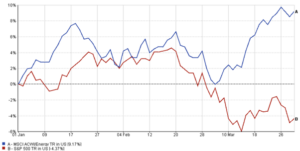

The Dow Jones Industrial Average dropped over 1000 points on Monday, as mounting fears of an economic slowdown weighed heavily on the high-flying technology stocks. By 16:00 ET (20:00 GMT), the Dow had lost 1033 points, or 2.6%, while the S&P 500 fell 2.9%, and the NASDAQ Composite dropped by 3.4%.

Slowdown Fears Shake Wall Street

These big losses came a week after the selloff driven by fears of an economic slowdown. A spate of soft economic readings dialed up the concerns that the Federal Reserve had held interest rates too high for too long, lessening the possibility of a soft landing for the economy.

This was magnified on Friday by the revelation of nonfarm payrolls for July, which came in way below expectation, thus indicating a significant cooling in the labor market. While this data raised hopes for further interest rate cuts by the Fed, it also took away any risk-driven appetite for assets.

Mixed Picture Painted by Economic Data

Monday's economic data indicated that a recession is not imminent, despite the market turmoil. The July ISM Services PMI beat economists' expectations, and even the prices paid index, which is a measure of inflation, surprised to the upside. In general, these readings pointed to underlying strength in the economy, contrary to broader slowdown fears.

Federal Reserve speakers will be the most watched this week as investors have already priced in aggressive rate cuts ahead. Chicago Federal Reserve President Austan Goolsbee said on Monday that the central bank is prepared to act at the first signs of weakness in the economy, perhaps indicating that interest rates may already be too tight. San Francisco Fed President Mary Daly was scheduled to speak Monday.

Market Reactions and Future Expectations

Markets now price in a 78% chance that the Federal Reserve will cut rates in September, with expectations for a full 50 basis point reduction. U.S. stock index futures climbed in evening trading on Monday, recovering mildly after Wall Street logged a series of substantial losses. S&P 500 Futures advanced 0.9% to 5,263.75 points, Nasdaq 100 Futures climbed by 1.2% to 18,224.25 points, and Dow Jones Futures climbed 0.5% to 39,053.0 points.

Recession Fears and Market Performance

The Wall Street tumbled from near-record highs in the past two weeks, triggered by concerns over a severe slowdown in economic growth after a string of underwhelming purchasing managers index and labor market readings. On Monday, the S&P 500 slid 3% to 5,186.33 points and the NASDAQ Composite tumbled 3.4% to 16,208.38 points, with both at three-month lows. The Dow Jones Industrial Average fell 2.6% to a two-month low of 38,703.27 points.

Weak data has kindled fears that the Fed had kept interest rates too high for a little too long, and any cuts now might not be enough for the soft landing of the economy. Markets, on the other hand, have already ratcheted up their expectations of a 50 basis-point cut in September and price at least 100 bps in rate cuts this year, according to CME Fedwatch.

Technology Stocks Under Pressure

The losses on Wall Street were triggered by the extended selling in technology stocks. Apple Inc. (NASDAQ: AAPL) is among the worst performers on Monday following news that Berkshire Hathaway Inc. (NYSE: BRKa) had cut stake in the iPhone maker by half. The stock, however, rose a tad in aftermarket trading.

NVIDIA Corporation NASDAQ: NVDA rose about 2.4% after losing more than 6%, according to a report that its latest artificial intelligence chip would be delayed because of a design flaw. Alphabet Inc NASDAQ: GOOGL also rose slightly, following its drop of 4.5% amid a court ruling the company had violated antitrust laws related to its search engine.

Coming Earning Reports

The market is also looking out for some key earnings reports over the coming days. On Tuesday, industrial bellwether Caterpillar Inc. NYSE: CAT and ride-sharing giant Uber Technologies Inc. NYSE: UBER take their places in the reporting calendar. Super Micro Computer Inc. NASDAQ: SMCI is also due to report on Tuesday and may shed further light on demand from the artificially intelligent industry. On schedule to report on Wednesday are media giants Walt Disney Company NYSE: DIS and Warner Bros Discovery Inc. NASDAQ: WBD.

Conclusion

Heeding concerns of an economic slowdown and the decision of policy by the Federal Reserve, investors are trying to wade through Wall Street's volatility. On tap, both the forthcoming economic data and earnings reports will further drive sentiment and expectations toward the future. Tech stocks continue to remain vulnerable to a sea of uncertainty, while the broad market looks for signs of either economic resiliency or further weakness.