Fed Holds, BoE Cuts: Markets Rattle as Jobs Disappoint and Tariffs Bite | Weekly Recap: 28 July – 1 Aug 2025

Markets faced a cautious tone from central banks last week, but soft data and trade friction stirred fresh concerns. In the US, the Fed kept rates unchanged at 4.25% to 4.50% for a fifth meeting in a row. Friday’s jobs report shifted sentiment. Just 73,000 jobs were added in July, with May and June revised sharply lower. Traders responded quickly, increasing bets on a near-term rate cut.

In the UK, the BoE lowered its policy rate by 25bps to 4.0%. Inflation has slowed to 3.6%, growth has stalled, and unemployment is at a four-year high of 4.7%. The pound weakened as markets assumed more easing was likely, even as the BoE signalled caution.

US GDP growth surprised on the upside at 3.0% in Q2, but the jump was driven by a plunge in imports. Core PCE inflation rose to 2.8% YoY, complicating the Fed’s policy outlook. Meanwhile, the ECB kept rates steady as inflation reached its 2% target and GDP barely grew.

China continued to underwhelm. Both official and private PMIs dipped below 50, reflecting contraction. While authorities blamed extreme weather, weak demand and limited stimulus were clearly weighing on confidence.

Trade tensions returned to the spotlight as the US implemented a fresh wave of tariffs. Some allies were spared, but others including India and Switzerland faced steep duties of up to 50 percent. Average US tariffs now hover near 18 percent, the highest in decades.

Equities, Bonds & Commodities

Markets pulled back sharply last week as growth fears and trade tensions outweighed strong earnings. The S&P 500 fell 2.4%, the Nasdaq lost 2.2%, and the Dow dropped 3.1%, marking its worst week in four months. Big tech couldn’t escape the selloff. Amazon slid 8% despite beating estimates, as investors focused on slowing cloud growth. Apple’s strong iPhone numbers didn’t stop its decline. Microsoft, Meta, and Alphabet also finished lower.

In Europe, the STOXX 600 lost 2.6%. Germany’s DAX dropped 3.3%, and France’s CAC 40 shed 3.7%. The FTSE 100 dipped just 0.6%, supported by a weaker pound and select corporate strength. Asian markets were mixed. Japan’s Nikkei fell 1.6%, while China underperformed again, with the Hang Seng down 3.5% and Shanghai’s Composite off nearly 1% amid weak data and modest policy support.

Bonds rallied on the shift in sentiment. The 10-year US Treasury yield sank to around 4.22%, while the 2-year dropped to 3.69%, steepening the curve as markets leaned toward Fed rate cuts.

Oil prices swung but ended lower. Brent crude settled near $70. Meanwhile, gold rallied 2% on Friday, closing around $3,415 per ounce. Haven demand and falling real yields lifted the metal to near-record highs.

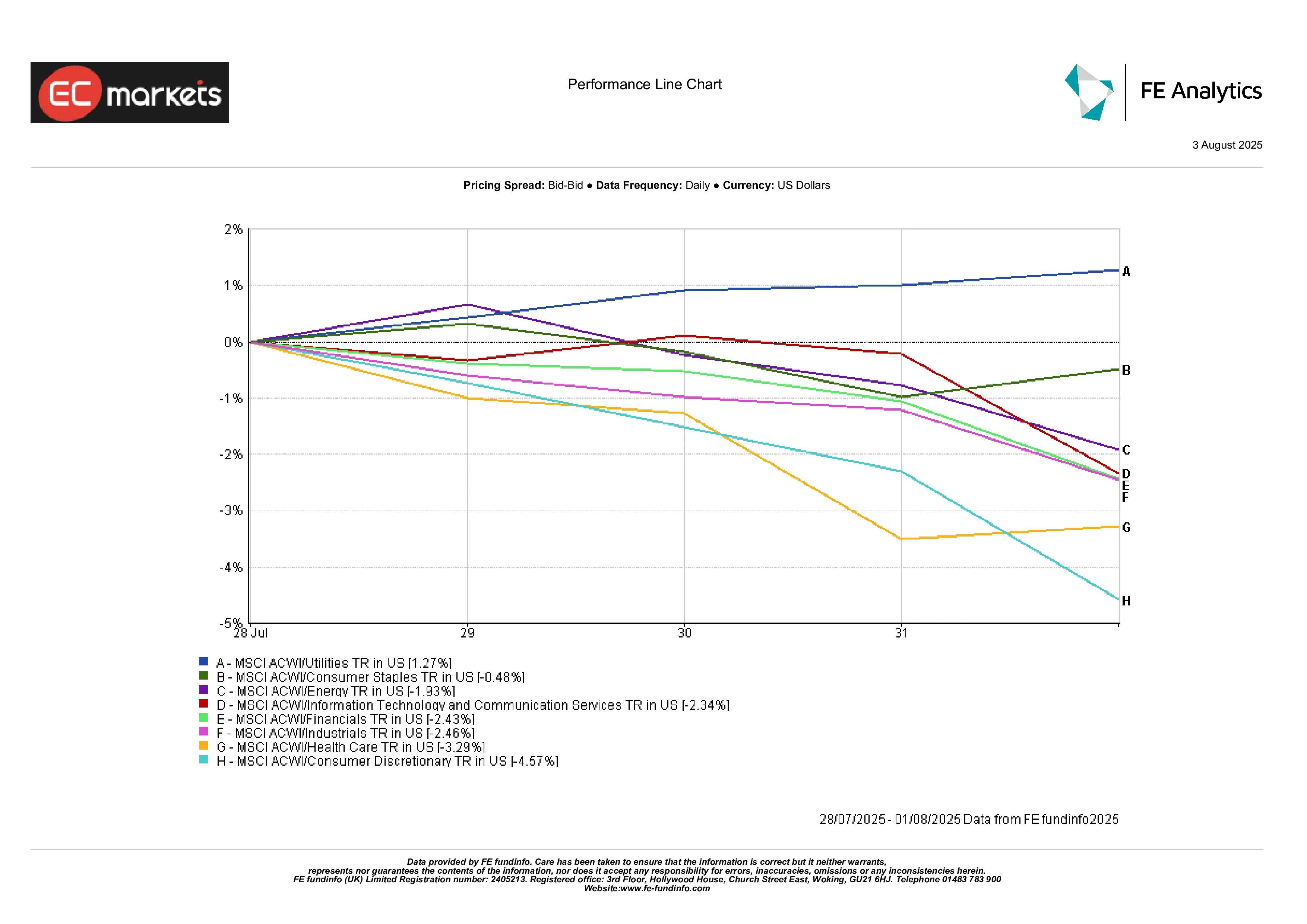

Sector Performance

Utilities (+1.3%) came out on top, the only sector in the green. Falling yields made their dividend streams more attractive. Consumer Staples held up reasonably well (-0.5%) as investors turned to predictable cash flows.

Energy stocks fell 1.9%, tracking crude prices. Healthcare (down 3.3%) struggled too, as a big pharma profit warning in Europe and renewed US political pressure weighed on sentiment.

The biggest laggard? Consumer Discretionary (-4.6%). Amazon’s fall dragged the whole sector. Retailers, autos, e-commerce, all under performed. Industrials (- 2.5%) also sank, hit by tariff headlines and soft guidance from machinery and logistics names.

Sector Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 1 August 2025.

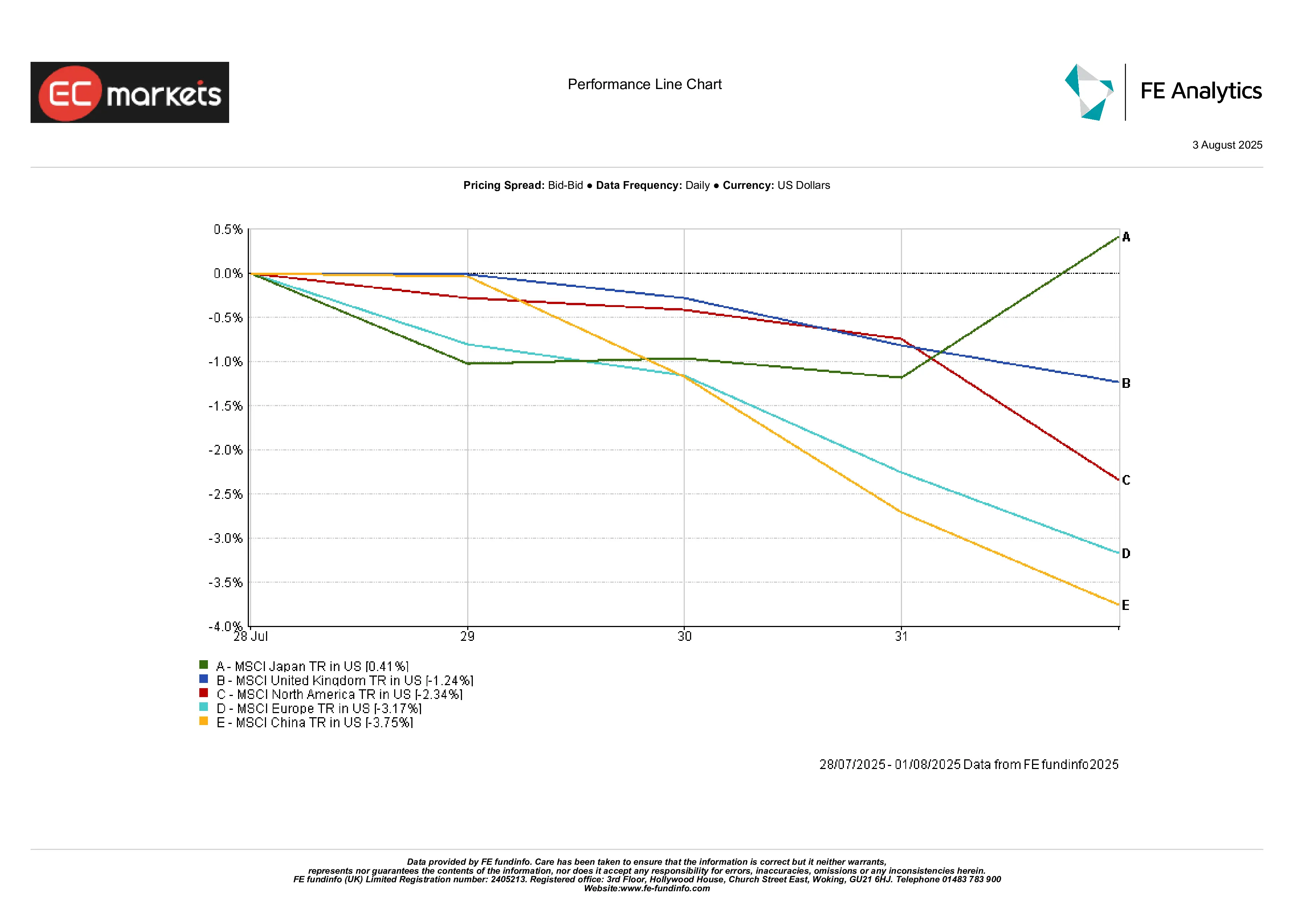

Regional Performance

Japan stood out. MSCI Japan gained 0.4%, the only major region in the green. The BoJ stayed dovish, and a weaker yen helped exporters.

The UK slipped 1.2% in USD terms. The rate cut hurt the pound, but that actually helped multinationals and kept the FTSE afloat.

North America fell 2.3%, tracking the broader US pullback. Europe dropped 3.2%, with Germany especially weak due to its exposure to trade and manufacturing. A pharma-led selloff didn’t help either.

China was the weakest link. MSCI China lost 3.8%, with investors growing increasingly frustrated by lack of stimulus and rising geopolitical risk.

Regional Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 1 August 2025.

Currency Markets

The US dollar looked strong early in the week, then fell sharply after the jobs data. The DXY ended down 1.2%, its worst daily drop in months.

USD/JPY jumped past ¥150.9 after the BoJ stayed dovish but then reversed violently to ¥147.4 on Friday. That’s a massive swing. Yen strength was sudden, and Japanese officials voiced concern, though no intervention followed.

The euro climbed to around $1.16, its highest since June. Stable ECB policy plus weaker US yields gave it legs. Sterling dipped mid-week on the BoE’s cut but clawed back gains by Friday, ending near $1.33.

Commodity currencies like AUD and CAD were shaky but recovered as the dollar faded. The Chinese yuan stayed near 7.20, weak but stable, as markets waited for firmer policy signals from Beijing.

Outlook & The Week Ahead

The week ahead could be messy or revealing.

The big event is the delayed US July jobs report (due 2 Aug) [See economic calendar]. If it’s another weak print, expect Fed cut bets to accelerate. If it surprises to the upside, we’re back to data-dependent guessing.

China’s July trade data and FX reserves are also on the docket, key to understanding whether capital outflows or domestic demand deterioration are worsening.

ECB speakers are scattered across events this week. With inflation at target, any dovish pivot will be closely watched. On the earnings side, results from Block, Eli Lilly, and several consumer and media names will give insight into how companies are navigating tariffs and macro stress.

Bottom line? Investors are still trapped between rate-cut hope and recession fear. Expect every data release, speech, and earnings line to move markets, one headline at a time.