Cautious Optimism Kicks Off 2026 as Rate Expectations Steady Risk Mood | Weekly Recap: 29 December 2025 - 02 January 2026

Economic Overview

Global policymakers enter 2026 with policy divergence and a broadly stable backdrop. In the US, Fed officials have signalled a pause in rate hikes after a 3.50-3.75% policy rate (no hikes likely ahead and only one cut pencilled in 2026). Economic data have shown cooling inflation and modest growth, and markets now see Fed cuts (perhaps two) outpacing other central banks.

In Europe, the ECB kept rates on hold in December, upgraded its growth forecasts and noted inflation around 2% target levels, effectively closing the door on further cuts and even hinting at a future hike.

By contrast, BoE is on a gentler path: easing is expected (rates likely cut in late 2025 to 3.75% from 4%), reflecting slowing growth and the UK’s still-high 3.2% inflation.

China’s economy showed modest signs of life: December factory PMIs ticked back into expansionary territory (around 50.1) and leaders pledged proactive fiscal and monetary support to meet the ~5% growth target.

Japan’s BoJ raised rates to 0.75% (a 30-year high) and signalled further hikes as inflation nears 2%, but the yen stayed weak amid cautious guidance.

In sum, the US and UK lean toward easing while Europe and Japan appear more hawkish. Against this backdrop, investors remain cautiously positioned: recent central bank signals have removed extreme uncertainty, but confidence is tempered by mixed data and geopolitical risks.

Equities, Bonds & Commodities

Global stocks moved steadily but modestly. Equity markets in the US ended the holiday week a bit softer, while Europe pushed higher, with London’s FTSE 100 breaking above 10,000 and broader European indices hitting new highs on growing optimism. Asian markets were mixed: Japan’s Nikkei ended higher for the week, but many Asian and emerging markets rose, with Asia ex-Japan gaining around 1.7%.

Sector moves were mixed, with leadership concentrated in a small number of areas rather than spread evenly across the market. On the fixed-income side, yields crept up modestly. US Treasury yields ended the week slightly higher, reflecting a firmer tone as investors awaited key data.

In commodities, oil was little changed after a volatile week, finishing the year modestly lower following a 2025 sell-off. Gold remained firm above $4,300 per ounce near record highs, supported by expectations of Fed rate cuts and ongoing safe-haven demand.

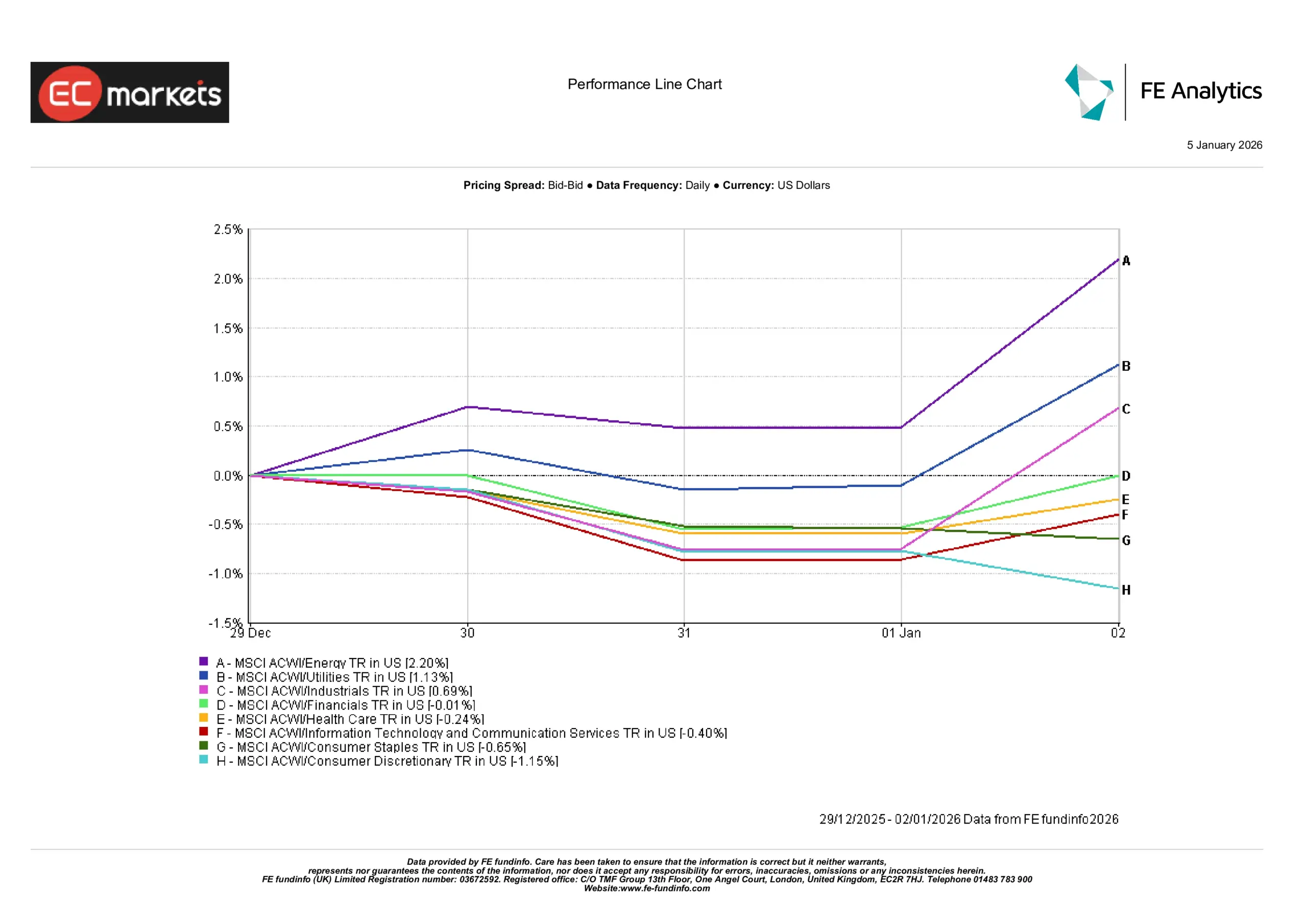

Sector Performance

The sector picture was mixed, with gains concentrated in just a few areas rather than spread evenly across the market. Energy stood out as the strongest performer, rising a little over 2% on the week, helped by firmer commodity prices. Utilities also moved higher, up just over 1%, as investors continued to favour areas seen as more stable.

Industrials edged higher, finishing the week modestly in positive territory, while most other sectors struggled to gain traction. Financials were broadly flat, and technology-related sectors slipped slightly, suggesting that growth stocks were not driving market moves during this period.

Elsewhere, performance was weaker. Consumer-facing sectors lagged, with Consumer Discretionary posting the largest decline and Consumer Staples also ending lower. Healthcare slipped slightly as well, though losses were limited. Overall, the sector mix points to a cautious tone, with strength focused on energy and defensive areas rather than a broad risk-on move.

Sector Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 02 January 2026.

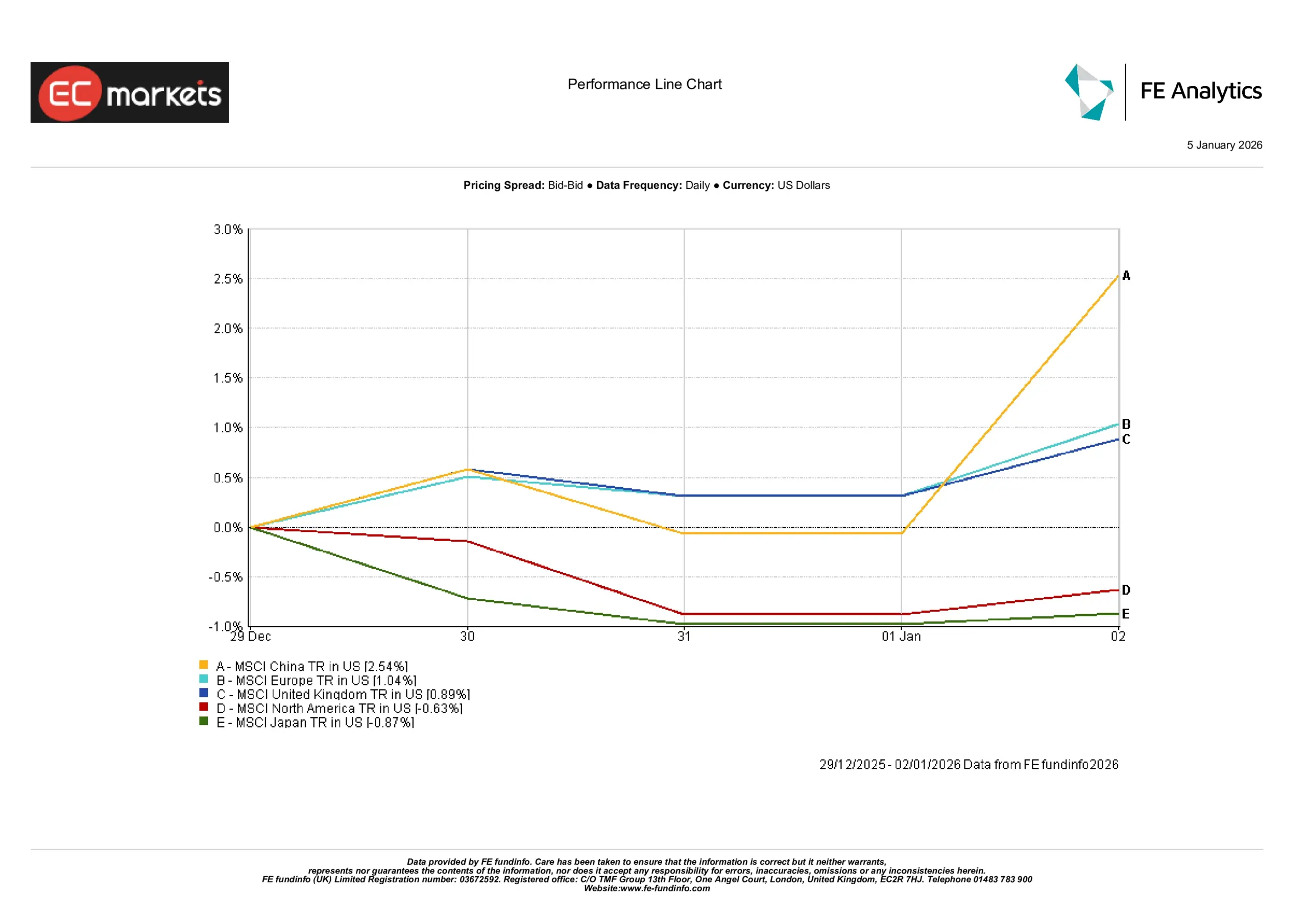

Regional Markets

Regional markets also showed clear differences in performance. China led the way, rising by more than 2.5% over the period, as sentiment improved toward the end of the year. European markets posted solid gains, while the UK market also finished higher, holding up well in US dollar terms.

By contrast, US equities edged lower, and Japanese stocks underperformed, both ending the period in negative territory. The gap between regions highlights how uneven market conditions remain, with some areas attracting renewed interest while others lagged behind.

Taken together, the regional picture suggests that investors were being selective rather than broadly optimistic, rotating into specific markets rather than adding risk across the board.

Regional Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 02 January 2026.

Currency Markets

Major FX moves were relatively contained. The euro and pound were little changed on the week. EUR/USD traded near 1.17, while GBP/USD hovered around the mid-1.34 area after pulling back slightly from recent highs. The yen weakened further, with USD/JPY reflecting wide yield differentials despite recent rate hikes by the BoJ. GBP/JPY finished near the 210-211 level, broadly unchanged.

Overall, higher US yields continued to underpin dollar strength against the yen, while the euro and pound faced mild pressure from their own central banks’ policy signals and softer data. Looking ahead, if the Fed ultimately cuts more aggressively than its peers, the dollar could begin to soften later in 2026. For now, currency moves have largely mirrored risk-on sentiment and yield differentials, with the US dollar index ending the week modestly firmer.

Outlook & The Week Ahead

As markets move into early 2026, attention turns back to incoming data. In the US, employment indicators will be closely watched, including ISM manufacturing and the January jobs report, for signs of labour-market cooling or renewed wage pressure. Central bank speakers from the Fed, ECB and BoE are also likely to shape near-term expectations.

US politics may add another layer of uncertainty, with developments around the Fed chair nomination and upcoming legal decisions on trade policy. Earnings season begins in mid-January, led by US banks and major technology firms, and guidance will be critical in shaping sentiment in what remains a momentum-driven market.

In Europe, fourth-quarter GDP and inflation data later in January will be key, though the immediate calendar is relatively light. China’s upcoming trade and PMI releases will be closely watched for insight into the durability of its recovery. Overall, markets are likely to remain data-driven and cautious in the holiday-thinned early weeks of the year. A broadly steady tone is expected unless fresh economic surprises or geopolitical developments reignite volatility.