Global Markets Pause as Investors Await Clearer Economic Signals | Weekly Recap: 2-9 February 2026

Economic Overview

The week unfolded against a backdrop of mixed economic signals and cautious policy stances across major central banks. In the US, the temporary government shutdown meant the January Employment Situation report did not arrive as planned, leaving investors without one of the week’s most closely watched data points. The Bureau of Labor Statistics confirmed the release would be rescheduled once funding resumed. This created a quieter information environment, with markets leaning more on surveys and company guidance than usual.

In the UK, the BoE kept Bank Rate at 3.75%, though the 5-4 vote highlighted just how finely balanced the discussion has become. While inflation is expected to fall back towards 2% from April, the Bank continues to emphasise the need for clear evidence that price pressures are easing on a sustainable basis. It was a steady decision, but the narrow split suggests policy is evolving gradually rather than standing still.

Across the euro area, the ECB also left rates unchanged and noted that inflation is settling closer to its 2% target. The message remained consistent: policy will follow the data, and decisions will be taken meeting‑by‑meeting. With global conditions still uncertain and the euro firmer than earlier in the year, the central bank struck a careful tone, neither signalling urgency nor complacency.

Equities, Bonds & Commodities

Equity markets delivered a mixed but steady week. In the US, the S&P 500 finished ~2% at 6,932.30, while the Nasdaq Composite also eased ~2% to 23,031.21, reflecting continued sensitivity in technology shares. Globally, the MSCI World Index slipped, closing at 4,528.99.

In the UK, the FTSE 100 held up comparatively well, ending the week with a gain, supported by more stable domestic conditions and a measured response to central bank commentary.

US government bond yields moved gently lower across maturities, with the 2‑year at 3.47%, the 10‑year at 4.21%, and the 30‑year at 4.85% by the end of the week. With the US payrolls report delayed, markets leaned on lighter data, contributing to a generally cautious tone.

Commodities showed firmer momentum. Brent crude ended the week 2.64% higher at $68.05, while WTI added 1.59% to finish at $63.13.

Gold also gained ground over the week. It finished about 4.3% higher, ending at $4,956, helped by a calmer tone across markets and a rebound from the sharp moves seen late in January.

Sector Performance

Sector movements were more defined than the broader equity market this week.

Energy led with a +4.78% return, supported by firmer oil prices, which typically improve revenue visibility for producers and lift sentiment across the supply chain. Consumer Staples followed with +4.37%, reflecting the sector’s role as a steady anchor when markets turn more selective; demand for everyday essentials tends to hold up even when economic signals are less clear. Industrials, up +2.51%, benefited from ongoing global activity, while Utilities rose +1.92% as investors leaned toward stable, income‑oriented areas.

Health Care (+0.77%) and Financials (+0.66%) were relatively steady, mirroring the quieter macro backdrop. The weakest results came from growth‑sensitive sectors. Information Technology & Communication Services (‑1.53%) softened as investors reassessed valuations amid shifting rate expectations, while Consumer Discretionary (‑3.18%) fell as uncertainty around household spending kept investors cautious.

Sector Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 6 February 2026.

Regional Markets

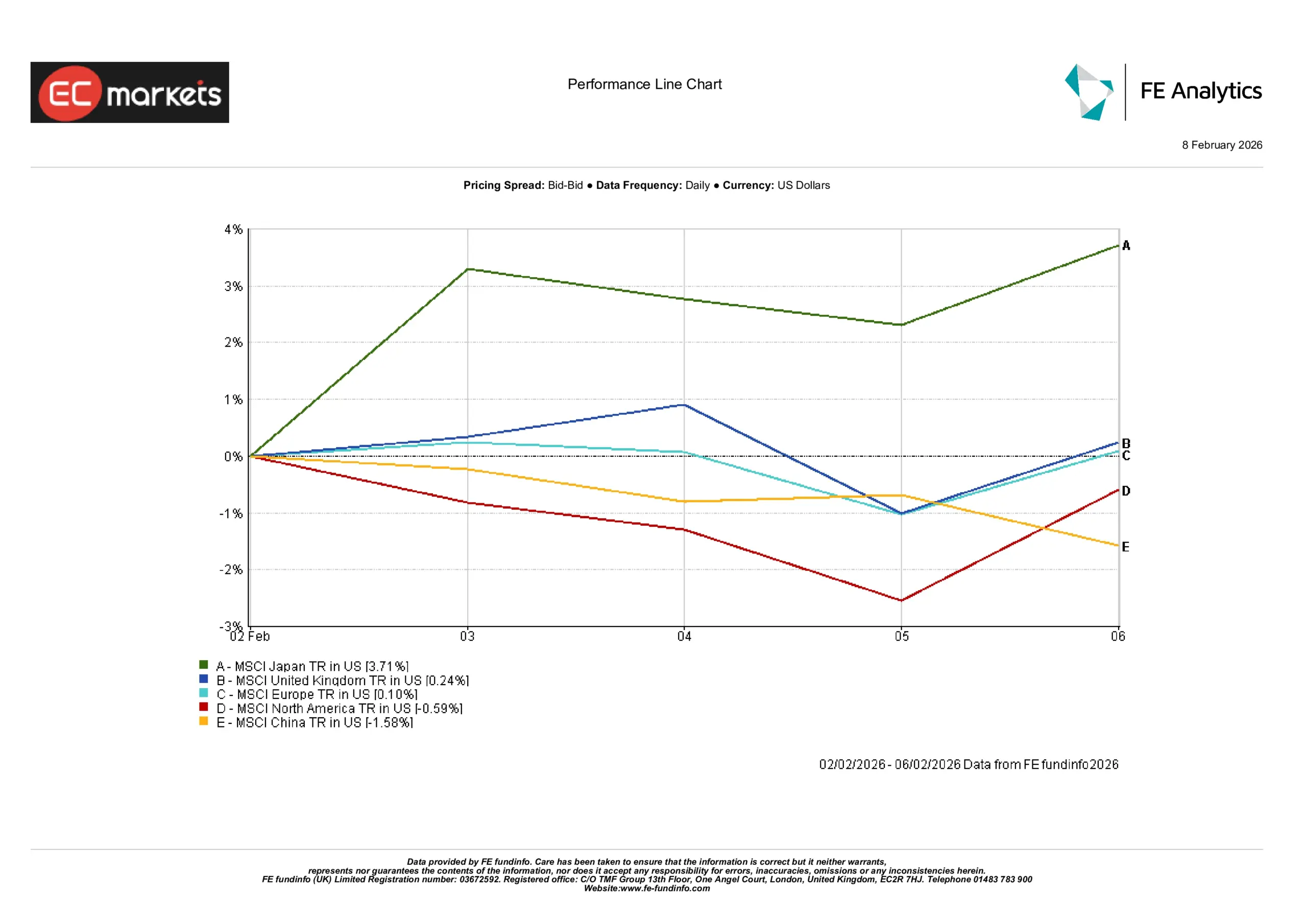

Regional returns were more dispersed than the headline global indices this week.

Japan led with a +3.71% gain, standing out as investors looked beyond the US technology complex and towards markets where performance was less tied to the same growth‑stock swings. The UK delivered a modest +0.24%, broadly in line with the FTSE 100’s steadier tone, while Europe was almost flat at +0.10% after the ECB left policy unchanged, reinforcing a sense of continuity rather than surprise.

North America slipped -0.59%, consistent with the softer week for US equities and a quieter data backdrop after the US payrolls report was delayed, which reduced the week’s macro anchors for sentiment. China fell -1.58%, contributing to a more cautious tone across Emerging Markets, where risk appetite remained selective rather than broad‑based.

Regional Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 6 February 2026.

Currency Markets

Currency moves were relatively measured this week, shaped more by central‑bank tone than by any strong directional momentum.

EUR/USD edged higher by 0.22%, supported by the ECB’s steady messaging and the absence of major surprises. The pair’s modest gain reflected a calm response to policy continuity rather than a shift in economic outlook.

GBP/USD slipped 0.38%, as sterling reacted to the Bank of England’s close vote and growing speculation about when rate cuts could begin. This left the pound softer, with investors favouring clarity over uncertainty.

USD/JPY rose 1.02%, with the yen continuing to feel the pressure from wide interest‑rate differentials. Even without significant data, the broader monetary backdrop kept the yen on the weaker side.

GBP/JPY gained 0.63%, combining sterling’s moderate softness against the dollar with the yen’s ongoing structural weakness, leaving the cross slightly higher overall.

Outlook & The Week Ahead

The next key focal point will be the rescheduled US January jobs report, which should help clarify where labour demand stands after a period of slower data flow. Its release will also give markets a cleaner sense of how the Fed is likely to interpret recent economic momentum.

In the UK and eurozone, attention will remain on incoming inflation data and how quickly services‑driven pressures continue to ease. Central banks have been clear that decisions will depend on evidence rather than expectations, so the tone is likely to stay measured.

With earnings season continuing and macro data returning to a more normal rhythm, markets may stay selective. Rather than a broad directional trend, we may see investors focusing on resilience, balance sheet strength, and the durability of earnings guidance as the picture for early 2026 becomes clearer.