| |

| Market Update |

| |

|

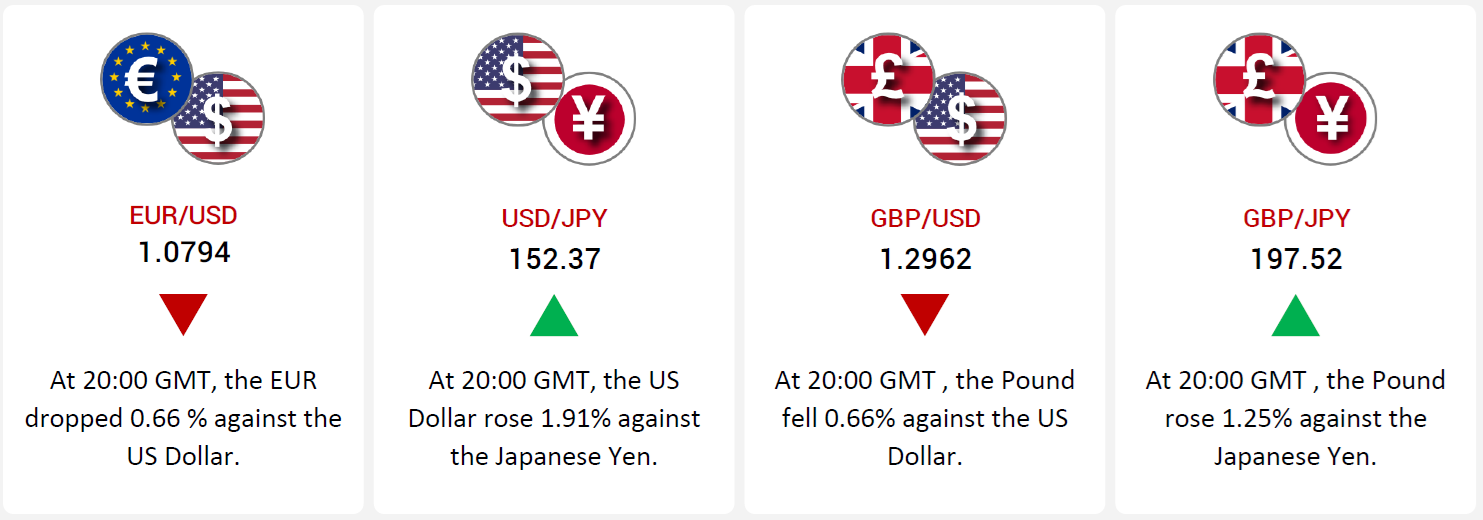

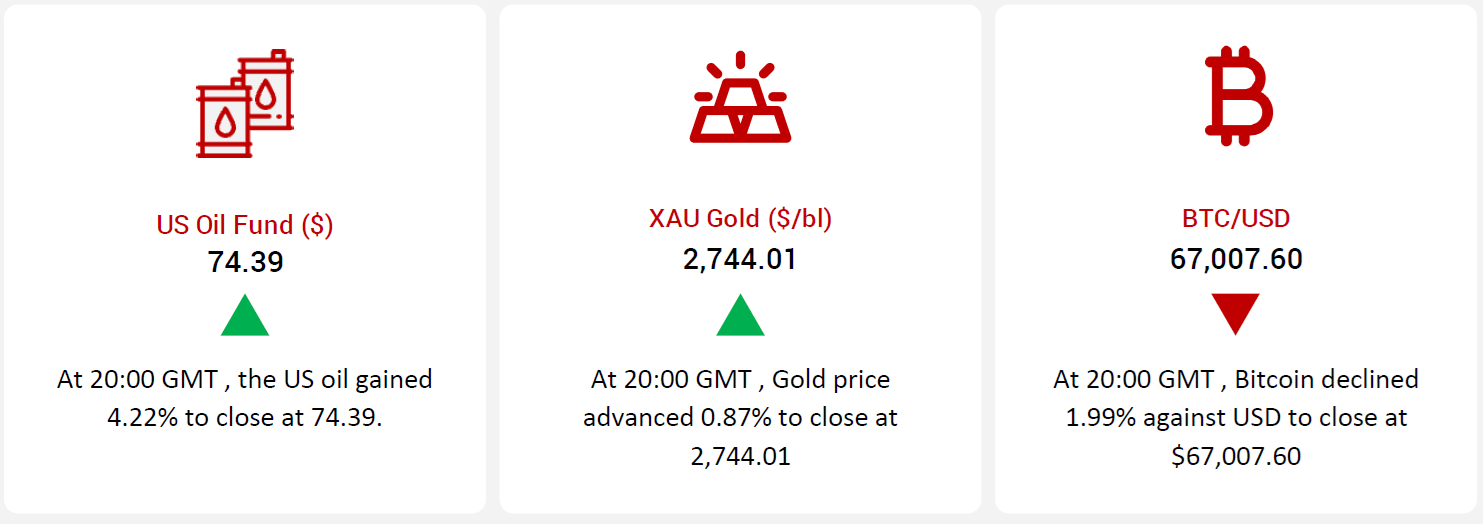

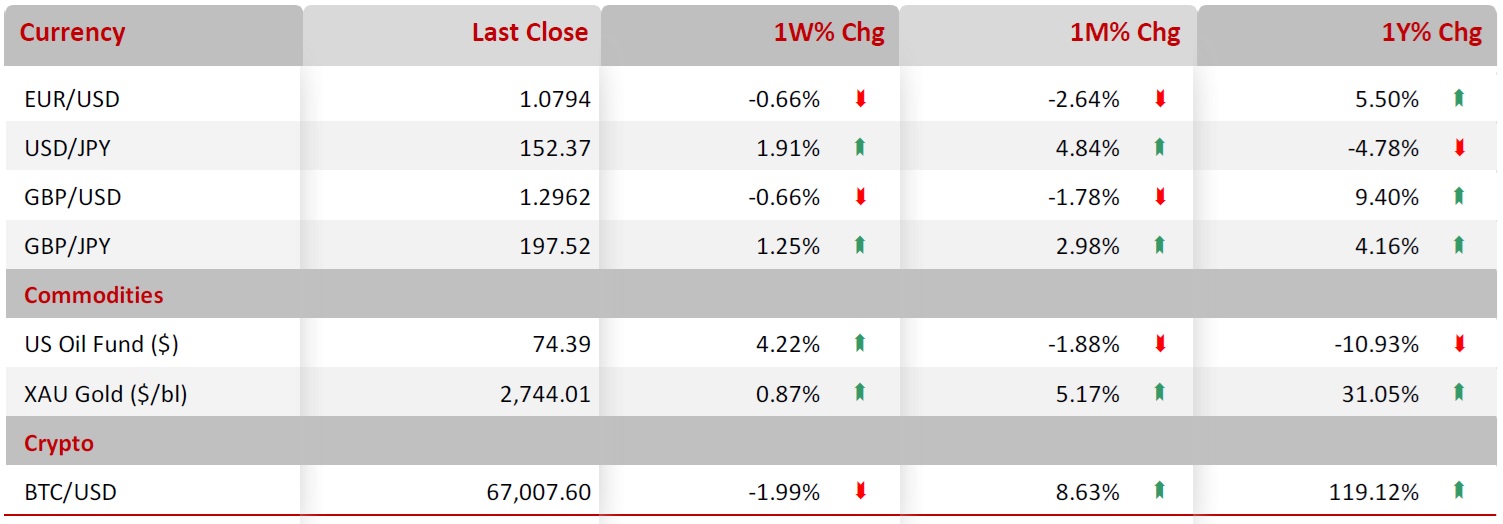

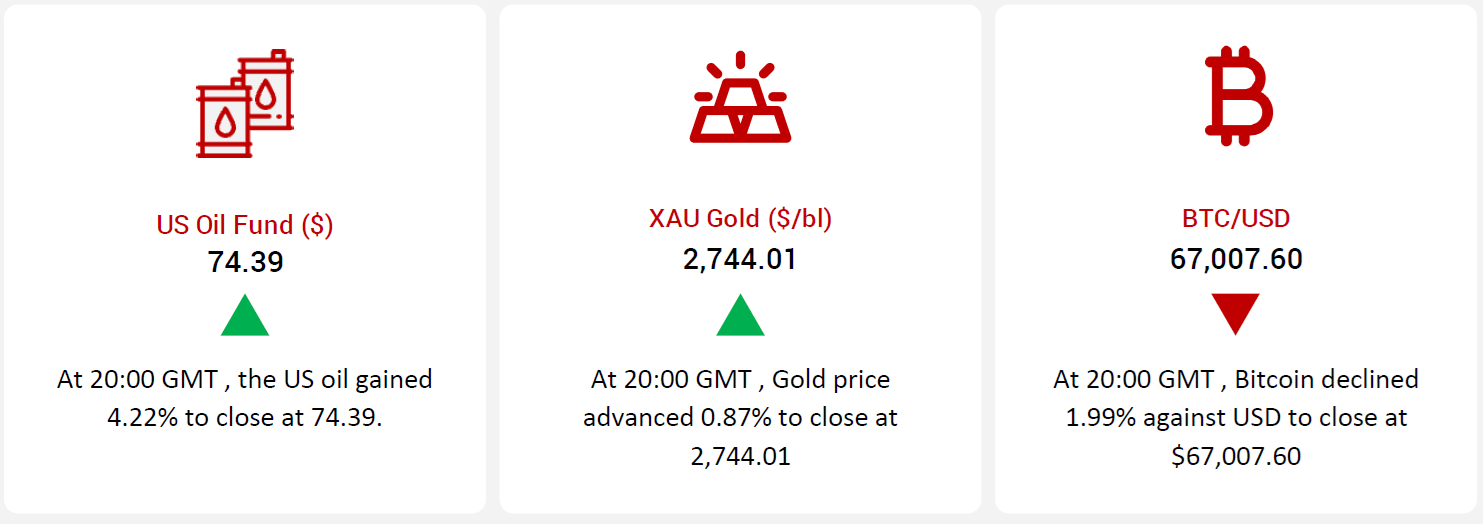

This week, global financial markets saw varied performances amid geopolitical concerns, economic indicators, and central bank policy speculations. Oil prices rose on the back of escalating Middle East tensions, raising fears of potential supply disruptions. Positive momentum also came from China’s recent benchmark rate cut aimed at boosting its economy, while ceasefire talks between the US and Israeli officials may influence regional stability.

Bitcoin experienced a significant drop as investor appetite for risk diminished due to uncertainties around the tight US Presidential election and elevated interest rates. The dollar’s strength, fueled by expectations of a slower Federal Reserve rate-cutting cycle, pressured crypto markets further. Meanwhile, calls from the SEC for clearer US crypto regulations highlighted contrasting regulatory advancements in Asia, adding to the uncertainty.

In safe-haven assets, gold prices advanced as demand surged on geopolitical and election-related concerns. Hopes for future Fed rate cuts provided additional support, as lower rates reduce the opportunity cost of holding non-yielding bullion. The US also pushed G7 nations to consider sanctions on Russian gold exports, adding potential impacts to the metal’s supply outlook.

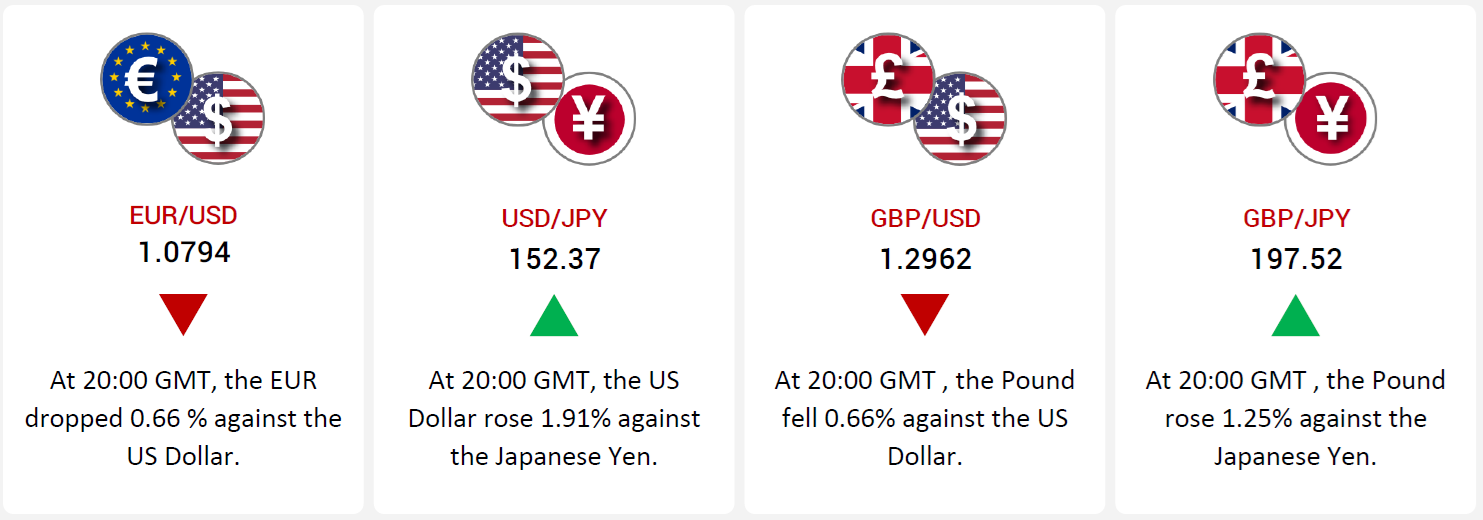

Currency markets also responded sharply to global cues. The Euro weakened 0.66% against the dollar as the ECB signaled possible rate cuts amid slowing growth in the Eurozone, while strong US economic data bolstered the dollar. Likewise, the Japanese Yen struggled, declining 1.91% against the dollar, with Japan’s manufacturing and services PMIs contracting and speculation rising over potential Bank of Japan interventions.

The British Pound fell 0.66% against the dollar as markets priced in possible BoE rate cuts and weaker UK economic indicators. However, the pound gained 1.25% against the yen, driven by Japan’s softening inflation and weaker industrial activity compared to the UK’s slightly resilient PMI readings.

Overall, financial markets reacted to a mix of geopolitical tensions, economic data, and varied central bank policy outlooks, leading to shifts across commodities, cryptocurrencies, and major currencies.

|

| |

|

|

Key Global Commodities

|

|

| |

| |

| |

|

| |

|

|

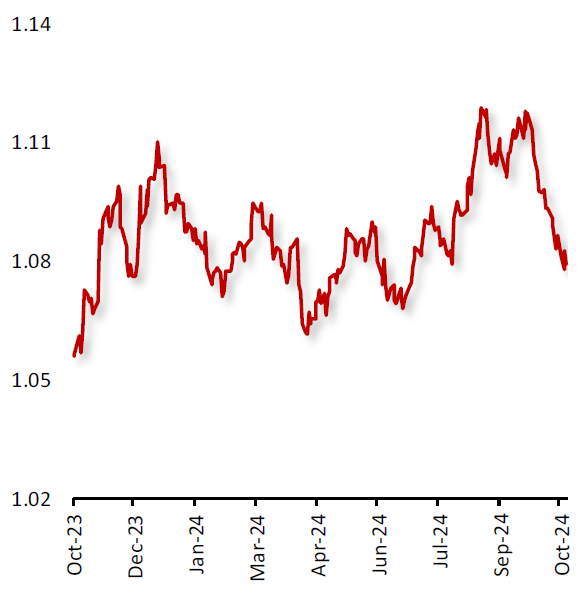

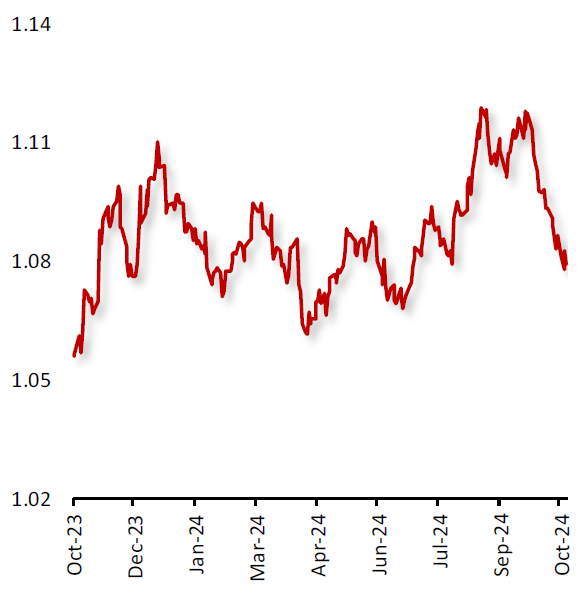

EUR/USD

|

|

|

Euro faces challenges as dollar strengthens

|

|

| |

|

|

The EUR declined 0.66% against USD during the week, as the European Central Bank (ECB) hinted at cutting interest rates again in December, with President Lagarde maintaining a cautious stance on inflation. Additionally, the Eurozone services sector unexpectedly dropped in October. As Germany is a major contributor to the Eurozone’s economy, the producer price index (PPI) dropped more than expected in September.

In contrast, the US dollar remains stronger, as positive economic data raised hopes for gradual rate cuts by the US Federal Reserve. The US new home sales rebounded by much more than expected in September. Additionally, the US initial jobless claims fell to 227,000 in the week ended 18 October 2024, while continuing claims rose to a nearly three-year high. The US dollar outlook remains upbeat as uncertainty increases ahead of the US Presidential election.

|

|

| |

| |

| |

|

|

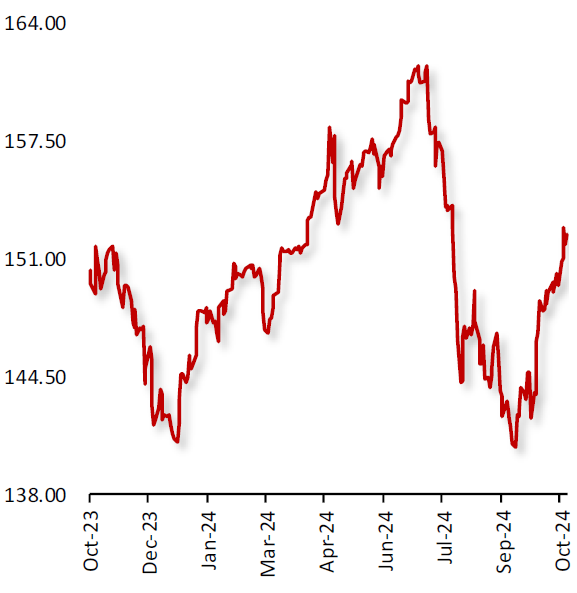

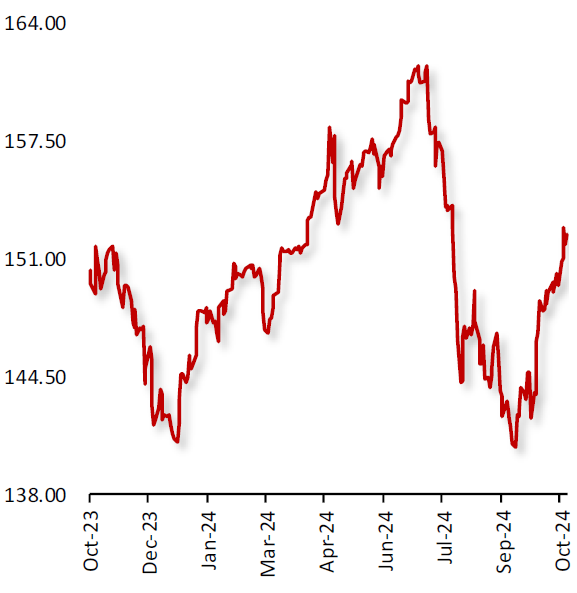

USD/JPY

|

|

|

USD Gains Against JPY Amid Fed Optimism

|

|

| |

|

|

The USD advanced 1.91% against the JPY this week, amid hopes for a less aggressive policy easing by the US Federal Reserve (Fed).

In the economic news, US manufacturing rose more than anticipated in October, while the services PMI advanced more than expected in the same month. Moreover, the US weekly jobless claims unexpectedly declined in the week ended 18 October 2024, while the Richmond Fed manufacturing index improved in October.

The Japanese Yen (JPY) continues with its relative underperformance, amid the uncertainty over the timing and pace of further rate hikes by the Bank of Japan (BoJ). Additionally, both manufacturing and services PMIs contracted in October, due to a muted economy and subdued new order inflows. Meanwhile, the recent remarks from Japanese authorities fueled speculations about a possible government intervention to prop up the domestic currency and limit the JPY losses.

|

|

| |

| |

| |

|

|

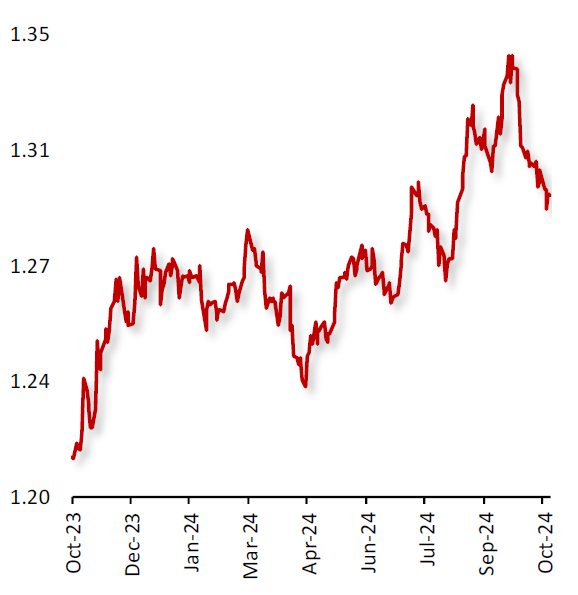

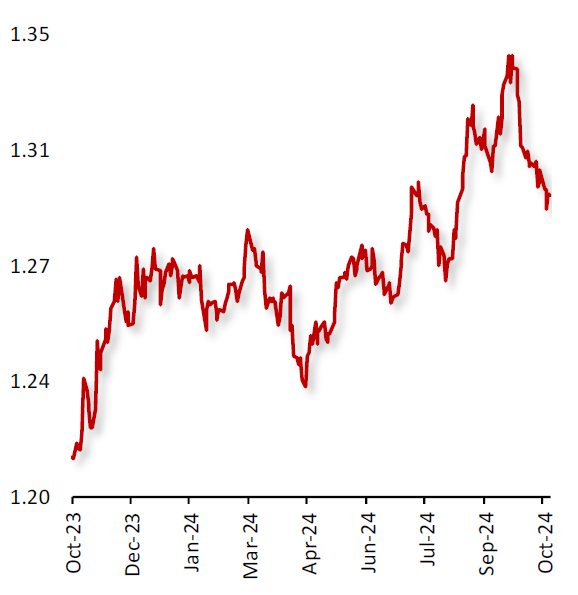

GBP/USD

|

|

|

GBP/USD Declines Amid BoE Rate Cut Speculation, Weak UK Data

|

|

| |

|

|

The GBP/USD fell 0.66% this week, amid hopes that the Bank of England (BoE) may resume interest rate cuts next month. In the UK, manufacturing PMI dropped to a 6-month low in October, led by a sharp contraction in goods orders from abroad, while the services sector fell to an 11-month low in October. Also, Britain’s consumer confidence fell to the lowest level since March, as concerns about possible tax hikes.

On the other hand, the US dollar remains strengthened, on expectations that the policy-easing cycle from the Federal Reserve (Fed) will be more gradual than previously expected. Also, the US Richmond Fed manufacturing index improved more than expected in October, while the new home sales in the US rebounded by much more than expected in September. Adding to the positive sentiment, the IMF has raised gross domestic product (GDP) projections for 2025 to 2.2% from prior expectations of 1.9%.

|

|

| |

| |

| |

|

|

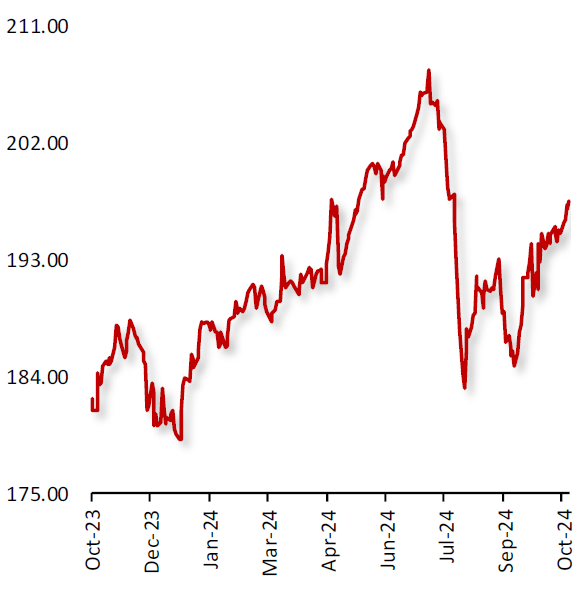

GBP/JPY

|

|

|

Yen struggles against pound

|

|

| |

|

|

The GBP/JPY advanced 1.25% this week, amid economic uncertainty in Japan.

In Japan, Tokyo consumer inflation softened to 1.8% in October from 2.1% in September, easing price pressures. Japan’s political landscape is in flux, with the ruling Liberal Democratic Party (LDP) at risk of losing its majority in the upcoming general election, which could lead to potential shifts in fiscal policy. Industrial activity showed signs of contraction as the Jibun Bank manufacturing PMI dropped to 49.00 in October, down from 49.70 in September, and the services PMI fell sharply to 49.30 from 53.10,

In the UK, the GfK consumer confidence index weakened to -21 in October, reflecting household concerns, though improved personal finances and easing inflation offered relief. Manufacturing PMI edged down to 50.30 from 51.50, while services PMI slightly decreased to 51.8 from 52.4, signaling a stable expansion.

|

|

| |

| |

| |

|

|

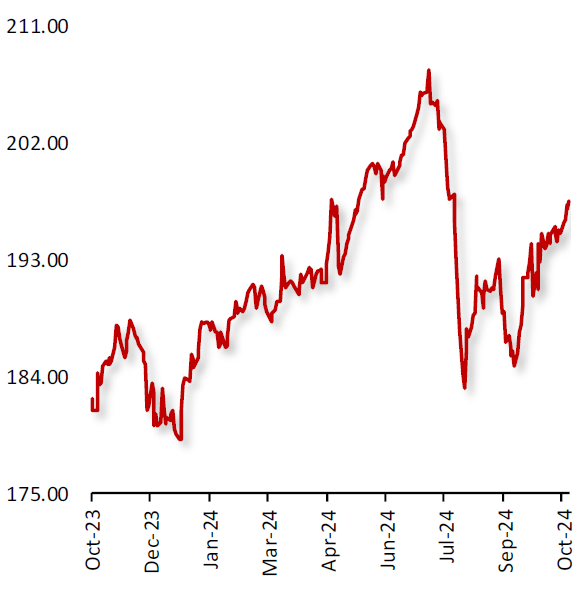

US Oil Fund ($)

|

|

|

Oil Prices Rise Amid Worries Surrounding Geopolitical Tensions in the Middle East

|

|

| |

|

|

Oil prices advanced last week, as intensifying geopolitical tensions in the world’s top oil-producing region, the Middle East, fuelled worries over supply disruptions. Also, uncertainty surrounding the US Presidential election outcome weighed on investor sentiment.

Adding to the positive sentiment, China, the world’s top oil importer, lowered its benchmark lending rates last week, as a part of a series of stimulus measures to revive the country’s economy.

Meanwhile, the US and Israeli officials are set to restart talks for a ceasefire and the release of hostages in Gaza in the coming days. US Secretary of State Antony Blinken stated that there is 'sense of urgency' in getting to a diplomatic resolution to end the conflict in Lebanon between Israel and Iran-aligned Hezbollah, while calling for the protection of civilians.

|

|

| |

| |

| |

|

|

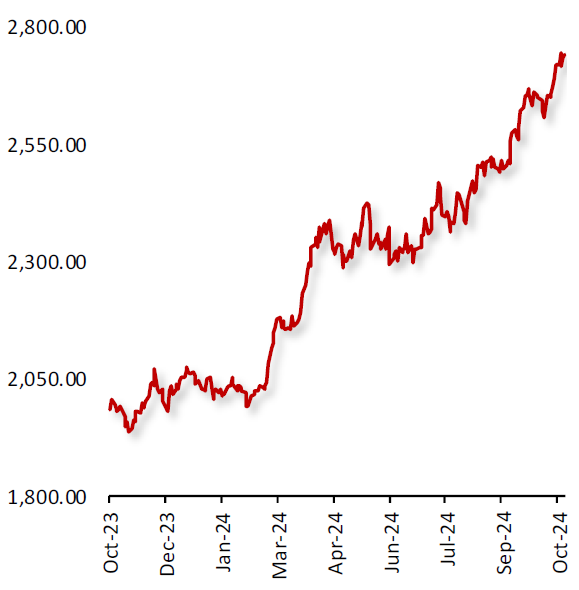

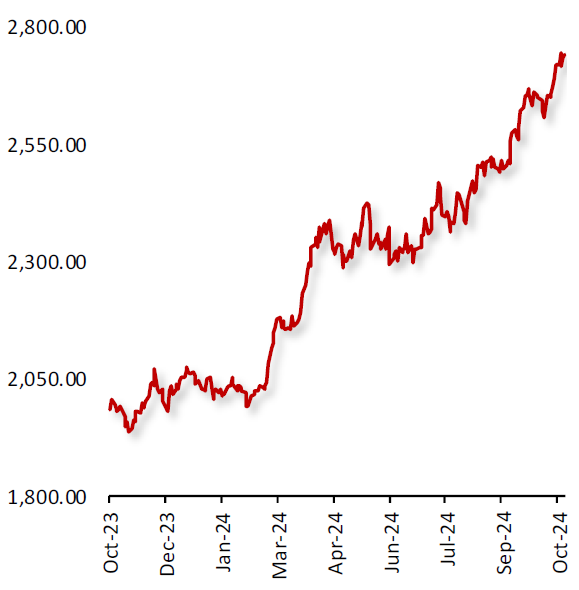

XAU Gold (XAU/USD)

|

|

|

Gold Prices Rise as Investors Seek Safe Haven

|

|

| |

|

|

Gold prices advanced last week, as uncertainty surrounding the US Presidential elections and persistent worries over geopolitical tensions in the Middle East boosted demand for the safe haven metal. Expectations of further interest rate cuts by the Federal Reserve supported the bullion.

Adding to the positive sentiment, the US economic activity remained steady from September to early October, with a slight rise in hiring, hinting at a likely 25 basis-point Federal Reserve rate cut soon. Lower rates reduce the opportunity cost of holding non-yielding bullion. Next week, investors await the US inflation data and a series of economic data for further cues on the health of the economy.

Elsewhere, the United States asked the Group of Seven allies to consider sanctions on Russian exports of the precious metal.

|

|

| |

| |

| |

|

|

BTC/USD

|

|

|

Bitcoin Drops as Risk Appetite Diminished Among Investors

|

|

| |

|

|

Bitcoin’s price plunged last week, as appetite for risk-driven assets diminished among investors amid uncertainty over a tight US Presidential election and high interest rates and boosted demand for the safe haven assets.

Speculation over a Trump Presidency also boosted the Dollar, pressuring crypto markets as investors bet on more inflationary policies in the coming years. The US Dollar was also supported by rising expectations that the Federal Reserve will cut interest rates at a slower pace in the coming months.

Meanwhile, US Securities and Exchange Commission (SEC) commissioner has urged the US to adopt a more proactive approach to crypto regulation, pointing to the leadership of Indo-Pacific nations like Japan, Singapore, and Hong Kong have crafted clear frameworks that foster innovation while protecting investors, in contrast to the US, where unclear guidelines leave market participants struggling with uncertainty.

|

|

| |

| |

| |

|

| |

|

|

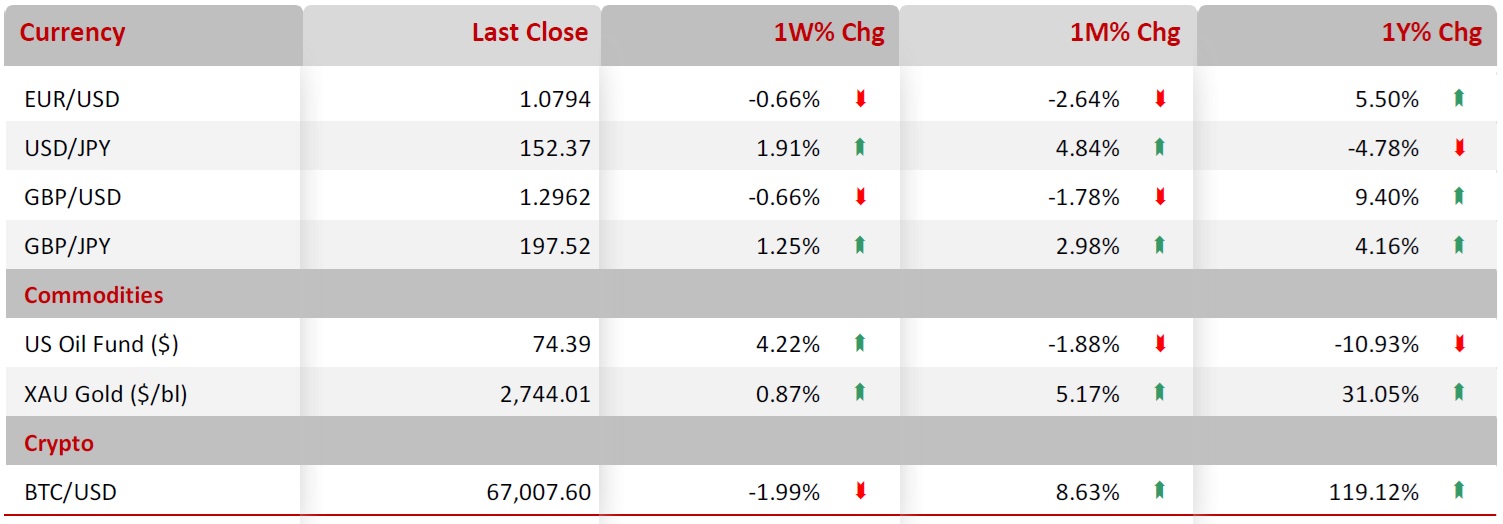

Key Global Currencies and Commodities

|

|

| |

| |

| |

|

Currency

|

| |

|

| |

|

Commodities & Crypto

|

| |

|

| |

|

| |

|