| |

| Market Update |

| |

|

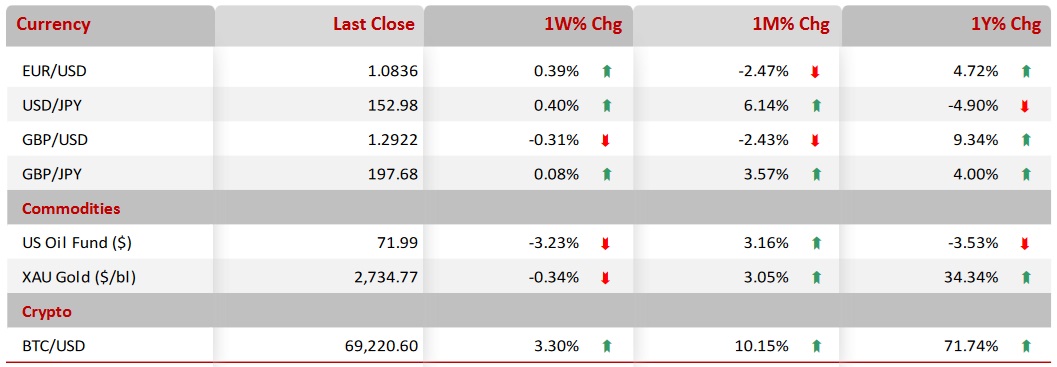

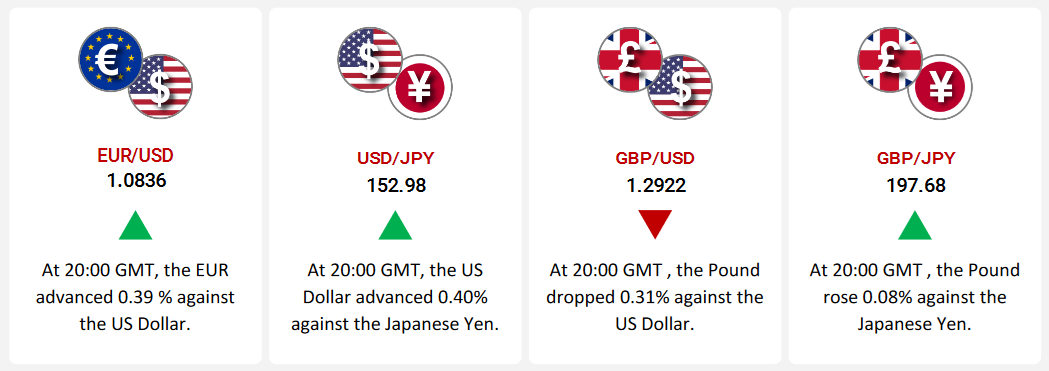

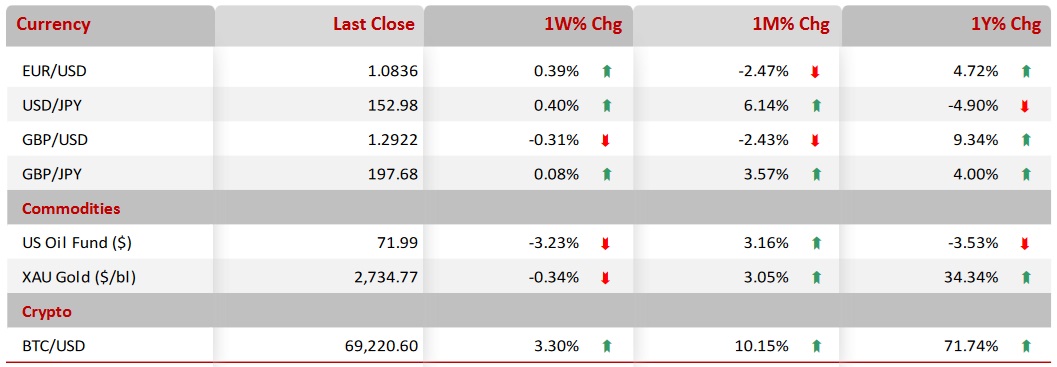

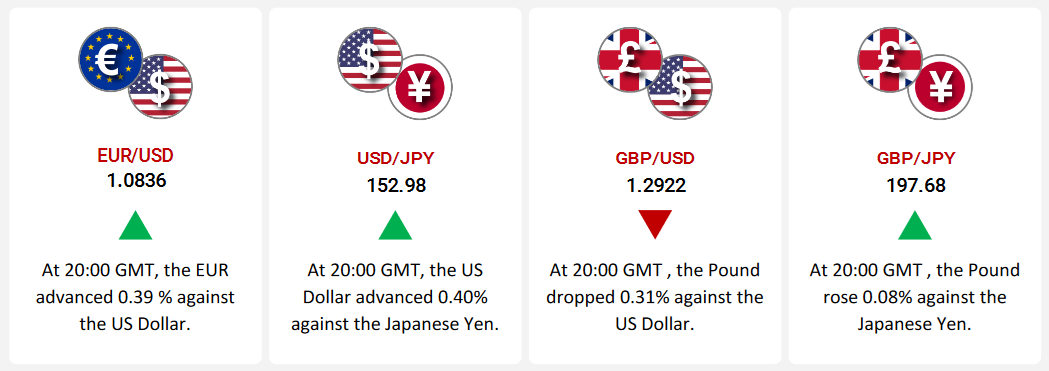

This week, financial markets saw varied movements influenced by central bank policies, economic data, and geopolitical factors. The EUR/USD pair experienced a 0.39% rise in the Euro to 1.0836, fueled by mixed Eurozone data and ECB policy speculation. Despite a slowdown in Eurozone manufacturing, Q3 GDP growth reached 0.4%, while strong US consumer confidence and GDP figures raised expectations for additional Fed rate hikes.

The USD/JPY climbed 0.4% to 152.98, with the dollar bolstered by robust US retail sales and consumer spending. Meanwhile, the BoJ maintained its ultra-loose monetary stance, making the dollar more attractive in the contrasting policy environment.

The GBP/USD fell 0.31% to 1.2922, reflecting concerns over the UK’s slowing economy and potential BoE easing. In contrast, the dollar’s resilience persisted on strong US economic indicators, particularly consumer confidence and GDP.

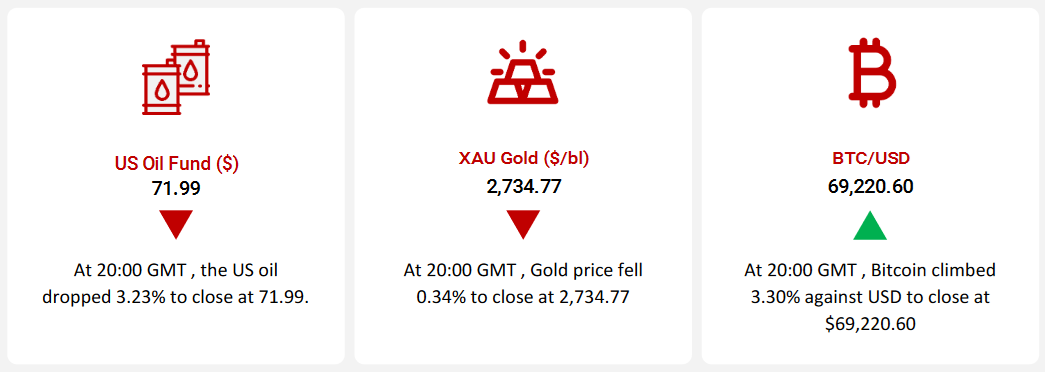

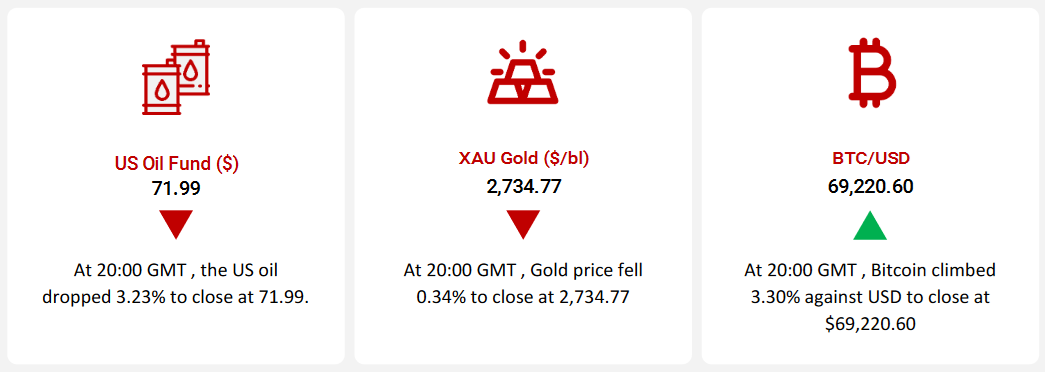

Oil prices declined as expected Israeli airstrikes spared crucial oil sites, reducing supply concerns. China’s sluggish economy and signals from OPEC to ease production further pressured prices. Meanwhile, the US Energy Department continued efforts to replenish the Strategic Petroleum Reserve, underscoring its commitment to stabilizing supply.

In employment, US nonfarm payrolls grew by only 12,000 jobs in October, the slowest since 2020, impacted by Hurricane Milton and labor strikes. The unemployment rate held at 4.1%, but weak job growth raised questions on Fed rate policy. Healthcare and government jobs showed strong gains, while manufacturing and temporary services faced declines. Average hourly earnings grew 0.4%, reaching $35.46, reflecting resilient wage growth amid employment pressures.

Safe-haven assets showed mixed results; gold prices dropped amid rising Treasury yields, dampening its appeal. Meanwhile, Bitcoin gained on optimism about potential pro-crypto policies under a Trump victory in the upcoming election, though regulatory scrutiny on Tether added to market volatility.

These shifts underscore the complex interplay of economic data, central bank policies, and geopolitical dynamics influencing asset performance across global markets.

|

| |

|

|

Key Global Commodities

|

|

| |

| |

| |

|

| |

|

|

EUR/USD

|

|

|

EUR Rises Amid Diverging Economic Data and ECB Rate Speculation

|

|

| |

|

|

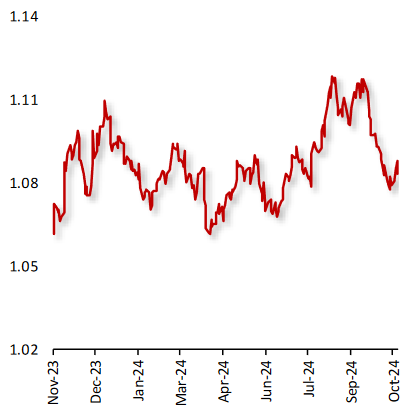

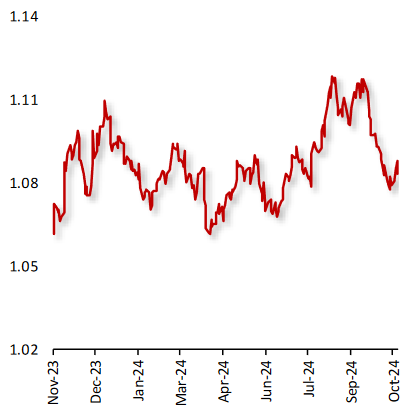

The EUR advanced 0.39% against the USD to close at 1.0836 this week.

This rise comes from mixed economic indicators in the eurozone and heightened expectations regarding the European Central Bank's (ECB) monetary policy.

The US dollar has been supported by strong consumer confidence and better-than-expected GDP growth of 3.2% in Q3, bolstering hopes that the Federal Reserve will continue rate hikes.

Data from Eurozone revealed a decline in manufacturing activity. This has raised concerns about economic stagnation, prompting speculation that the European Central Bank (ECB) may adopt a more dovish stance in upcoming meetings. The Eurozone economy expanded 0.4% QoQ in the third quarter of 2024, stronger than expected. The eurozone inflation pressures remain high, driven by wage growth. During its latest meeting in October, the ECB reiterated that its commitment to a "data-dependent and meeting-by-meeting" approach to future policy decisions.

|

|

| |

| |

| |

|

|

USD/JPY

|

|

|

USD Rises Amid Strong US Economic Data and BoJ Stance

|

|

| |

|

|

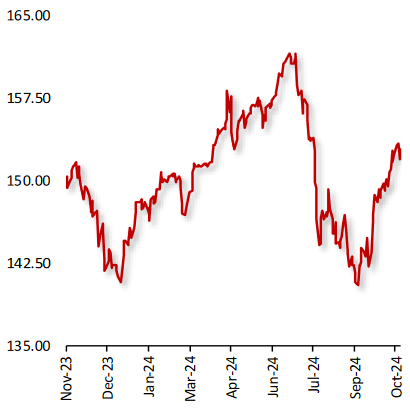

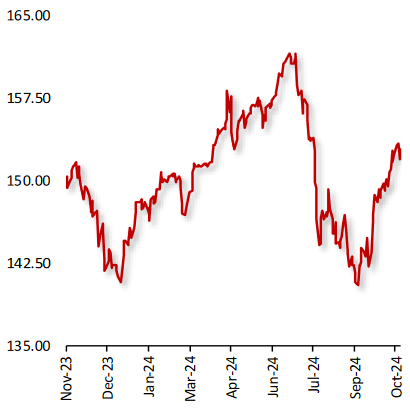

The USD advanced 0.4% against the JPY to close at 152.98 this week.

This upward movement is driven by robust US economic indicators and the Bank of Japan’s (BoJ) continued commitment to its loose monetary policy.

Recent data from the US highlighted a significant increase in consumer spending, with retail sales jumping by 1.5% in September, reinforcing expectations for sustained Federal Reserve rate hikes. This economic strength has bolstered the dollar, making it more attractive to investors.

In contrast, the BoJ has maintained its ultra-loose monetary policy, with Governor Kazuo Ueda reiterating the need to support growth amidst persistent inflation. While inflation pressures mount, the central bank has signaled no immediate intention to adjust rates.

|

|

| |

| |

| |

|

|

GBP/USD

|

|

|

GBP Declined Amid Economic Concerns and BoE Dovish Signals

|

|

| |

|

|

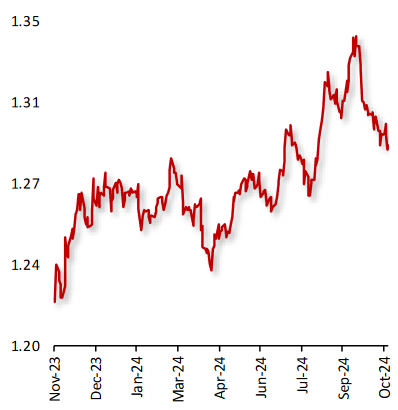

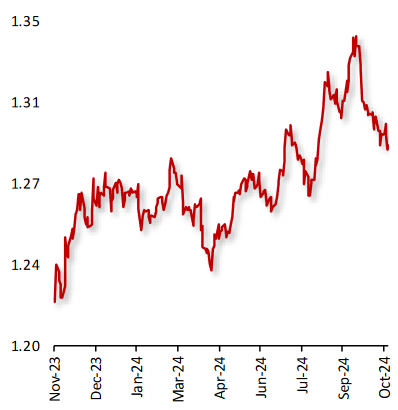

The GBP declined 0.31% against the USD to close at 1.2922 this week.

This decline reflects ongoing economic concerns in the UK and shifting expectations regarding the Bank of England’s (BoE) monetary policy.

Recent economic data revealed a slowdown in the UK, with 3Q GDP growth only at 0.2%, raising fears of a potential recession. BoE Governor Andrew Bailey hinted at a more cautious approach to rate adjustments, suggesting that if economic conditions do not improve, further easing might be necessary.

In contrast, the US dollar has gained strength from positive economic indicators, including a robust consumer confidence report, which supports expectations for continued Federal Reserve interest rate hikes.

|

|

| |

| |

| |

|

|

GBP/JPY

|

|

|

GBP slightly advances amid UK Economic Concerns Weigh on the Pound

|

|

| |

|

|

The GBP advanced 0.08% against the JPY to close at 197.68 this week.

This movement reflects ongoing economic challenges in the UK and contrasting monetary policies between the Bank of England (BoE) and the Bank of Japan (BoJ).

Recent UK data indicated sluggish growth, with 3Q GDP rising only 0.2%, raising concerns about potential recession risks. BoE Governor Andrew Bailey’s comments on the need for a cautious approach to interest rates have further weighed on the pound, with expectations of possible easing if the economic situation worsens.

Meanwhile, the BoJ remains committed to its ultra-loose monetary policy, with Governor Kazuo Ueda emphasizing support for economic growth despite persistent inflationary pressures.

|

|

| |

| |

| |

|

|

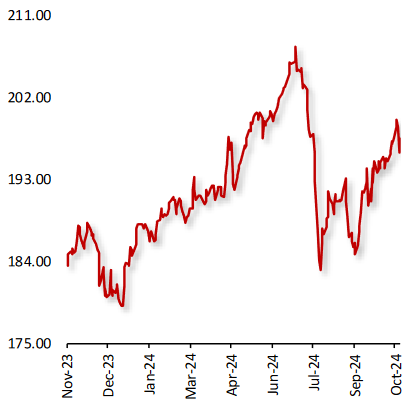

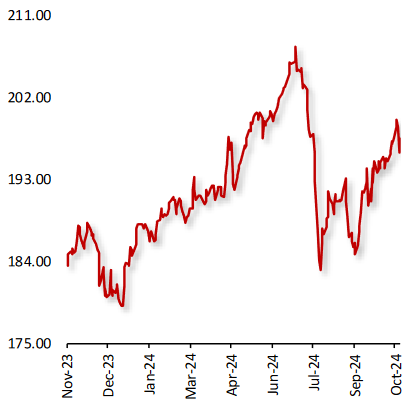

US Oil Fund ($)

|

|

|

Oil Prices Decline as Fears Over Supply Constraints Subsided

|

|

| |

|

|

Oil prices declined this week, after widely anticipated Israeli airstrikes against Iran did not hit crucial oil and nuclear facilities, easing concerns over supply disruptions.

Adding to the negative sentiment, China’s economic activity remained subdued, as fresh stimulus failed to boost investor sentiment. Additionally, the Organization of the Petroleum Exporting Countries (OPEC) appeared willing to relax production restrictions, and non-OPEC countries are increasing crude production.

On the other hand, the US Energy Department stated that it would take bids for up to 3 million barrels of oil for delivery to the Strategic Petroleum Reserve’s Bryan Mound site in Texas from April through May. The department said it had bought more than 55 million barrels to date to replenish the reserve in response to spiking crude prices following Russia’s invasion of Ukraine.

|

|

| |

| |

| |

|

|

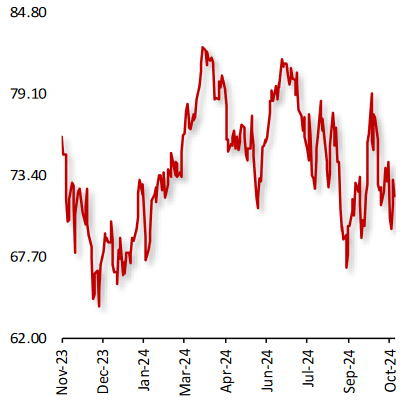

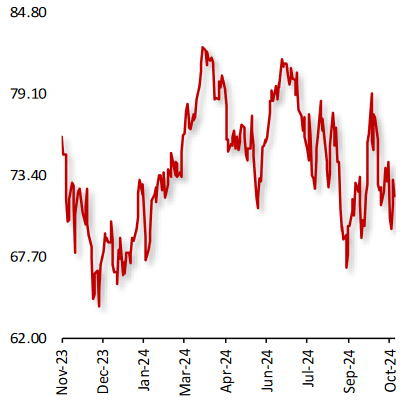

XAU Gold (XAU/USD)

|

|

|

Gold Prices Decline Amid Rise in the US Treasury Yields

|

|

| |

|

|

Gold prices dropped last week, amid strength in the US Dollar and rise in the US Treasury yields. Yields on benchmark 10-year Treasuries rose to a three-month high. Moreover, investors await series of US Personal Consumption Expenditures and payrolls data for further cues on the Federal Reserve's interest rate outlook.

Meanwhile, manufacturing activity in biggest gold consumer, China expanded in October for the first time in six months, supporting policymakers' optimism that recent fresh stimulus would bring the economy back on track.

Elsewhere, data indicated that the US private payrolls growth surged by a higher-than-expected 233,000 jobs in October, despite fears of temporary disruptions from hurricanes and strikes. Following the data, Fed policymakers are nearly certain to deliver a quarter-point reduction in short-term borrowing costs next week.

|

|

| |

| |

| |

|

|

BTC/USD

|

|

|

Bitcoin Climbs Amid Hopes Surrounding Improvements in the Regulatory Framework

|

|

| |

|

|

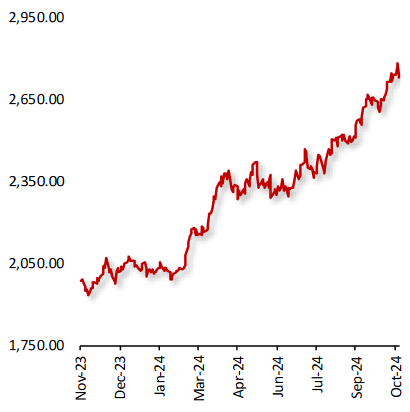

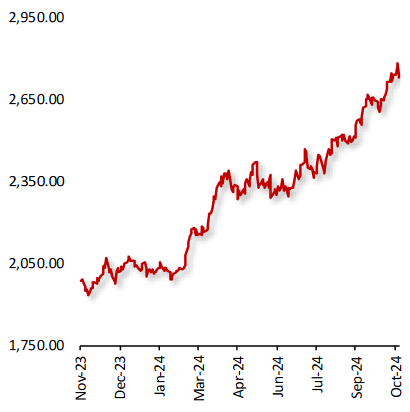

Bitcoin's price climbed last week amid growing expectations of a Trump victory over Kamala Harris in the upcoming U.S. presidential election, as his policies are seen as more favorable to crypto. Additionally, geopolitical tensions in the Middle East have driven demand for Bitcoin as an alternative asset.

Concurrently, a U.S. investigation into Tether Holdings Ltd. for possible sanctions and anti-money-laundering violations underscored the significance of Stablecoins as critical gateways in cryptocurrency markets, often used as intermediaries for fiat-to-token conversions and as collateral for crypto loans.

Strong U.S. economic data further signals resilience, potentially limiting the likelihood of sharp rate cuts from the Federal Reserve. Investors now await the election’s outcome and more information on China’s economic stimulus plans.

|

|

| |

| |

| |

| Nonfarm Payrolls: Increased by 12,000 in October |

| |

|

The US economy added jobs at the slowest pace since 2020 in October, largely due to disruptions from significant weather events, such as Hurricane Milton, and labor strikes, notably the Boeing factory worker walkout.

Nonfarm payrolls increased by just 12,000 jobs, a sharp drop from September's revised gain of 223,000. Despite this slowdown, the unemployment rate remained stable at 4.1%.

The latest employment figures suggest a potential labor market weakening, prompting questions about whether the Federal Reserve might consider more aggressive measures.

Healthcare and government led job creation for the month, with healthcare adding 52,000 positions in October after averaging 58,000 over the previous 12 months. Government jobs grew by 40,000 in October.

Meanwhile, within professional and business services, employment in temporary help services declined by 49,000 in October whereas manufacturing employment decreased by 46,000 in October.

Average hourly earnings for all employees on private nonfarm payrolls increased by $0.13, or 0.4%, bringing the average to $35.46.

|

| |

|

| |

|

|

Key Global Currencies and Commodities

|

|

| |

| |

| |

|

Currency

|

| |

|

| |

|

Commodities & Crypto

|

| |

|

| |

|

| |

|