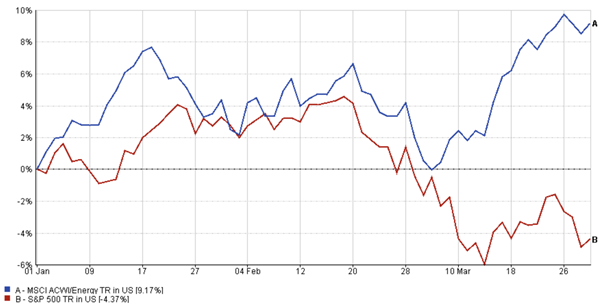

For most of 2024, tech stocks dominated headlines and investor attention. But in 2025, something unexpected happened: oil stocks quietly took the lead. While names like Nvidia and Meta stumbled out of the gate, traditional energy companies – think ExxonMobil, Chevron, Shell – posted steady gains. In fact, the MSCI ACWI Energy Index was up nearly 9% by the end of Q1, while the broader S&P 500 was down around 4%.

Q1 2025 Performance: S&P 500 vs. MSCI ACWI Energy Index

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 08 July 2025.

So, what’s driving this silent rally? And is it just a blip – or something more durable?

From Wallflower to Winner: A Rotation into Value

The shift toward energy isn’t just about oil prices ticking up. It’s part of a broader rotation. Investors who spent the past few years chasing high-growth tech stocks – often with stretched valuations – are now looking for safety, income, and value.

Energy companies, which had lagged behind during the tech boom, suddenly became more attractive. Many entered the year with relatively low price-to-earnings (P/E) ratios, strong balance sheets, and real, tangible earnings. When inflation stayed sticky and growth outlooks dimmed, these “old economy” stocks started to shine.

Strong Fundamentals Are Doing the Heavy Lifting

Let’s talk numbers. Oil majors have been posting serious profits over the last few years. Even as crude prices cooled from 2022’s highs, companies like ExxonMobil still reported healthy earnings and continued rewarding shareholders. In 2023, Exxon posted a return on equity (ROE) of roughly 18% – a sign it was using investors’ capital efficiently.

Dividend yields in the sector also stand out. Exxon’s yield currently hovers around 3.3%, compared to the S&P 500 average of under 2%. That’s real cash in investors’ pockets – and a big reason income-seeking portfolios have rotated into the sector.

Meanwhile, valuations remain conservative. Many energy stocks trade at P/E ratios in the single digits or low teens, well below the 20+ multiples seen in tech. That pricing cushion – often called a “margin of safety” – makes energy more attractive in uncertain times.

Macroeconomic Tailwinds: Inflation, Rates, and Rebalancing

There’s also a macro story here. With interest rates at decade-high levels and inflation proving stickier than expected, investors are reevaluating where to park their money. Future-focused growth stocks tend to suffer in such environments because their projected earnings are discounted more heavily.

On the other hand, energy stocks offer current, real cash flows – a big plus when you can already get almost 5% from a Treasury bond. And because oil and gas prices often rise with inflation, energy is viewed as a natural hedge.

In short: when rates are high and inflation won’t quit, energy feels like a safer bet than a high-flying tech stock with sky-high expectations.

Risks: It’s Not All Smooth Sailing

Obviously, energy isn’t risk-free. Oil prices can swing dramatically with global events. In 2025 alone, crude jumped above $80 per barrel in January and slid below $60 by May, before rebounding again on Middle East tensions.

Geopolitics aside, long-term structural risks remain. The transition to clean energy continues, and institutional investors with ESG mandates may still avoid fossil fuel companies. While oil demand isn’t disappearing overnight, the long-term runway is murkier than it once was.

Final Takeaway: Don’t Count Energy Out

The energy sector may not be flashy, but in 2025, it’s been quietly doing the work. Strong cash flows, attractive dividends, low valuations, and macro tailwinds have made oil stocks a relative winner in a volatile market.

That doesn’t mean every investor should go all-in. But as part of a balanced portfolio – especially one that values income and diversification – energy is worth another look.