| |

| Market Update |

| |

|

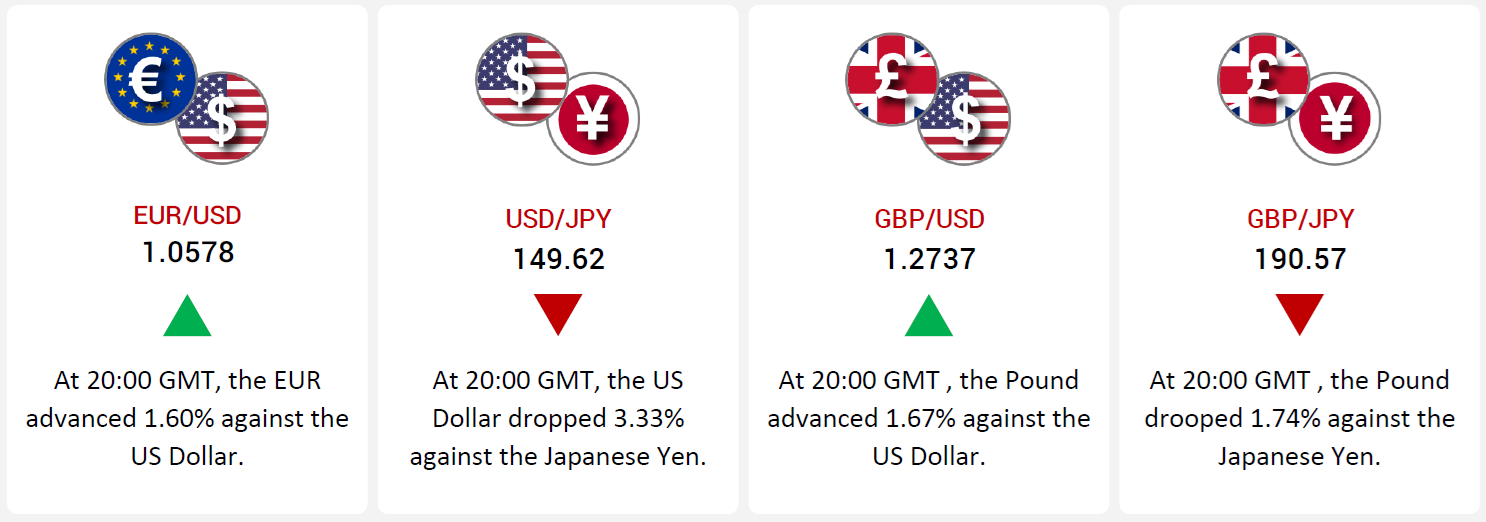

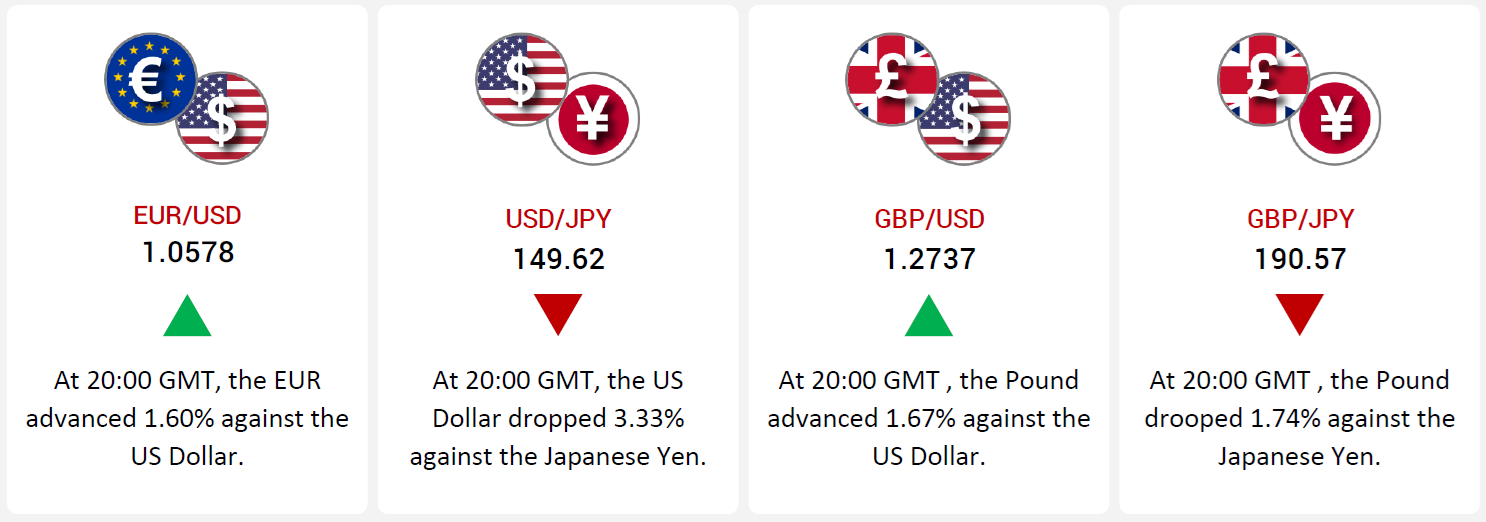

Last week, the Euro strengthened by 1.60% against the US Dollar, buoyed by improving eurozone sentiment, despite weaker German confidence metrics. Optimism among industrial managers and retailers offset these concerns, while resilient US economic indicators, including steady GDP growth at 2.8% and lower jobless claims, highlighted robustness. However, the Fed’s cautious approach to rate cuts tempered Dollar gains.

The Yen surged 1.74% against the Pound, supported by strong Japanese inflation and robust economic data. Tokyo's November CPI rose 2.6% YoY, the highest in three months, boosting expectations for a BoJ rate hike in December. Conversely, weak UK retail sales and economic concerns weighed on the Pound.

Despite challenges, the Pound appreciated 1.67% against the Dollar as easing UK inflation and cautious BoE policies offered optimism. Meanwhile, the Dollar's weakness was exacerbated by Fed signals for gradual rate cuts.

The US Dollar depreciated 3.33% against the Yen due to lower US Treasury yields and strong Japanese inflation data, with core consumer prices exceeding the BoJ’s 2% target. This reinforced expectations of a BoJ rate hike, further weakening the Dollar.

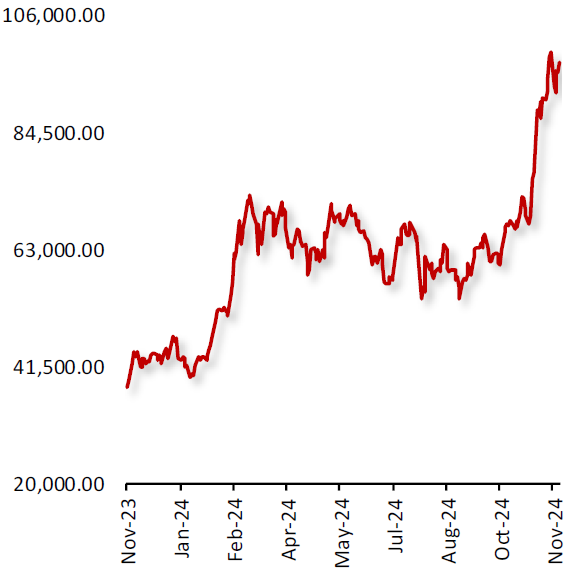

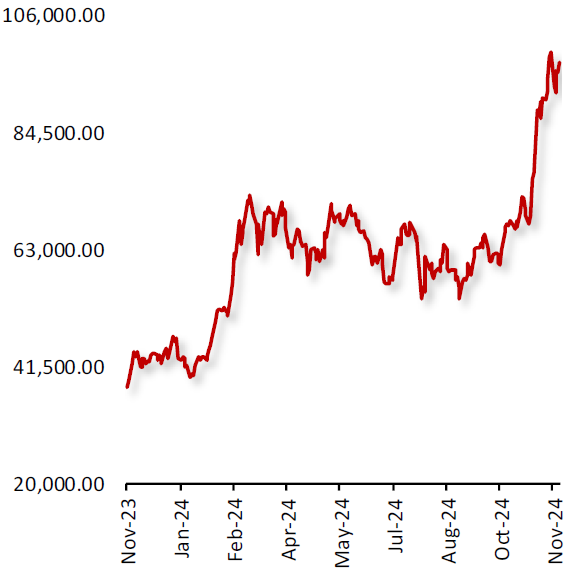

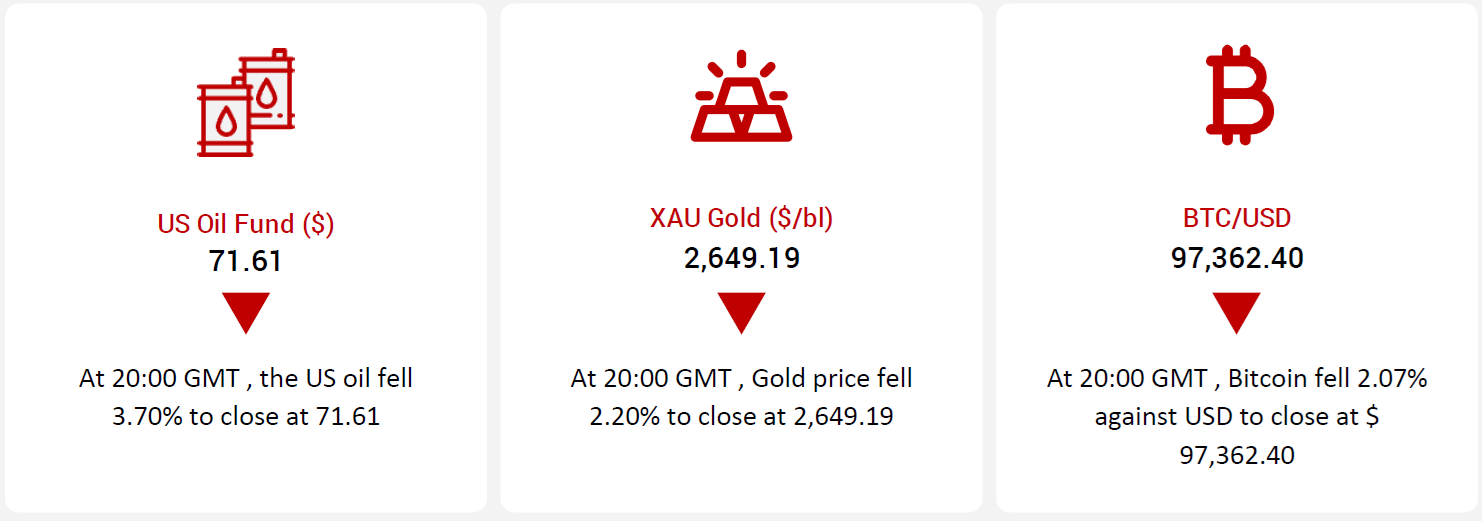

Bitcoin prices declined amid speculation that crypto advocate Paul Atkins could replace Gary Gensler as SEC Chair, raising hopes for pro-crypto policies. Additionally, the BITCOIN Act proposed a US strategic Bitcoin stockpile, drawing attention to crypto investments under President-elect Trump’s administration.

Oil prices fell as Middle East tensions eased with a cease-fire between Israel and Hezbollah. Weak demand, expectations of slower Fed rate cuts, and anticipation of the OPEC+ meeting added pressure, despite falling US crude inventories.

Gold prices slipped as safe-haven demand reduced following the Israel-Hezbollah cease-fire. However, ongoing geopolitical risks and rising US inflation expectations limited the decline, with markets bracing for a cautious Fed stance.

|

| |

|

|

Key Global Commodities

|

|

| |

| |

| |

|

| |

|

|

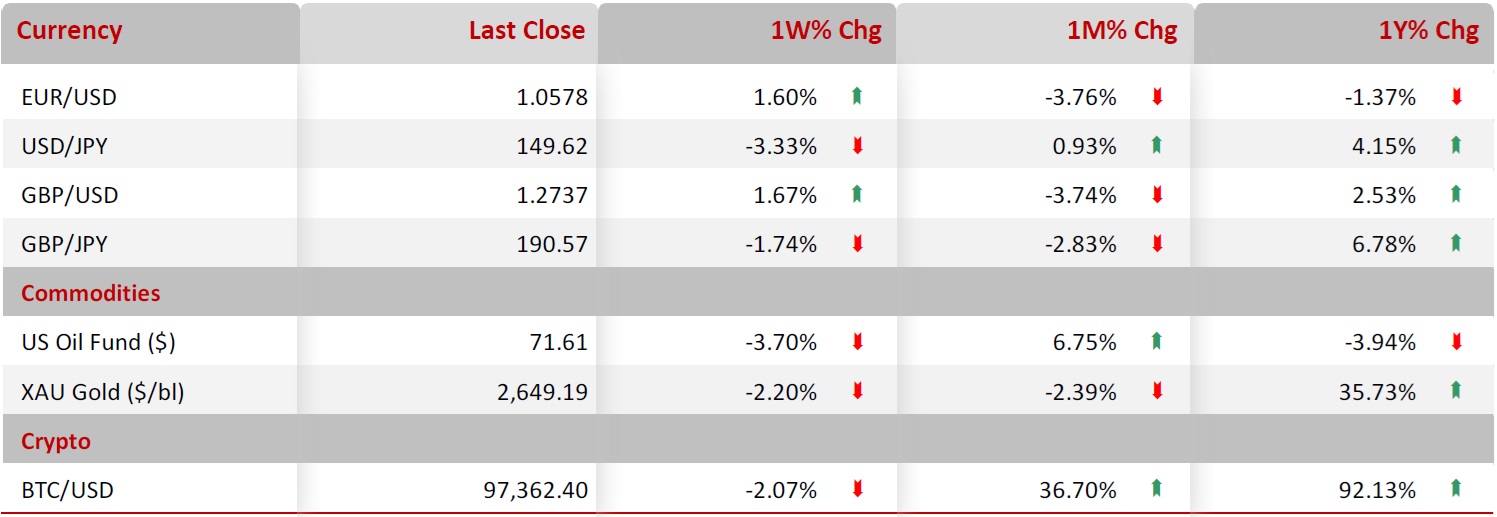

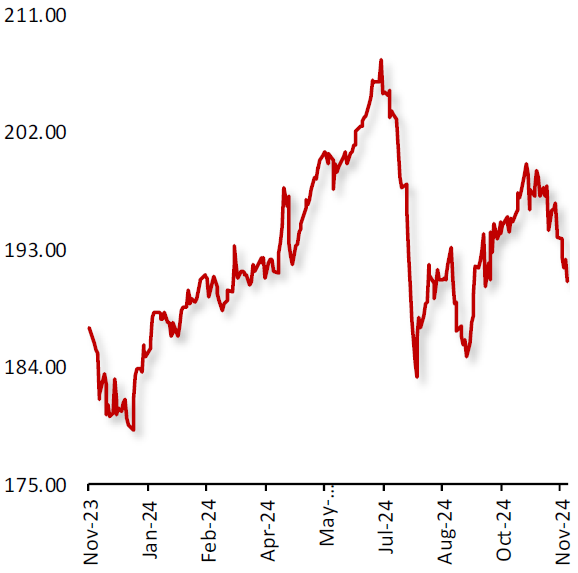

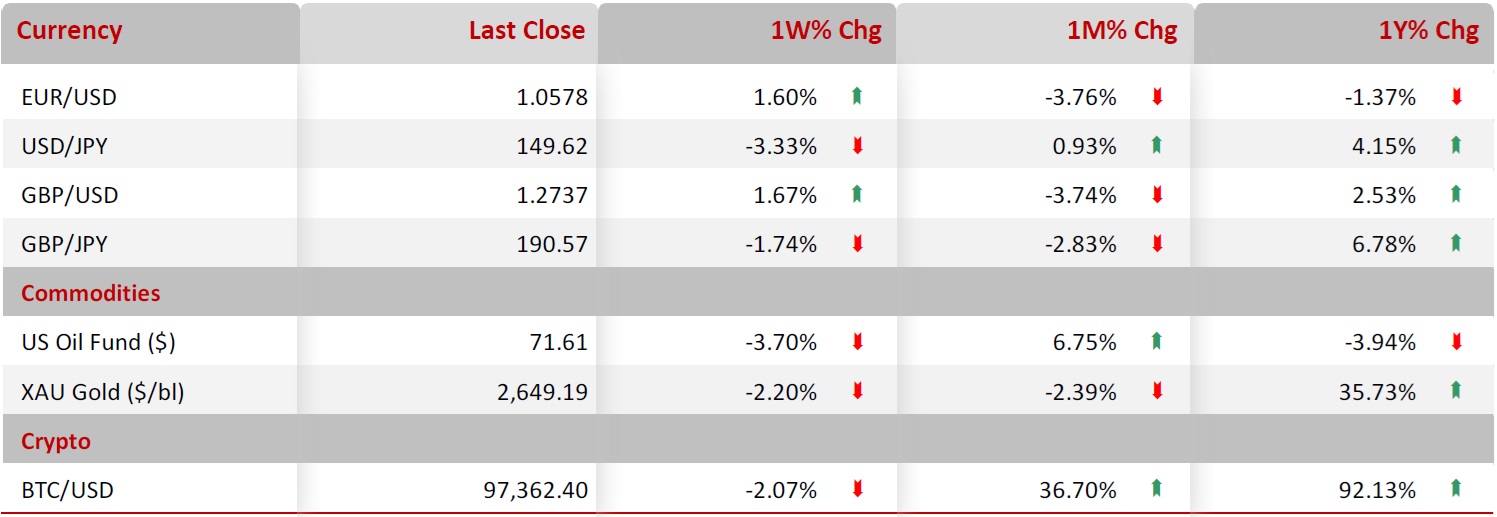

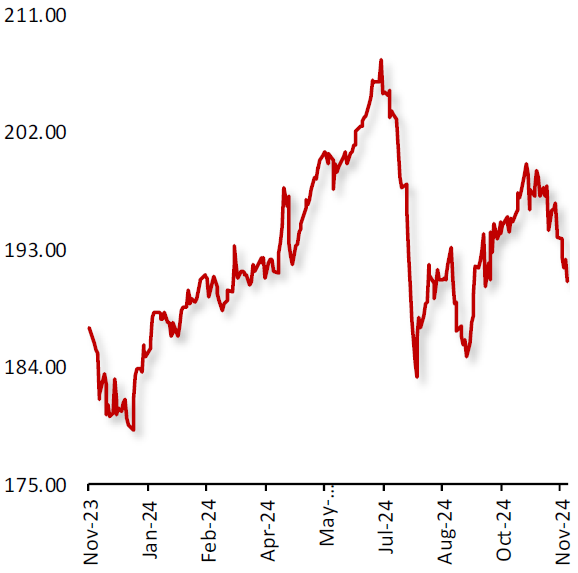

EUR/USD

|

|

|

EUR Strengthens Against Dollar Amid Improved Eurozone Sentiment

|

|

| |

|

|

The EUR advanced 1.60% against USD during the week, supported by improving sentiment in the eurozone, despite mixed economic data.

In the eurozone data presented a positive outlook. Although Germany’s GfK consumer sentiment and business confidence weakened, overall economic confidence in the eurozone improved, driven by rising optimism among industrial managers and retailers.

In contrast, in the US, economic indicators showed resilience, with the consumer confidence index rising. Additionally, the GDP growth held steady at 2.8% in 3Q24. Weekly jobless claims also fell unexpectedly to 213,000, emphasizing labour market strength. Additionally, consumer price growth met expectations, and the Federal Reserve signalled a cautious stance on rate cuts, lending further support to the dollar.

|

|

| |

| |

| |

|

|

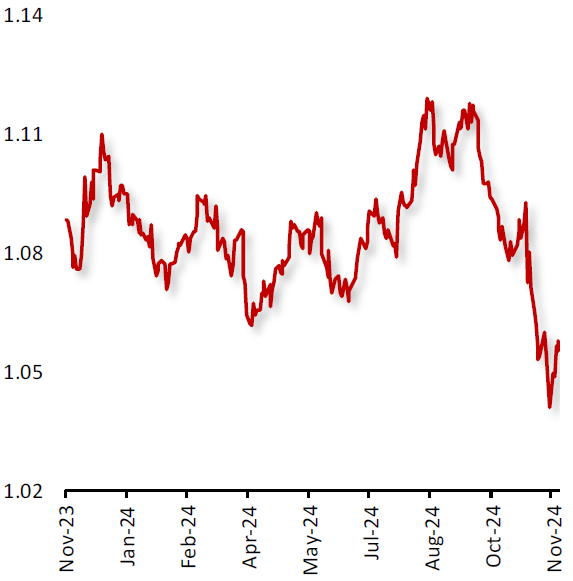

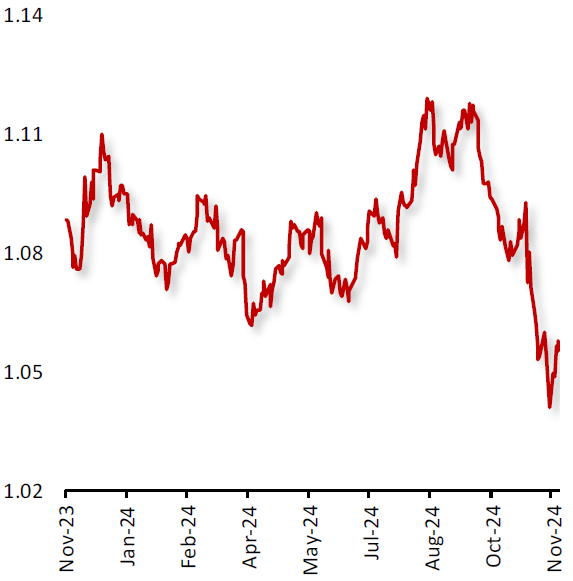

USD/JPY

|

|

|

US Dollar Weakens Amid Drop in the US Treasury Yields

|

|

| |

|

|

On Friday, US Dollar weakened 3.33% against JPY, amid drop in the US Treasury yields and as Japan’s stronger than expected inflation data reignited hopes for a Bank of Japan interest rate hike next month. Core consumer prices in Japan rose 2.2% in November from a year earlier and stayed above the central bank’s 2% target in a sign of broadening price pressure.

Additionally, US President-elect Donald Trump appointed hedge fund manager Scott Bessent as the next US Treasury secretary, fuelling hopes that he would be more fiscally disciplined.

Moreover, the latest Federal Open Market Committee's (FOMC), in its November meeting minutes, indicated that policymakers are adopting a cautious stance on cutting interest rates, citing easing inflation and a robust labour market. Also, investors await US jobs data for further cues on the Federal Reserve’s policy outlook.

|

|

| |

| |

| |

|

|

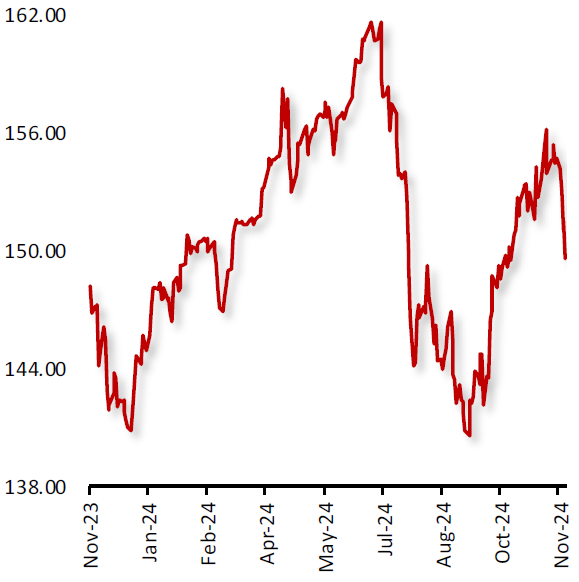

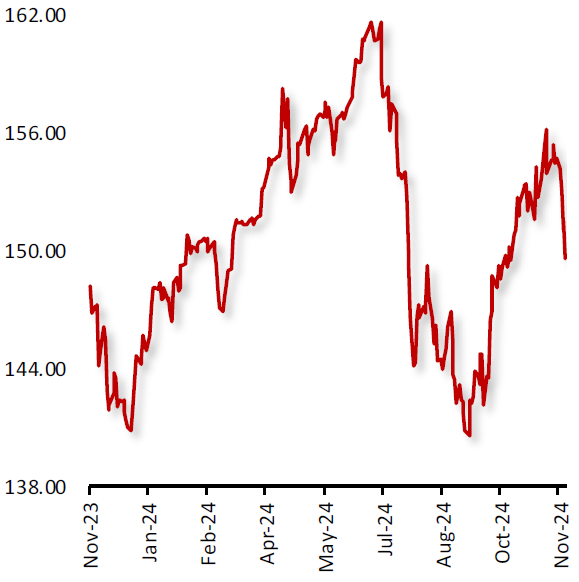

GBP/USD

|

|

|

Pound Rises Amid UK Optimism and Fed Signals for Rate Cuts

|

|

| |

|

|

The GBP/USD advanced by 1.67% this week, despite recent challenges.

In the UK, a slowdown in shop price deflation suggested easing inflationary pressures. This development offered cautious optimism about the UK economy, despite concerns over fragile retail demand. Bank of England (BoE) policymaker Swati Dhingra's remarks on uncertain inflation dynamics tempered rate hike expectations but failed to fully dampen GBP sentiment.

In the US, economic data showcased resilience, as GDP growth remained steady at 2.8% and weekly jobless claims declined to 213,000, highlighting robust economic strength. However, recent Federal Reserve minutes signalled expectations of gradual rate cuts, tempering the USD’s dominance. This shift, coupled with easing market pressure on the greenback, provided room for the GBP to regain some momentum.

|

|

| |

| |

| |

|

|

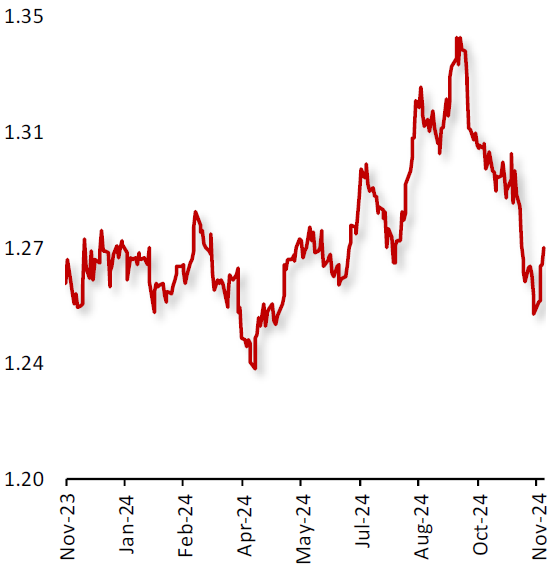

GBP/JPY

|

|

|

Yen strengthens as rising inflation and BoJ rate hike bets weigh on Pound

|

|

| |

|

|

The GBP/JPY fell 1.74% during the week, bolstered by rising speculation that the Bank of Japan (BoJ) may raise interest rates in December, following stronger-than-expected inflation data. Tokyo's November Consumer Price Index (CPI) surged 2.6% YoY, the highest in three months, fueling further rate hike bets. Additionally, solid industrial production and retail sales data supported the Yen, which also benefitted from ongoing geopolitical risks.

The British Pound faced downward pressure, primarily due to concerns over the UK's economic outlook and shifting expectations for the Bank of England's (BoE) monetary policy. Weak economic data, including a sharper-than-expected contraction in retail sales and a contraction in the November PMI, raised doubts about the pace of economic recovery. Although the BoE officials remain cautious about further tightening. This uncertainty, coupled with persistent inflationary pressures, weighed on investor sentiment towards the Pound.

|

|

| |

| |

| |

|

|

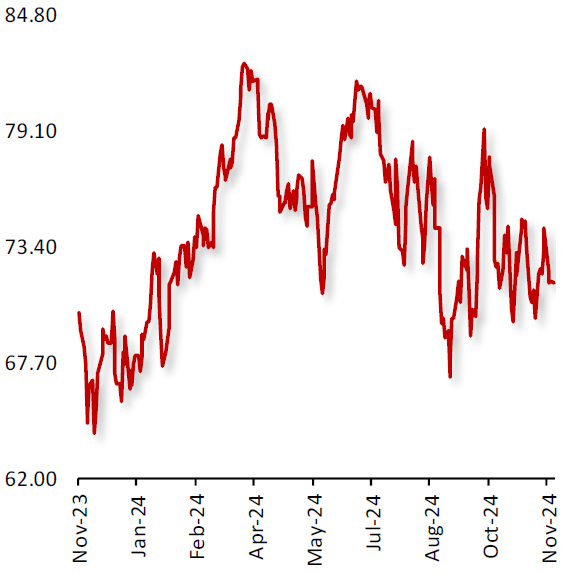

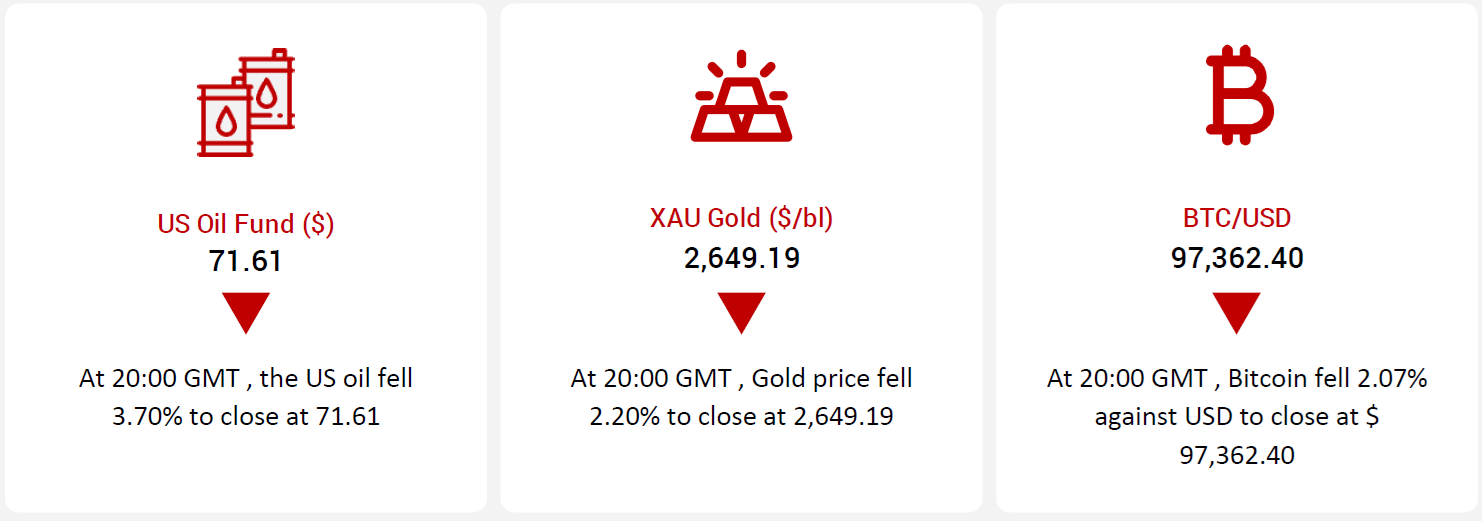

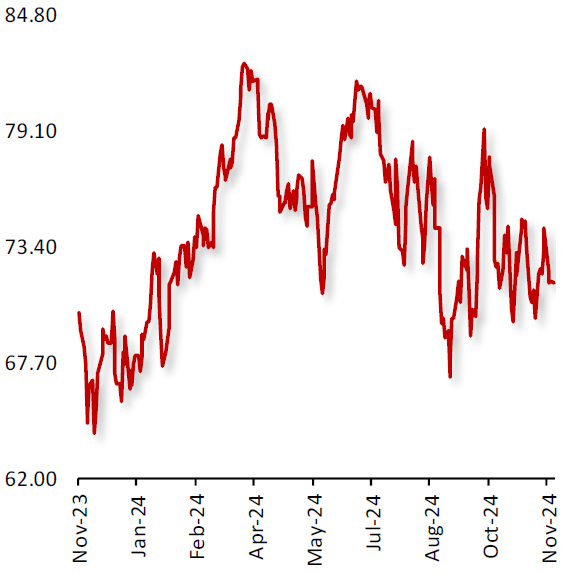

US Oil Fund ($)

|

|

|

Oil Prices Decline as Fears Over Wider Geopolitical Conflict Subsided

|

|

| |

|

|

Oil prices declined this week, as fears surrounding wider geopolitical conflict subsided after Israel and Lebanon-based Hezbollah reached a cease-fire agreement. Additionally, investors await the OPEC+ meeting on oil output policy. The OPEC+ is widely expected to once again delay restoring production when it next meets, to offset concerns about an anticipated glut next year.

Oil prices further declined by the US data showing progress on lowering inflation appears to have stalled in recent months, which could narrow the scope for the Federal Reserve to cut interest rates in 2025. Slower-than-expected rate cuts would keep the cost of borrowing elevated, which could slow economic activity and dampen demand for oil.

Meanwhile, the US crude inventories fell by 1.8 million barrels last week, according to the Energy Information Administration (EIA). While the US gasoline stocks rose by 3.3 million barrels in the week to 212.2 million barrels.

|

|

| |

| |

| |

|

|

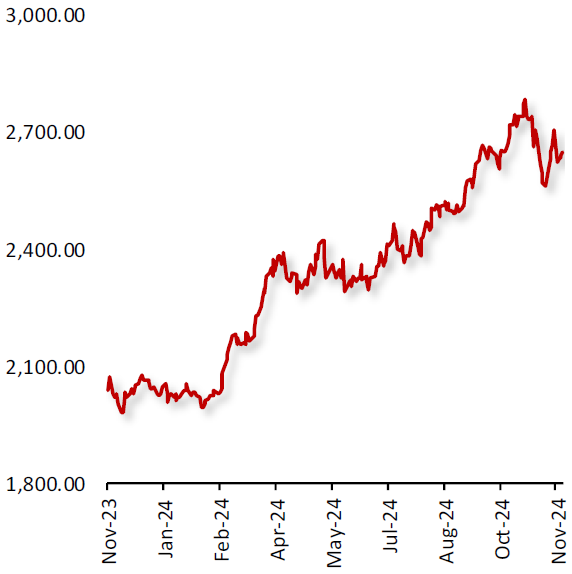

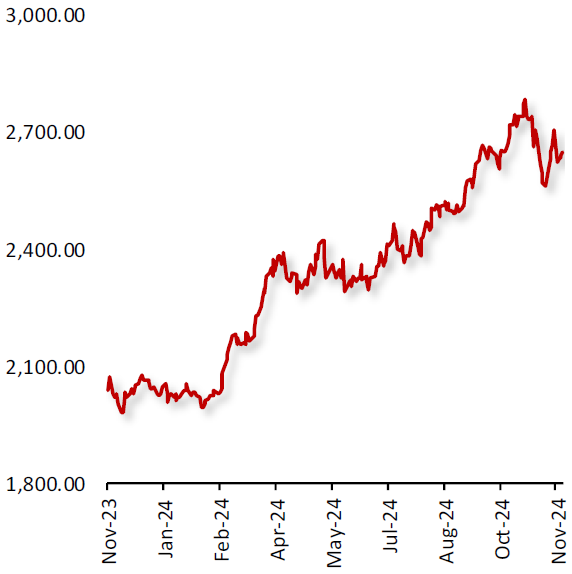

XAU Gold (XAU/USD)

|

|

|

Gold Prices Decline as Israel reaches a 60-day cease-fire agreement with Hezbollah

|

|

| |

|

|

Gold prices declined last week, after Israel reached a 60-day cease-fire agreement with the Lebanese militant group Hezbollah, easing concerns over geopolitical tensions and diminishing its appeal as a safe haven asset.

However, gains were limited, as geopolitical risks remain elevated with ongoing war in Russia-Ukraine and as potential ceasefire violation by Israeli. The Israeli military stated that its air force struck a facility, used by Hezbollah to store mid-range rockets in southern Lebanon. Additionally, Russia launched its second big attack on Ukraine's energy infrastructure this month.

Meanwhile, the latest US data showed a key inflation gauge picked up last month, reinforcing expectations that the Federal Reserve will adopt a measured approach to lowering interest rates. The Fed’s preferred measure of underlying inflation, the core personal consumption expenditures price index rose 2.8% from October and 0.3% from a month earlier.

|

|

| |

| |

| |

|

|

BTC/USD

|

|

|

Bitcoin declined After Paul Atkins Emerges as a Top Contender SEC Chair

|

|

| |

|

|

Bitcoin’s price declined last week, after Crypto supporter Paul Atkins has emerged as a top candidate to replace Gary Gensler as Securities and Exchange Commission (SEC) chair and hopes that his leadership may promote a more innovation-friendly stance on US crypto regulation, potentially encouraging sector growth.

Adding to the positive sentiment, prospect of more crypto-friendly policies under President-elect Donald Trump’s upcoming administration supported further advance. Also, Republican Senator Cynthia Lummis of Wyoming has put forward a bill called the BITCOIN Act that would call on the US to sell some of the Federal Reserve’s gold to acquire 1 million Bitcoin for a strategic stockpile.

Furthermore, China-born crypto entrepreneur Justin Sun has invested $30 million in President-elect Donald Trump’s World Liberty Financial, making him the largest investor in the decentralized finance project.

|

|

| |

| |

| |

| |

|

| |

|

|

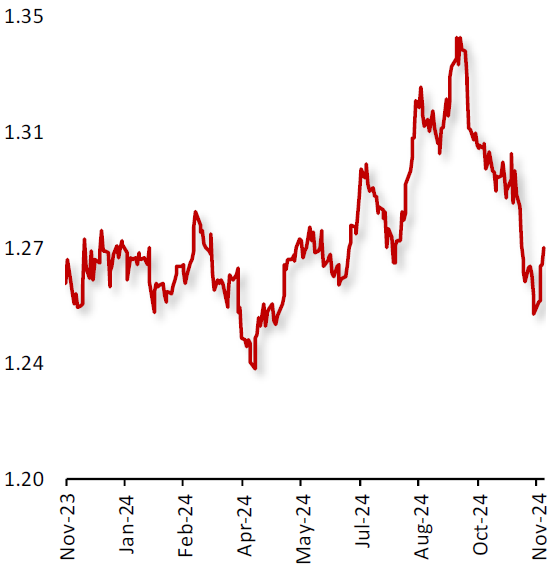

Key Global Currencies and Commodities

|

|

| |

| |

| |

|

Currency

|

| |

|

| |

|

Commodities & Crypto

|

| |

|

| |

|

| |

|