| |

|

Market Update |

|

|

|

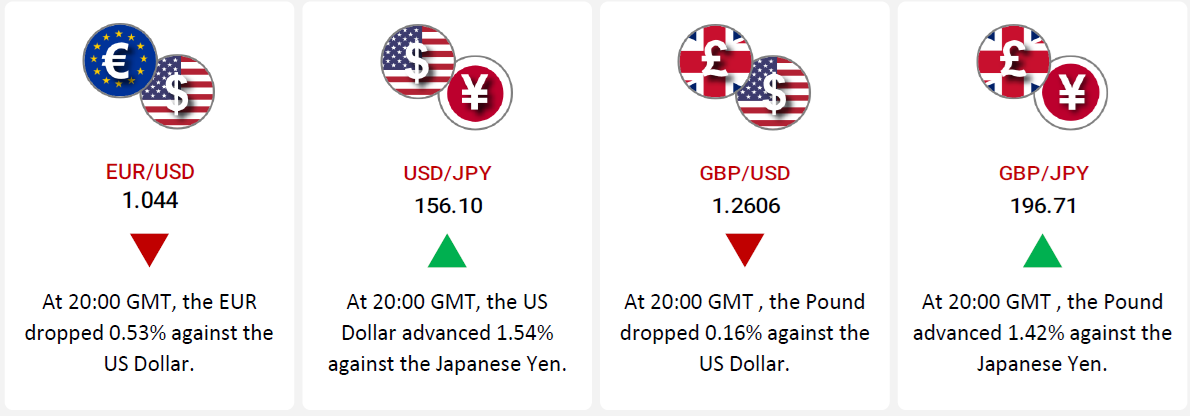

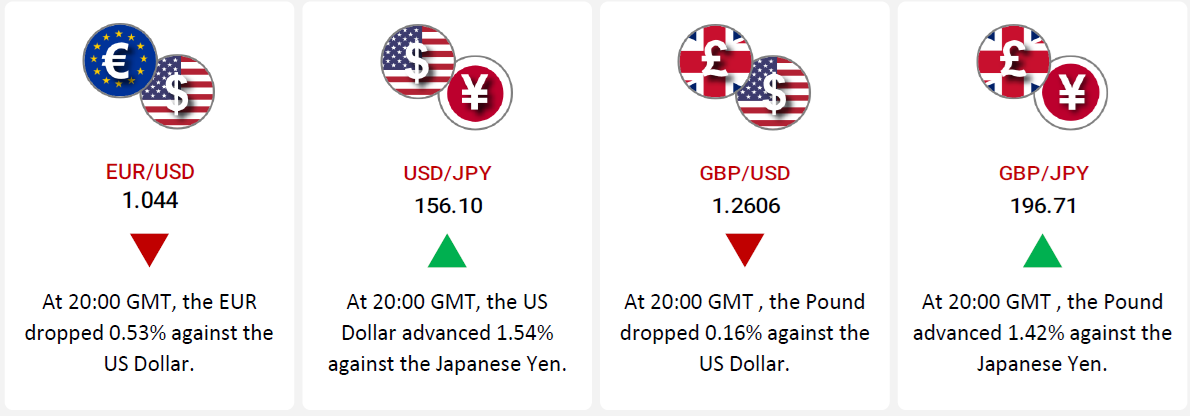

The USD strengthened significantly, rising 1.54% against the JPY,

buoyed by robust US labor data. The US added 232,000 jobs,

reinforcing expectations for prolonged Federal Reserve tightening.

Meanwhile, Japan's economy showed signs of contraction, with

manufacturing PMI falling to 48.5 and weaker retail sales. The Bank

of Japan’s ultra-loose monetary policy further pressured the yen.

The EUR declined 0.53% against the USD, impacted by mixed Eurozone

data, including a drop in German manufacturing PMI and persistent

inflation concerns. The European Central Bank’s cautious tone on

rate hikes added to uncertainty.

The GBP experienced mixed performance, rising 1.42% against the JPY

but falling 0.16% against the USD. UK manufacturing PMI dropped to

47.8, indicating contraction, while the services sector showed

modest growth. Weak retail sales and a cautious Bank of England

stance weighed on the pound, especially against a strong USD

supported by robust US job data.

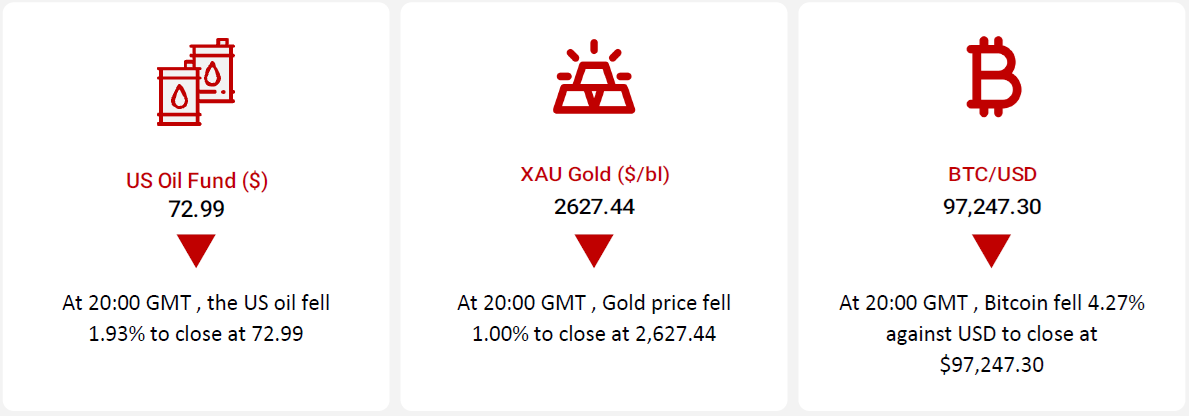

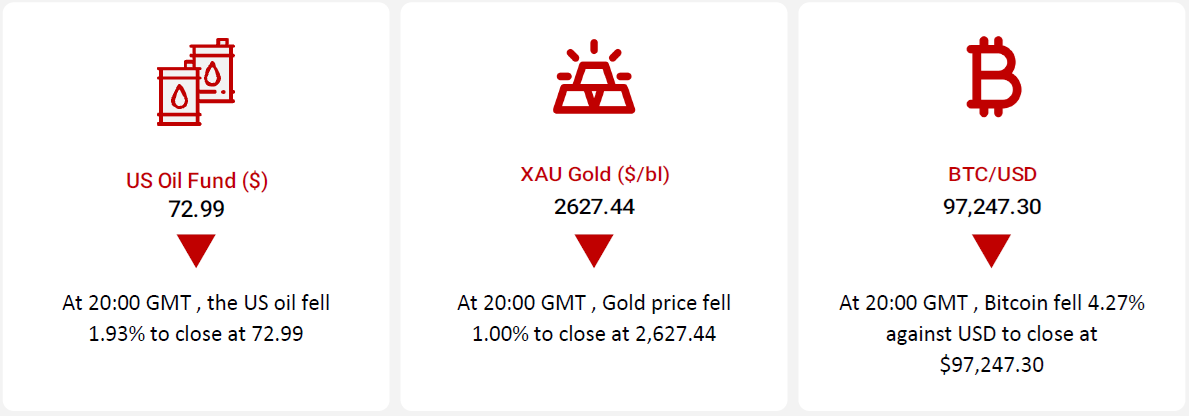

Oil prices declined, driven by concerns over slowing demand growth,

particularly in China, and the strengthening USD. Central banks’

limited policy easing further dampened market sentiment, raising

fears of weaker economic activity in 2025. Gold prices also fell as

rising Treasury yields and a strong USD reduced its appeal. The

Federal Reserve’s projection of fewer rate cuts amid persistent

inflationary pressures further impacted gold markets.

Bitcoin faced downward pressure following hawkish Fed policy

announcements and remarks from Federal Reserve Chair Jerome Powell

rejecting the idea of holding Bitcoin reserves. Despite short-term

volatility, optimism emerged as MicroStrategy Inc. increased its

Bitcoin holdings and discussions of "buying the dip" surged.

Long-term investor confidence remains resilient despite current

market challenges.

|

|

|

|

|

Key Global Commodities

|

|

|

|

|

|

|

|

|

|

|

|

|

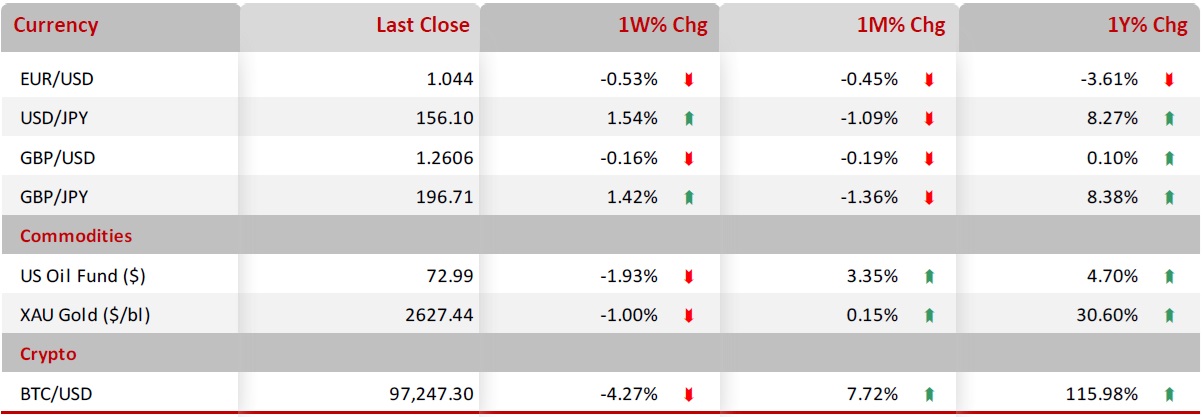

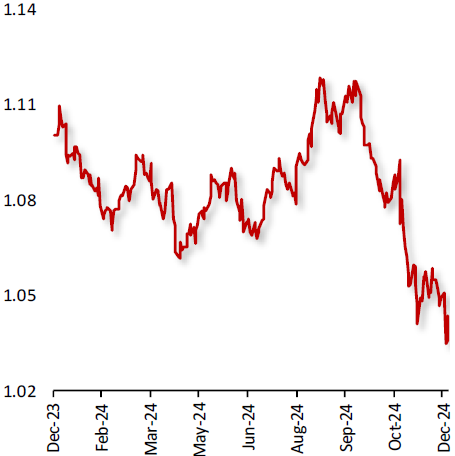

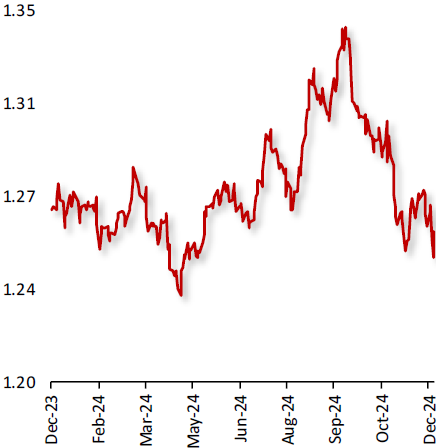

EUR/USD

|

|

|

EUR weakens amid US Jobs Data and ECB Outlook

|

|

|

|

|

|

The EUR fell 0.53% against the USD during the week,

driven by mixed Eurozone data and strong US jobs

reports.

In the Eurozone, the German manufacturing PMI

unexpectedly dropped in December, signaling

continued contraction in the manufacturing sector,

though the services sector showed signs of

improvement. Germany’s Ifo business climate index

also fell, while the ZEW Economic Sentiment Index

rebounded. Eurozone inflation rose for the second

consecutive month, raising concerns about the need

for tighter policies. The ECB indicated that rates

may remain elevated for an extended period due to

persistent inflation risks, adding to market

uncertainty. German consumer confidence showed a

slight recovery in December, but broader economic

concerns remained.

In the US, the manufacturing PMI dropped in

December, but the services sector saw growth.

|

|

|

|

|

|

|

|

|

|

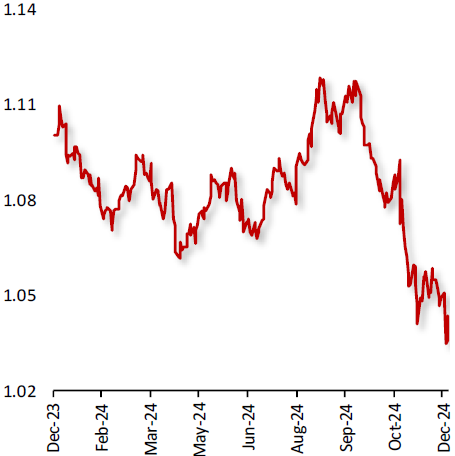

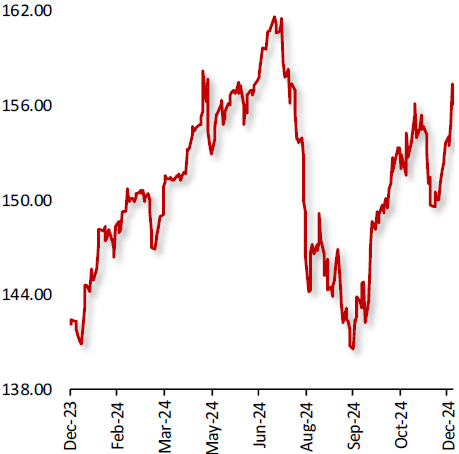

USD/JPY

|

|

|

Dollar strengthens amid robust US Jobs Data and Japan's

Economic Slowdown

|

|

|

|

|

|

The USD rose 1.54% against the JPY during the week,

driven by stronger-than-expected US jobs data and

ongoing concerns over Japan’s economic performance.

In Japan, economic data pointed to a slowdown. The

Japanese manufacturing PMI dropped to 48.5 in

December, indicating contraction in the sector,

while the services sector showed only modest growth.

Japan's industrial production fell 0.3% in November

and retail sales were weaker than expected, raising

concerns about the pace of economic recovery. The

Bank of Japan’s continued ultra-loose monetary

policy and its commitment to maintaining low

interest rates also weighed on the yen.

Meanwhile, in the US, strong labor market reinforced

expectations that the Federal Reserve will keep

interest rates higher for a prolonged period, which

supported the USD.

|

|

|

|

|

|

|

|

|

|

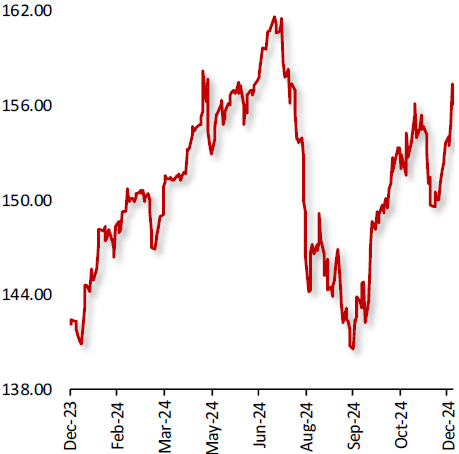

GBP/USD

|

|

|

Pound weakens amid mixed UK Data and strong US Jobs

reports

|

|

|

|

|

|

The GBP closed 0.16% lower against the USD during

the week, as a combination of mixed UK economic data

and strong US labor market reports weighed on the

currency.

In the UK, economic indicators presented a mixed

outlook. The UK manufacturing PMI unexpectedly

dropped to 48.1 in December, signaling a contraction

in the sector, while the services sector showed

resilience with a slight improvement. UK retail

sales came in weaker than expected in November,

reflecting ongoing challenges in consumer spending.

The Bank of England's recent dovish signals,

suggesting a cautious approach to further

tightening, added to pressure on the pound.

Meanwhile, in the US, the economy added 232,000 jobs

in the week ending 14 December 2024, exceeding

market expectations.

|

|

|

|

|

|

|

|

|

|

GBP/JPY

|

|

|

Pound Strengthens Against JPY Amid Mixed Economic

Signals

|

|

|

|

|

|

The GBP rose 1.42% against the JPY during the week,

as mixed UK economic data combined with a strong US

labor market report weighed on the pound.

In the UK, manufacturing PMI dropped to 47.8 in

December, indicating ongoing contraction in the

sector, while the services sector showed modest

growth. UK retail sales underperformed expectations

in November, highlighting persistent weakness in

consumer spending. The Bank of England’s cautious

stance on rate hikes raised concerns over slower

growth and ongoing inflation pressures in the UK.

Meanwhile, the Japanese manufacturing PMI fell to

48.5 in December, signaling continued contraction.

Japan’s industrial production dropped 0.3% in

November and retail sales were weaker than expected.

Despite these challenges, the Bank of Japan

maintained its ultra-loose monetary policy.

|

|

|

|

|

|

|

|

|

|

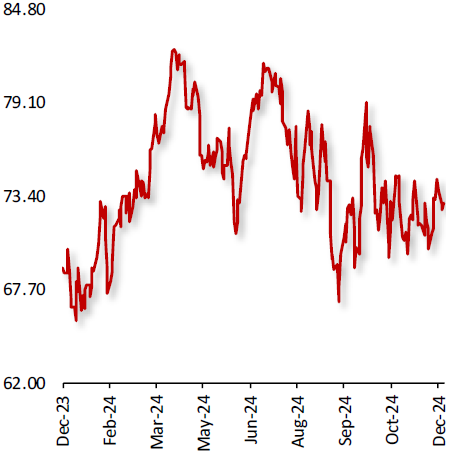

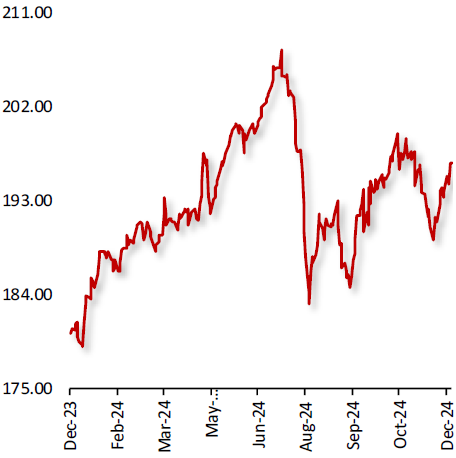

US Oil Fund ($/bl)

|

|

|

Oil Prices Decline Amid Demand Growth Concerns and

Strong Dollar

|

|

|

|

|

|

Oil prices fell last week pressured by concerns over

slowing demand growth in 2025, particularly in

China, the world's largest crude importer. The

strengthening US dollar added to the downward

pressure, as a robust dollar makes oil more

expensive for holders of other currencies,

potentially dampening demand.

Market sentiment was further weighed down by

cautious signals from central bankers in the US and

Europe. Both indicated limited room for additional

monetary policy easing, raising fears that weaker

economic activity could negatively impact oil demand

in the coming year. Although the US Federal Reserve

implemented a quarter-percentage-point rate cut as

expected, Federal Reserve Chair Jerome Powell

emphasized that persistent inflation challenges

might necessitate a more cautious approach to

further rate reductions in 2024.

Adding to the geopolitical tensions, US

President-elect Donald Trump issued a stark warning

to the European Union.

|

|

|

|

|

|

|

|

|

|

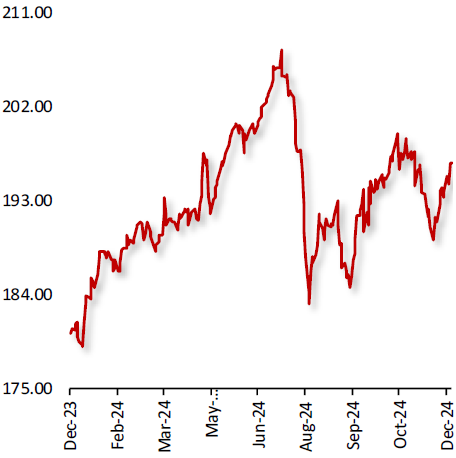

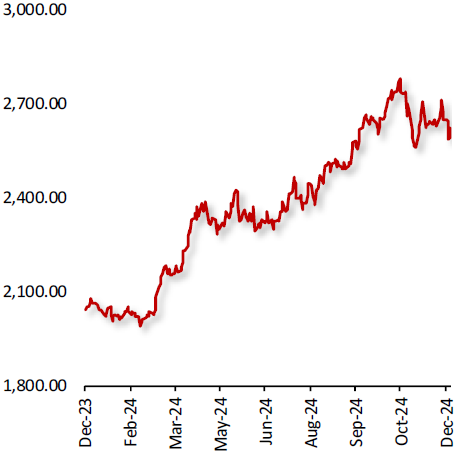

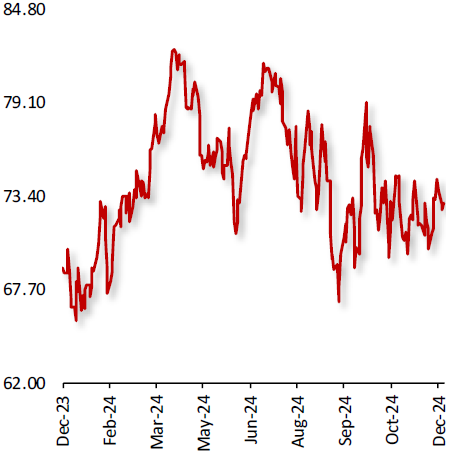

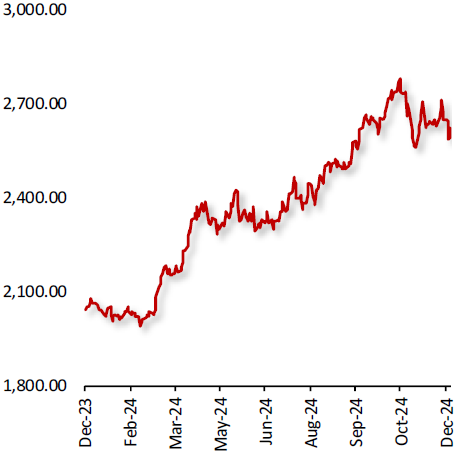

XAU Gold ($/oz)

|

|

|

Gold Prices Decline as Fed Maintains Cautious Outlook

Amid Inflation Concerns

|

|

|

|

|

|

Gold prices dropped last week, as the U.S. dollar

strengthened and Treasury yields rose, driven by the

U.S. Federal Reserve’s (Fed) projection of fewer

than expected interest rate cuts for the upcoming

year amid ongoing inflationary pressures.

Adding to the negative sentiment, robust U.S. gross

domestic product (GDP) and retail sales data further

boosted the dollar, putting additional pressure on

gold prices. The Fed revised its rate cut forecast

to two from four in its prior projections, signaling

a more cautious approach as inflation remains

elevated in the U.S. through 2025.

Additionally, the Fed’s stance on maintaining

tighter monetary policy reduced gold’s appeal. As

the Fed shifts to a more gradual easing cycle,

uncertainty surrounding inflation and economic

growth continues to impact gold markets,

contributing to recent declines.

|

|

|

|

|

|

|

|

|

|

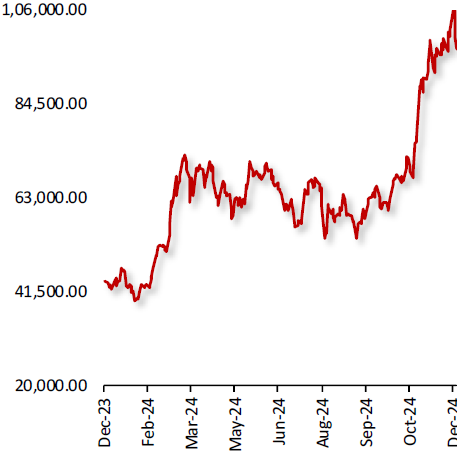

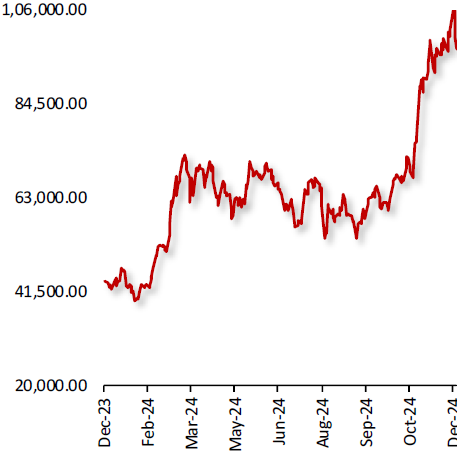

BTC/USD

|

|

|

Bitcoin Faces Market Pressures Amid Hawkish Fed Policies

|

|

|

|

|

|

Bitcoin's price declined last week, weighed down by

hawkish US Federal Reserve policy announcements and

remarks. The US Fed’s 25-basis-point rate cut,

alongside projections for only two quarter-point

reductions in 2025, fell short of market

expectations, dampening investor sentiment. Federal

Reserve Chair Jerome Powell’s rejection of the idea

of the Fed holding Bitcoin reserves added further

pressure on the cryptocurrency market.

Amid the downturn, optimism emerged as

President-elect Donald Trump endorsed a national

Bitcoin reserve, and MicroStrategy Inc. prepared for

its inclusion in the Nasdaq 100. MicroStrategy’s

recent $1.5 billion Bitcoin purchase has bolstered

investor confidence. Additionally, social media

discussions about "buying the dip" surged to an

eight-month high, reflecting continued interest in

Bitcoin despite short-term volatility. The

combination of market challenges and long-term

optimism leaves Bitcoin at a pivotal point.

|

|

|

|

|

|

|

|

|

|

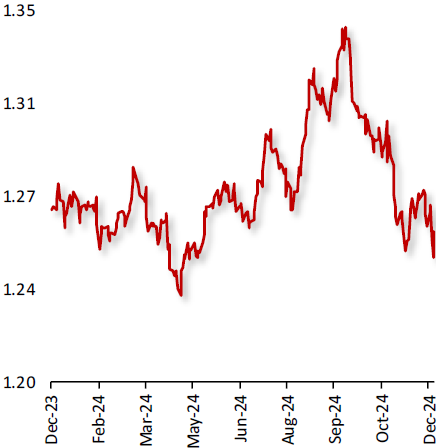

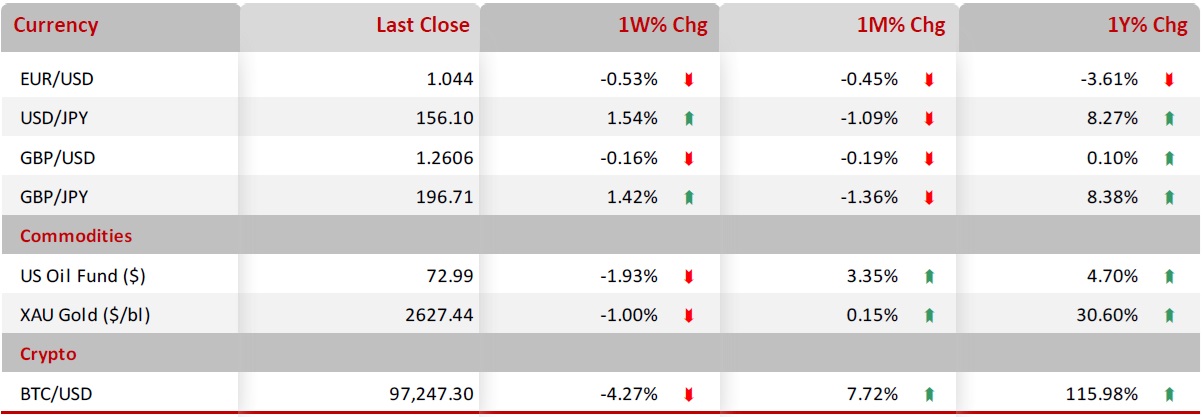

Key Global Currencies and Commodities

|

|

|

|

|

|

|

|

|

Currency

|

|

|

|

|

|

|

Commodities & Crypto

|

|

|

|

|

|

|

| |

|

|