| |

| Market Update |

| |

|

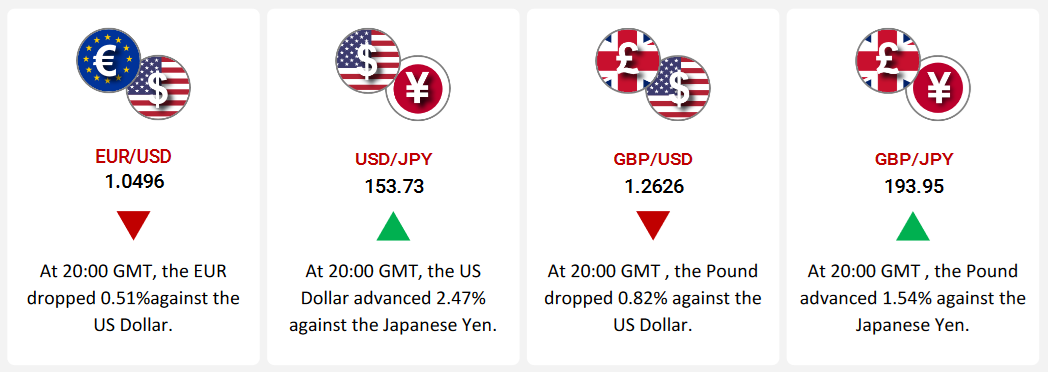

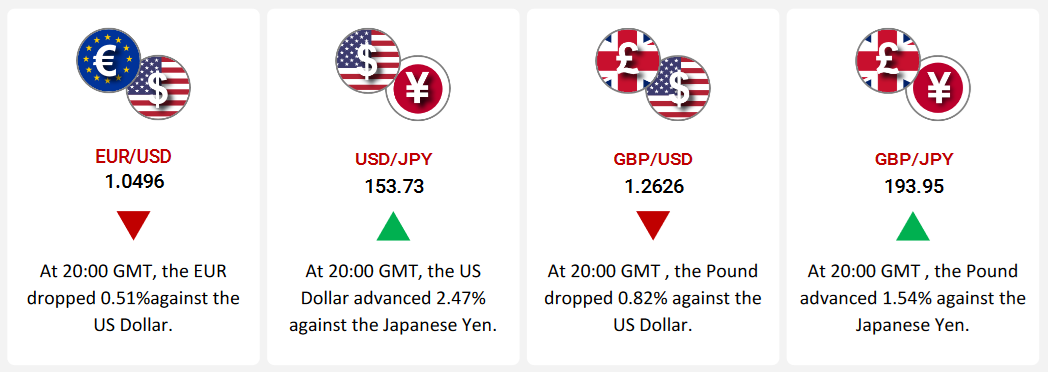

The EUR/USD dropped 0.51% last week, pressured by weak Eurozone sentiment and strong U.S. data. While the U.S. NFIB business confidence index hit a three-year high, Eurozone’s Sen tix investor confidence fell to a 13-month low. Inflationary pressures persisted in the U.S., with producer prices exceeding expectations, which supported the dollar.

The USD/JPY surged 2.47%, driven by robust U.S. economic indicators and divergent central bank policies. The Bank of Japan maintained its dovish stance, emphasizing caution before policy shifts, which weighed on the yen.

The GBP/USD declined 0.82% due to weak UK data and rate cut expectations. The UK economy contracted, and industrial production hit its lowest since May 2020, intensifying concerns over monetary easing. Meanwhile, GBP/JPY rose 1.54%, supported by improved UK consumer confidence and weaker yen sentiment.

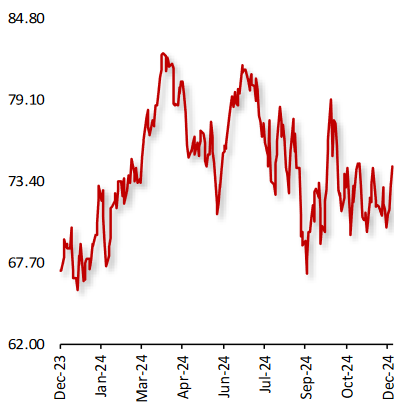

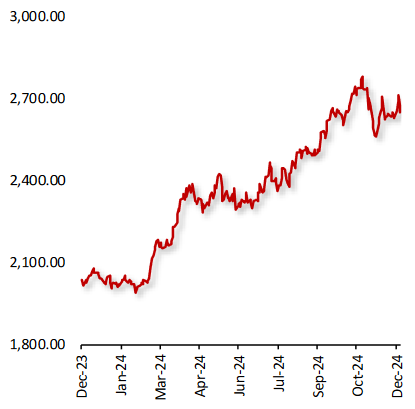

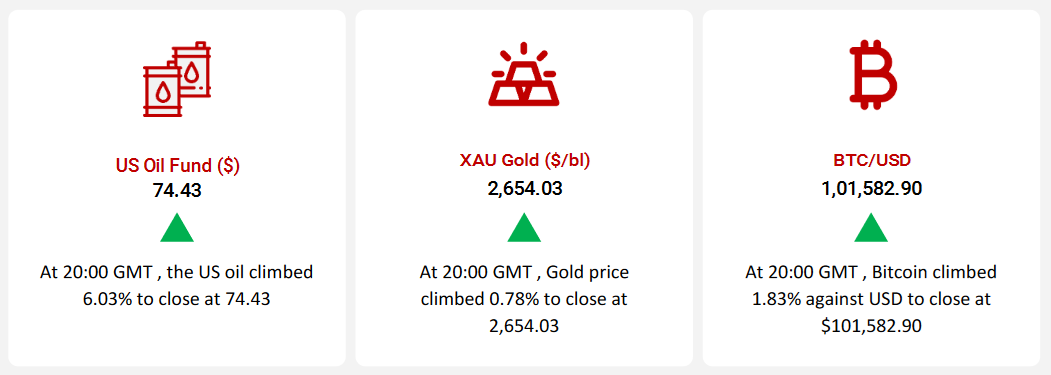

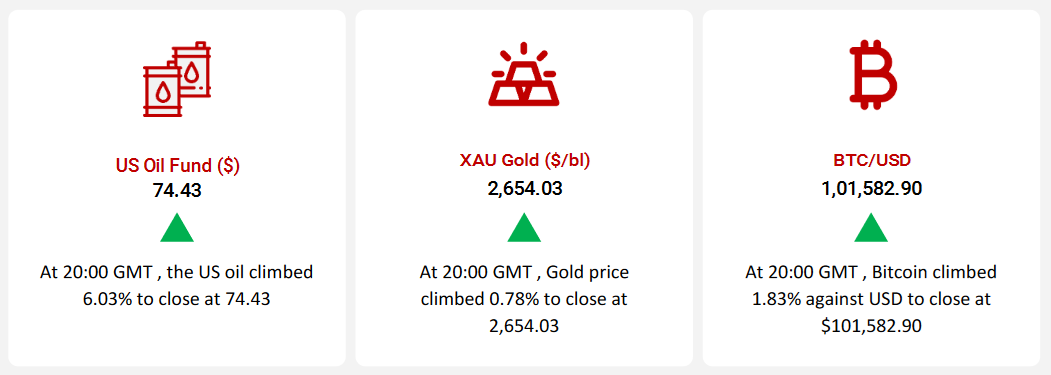

Oil prices rose amid supply concerns tied to sanctions on Russia and Iran, along with hopes of demand recovery from China’s planned stimulus. However, forecasts of a supply surplus in 2025 capped gains. Gold advanced on expectations of a Federal Reserve rate cut, bolstered by rising jobless claims and China’s gold purchases.

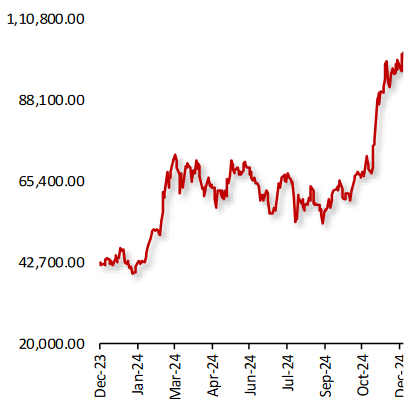

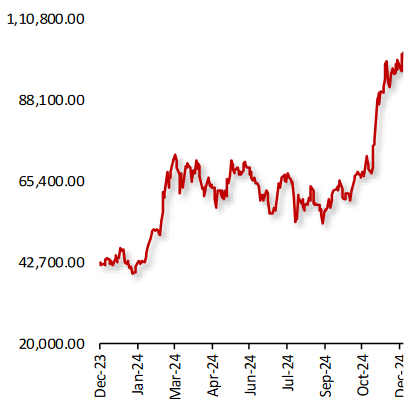

Bitcoin climbed on optimism surrounding U.S. rate cuts and supportive regulatory developments. Positive sentiment was further fueled by crypto ETF inflows and strategic partnerships like Binance and Circle’s efforts to promote USD Coin adoption.

The U.S. added 227,000 jobs in November, rebounding from hurricane-related disruptions. Healthcare and leisure sectors led growth, while the unemployment rate edged up to 4.2%. Average hourly earnings rose 3.9% annually, signaling sustained wage growth.

|

| |

|

|

Key Global Commodities

|

|

| |

| |

| |

|

| |

|

|

EUR/USD

|

|

|

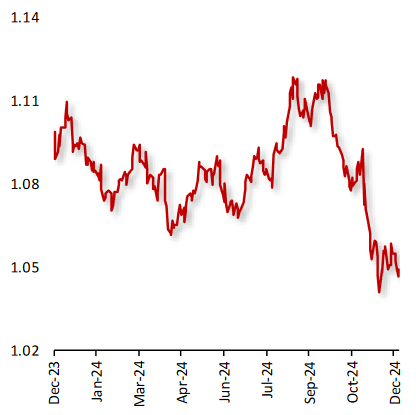

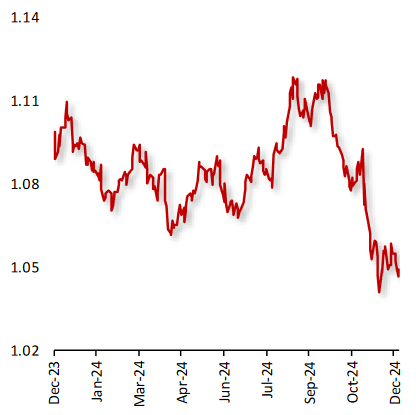

EUR/USD Declines Amid Weak Eurozone Sentiment and Strong U.S. Economic Data

|

|

| |

|

|

The EUR/USD declined by 0.51% last week, weighed down by weaker economic sentiment in the Eurozone and robust U.S. data.

In the U.S., dollar gained strength amid solid economic indicators as the NFIB business confidence index surged to its highest point in over three years in November. Meanwhile, the consumer price inflation rose in line with expectations in November. Also, the producer price index exceeded expectations in November. Additionally, weekly jobless claims unexpectedly rose to a two-month high to 242,000 in the week ended 06 December 2024. Despite this, market sentiment remained largely focused on robust U.S. economic fundamentals, supporting the dollar's strength.

In contrast, Eurozone’s Sen tix investor confidence index dropped to -17.5 in November, marking its lowest level in 13 months.

|

|

| |

| |

| |

|

|

USD/JPY

|

|

|

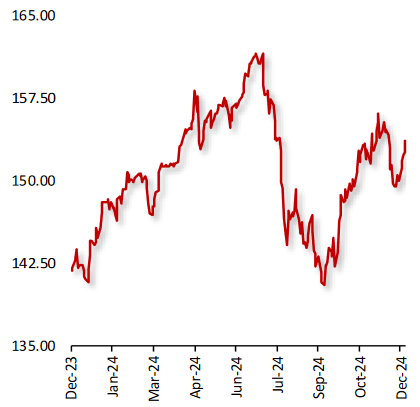

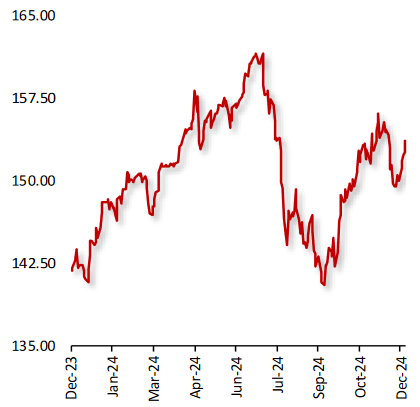

USD/JPY Climbs Amid Strong U.S. Data and Divergent Monetary Policies

|

|

| |

|

|

The USD/JPY rose 2.47% last week, driven by robust U.S. economic data and contrasting central bank policies.

In the U.S., the NFIB business confidence index surged in November to its highest point in over three years in November, buoyed by reduced economic uncertainty. However, inflationary pressures persisted as headline CPI ticked higher, while core CPI remained steady. Additionally, the producer price index exceeded expectations in November, signalling ongoing price pressures. Despite a rise in weekly jobless claims, market sentiment remained largely focused on robust economic indicators.

In contrast, the Bank of Japan maintained its dovish monetary policy, emphasizing the need for sustainable inflation and wage growth before considering significant policy shifts. A speech by a BoJ official highlighted the central bank's cautious approach to unwinding stimulus measures, further weighing on the yen.

|

|

| |

| |

| |

|

|

GBP/USD

|

|

|

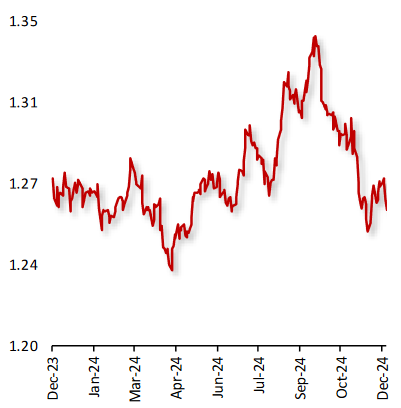

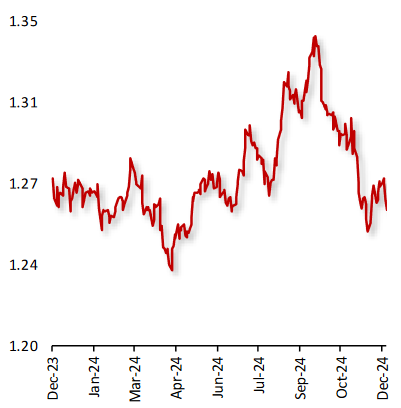

Pound Falls Due to Weak UK Economic Data and Rate Cut Expectations

|

|

| |

|

|

The GBP/USD declined by 0.82% last week, primarily due to weak British economic data and concerns over potential rate cuts by the Bank of England.

In the UK, economy unexpectedly contracted for second consecutive month in October. Industrial production also fell to its lowest level since May 2020 in October, driven by sharp decreases in manufacturing and mining sectors. These signs of economic weakness led to heightened expectations of faster rate cuts by the Bank of England, which weighed on the pound.

In the U.S., inflationary pressures persisted as consumer price inflation rose in line with expectations in November. Also, the producer price index exceeded expectations in November. Moreover, the NFIB business confidence index surged to its highest point in over three years in November.

|

|

| |

| |

| |

|

|

GBP/JPY

|

|

|

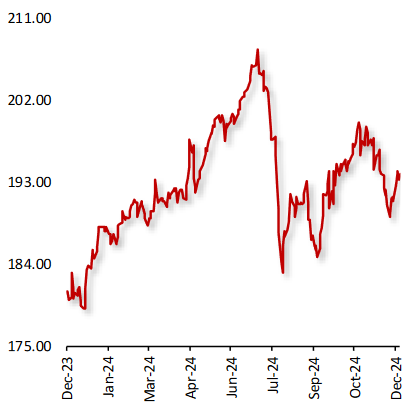

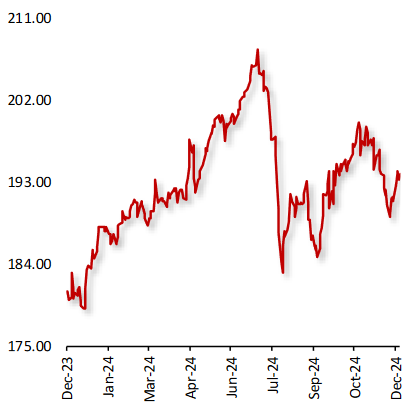

GBP/JPY Rises Amid UK Consumer Confidence and Diminished Yen Appeal

|

|

| |

|

|

The GBP/JPY rose by 1.54% last week, supported by contrasting economic developments in the UK and Japan.

In the UK, market sentiment for the pound improved after the GfK consumer confidence index unexpectedly advanced in December, offering a glimmer of optimism. However, the UK economy contracted in October, and industrial production fell to its lowest level since May 2020, primarily due to sharp declines in manufacturing and mining. These signs of economic weakness fuelled speculation that the Bank of England may implement rate cuts next year.

In Japan, scepticism about the Bank of Japan's commitment to further rate hikes diminished, weakening the yen’s appeal. Despite Tokyo Core CPI rising to 1.8%, inflationary concerns were subdued as a Bank of Japan official’s cautious remarks signalled the central bank’s continued focus on maintaining stimulus measures.

|

|

| |

| |

| |

|

|

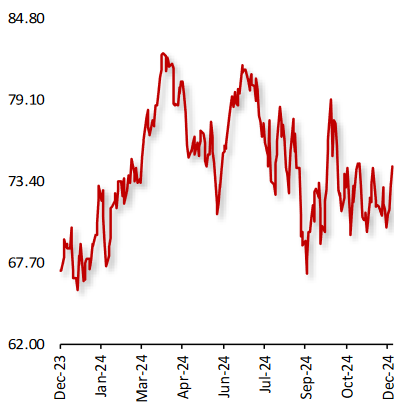

US Oil Fund ($)

|

|

|

Oil Prices Rise Amid Worries Over Supply Constraints

|

|

| |

|

|

Oil prices climbed this week, as tighter sanctions on Russia and Iran fuelled worries over supply constraints and amid hopes that China’s fresh stimulus measures could lift oil demand in the world’s top oil consumer.

China’s top officials signalled further stimulus measures including raising its budget deficit ratio in 2025 at a key economic meeting that sets policy priorities for the coming year.

Moreover, the International Energy Agency (IEA) increased its forecast for 2025 global oil demand growth to 1.1 million barrels a day. However, the IEA forecasted a surplus for next year, when non-OPEC nations were set to boost supply by about 1.5 million barrels a day, driven by Argentina, Brazil, Canada, Guyana and the US. Furthermore, investors await the US Federal Reserve’s interest rate decision next week for further direction.

|

|

| |

| |

| |

|

|

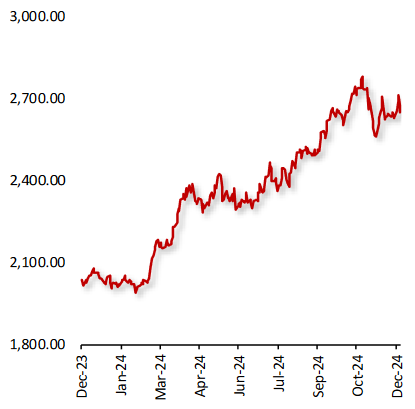

XAU Gold (XAU/USD)

|

|

|

Gold Prices Advance Amid Hopes Surrounding Rate Cuts

|

|

| |

|

|

Gold prices advanced last week, after the US jobs report reaffirmed expectations of 25 basis point rate cut by the Federal Reserve (Fed) next week.

Jobless claims rose in the latest week pointing towards an easing labour market making it more likely that the Fed will cut interest rates next week for the third time, despite little progress in lowering inflation down to its 2% target in recent months.

The US producer prices rose more than expected in November, amid a surge in the cost of food, followed by inflation data showing consumer prices rose by the most in seven months in November.

Additionally, top consumer, China pledged to ramp up policy stimulus to help spur economic growth and the central bank expanded its gold reserves in November, ending a six-month pause in purchases, further supporting prices.

|

|

| |

| |

| |

|

|

BTC/USD

|

|

|

Bitcoin Rise Amid Optimism Surrounding Interest Rate Cuts

|

|

| |

|

|

Bitcoin’s price climbed last week, after stronger than expected US inflation data reignited hopes for interest rate cuts by the Federal Reserve (Fed) in its next policy meeting. Additionally, President-elect Donald Trump reiterated his pledge to make the US a global crypto leader.

Adding to the positive sentiment, crypto market data indicated that spot exchange-traded funds tracking Bitcoin and Ether saw sustained inflows through early December, amid sustained optimism over friendlier regulations under Trump.

In major news, US regulators are inviting public feedback on NYSE Arca’s proposal to list a new cryptocurrency exchange-traded fund (ETF) developed by Bitwise. The fund would hold actual Bitcoin and Ether, providing investors with direct exposure to the two leading cryptocurrencies in a convenient, regulated format. Separately, Binance and Circle have announced a strategic partnership to boost adoption and utility of USD Coin worldwide.

|

|

| |

| |

| |

| Non-farm payrolls: 227K Jobs Added in November |

| |

|

The US economy added 227,000 jobs in November, surpassing expectations and staging a robust rebound from the previous month. Notably, job gains for October were revised upward to 36,000 from 12,000. The rebound in the November jobs data is largely attributed to a recovery from disruptions in October, when job growth was weakened by hurricanes in the Southeast and a dockworkers’ strike.

In November, growth in nonfarm payrolls was primarily fuelled by increases in several sectors. The healthcare sector added 54,000 jobs, while the leisure and hospitality sector added 53,000 jobs.

The unemployment rate advanced to 4.2% in November, compared to the 4.1% reported in October. Meanwhile, average hourly earnings rose by 3.9% in the year through November following a 4.0% growth in October.

|

| |

|

| |

|

|

Key Global Currencies and Commodities

|

|

| |

| |

| |

|

Currency

|

| |

|

| |

|

Commodities & Crypto

|

| |

|

| |

|

| |

|