On November 7, the Bank of England (BoE) cut interest rates by 25 basis points, lowering the benchmark rate from 5.0% to 4.75%, as widely anticipated. This was the second rate cut in the current cycle, following a previous cut in August. The decision was made with a vote of 8 in favor and 1 against, indicating the central bank's confidence in a slowing inflation trend. However, there is concern in the market about inflation’s “stickiness,” which could limit the BoE's capacity for further rate cuts.

Background and Purpose of the BoE’s Rate Cut

The BoE's rate reduction was primarily influenced by two factors: inflation and budget expansion. According to Goldman Sachs, the current UK economy is under mixed pressures—while inflation is easing, the autumn budget has introduced expansionary fiscal policies, creating opposing forces. The BoE's latest forecast suggests that the UK’s GDP growth will increase by 0.75% over the next year, while inflation is expected to reach 2.7% (above the 2.4% forecast in August).

To ensure inflation remains on a stable downward trajectory, the BoE plans to follow a “gradual” rate-cutting strategy, aiming to avoid an overly sharp economic slowdown. BoE Governor Andrew Bailey is expected to elaborate on the background of this rate cut, likely emphasizing inflation risks and the importance of maintaining policy flexibility.

Changes in Inflation Expectations and Their Impact

The BoE’s recent projections show that UK inflation is likely to reach 2.2% in two years and 1.8% in three years. These figures, revised upward from August’s estimates, reflect a persistent concern about inflation. Additionally, an increase in government spending could push inflation higher in the future, especially after the UK elections, as additional spending would add pressure on the BoE's interest rate policies.

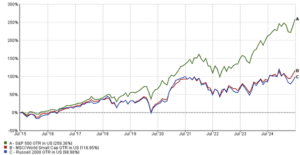

Following the rate cut announcement, the British pound rose against the dollar, signaling the market’s positive reception of the BoE’s decision.

International Implications and Future Policy Outlook

The BoE's pace of rate cuts will inevitably be influenced by global economic and geopolitical factors. For example, Trump’s recent election victory in the U.S. could spark new global trade tensions, impacting the UK’s economic policies. Furthermore, UK Chancellor Rachel Reeves' expansionary fiscal policies are likely to drive inflation higher over the next few years, potentially limiting the BoE’s capacity for aggressive rate cuts.

According to Société Générale, the BoE may maintain a “gradual” easing path, with plans to cut rates by 25 basis points each quarter through 2026, barring any major economic surprises. Economic data over the next few months, particularly inflation in the services sector, will be critical in determining the number and size of rate cuts. Should inflation run below expectations, there may be room for additional cuts next year.

Conclusion

The BoE’s latest rate cut reflects its confidence in inflation moderating while highlighting caution regarding economic growth and fiscal policy. Moving forward, as the global economic environment and domestic fiscal policies evolve, the BoE will likely continue to take flexible measures to ensure economic stability.

For forex markets, the pound's performance will be influenced by the BoE’s rate-cutting pace and international factors. Investors should closely monitor UK inflation and GDP data to assess future rate cut possibilities and the pound’s potential trajectory.