Better Together: Making Sense of Fundamentals and Technicals in Trading

There’s this thing that happens sometimes when you’re trading. You dig into a company’s financials, check the earnings, read the news. Everything seems to line up. On paper, it’s solid. But then you look at the chart… and it’s been trending down. For weeks. So you keep thinking, “Did I miss something? This doesn’t make sense.”

That’s where the tension between fundamental and technical analysis usually pops up. And if you’ve ever had that moment of doubt, you’re not alone. But here’s a thought, what if you didn’t have to pick one over the other?

Two Ways to See the Market

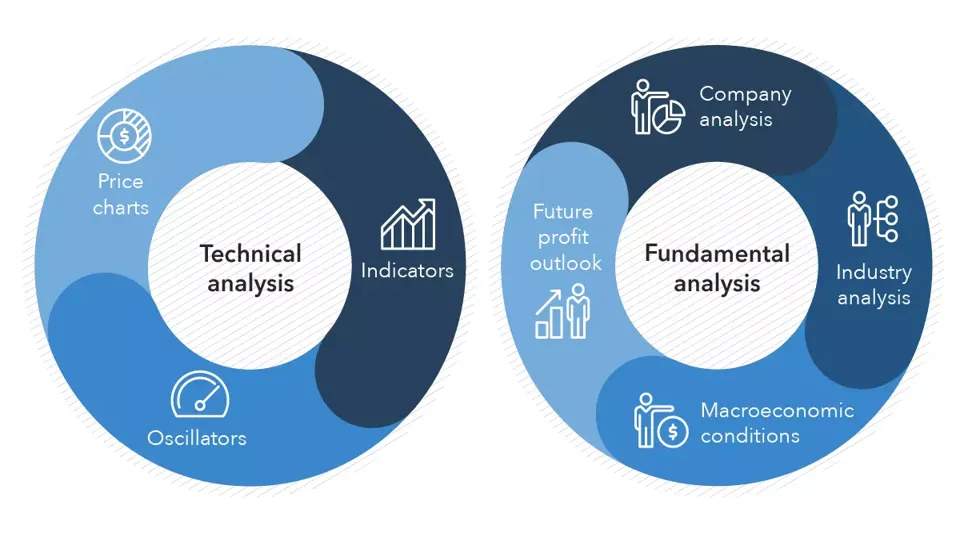

Fundamental analysis is all about the “why.” You’re looking at earnings, economic news, interest rates, or industry trends, the stuff that drives a company’s actual value. Is this business profitable? Is the economy helping or hurting it? That’s what fundamentals aim to answer. It’s the lens used by long-term investors, fund managers, and economists alike. If you want to dig in deeper, we help you understand concepts better here.

Technical analysis is more about the “when.” Here, the focus shifts to price charts, patterns, and indicators like the Relative Strength Index (RSI) or moving averages. It’s less concerned with what the company does and more with how traders are reacting in real time. Technical traders believe everything, from news to earnings to rumours, is already reflected in the price. So if a stock breaks above resistance on strong volume, they see that as a signal to act.

Why Bother with Both?

Here’s a real-world scenario. Back in 2022, central banks increased interest rates by a significant percentage. That’s a fundamental shift, and it hit growth stocks hard, especially tech. At the same time, the Nasdaq was already in a downtrend. So you had the narrative and the price action pointing the same way. That’s powerful. You’re not guessing. You’re reacting.

Or flip the script. Think about the GameStop craze. The chart was going parabolic. But fundamentally? Nothing had changed in the business. A trader relying purely on technicals might’ve jumped in too late. Someone blending both methods might’ve spotted the disconnect early.

Making It Work for You

One simple trick: start with a fundamental shortlist. Maybe it’s stocks with strong earnings, or currencies from healthy economies. Then, instead of jumping in straight away, check the charts. Is momentum building? Is resistance breaking? That’s your green light.

And if things don’t line up, like the fundamentals say buy but the chart’s still weak, it might just be a matter of time before things reveal themselves.

Final Thoughts

Blending fundamental and technical analysis offers the best of both worlds for traders. Instead of treating them as opposing philosophies, think of them as complementary tools in your kit. Fundamentals anchor your decisions in real-world logic, they tell you why a price should move and whether an asset has intrinsic value. Technicals translate the market’s mood and timing, they show you when momentum is shifting and how other traders are behaving. Used together, they help you see the fuller picture.

At EC Markets, we get that. That’s why we share insights on both fronts, whether you’re the kind of trader who likes macro trends or one who just wants to read the tape. Either way, knowing how to mix the two can give you a clearer edge in the market.