Equities Slide on Policy Uncertainty and Weak Global Data | Weekly Recap: 17-21 November 2025

Economic Overview

Last week’s backdrop was shaped by the end of the 43-day US government shutdown and cautious tone from central banks. The funding extension cleared a key uncertainty but created a backlog of economic data, with the October CPI report cancelled. Markets increasingly expect a Fed rate cut in December, though Fed officials signalled that policy will stay restrictive until inflation is controlled.

In Asia, Chinese economic data disappointed. October industrial production and retail sales grew at their slowest pace since mid-2024, highlighting ongoing property weakness and fragile consumption. However, improved US-China trade dialogue and Beijing’s 2026-30 policy focus on tech and domestic demand provided some relief.

In Europe, inflation trends continued to soften. Eurozone headline CPI eased to 2.1%, with core inflation near 2.4%, prompting ECB officials to hint that the tightening cycle is over. Similarly, the BoE struck a dovish tone as UK inflation fell to 3.6% and wage growth moderated. Nonetheless, the UK labour market showed signs of strain, with unemployment rising to 5.0%.

Geopolitical developments also influenced sentiment. Diplomatic de-escalation in the Taiwan Strait and a reported EU-led Ukraine ceasefire plan helped temper global tensions but weighed on European defence shares. Overall, risk appetite was mixed, with markets navigating between optimism on easing inflation and lingering concerns over sluggish growth.

Equities, Bonds & Commodities

Global equities fell last week as investors trimmed exposure to stretched valuations, particularly in growth sectors. The MSCI World Index posted a broad-based decline, with the US leading losses. S&P 500 (almost 2%) and Nasdaq (almost 1%), led by tech and consumer discretionary names. Defensive sectors such as healthcare and staples outperformed. In Europe, the STOXX Europe 600 dipped, with Germany’s DAX down, and the FTSE 100 losing amid weakness in cyclicals and defence. Japan’s Nikkei edged higher on policy support, while China and Hong Kong underperformed on soft economic data. Overall, the tone was defensive, with North America underperforming and market breadth narrowing across regions.

Bond yields declined across regions amid safe-haven buying. US 10‑year yields fell from ~4.13% to 4.06%; Bunds and Gilts also eased slightly. High-yield credit spreads narrowed on Friday’s rally.

In commodities, Brent crude dropped to $62/bbl and WTI to $58, their lowest levels in years, amid oversupply concerns. Gold rose modestly, while industrial metals weakened. European natural gas prices

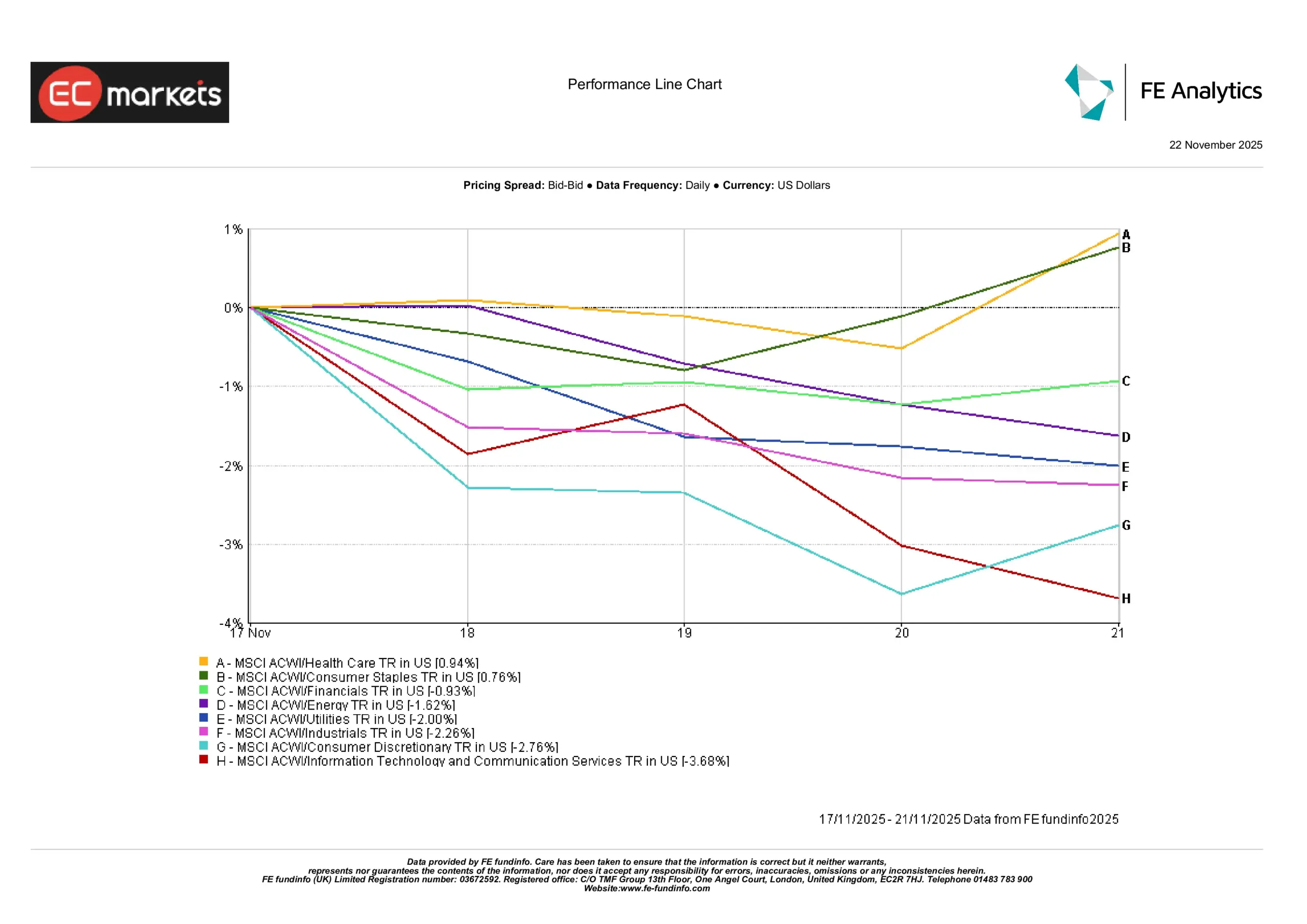

Sector Performance

Market rotation continued with a clear tilt toward defensives. According to the sector chart below, health care (+0.94%) and consumer staples (+0.76%) outperformed, reflecting investor preference for resilience and income stability amid policy and geopolitical uncertainty. Financials also showed decent gains (+0.93%), supported by relatively stable yields.

On the other end, growth-oriented sectors lagged. Information technology and communication services plunged big time -3.68%, and consumer discretionary fell -2.76%, marking the worst-performing groups as valuation concerns and earnings fatigue triggered a sell-off. Industrials and utilities also slipped -2.26% and -2.00%, respectively, while energy declined -1.62%, reflecting weak oil prices.

Sector Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 21 November 2025.

In summary, the market broadly shifted away from cyclical and high-growth areas and toward more defensive, lower-volatility sectors. This mirrored broader risk-off sentiment and investor caution around macro data, earnings season, and global central bank signals.

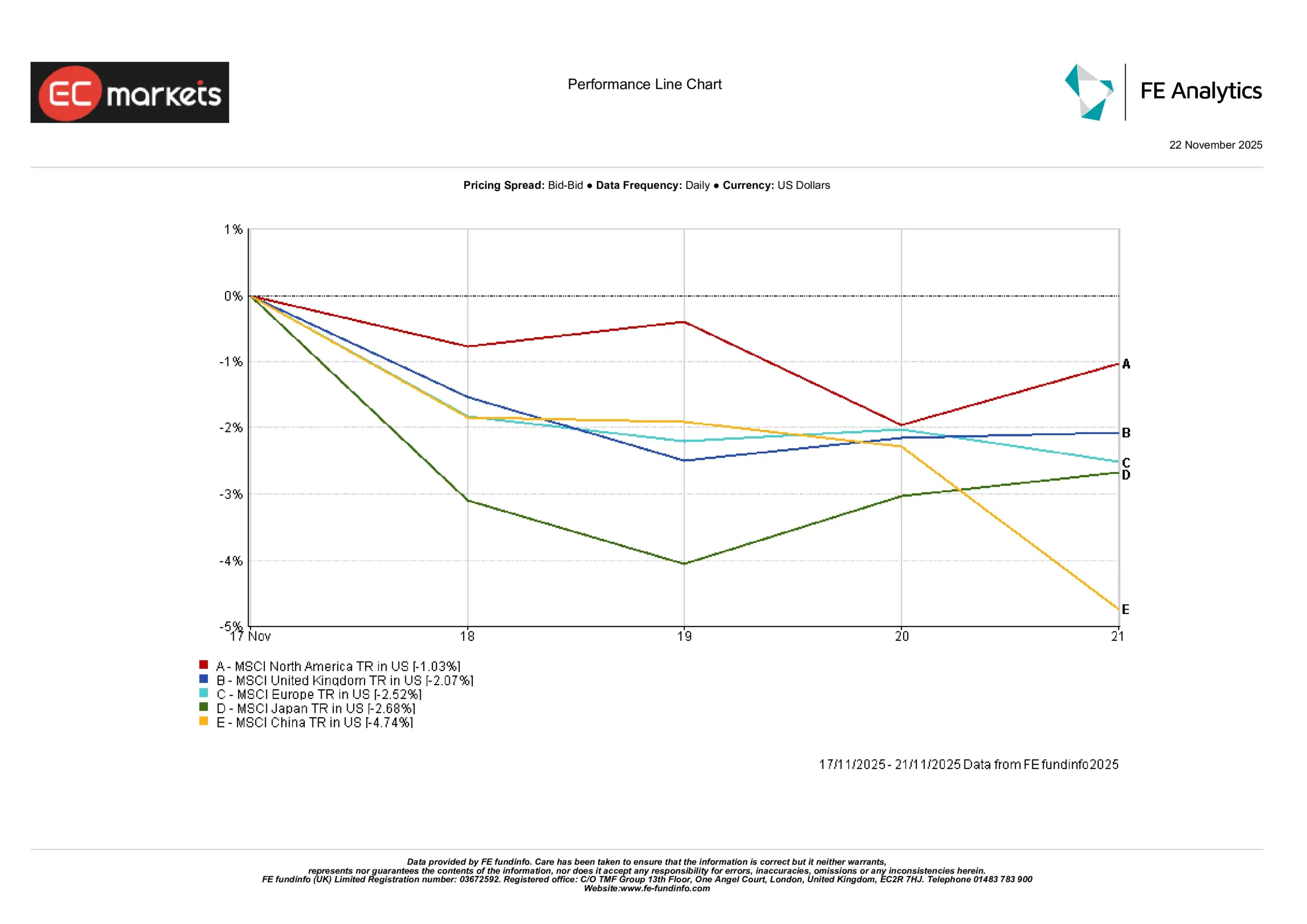

Regional Markets

Regional equity performance was sharply divided. The MSCI China Index plunged the most, down -4.74%, reflecting weak data and persistent concerns around property and consumption (something we’ve been seeing since the beginning of the year). Japan also underperformed, with the MSCI Japan Index falling -2.68%, reversing the prior week’s gains despite stimulus optimism.

European equities slid as well: the MSCI Europe Index fell -2.52%, led by declines in tech, luxury, and defence stocks. The UK fared slightly better but still declined -2.07%, pressured by budget concerns and mixed earnings, as shown by the MSCI UK Index.

North America was the relative outperformer: the MSCI North America Index dipped just -1.03%, thanks to Friday’s partial rebound and strength in defensive sectors.

Overall, the chart shows a broad pullback across regions, with China and Japan leading the declines, and North America showing relative resilience.

Regional Performance

Source: FE Analytics. All indices total return in USD. Past performance is not a reliable indicator of future performance. Data as of 21 November 2025.

Currency Markets

The US dollar was slightly stronger overall last week, supported by safe-haven demand and firming expectations for a December Fed rate cut. EUR/USD dipped slightly to below by Friday. The euro’s modest slide reflected relative policy divergence, with US yields remaining more attractive. GBP/USD was broadly flat for the week, trading in the lows but easing from mid-week highs. Sterling came under mild pressure on reports of upcoming UK fiscal tightening and a dip in consumer sentiment.

The yen extended its weakness, with USD/JPY climbing above 155 (a level not seen in nearly nine months!). Japan’s zero-rate stance and cautious signals from the new Prime Minister weighed on the currency, while GBP/JPY also rose toward 204.

Outlook & The Week Ahead

The spotlight shifts to delayed US data and central bank signals. Markets await October’s nonfarm payrolls, inflation, retail sales, and industrial output, pushed into late November and early December due to the shutdown. Flash PMIs (due 24 November) in the US and Europe will offer clues on near-term momentum. In China, early December’s Caixin PMIs will be closely watched for evidence of stabilisation or further stimulus needs.

Central bank commentary remains key. Fed Chair Powell and others will be scrutinised for any pivot toward a December rate cut, especially after dovish hints from NY Fed’s Williams. The Fed’s meeting minutes and the upcoming UK budget (22 November) will also influence rate expectations. Meanwhile, the ECB remains quiet until December, though investors will monitor speeches and forecasts.

Earnings and geopolitics also shape the picture. Nvidia’s guidance stirred volatility, and other tech names could follow. OPEC’s 30 November meeting may impact oil sentiment. UK fiscal plans, likely featuring tax hikes, could influence the pound and bond markets.

Risk sentiment remains cautious. Equities hover near resistance and yields sit near lows. Incoming data and policy signals will be crucial in determining whether markets sustain their footing or retreat amid lingering uncertainty.