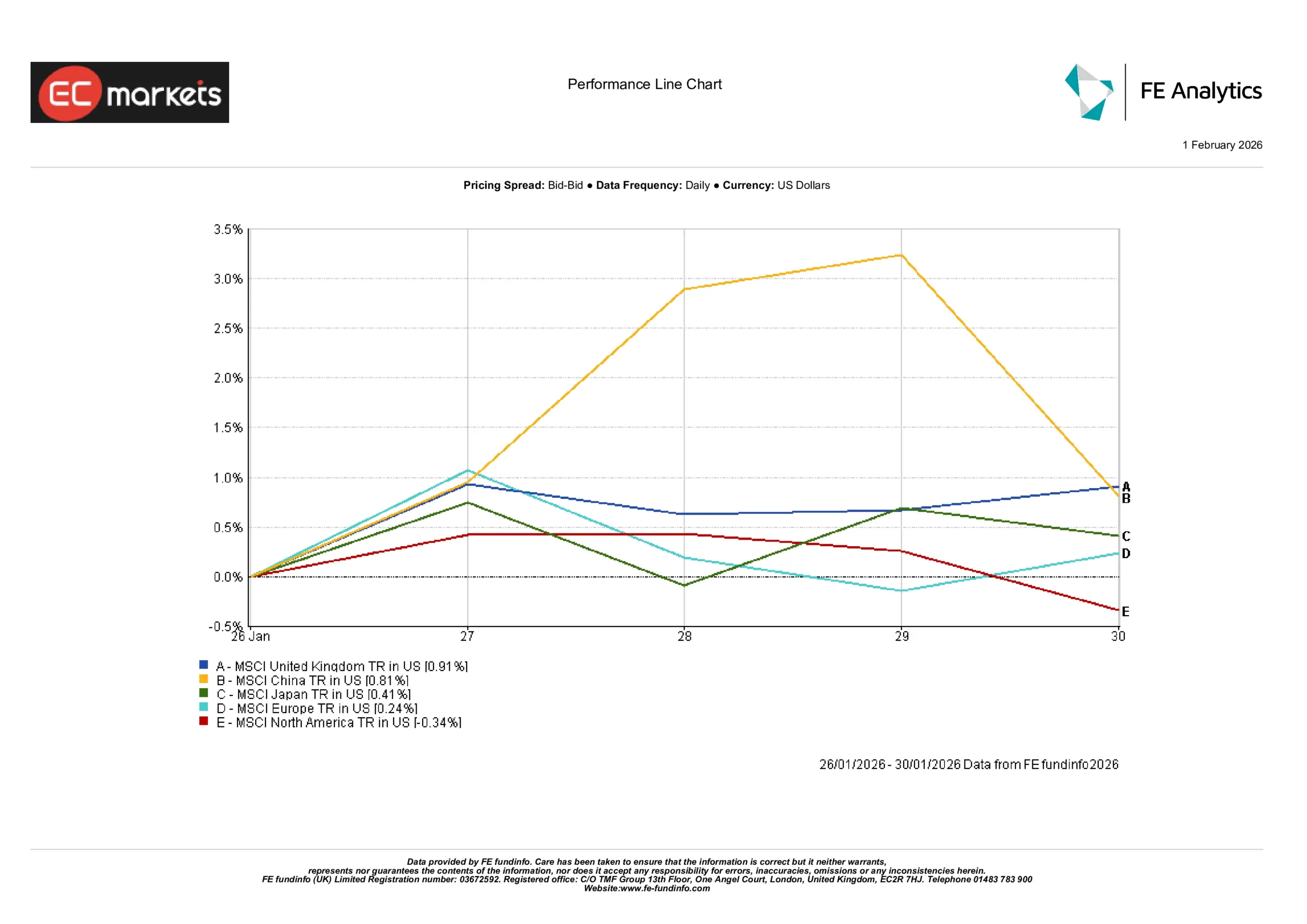

Regional Markets

Regional performance was led by the UK, up 0.91%, and China, up 0.81%. Japan rose 0.41% and Europe finished modestly higher, up 0.24%. North America was the outlier, down 0.34% over the week.

The relative split is consistent with what investors experienced day to day: US markets were pulled between supportive macro resilience and more selective reactions to earnings, while parts of Europe and Asia held up better into month-end. It is also worth noting that, in weeks like this, regional results can reflect not just local news but the mix of sectors within each region, particularly the weight of energy, defensives, and large technology.

Regional Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 30 January 2026.

Currency Markets

EUR/USD eased over the week, briefly firming before drifting lower as shifting Fed expectations lent some support to the dollar. GBP/USD was broadly steady, with mid‑week strength fading as broader dollar moves dominated. USD/JPY softened early on before recovering, reflecting the usual push and pull between risk sentiment and US yield moves. GBP/JPY edged higher overall, suggesting a slightly firmer risk tone by week‑end despite two‑way trading earlier in the week.

Outlook & The Week Ahead

The coming week is likely to keep investors focused on the same trio of drivers: central bank communication, the next set of inflation and activity indicators, and the cadence of corporate reporting. After the Fed’s decision to hold rates steady and emphasise data-dependence, upcoming US releases will be watched closely for whether they reinforce the picture of resilient growth with inflation still above target, or whether they soften that view.

Earnings season also remains an important texture in the background. Even when macro feels stable, company results and guidance can move index leadership around quickly, particularly in areas tied to technology spending, consumer demand, and interest-rate sensitivity. For most investors, the most practical mindset is a calm one: the week just passed showed that markets are still capable of switching tone quickly, but also that price moves can remain contained when policymakers are steady and the data is not delivering major surprises.