| |

| Market Update |

| |

|

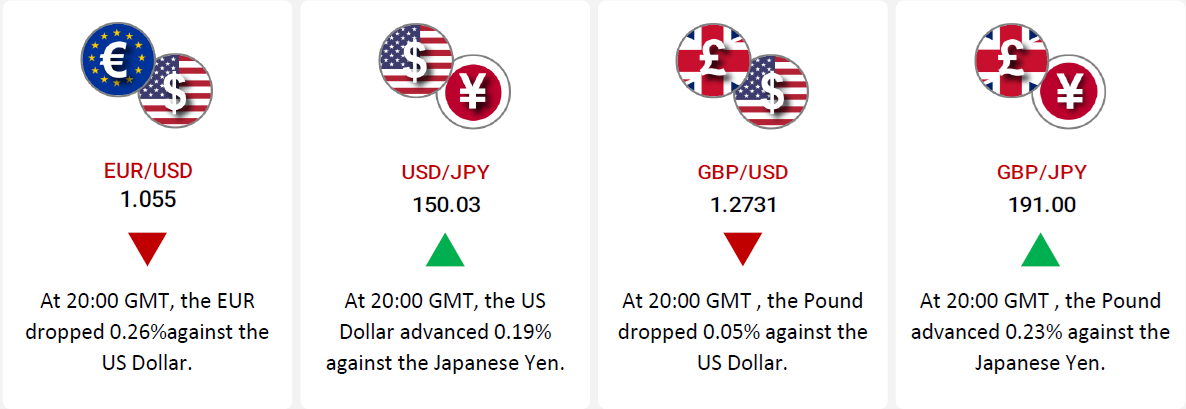

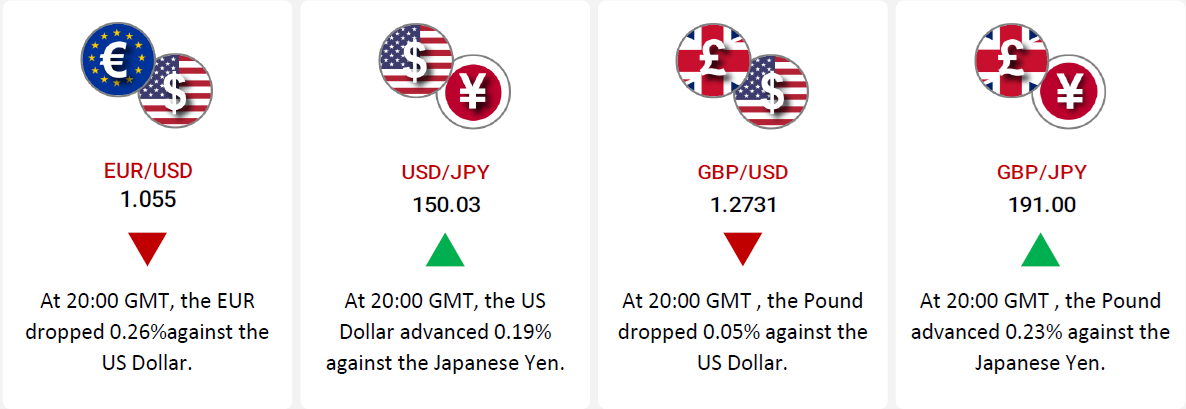

The USD rose 0.19% against the JPY, driven by speculation of a potential BoJ rate hike following strong inflation data. Tokyo’s CPI reached a three-month high in November, signaling inflationary pressures. Positive Japanese industrial production and retail sales further supported the Yen. However, the Dollar faced uncertainty over the Fed's policy as slowing wage growth and economic risks tempered expectations for further rate hikes.

The GBP gained 0.23% against the JPY on similar BoJ rate hike speculation but closed 0.05% lower against the USD. Optimism over UK inflation and resilient housing data supported the Pound. However, weak retail sales and PMI data, coupled with persistent inflation concerns from the BoE, highlighted challenges to the UK economy.

The EUR fell 0.26% against the USD as mixed Eurozone economic data, including weak German industrial production and retail sales, raised growth concerns. Inflation rose to 2.3% in November, exceeding the ECB’s target, while geopolitical risks and energy price uncertainty weighed on the Euro. Robust US job data strengthened the Dollar despite slower wage growth, supporting Fed rate hike expectations.

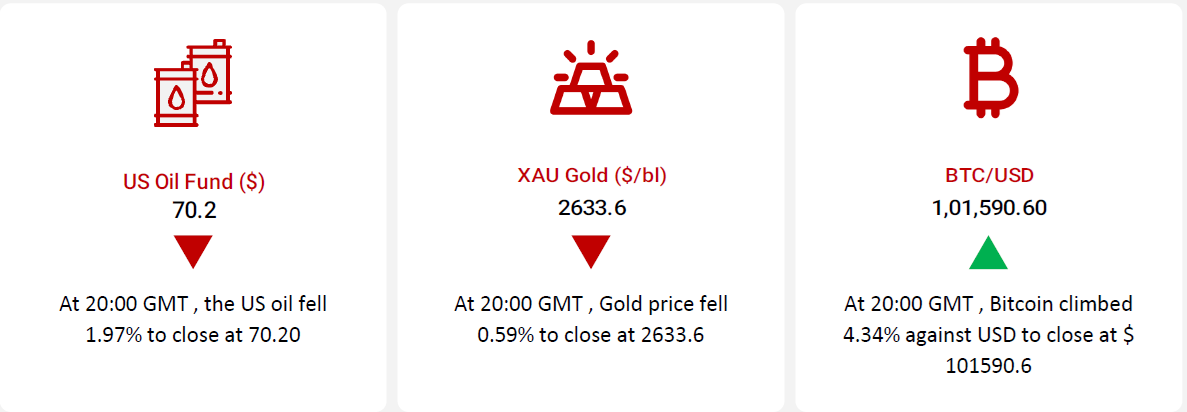

Oil prices declined due to demand concerns and OPEC+ postponing supply increases to 2025. A sharper-than-expected drop in US crude inventories offered some support. Meanwhile, eased tensions in the Middle East reduced supply disruption fears.

Gold fell as rising US Treasury yields outweighed demand. Investors awaited further Fed signals, with labor data showing a resilient market and moderate wage growth, limiting scope for additional rate cuts.

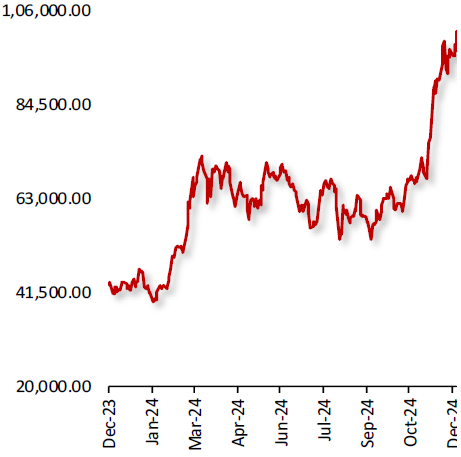

Bitcoin surged amid optimism for crypto-friendly policies under the US President-elect. Increased institutional investments in Bitcoin ETFs and remarks positioning Bitcoin as a gold competitor drove gains, signaling confidence in the digital asset market.

|

| |

|

|

Key Global Commodities

|

|

| |

| |

| |

|

| |

|

|

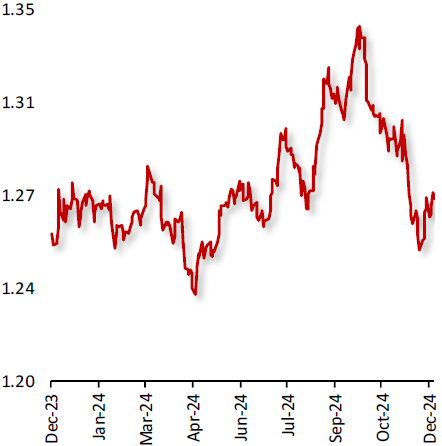

EUR/USD

|

|

|

EUR weakened as US Jobs Data and ECB Policy outlook drive volatility

|

|

| |

|

|

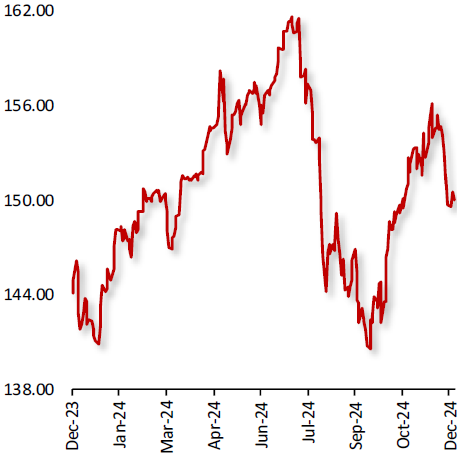

The EUR fell 0.26% against the USD during the week, amid concerns over Eurozone's economic outlook. Mixed economic indicators, including weaker-than-expected German industrial production and retail sales, raised doubts about growth prospects. Eurozone inflation rose to 2.3% in November, exceeding the European Central Bank’s target for the first time in three months. Moreover, geopolitical risks in the Europe and ongoing uncertainty over energy prices also kept the Euro under pressure.

Meanwhile, the US added 224,000 jobs in the week ended 29 November 2024, raising hopes that the Federal Reserve may keep interest rates elevated for longer. Despite a slight moderation in wage growth, the strong labor market bolstered expectations for the Fed’s tightening stance.

|

|

| |

| |

| |

|

|

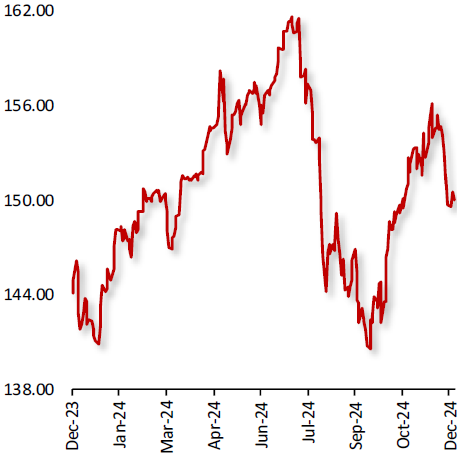

USD/JPY

|

|

|

Yen weakens as rising inflation and BoJ rate hike bets lift sentiment

|

|

| |

|

|

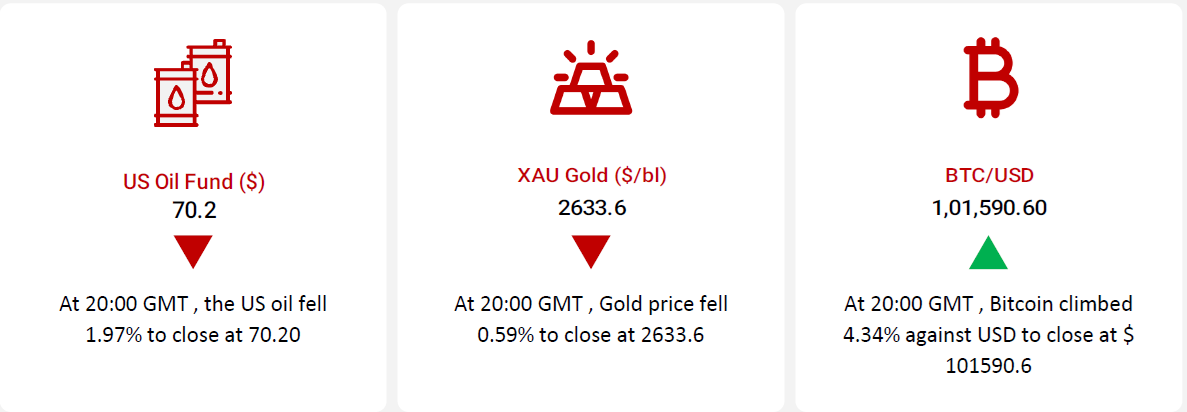

The USD climbed 0.19% against the JPY during the week, driven by growing speculation that the Bank of Japan (BoJ) may raise interest rates in December, following stronger-than-expected inflation data. Tokyo's Consumer Price Index (CPI) rose in November, marking the highest increase in three months. Raising expectations for a potential rate hike by the BoJ to combat rising inflationary pressures. Additionally, positive industrial production and retail sales data provided further support for the Yen.

Meanwhile, the US Dollar faced pressure as concerns over the Federal Reserve's tightening policy outlook grew. Despite strong job market data, including the addition of 224,000 jobs in the week ended 29 November, the market expects that the Fed could pause its rate hikes due to moderation in wage growth and potential risks to economic growth.

|

|

| |

| |

| |

|

|

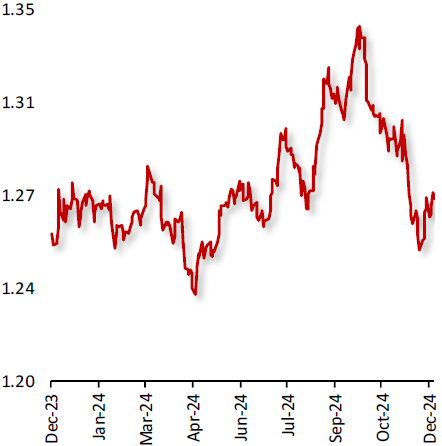

GBP/USD

|

|

|

GBP set for potential rebound as market sentiment shifts

|

|

| |

|

|

The GBP closed 0.05% lower against the USD, amid optimism surrounding the UK’s inflation outlook and signs of resilience in the services sector. Seasonally adjusted house price index rose more than expected in November. Meanwhile, weaker-than-expected UK economic data, including a contraction in retail sales and a soft PMI reading. The Bank of England (BoE) officials showed concerns over price pressures remaining persistent. Manufacturing PMI dropped more than expected in November.

Meanwhile, the US Dollar strengthened this week amid market uncertainty surrounding the Federal Reserve's policy outlook grew. Despite concerns about slowing wage growth and potential risks to economic growth, strong job market data, including the addition of 224,000 jobs in the week ended 29 November, led to speculation that the Fed might pause its rate hikes.

|

|

| |

| |

| |

|

|

GBP/JPY

|

|

|

GBP strengthens as UK economic concerns and BoJ rate hike bets lift Yen

|

|

| |

|

|

The GBP advanced 0.23% against JPY during the week, amid growing speculation that the Bank of Japan (BoJ) may raise interest rates in December, following stronger-than-expected inflation data. Tokyo's November Consumer Price Index (CPI) climbed to its highest increase in three months, which further fueled expectations of a rate hike by the BoJ to combat rising inflationary pressures.

Meanwhile, the British Pound strengthened amid optimism surrounding the UK’s inflation outlook and signs of resilience in the services sector. Seasonally adjusted house price index rose more than expected in November. The Bank of England’s cautious approach to further tightening added to the benefit of the Pound.

|

|

| |

| |

| |

|

|

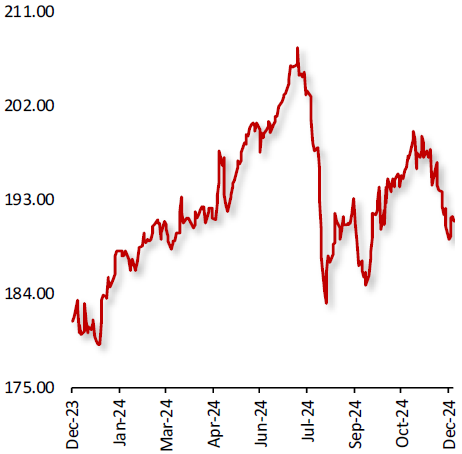

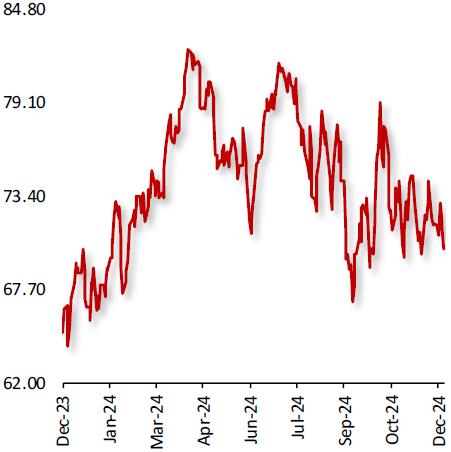

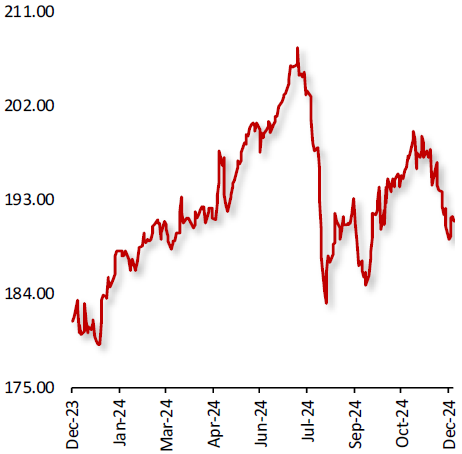

US Oil Fund ($/bl)

|

|

|

Oil Prices Decline on Concerns Over Global Demand Outlook

|

|

| |

|

|

Oil prices declined this week, amid worries over weaker oil demand. Moreover, the Organization of the Petroleum Exporting Countries and its allies postponed planned supply increases by three months until April 2025 and extended the full unwinding of cuts by a year until the end of 2026.

Meanwhile, the US crude oil inventories fell more than expected last week and product stocks saw a buildup as refineries ramped up their capacity use, according to data released Wednesday by the US Energy Information Administration. Commercial crude oil stocks excluding the Strategic Petroleum Reserve fell by 5.1 million barrels to 423.4 million barrels in the week ended 29 November 2024.

Elsewhere, Donald Trump's Middle East envoy has travelled to Qatar and Israel to kick-start diplomatic push to help reach a Gaza ceasefire and hostage release deal before 20 January, easing concerns over supply disruptions.

|

|

| |

| |

| |

|

|

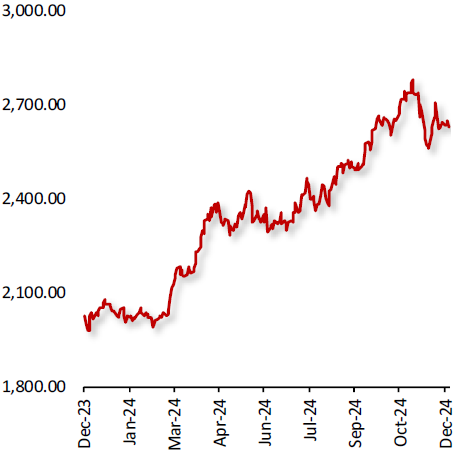

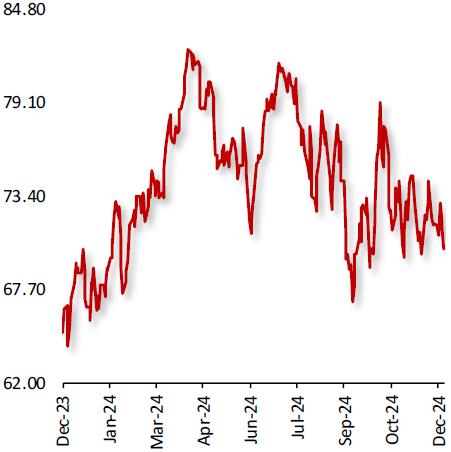

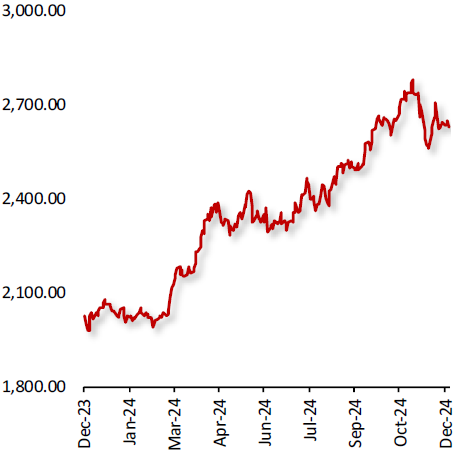

XAU Gold ($/oz)

|

|

|

Gold Prices Decline Amid Rise in the US Treasury Yields

|

|

| |

|

|

Gold prices declined last week, amid rise in the US Treasury yields. Additionally, investors await the US payrolls data for further direction on the Federal Reserve’s (Fed) path of interest rate cuts.

Data indicated that the number of Americans filing new applications for unemployment benefits rose slightly last week, pointing to steadily easing labour market conditions heading into the final stretch of 2024. Also, Fed chair, Jerome Powell indicated that the US economy was stronger than it had appeared in September, when the central bank began cutting rates, allowing policymakers to potentially be a little more cautious in reducing rates further.

Moreover, US JOLTS job openings rose by 372,000 jobs to 7.744 million in October, showing a stronger labour market than expectations of 7.519 million.

|

|

| |

| |

| |

|

|

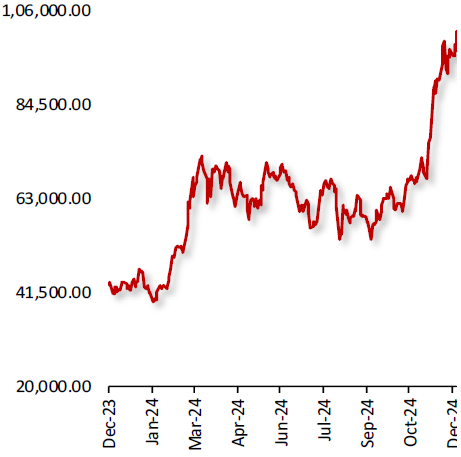

BTC/USD

|

|

|

Bitcoin Climbs Amid Hopes Surrounding Prospects of Relaxed Regulatory Environment

|

|

| |

|

|

Bitcoin’s price climbed last week, amid hopes that US President-elect Donald Trump’s administration will provide support to the digital-asset industry. Additionally, market sentiment has been buoyed by the expectation that Paul Atkins' leadership could foster a more innovation-friendly approach to the US crypto regulation, potentially driving sector growth.

Also, US Federal Reserve Chair Jerome Powell has reiterated that Bitcoin is a direct competitor to gold and isn’t a threat to the US Dollar, further supporting the digital asset’s rally. Furthermore, US listed bitcoin exchange-traded funds have witnessed a large-scale buying, with more than US$4 billion streaming into these funds since the US election.

Elsewhere, former US treasury secretary Lawrence Summers dismissed President-elect Donald Trump’s plan for a strategic Bitcoin reserve but agreed that “crypto has been over-regulated.”

|

|

| |

| |

| |

|

| |

|

|

Key Global Currencies and Commodities

|

|

| |

| |

| |

|

Currency

|

| |

|

| |

|

Commodities & Crypto

|

| |

|

| |

|

| |

|