Tariff Policies Trigger Market Volatility

President-elect Donald Trump announced plans to impose a 25% tariff on all goods from Canada and Mexico and an additional 10% tariff on Chinese imports on his first day in office. This announcement has been interpreted as a significant signal of potential disruption in currency markets. Underestimating the impact of these policies could be highly risky for the market.

Following the announcement, the U.S. dollar gained more than 2% against the Mexican peso and hit a four-year high against the Canadian dollar. The dollar index also rose slightly by 0.25% to 107.06, while the euro and British pound pared earlier gains and remained relatively stable against the dollar.

Heightened Currency Market Volatility

These tariff policies are expected to lead to increased currency market volatility. Currencies often serve as the primary adjustment tool in response to tariff-related announcements, and the potential for long-term turbulence in the markets is significant.

While the market has not fully priced in the long-term effects of these tariffs, some believe they may primarily serve as a negotiation tactic. However, Trump's earlier campaign promises included even higher tariffs, such as a 60% tariff on Chinese goods and a 2,000% tariff on vehicles made in Mexico. These possibilities heighten concerns about escalating trade tensions.

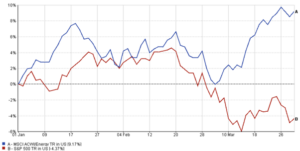

Market Reactions and Projections

The current tariff threats are seen largely as a negotiation strategy, but their immediate market impact cannot be ignored. For instance, if a 25% tariff on Mexican imports materializes, the peso could weaken further, potentially reaching 24 or 25 against the U.S. dollar.

Tariffs are also expected to become a key tool in negotiations with Mexico's government. While these measures may be intended to exert pressure rather than to be implemented outright, every headline related to tariffs could lead to sharp fluctuations in the peso, with daily moves of 1.5% to 2% being possible.

Outlook for Currency Markets

Currency markets are likely to face prolonged uncertainty. The dollar may strengthen further as tariff policies come into effect, especially if new measures target major economies like China and others. Such policies could provide broad support for the dollar in the global currency markets.

This trade conflict may evolve into a protracted negotiation process. While the U.S. may gain some concessions, economies such as China, Europe, and Mexico may face increased pressure to compromise.