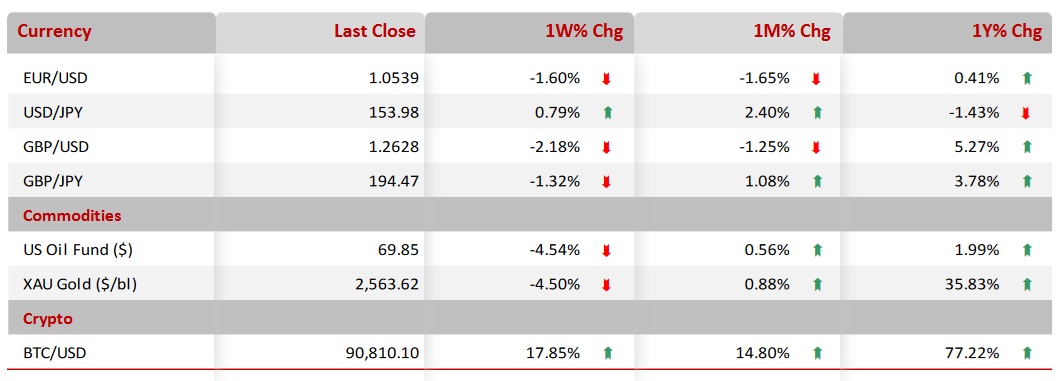

| |

| Market Update |

| |

|

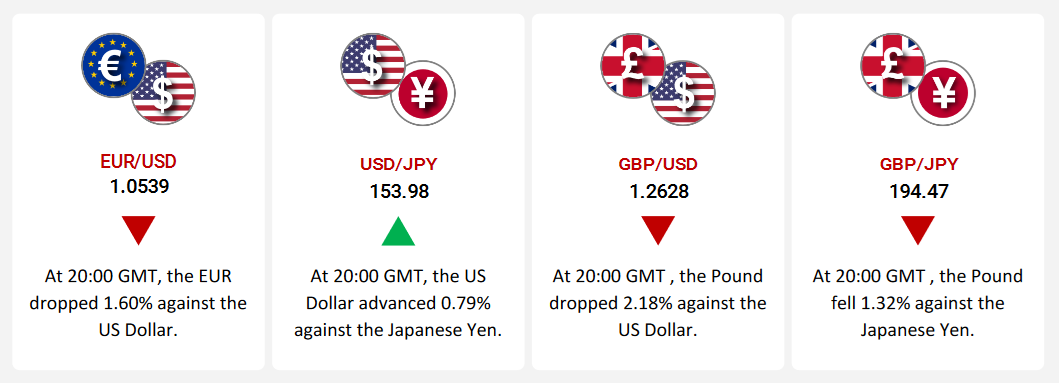

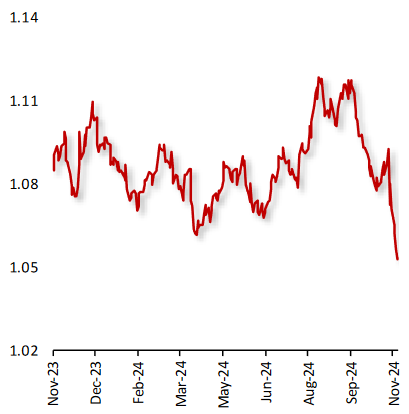

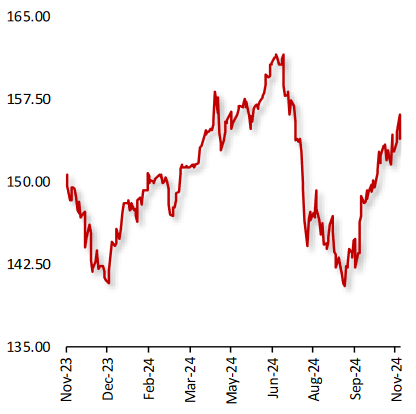

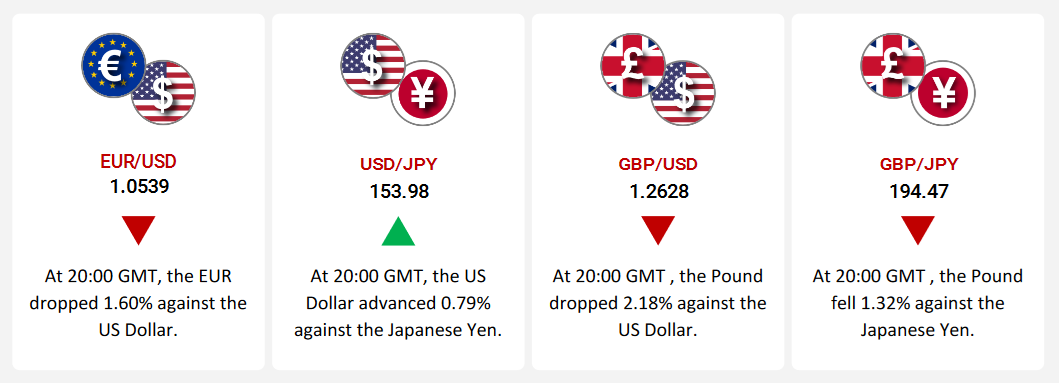

The US Dollar strengthened across several currencies this week, with the USD/JPY rising by 0.79%. The dollar’s rally was driven by an acceleration in US consumer inflation in October and hawkish comments from Federal Reserve (Fed) Chair Jerome Powell, suggesting that strong economic growth and persistent inflation would delay aggressive interest rate cuts. Additionally, positive US data, including lower jobless claims and an improved business optimism index, further supported the dollar. Meanwhile, Japan's weak economic performance, with a narrowing current account surplus and a second consecutive decline in industrial production, put downward pressure on the Yen.

The Pound fell 1.32% against the Yen, affected by disappointing UK economic data. UK GDP growth for Q3 2024 was slower than expected, and the unemployment rate rose to 4.3%. Industrial and manufacturing activity also contracted, signaling a slowdown in the economy. This raised expectations that the Bank of England might cut interest rates. Conversely, Japan’s stronger-than-expected GDP and producer price index (PPI) helped support the Yen.

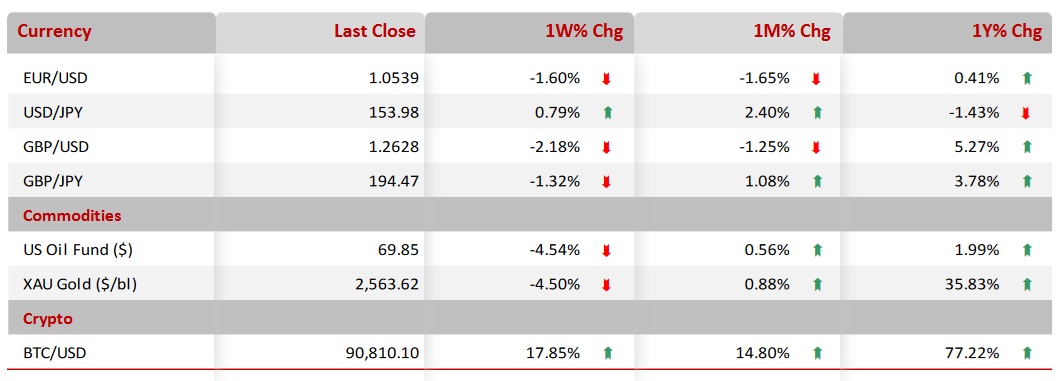

The EUR/USD pair declined by 1.60%, driven by fears of potential US tariffs under a new administration and weak economic data from the Eurozone. The Eurozone's ZEW economic sentiment index dropped, and industrial production in September was worse than expected. European Central Bank (ECB) policymaker Olli Rehn hinted at further rate cuts, adding to negative sentiment. Concerns over US tariffs on European imports and political instability in Germany pressured the Euro.

The GBP/USD pair dropped 2.18% as the UK’s rising unemployment rate and slower-than-expected GDP growth worsened the economic outlook. This increased expectations of a Bank of England rate cut, adding downward pressure to the Pound. Meanwhile, the US Dollar remained strong amid inflation concerns and speculation over future tariffs under President-elect Donald Trump.

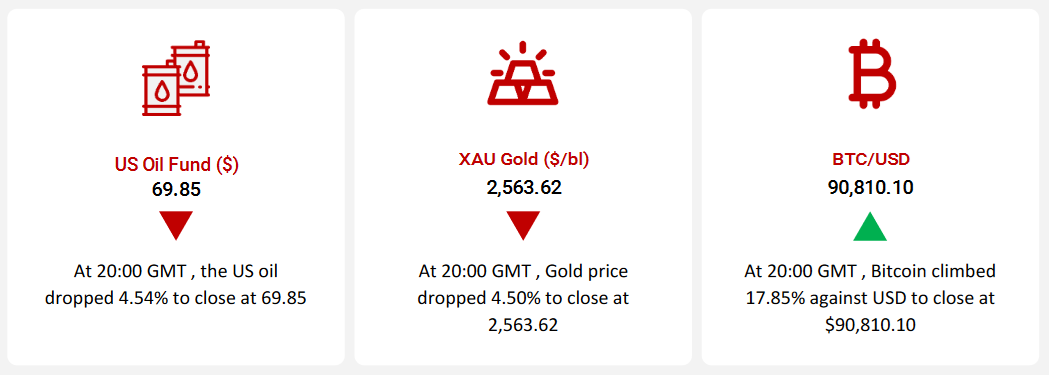

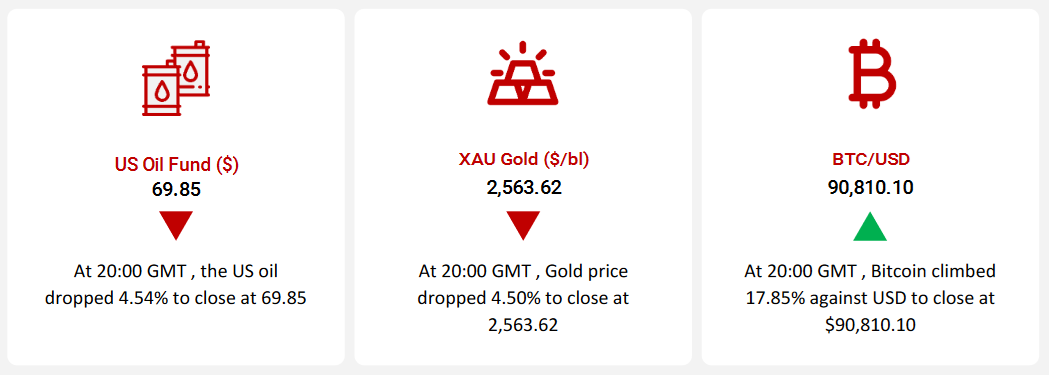

Oil prices fell amid global demand concerns and a stronger US Dollar. OPEC revised its 2024 and 2025 oil demand growth forecasts lower, and US crude inventories increased. Gold also declined, pressured by a stronger US Dollar, rising Treasury yields, and hawkish remarks from Powell on interest rates.

|

| |

|

|

Key Global Commodities

|

|

| |

| |

| |

|

| |

|

|

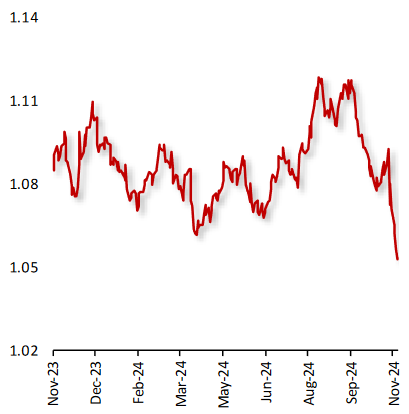

EUR/USD

|

|

|

EUR/USD falls As Worries Over Trump’s Tariffs

|

|

| |

|

|

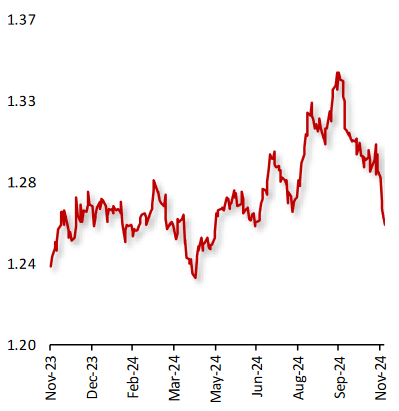

The EUR/USD currency declined 1.60% during the week, weighed down by investor concerns over potential tariffs by a new US White House administration which could hurt the euro area's economy.

On the macro front, the Eurozone ZEW economic sentiment unexpectedly dropped in November, while industrial production fell more than anticipated in September, amid a drop in energy and capital goods output. Additionally, the ECB policymaker Olli Rehn said that additional interest rate cuts are coming, and the deposit rate could hit the so-called neutral level in the first half of next year. Separately, Germany’s ZEW economic sentiment index dropped to 7.4 in November from 13.1 in the previous month.

The Euro (EUR) also remains vulnerable due to growth concerns, the political crisis in Germany and fear of the US imposing tariffs on European imports, further weighing on the pair.

|

|

| |

| |

| |

|

|

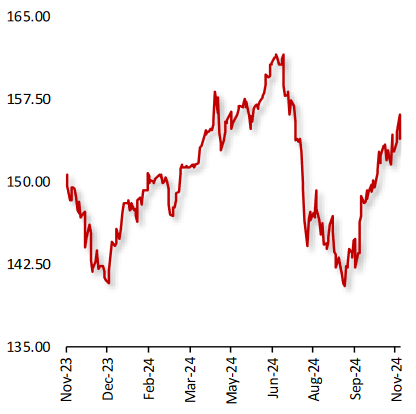

USD/JPY

|

|

|

Dollar Strengthens Against Yen on US Inflation, Weak Japan Data

|

|

| |

|

|

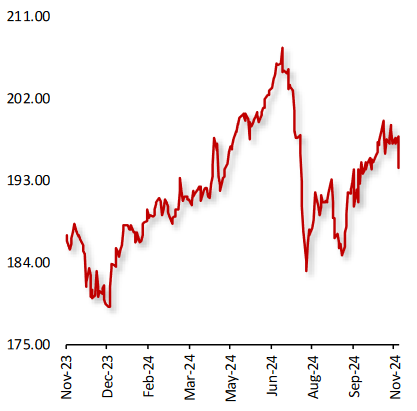

The Dollar advanced against the Yen after the US inflation accelerated in October.

The USD/JPY currency rose 0.79% this week as the US dollar strengthened following an acceleration in the US consumer inflation in October and after the Federal Reserve (Fed) Chair Jerome Powell signaled a cautious approach to interest rate cuts by the bank citing robust economic growth and inflation remaining above the banks 2% target range. Adding to the Dollars positive momentum the US weekly jobless claims unexpectedly dropped last week while, the NFBI business optimism index improved more than market expectations in October.

Meanwhile, Japan’s weaker economic data weighed on the Yen with current account surplus narrowing sharply in September and annual industrial production declining for the second consecutive month weighing on the investor’s sentiment.

|

|

| |

| |

| |

|

|

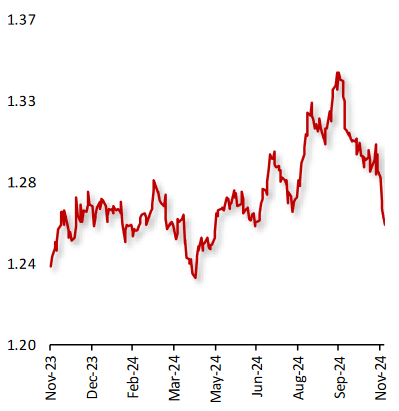

GBP/USD

|

|

|

GBP/USD Faced Underperformance as Rise in Unemployment Rate

|

|

| |

|

|

The GBP/USD currency fell 2.18% this week, weighed down by a rise in Britain’s unemployment rate.

In the UK, the gross domestic product grew by a slower-than-expected 0.1% in the third quarter of 2024. Moreover, the unemployment rate rose more than expected to 4.3% for the three months in September, weighing on the Pound Sterling (GBP). Also, it could put pressure on the BoE to cut interest rates to stimulate borrowing, growth and job creation. Further, the monthly UK industrial and manufacturing production both declined by 0.5% and 1.0%, respectively, in September.

On the other hand, the US dollar remains strengthened, amid speculation of inflationary import tariffs from Republican President-elect Donald Trump.

|

|

| |

| |

| |

|

|

GBP/JPY

|

|

|

Pound Falls Against Yen as UK Economic Data Disappoints

|

|

| |

|

|

The Pound fell against the Japanese Yen following Britain’s dismal economic data.

The GBP/JPY currency dropped 1.32% this week as Britain’s gross domestic product rose less than expected in the 3Q24 signaling a slowdown in economic activity in the UK while, unemployment rate unexpectedly climbed in September. Additionally, UK’s trade deficit widened more than market expectations in September. Furthermore, both industrial and manufacturing activities in the UK declined more than market forecasts in September. Adding to negative sentiment UK’s wage growth slowed in the 3Q24.

Meanwhile, Japan’s encouraging economic growth data bolstered the Yen with Japan’s gross domestic product rising in line with market expectations and adding to the Japan’s producer price index (PPI) rose far more than market expectations in October.

|

|

| |

| |

| |

|

|

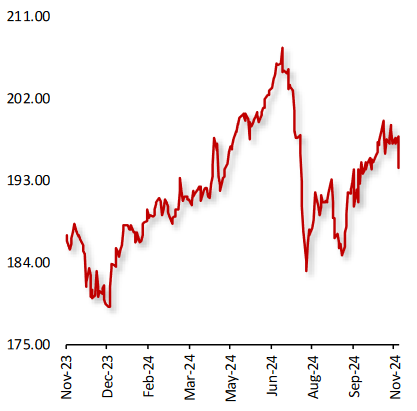

US Oil Fund ($)

|

|

|

Oil Prices Decline on Demand Concerns

|

|

| |

|

|

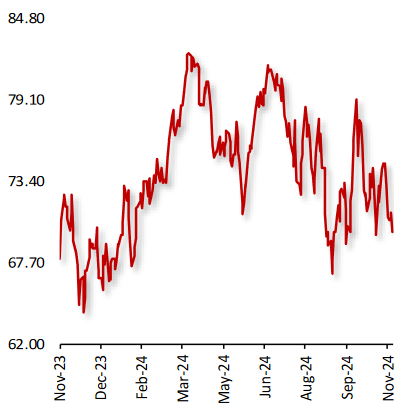

Oil prices declined this week, amid strength in the US Dollar and after the OPEC cut its forecast for global oil demand growth in 2024 and lowered its projection for 2025. Adding to the negative sentiment, China’s ¥10 trillion ($1.4 trillion) debt package to ease local government financing strains failed to boost investor sentiment.

Moreover, commercial crude oil stockpiles excluding the strategic petroleum reserve rose by 2.1 million barrels to 429.7 million barrels in the week ended 8 November 2024. Crude imports rose by 269,000 barrels a day last week to 6.5 million barrels a day, and exports increased by 590,000 barrels a day to 3.4 million barrels a day, said the EIA.

On the other hand, the Energy Information Administration (EIA) raised its forecast for the national average wholesale gasoline price in 4Q24.

|

|

| |

| |

| |

|

|

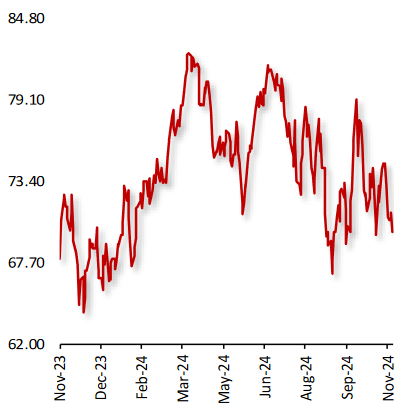

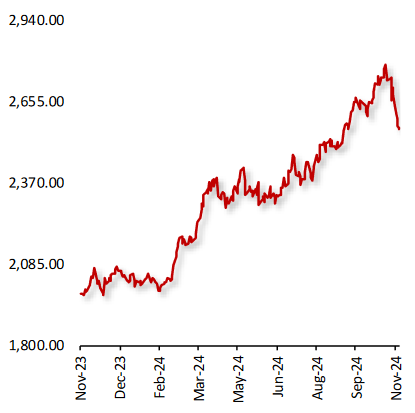

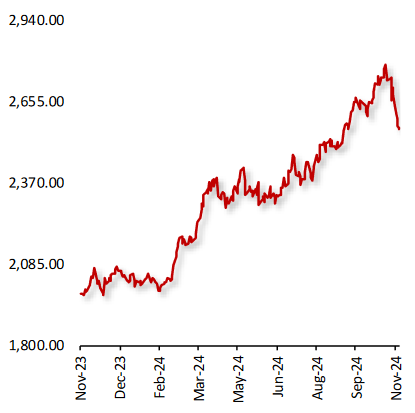

XAU Gold (XAU/USD)

|

|

|

Gold Prices Decline Amid Strength in the US Dollar

|

|

| |

|

|

Gold prices dropped last week, amid strength in the US Dollar and rise in the US Treasury yields. Moreover, the Federal Reserve (Fed) chair, Jerome Powell’s hawkish remarks dampened hopes for December rate cuts. Fed chair Jerome Powell stated that steady economic growth, a strong job market, and persistent inflation justified caution in cutting rates quickly.

Further, US producer prices advanced in October, adding to signs that progress towards lower inflation was stalling. Although recent US inflation data indicated that the Fed might slightly ease rates in the coming month, expectations of higher inflation next year have led to fewer anticipated rate cuts.

Additionally, investors expect President-elect Donald Trump's tariff plans would stoke inflation, potentially slowing the Fed's rate easing cycle.

|

|

| |

| |

| |

|

|

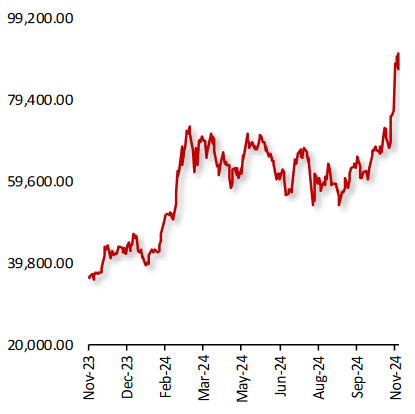

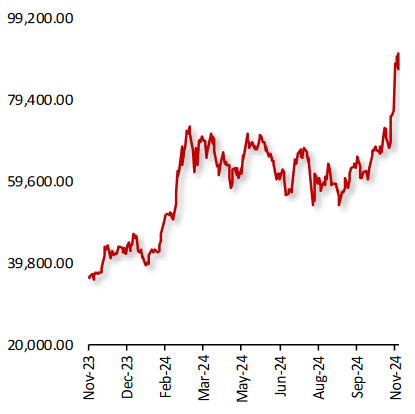

BTC/USD

|

|

|

Bitcoin Climbs Amid Hopes Surrounding President-elect Donald Trump’s pro-crypto stance

|

|

| |

|

|

Bitcoin’s price climbed last week, amid expectations of further interest rate cuts by the US Federal Reserve and hopes surrounding President-elect Donald Trump’s pro-crypto stance.

The President-elect has pledged to create a friendly regulatory framework for crypto, set up a strategic Bitcoin stockpile and make the US the global hub for the industry.

Donald Trump’s stance is a sharp break from a Securities & Exchange Commission crackdown on the divisive industry under President Joe Biden. The change of tone has energized speculative buying of large and small tokens alike, raising the value of digital assets overall to about $3.1 trillion.

Meanwhile, Federal Reserve chair, Jerome Powell’s hawkish remarks weighed on investors sentiment. Also, US robust inflation data in October indicated that progress towards lower inflation was stalling.

|

|

| |

| |

| |

|

| |

|

|

Key Global Currencies and Commodities

|

|

| |

| |

| |

|

Currency

|

| |

|

| |

|

Commodities & Crypto

|

| |

|

| |

|

| |

|