| |

| Market Update |

| |

|

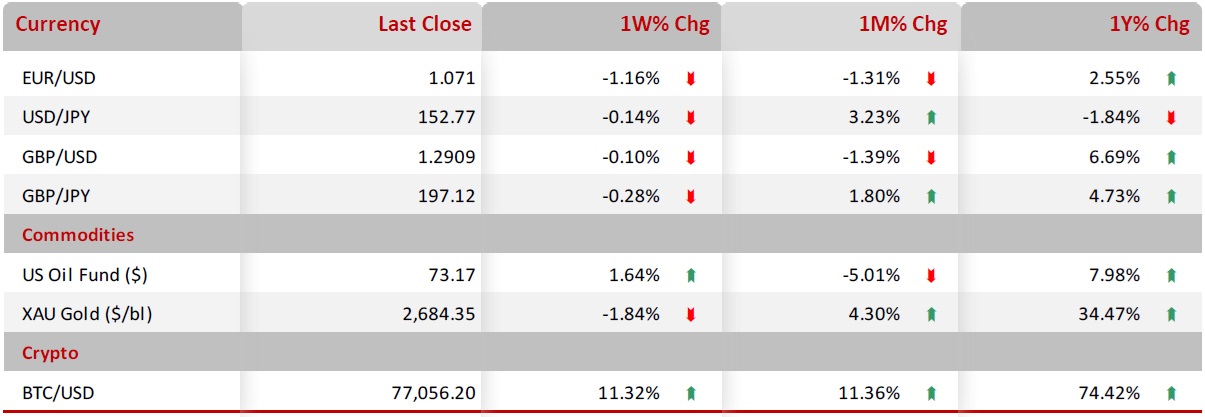

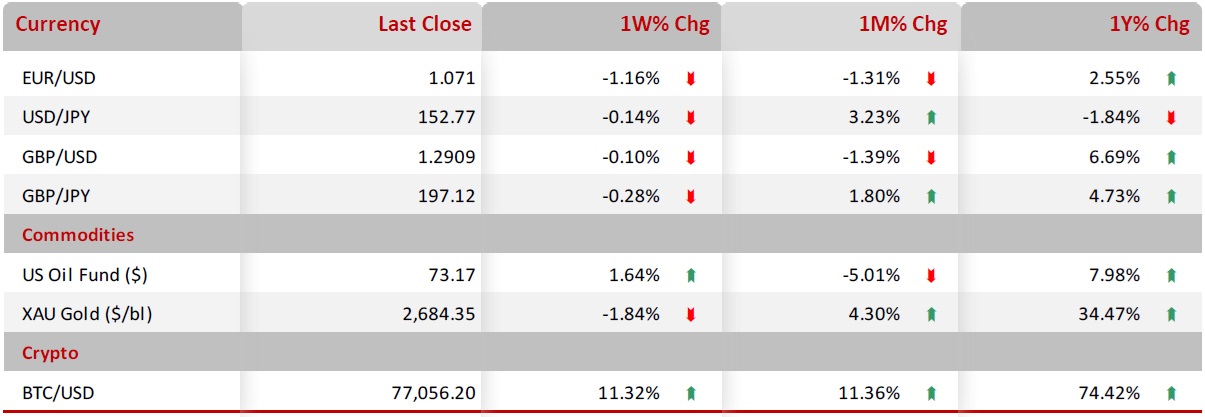

The currency and commodities markets experienced significant movements last week, influenced by a combination of central bank policies, the recent U.S. presidential election, and ongoing economic data. The USD/JPY declined after the Federal Reserve’s second consecutive 25-basis point rate cut, weakening the U.S. dollar amid concerns over trade deficits, declining factory orders, and rising jobless claims. Meanwhile, the Bank of Japan’s hawkish outlook bolstered confidence in the Yen, as Japan’s economic indicators showed signs of improvement.

Similarly, the Pound weakened against the Yen after the Bank of England implemented another 25-basis point rate cut, highlighting a slowdown in the UK’s service sector. The BoJ’s positive economic assessment further strengthened the Yen, signaling potential rate hikes if economic growth continues.

The EUR/USD pair also fell as Donald Trump’s election victory fueled a stronger dollar, amplified by Germany’s weaker-than-expected trade surplus and industrial output. The U.S. economy demonstrated resilience, with the ISM services PMI rising unexpectedly in October, contrasting with the Eurozone’s vulnerability to Trump’s protectionist policies. The GBP/USD faced downward pressure due to the Bank of England's rate cut and slower retail sales in the UK, while the dollar gained on optimism about Trump’s economic growth agenda.

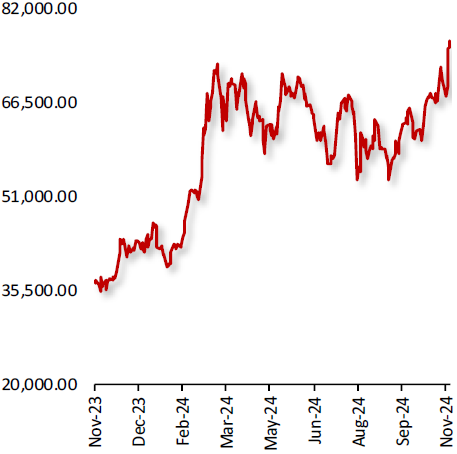

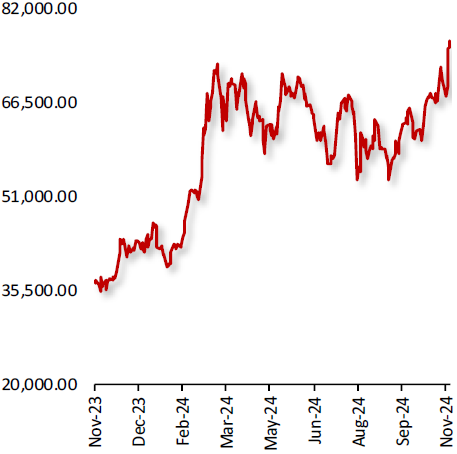

In the cryptocurrency market, Bitcoin surged, buoyed by Trump’s victory and potential favorable regulatory developments for cryptocurrencies. Investors speculated on the creation of a Federal Bitcoin reserve and welcomed record inflows into U.S. Bitcoin ETFs, reflecting a growing interest in the asset amid expectations of further rate cuts.

Oil prices climbed, supported by OPEC+’s extended production cuts and speculation that Trump’s administration may impose stricter sanctions on Iran and Venezuela, reducing supply. The recent hurricane also contributed to supply disruptions, with 22.36% of daily oil production in the Gulf of Mexico shut down.

Gold prices declined as the stronger U.S. dollar and rising Treasury yields made gold less attractive to investors. Unemployment claims rose, reflecting a weaker labor market, while upcoming stimulus measures from China’s National People’s Congress could impact global gold demand and add uncertainty to the price outlook. Together, these dynamics shaped a volatile week across various asset classes as markets adjusted to new economic and political developments.

|

| |

|

|

Key Global Commodities

|

|

| |

| |

| |

|

| |

|

|

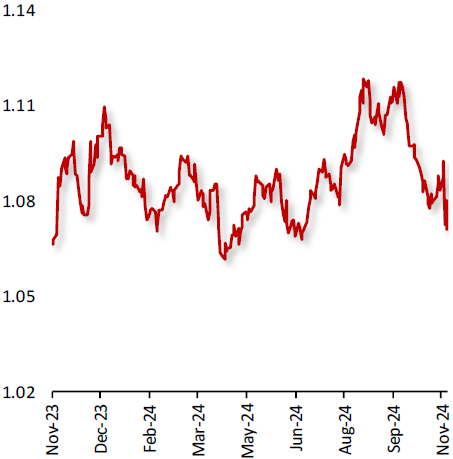

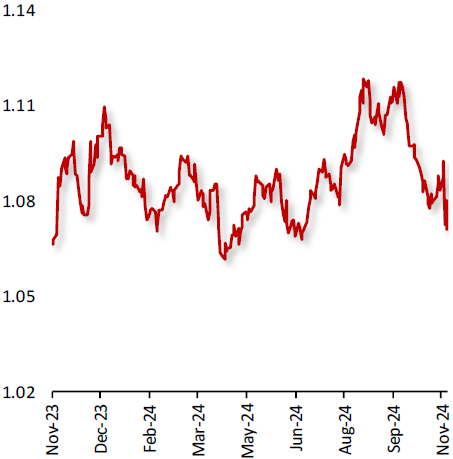

EUR/USD

|

|

|

Euro struggles to extend recovery against dollar

|

|

| |

|

|

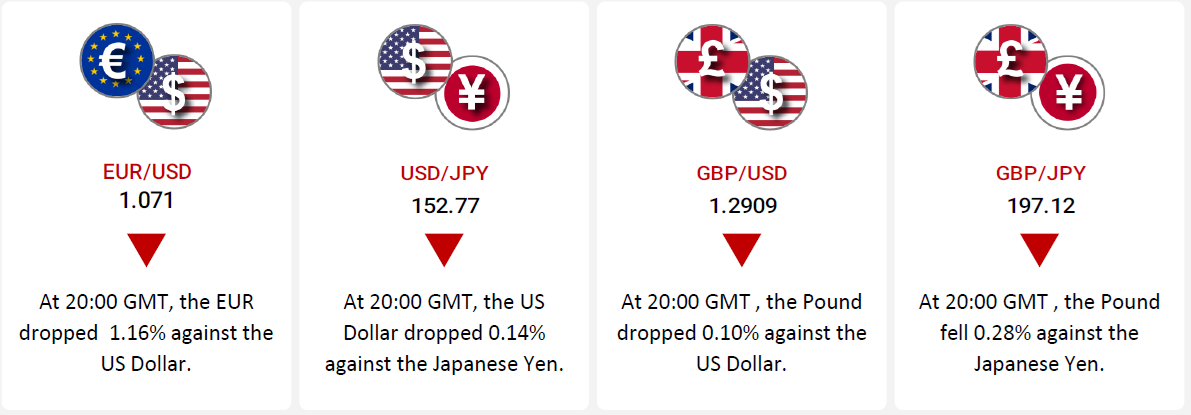

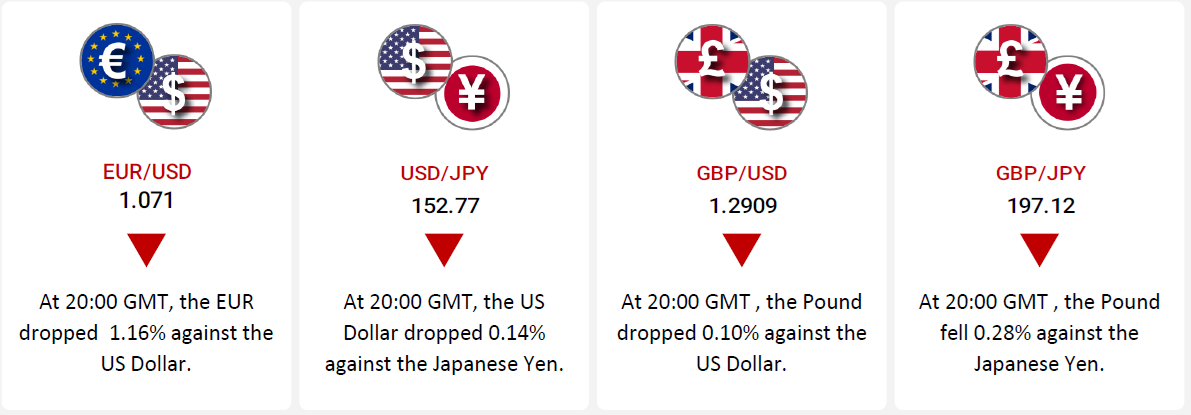

The EUR/USD declined 1.16% during the week, due to Donald Trump’s victory in the US Presidential election.

In Germany, a major contributor to the Eurozone economy, the trade surplus narrowed more than expected in September, while industrial production declined by 2.5%, faster than the 1% contraction expected by market participants in September.

However, the outlook of the major currency pair remains vulnerable as the Eurozone economy is expected to face a significant burden from Trump’s protectionist policies.

In contrast, the US ISM services PMI unexpectedly climbed in October. Adding to the dollar’s strength is the relatively strong US economy compared to the eurozone, suggesting the greenback may stay resilient in the short term.

|

|

| |

| |

| |

|

|

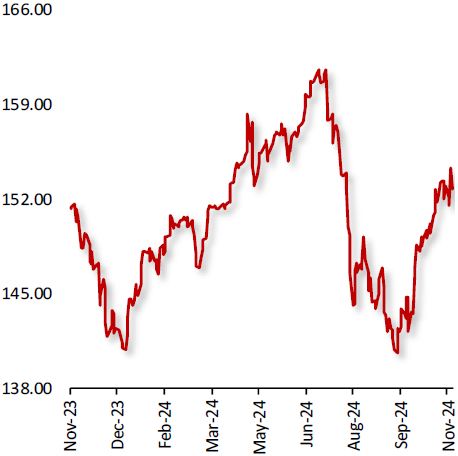

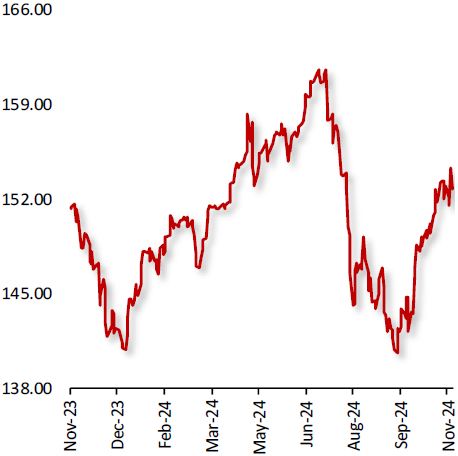

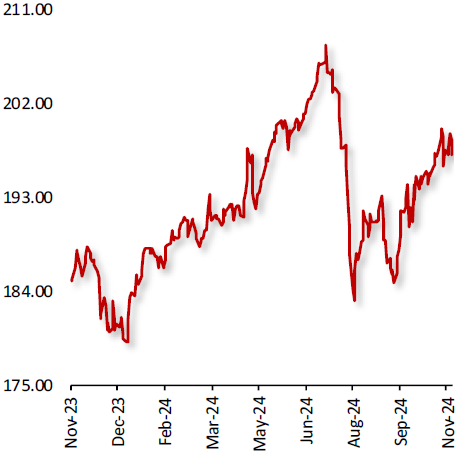

USD/JPY

|

|

|

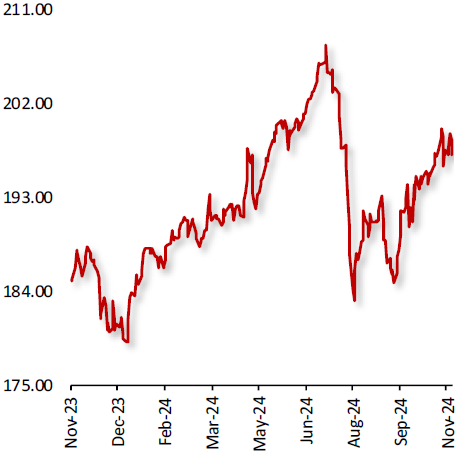

USD/JPY Drops as Fed Rate Cut Weakens Dollar

|

|

| |

|

|

The Dollar dropped against the Yen after the US Federal Reserve (Fed) delivered its second consecutive rate cut in its policy meeting.

The US dollar weakened after the US goods trade deficit widened in September, while factory orders in the US declined for a second consecutive month in September. Additionally, the US weekly jobless claims rose as expected in the week ended 1 November 2024 weighing on the investor sentiment. Also, the major contributor of weakness in the US dollar was Fed announcing a 25 basis point rate cuts in its policy meeting.

Meanwhile, In Japan the recently released meeting minutes of Bank of Japan revealed that the policymakers are confident that Japan’s economy is making progress and meeting conditions for raising interest rates. Adding to the positive sentiment, Japan’s leading economic index climbed more than market expectations in September.

|

|

| |

| |

| |

|

|

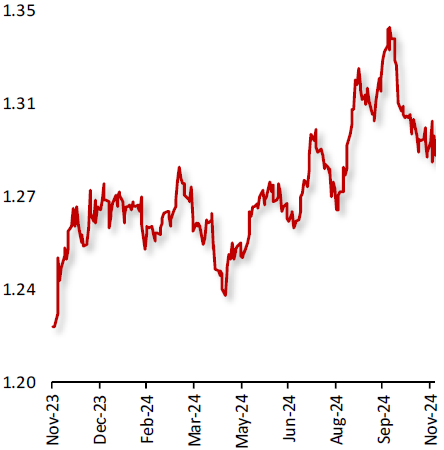

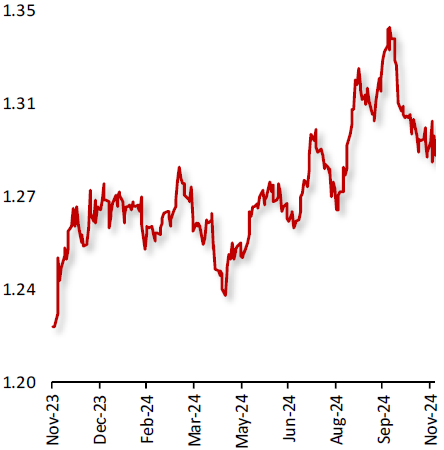

GBP/USD

|

|

|

Pound struggles against the dollar

|

|

| |

|

|

The GBP/USD currency fell 0.10% this week, after the Bank of England (BoE) reduced its interest rate by 0.25 basis points, as widely expected.

In the UK, the BRC like-for-like retail sales rose less than expected in October. Also, the Bank of England cut benchmark interest rates by 0.25 points to 4.75%, for the second time since 2020, indicating that future reductions were likely to be gradual.

On the other hand, the US dollar remains strengthened, following the US presidential election victory by Republican Donald Trump fueled optimism about stronger economic growth. The US services sector climbed to a more than two-year high in October, as employment rebounded strongly.

|

|

| |

| |

| |

|

|

GBP/JPY

|

|

|

Pound Weakens Against Yen Amid BoE Rate Cut

|

|

| |

|

|

The Pound declined against the Yen following further monetary policy easing by the Bank of England (BoE).

The Bank of England announced a 25-basis points rate cut in policy meeting its second since 2020. Additionally, the UK BRC like-for-like retail sales rose less than market forecasts in October. Moreover, the UK services sector activity declined in October highlighting a slowdown in service sector.

Meanwhile, In Japan the recently released meeting minutes of the Bank of Japan (BoJ) revealed the central banks hawkish monetary policy stance as policymakers expressed confidence in the ongoing progress in Japan’s economic activity and hinted that the central bank could move with a rate hike in the near term if needed.

|

|

| |

| |

| |

|

|

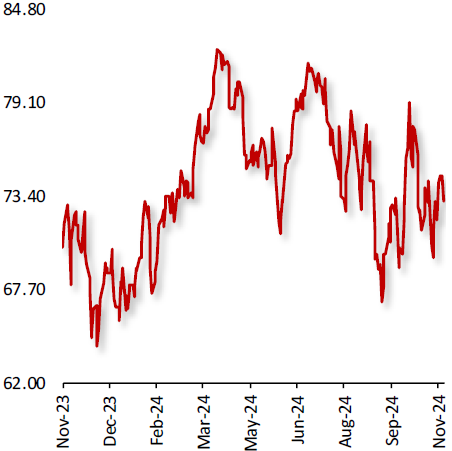

US Oil Fund ($)

|

|

|

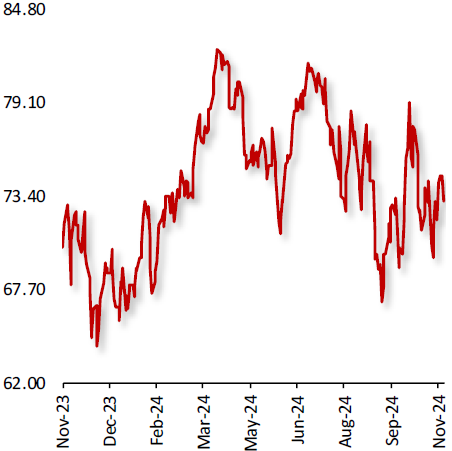

Oil Prices Rise Amid OPEC+ Cuts, Election Uncertainty

|

|

| |

|

|

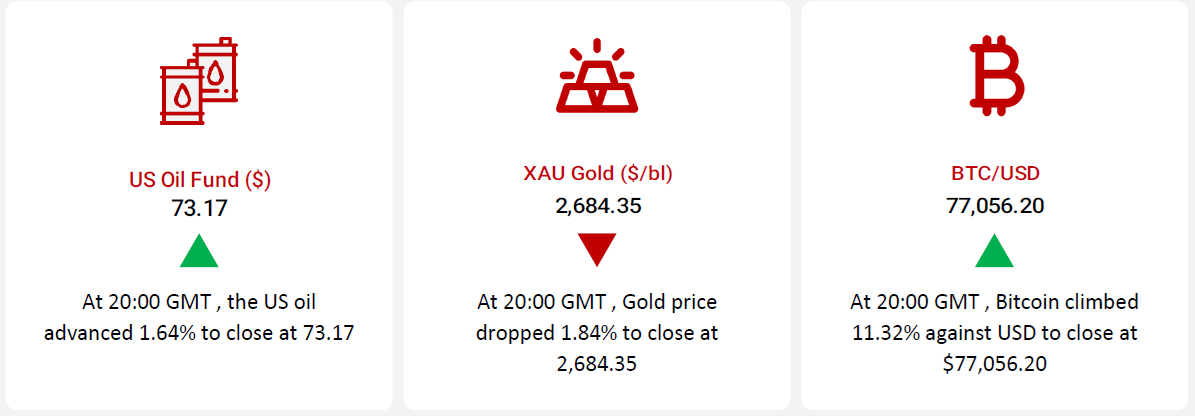

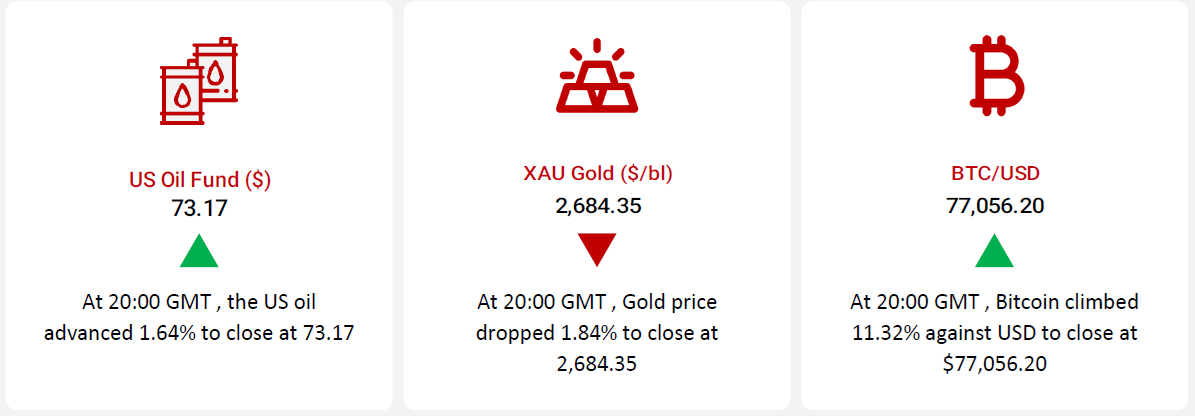

Oil prices climbed last week, as investors closely monitored the potential effects of the U.S. presidential election on energy markets.

Furthermore, expectations that the incoming administration under Donald Trump may impose stricter sanctions on Iran and Venezuela, potentially further constraining supply, provided additional support to oil prices.

OPEC+ also extended its production cut of 2.2 million barrels per day (bpd) into December, responding to persistently weak demand, particularly from China. This move aims to stabilize prices and address concerns over potential oversupply, signaling a strategic effort to prevent further downward pressure on the market.

Additionally, the US Bureau of Safety and Environmental Enforcement (BSEE) revealed that approximately 22.36% of the current daily oil production in the Gulf of Mexico has been shut-in response to Hurricane Rafael.

|

|

| |

| |

| |

|

|

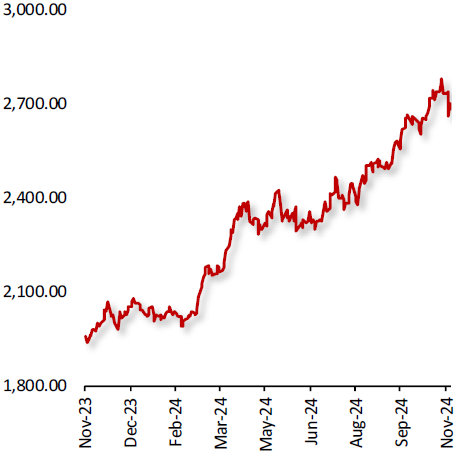

XAU Gold (XAU/USD)

|

|

|

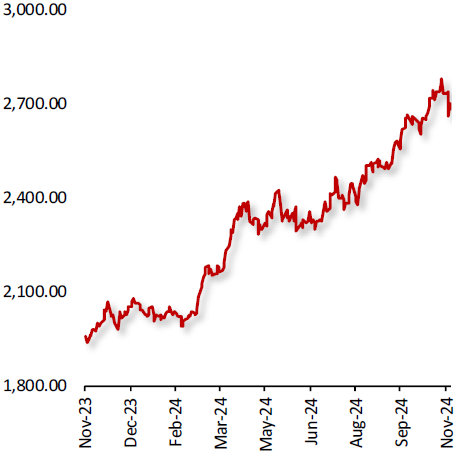

Gold Prices Fall Amid Stronger Dollar, Rising Yields

|

|

| |

|

|

Gold prices declined last week, following the election of Republican Donald Trump as the new U.S. President.

A stronger U.S. dollar and the possibility of rising U.S. Treasury yields reduced gold’s appeal, as investors shifted towards higher-return assets in light of the stronger dollar. Meanwhile, U.S. initial claims for state unemployment benefits rose to a seasonally adjusted 221,000 for the week ending November 2, 2024, in line with market expectations, indicating a generally weaker labor market. This also reinforced the belief that hurricanes and strikes contributed to a slowdown in job growth during October.

Investors await the National People’s Congress meeting in China, where expected stimulus measures could boost economic growth. These potential actions may impact demand for gold in global markets, adding uncertainty to the price outlook.

|

|

| |

| |

| |

|

|

BTC/USD

|

|

|

Bitcoin Climbs Following Donald Trump's Historic US Presidential Election Victory

|

|

| |

|

|

Bitcoin’s price climbed last week, following Donald Trump's historic US Presidential election victory and the Federal Reserve's 25 basis point interest rate cut.

Investors view a future Trump Administration as a positive development for Bitcoin and cryptocurrency more broadly, specifically in relation to regulation and the potential for the creation of a Federal strategic bitcoin reserve, potential tax cuts for an asset that is both held long term but also day traded, less dependency on parts of government and the Fed or at least an alternative for decentralized currency and overall support of risk assets. Further, investors expect more rate cuts in December and possibly into 2025.

Additionally, investors cheered by inflows into US Bitcoin exchange-traded funds. Cumulative net inflows across all products crossed $25 billion for the first time. None of the twelve ETFs showed any net outflows.

|

|

| |

|

| |

|

|

Key Global Currencies and Commodities

|

|

| |

| |

| |

|

Currency

|

| |

|

| |

|

Commodities & Crypto

|

| |

|

| |

|

| |

|