Bank of Japan (BOJ) Governor Kazuo Ueda has refrained from giving a definitive signal about the possibility of raising interest rates next month. Instead, he emphasized the need to monitor economic and financial risks carefully, a statement that caused a slight weakening of the Japanese yen and drew attention from forex traders.

Flexible Approach to Policy Adjustments

Governor Ueda stressed that the timing and pace of any adjustments to Japan’s ultra-loose monetary policy would depend on developments in economic activity, inflation trends, and financial conditions. Speaking at a business conference in Tokyo, he stated that the BOJ must consider both domestic and global risk factors to assess their potential impact on Japan's economic outlook and inflation.

Ueda’s remarks follow last week’s indications that the central bank might delay tightening its policy, surprising investors who had anticipated a potential January rate hike. His latest comments suggest he aims to keep the central bank's options open, avoiding premature commitments on whether or not to raise rates soon.

Market Reaction and Risk Considerations

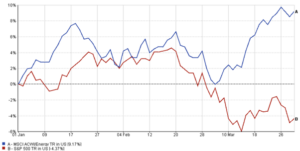

The yen showed a mild weakening after Ueda’s speech, dropping from 157.13 to 157.37 against the dollar, though the overall movement was limited. The currency did not test last week’s five-month low of 157.93, suggesting market participants are scaling back expectations for an imminent rate hike.

Analysts believe a January hike is still possible but think a March decision is more likely. Masato Koike, a senior economist at Sompo Institute Plus, explained that uncertainties such as the yen’s volatility and global economic conditions, including U.S. monetary policy under President-elect Donald Trump, make Ueda’s cautious stance reasonable.

Long-Term Policy Direction: Balancing Growth and Inflation

As Japan moves closer to achieving its stable 2% inflation target, Ueda reiterated the importance of maintaining accommodative financial conditions to support the economy. "We must ensure that Japan’s economy does not return to a deflationary or low-inflation environment," he said. This suggests that even if the BOJ eventually tightens policy, it will likely proceed cautiously to avoid derailing the economic recovery.

At the same time, Ueda acknowledged the risks of keeping interest rates too low for an extended period. By highlighting both the necessity of low rates and the potential risks of prolonged monetary accommodation, Ueda is signaling that the BOJ will carefully weigh its policy options going forward.

Implications for Forex Traders

For forex traders, Ueda’s remarks provide two critical takeaways:

-

Short-Term Policy Stability: The BOJ appears inclined to maintain its accommodative policy in the near term, with any tightening possibly delayed until March or beyond. This could keep the yen under some pressure in the short term.

-

Global and Domestic Factors at Play: The yen’s movement will remain influenced by global economic developments and market sentiment, particularly regarding U.S. monetary policy and broader currency market trends.

Traders should be prepared for yen volatility driven by shifts in market expectations or BOJ communication. Maintaining flexible positions and closely monitoring BOJ statements on inflation and economic conditions will be crucial for navigating potential fluctuations.

Conclusion

Governor Ueda’s cautious approach underscores the BOJ's balancing act between supporting economic recovery and managing potential risks associated with ultra-loose monetary policy. While a January rate hike remains on the table, the central bank is unlikely to commit to a definitive timeline soon. In the coming months, the interplay between Japan’s inflation trajectory and global market dynamics will likely dominate the forex market's focus, making BOJ updates critical for traders worldwide.