Central Banks Diverge as Markets Reprice Policy Paths | Weekly Market Recap: 15-19 December 2025

Economic & Macro Overview

Markets closed out the penultimate full trading week of 2025 grappling with a defining theme: policy divergence. Despite several potential volatility catalysts, investors largely held existing positioning, with mixed US macro data failing to force a meaningful repricing into year-end.

A rare double US Non-Farm Payrolls release was the key macro focus. The data confirmed that US labour market conditions remain weak, but the slowdown was not sufficiently pronounced to alter expectations for the Federal Reserve’s easing path. As a result, pricing for a March 2026 rate cut remains close to a 50-50 call, and markets avoided the volatility spike some had anticipated.

Other US data reinforced the mixed picture. Retail sales surprised to the upside, with the control group rising 0.8% month-on-month, the strongest increase since June. This resilience highlighted an increasingly evident K-shaped consumer dynamic: higher-income households continue to benefit from equity-market strength, while lower-income consumers remain under pressure from elevated living costs, job insecurity and weaker confidence.

Central bank divergence remained a defining theme. The Bank of Japan raised rates by 25bp to 0.75%, reinforcing confidence that policy normalisation is progressing. In contrast, the Bank of England cut rates by 25bp to 3.75%, though a narrowly split vote underscored internal disagreement and suggested a cautious easing path ahead. The European Central Bank held rates unchanged, maintaining a data-dependent stance into 2026.

Overall, the macro backdrop remains finely balanced: labour market conditions are softening, inflation progress is uneven, and policy paths are increasingly asynchronous.

Equities, Bonds & Commodities

Global equity markets finished the week modestly higher, though performance varied meaningfully across regions and sectors.

US equities experienced a two-phase week. Early pressure, particularly on rate-sensitive and cyclical names, gave way to a late-week rebound, led by large-cap technology and AI-linked stocks. The Nasdaq recovered earlier losses, while broader indices ended the week slightly positive.

Bond markets reflected growing policy dispersion rather than a uniform easing narrative. UK front-end yields declined following the BoE cut, Japanese yields moved higher after the BoJ hike, and US yields remained relatively range bound as investors balanced softer inflation expectations against resilient growth signals.

In commodities, gold remained well supported, holding elevated levels amid lower real yields and continued demand for diversification and inflation hedging. Oil prices drifted lower, pressured by persistent concerns around global demand and ample supply, despite ongoing geopolitical risks. Cryptocurrency markets were volatile, with sharp intraweek moves reflecting thinner liquidity and sensitivity to global macro shifts.

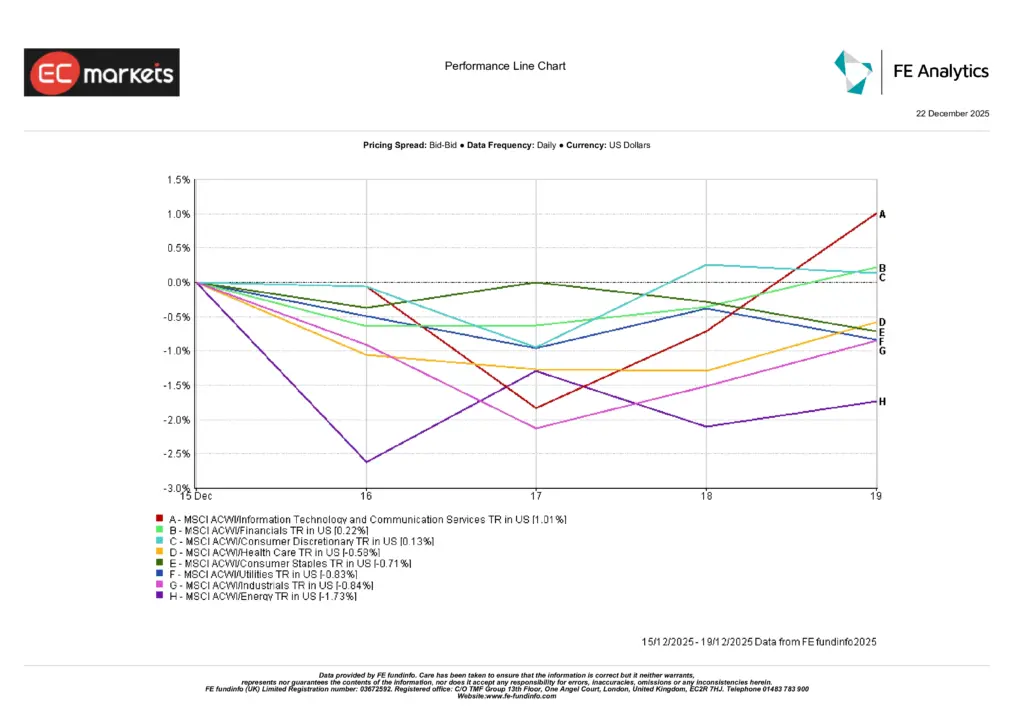

Sector Performance

Sector performance reinforced the theme of rotation rather than rally.

Information Technology & Communication Services led gains, rising 1.01%, supported by a late-week rebound in large-cap technology stocks. Financials advanced 0.22%, benefiting modestly from stable sentiment, while Consumer Discretionary edged higher by 0.13%, supported by resilient headline spending.

On the downside, defensive and cyclical sectors lagged. Health Care fell 0.58%, Consumer Staples declined 0.71%, and Utilities dropped 0.83%. Industrials slipped 0.84%, while Energy was the weakest sector, falling 1.73%, pressured by softer oil prices and demand concerns.

The dispersion highlights an increasingly selective market environment, driven by valuation discipline and short-term positioning rather than broad risk appetite.

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 19 December 2025.

Regional Markets

Regional equity performance was mixed, reflecting policy divergence, currency moves and late-year positioning.

The United Kingdom led regional returns, with the MSCI UK up 1.28% (USD), supported by value exposure and currency dynamics following the Bank of England’s rate cut. Europe ex-UK followed, gaining 0.42%, as investors responded calmly to the ECB’s steady policy stance.

North America edged higher by 0.31%, with late-week strength in US technology offsetting earlier caution, while China posted a marginal gain of 0.07%, as persistent domestic demand weakness continued to cap upside.

Japan significantly underperformed, with the MSCI Japan down 3.05%, as equity markets reacted negatively to the Bank of Japan’s rate hike, stronger yen dynamics and profit-taking after a strong run earlier in the quarter.

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 19 December 2025.

Currency Markets

Currency markets reflected a firmer US dollar and notable yen weakness, driven by policy divergence and restrained rate-cut repricing. The US Dollar Index rose around 0.5% on the week, as the double Non-Farm Payrolls release failed to justify more aggressive easing expectations for 2026.

The Japanese yen underperformed, with USD/JPY rising roughly 1.5%, as markets reacted negatively to the Bank of Japan’s rate hike guidance and continued to focus on wide yield differentials. In Europe, the euro softened modestly, with EUR/USD drifting lower following the ECB’s steady policy stance, while sterling was broadly stable, as the Bank of England’s rate cut was largely priced and attention shifted to the pace of future easing.

Overall, FX moves reflected relative policy paths rather than a shift in global risk sentiment, with year-end positioning reinforcing established trends.

Outlook & The Week Ahead

With year-end approaching and liquidity thinning, markets appear increasingly sensitive to incremental data and policy signals. Key themes heading into the final trading days of 2025 include:

- Ongoing reassessment of Japan’s policy normalisation and its spillover effects

- Scrutiny of UK growth and inflation dynamics following the BoE cut

- Continued focus on US labour and inflation data to validate expectations for further easing in 2026

As central bank paths continue to diverge, volatility may remain elevated, reinforcing the importance of selective positioning and disciplined risk management into the new year.