Economic Overview

Markets moved higher last week as progress on US-China trade talks and softer inflation data lifted investor sentiment.

In Geneva, senior US and Chinese officials agreed to pause their ongoing tariff dispute for 90 days. As part of the truce, both countries promised to scale back certain import taxes. Both sides also agreed to hold regular discussions to avoid further escalation. This cooperative tone marked a change from earlier, more aggressive exchanges, giving global markets a reason to breathe easier.

On the economic front, fresh US inflation data came in softer than expected. The Producer Price Index – which tracks the prices businesses receive for their goods and services – fell 0.5% in April. The decline was mainly due to a sharp drop in prices for services, suggesting that inflation may be cooling. That, in turn, eased worries that the Fed would need to raise interest rates again soon.

Together, trade progress and easing inflation gave investors a reason to feel more optimistic – even as they remain cautious ahead of key decisions on interest rates and trade policy in the coming weeks.

Equities, Fixed Income, and Commodities

US stocks climbed across the board. The S&P 500 rose nearly 2%, closing above 5,775, while the Nasdaq led with a 2.3% gain, helped by tech momentum. The Dow added about 1%.

One standout was Coinbase, which rallied after news it will join the S&P 500 next week. While a mid-week hack disclosure briefly sent shares down 7%, optimism around institutional recognition and long-term adoption kept the stock up more than 30% for the week.

Yields on 10-year US Treasuries edged slightly higher, ending around 4.42%. Investors initially reacted to strong economic prints, but a cooler inflation report on Wednesday eased rate fears and stabilized bond markets.

Gold prices fell 3.5%, closing near $3,200/oz – its worst week in months. As investors shifted to risk assets on trade optimism, safe-haven demand dropped. Still, gold’s longer-term appeal remains intact amid geopolitical uncertainty.

Oil prices were mixed. Hopes for stronger demand lifted prices early, but comments suggesting potential progress on an Iran nuclear deal pulled crude back. WTI settled near $60/barrel, as traders weighed trade-driven demand hopes against possible supply increases.

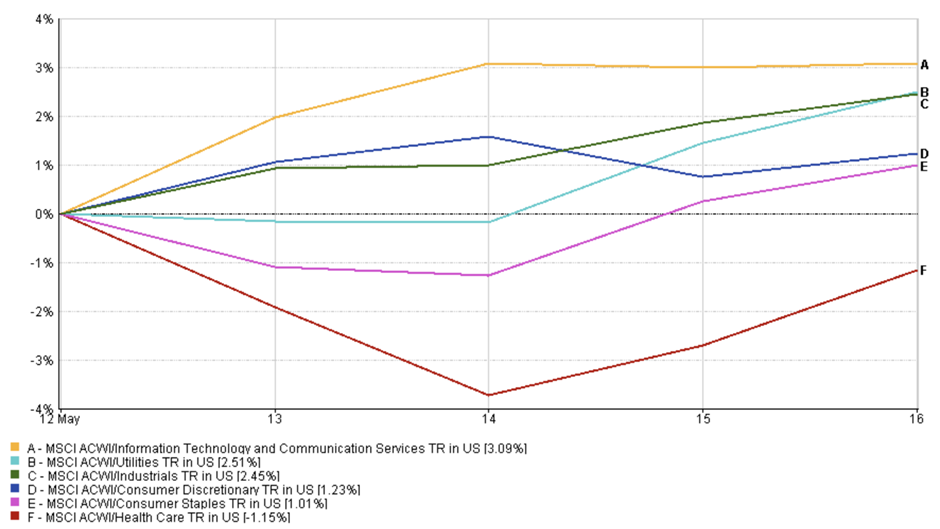

Sector Performance Updates

Growth-focused sectors led the market rally as investors rotated back into tech and consumer names following signs of easing inflation and progress on trade.

Technology and communication services were the week’s top performers, rising 3.1%. Investor appetite for AI, cloud computing, and digital platforms remained strong. Shares of Arm Holdings initially dipped after issuing cautious trade-related guidance, but the sector quickly regained momentum.

Consumer discretionary stocks gained 1.2%, supported by steady demand in travel and retail. Airbnb shares held firm after posting a 6% revenue increase, reflecting sustained appetite for post-pandemic experiences.

Sector Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 16 May 2025.

Industrials rose 2.45%, helped by optimism around Trump’s visit to the UAE, where over $100 billion in aerospace and defense deals were signed – boosting sentiment for logistics and manufacturing firms.

Healthcare underperformed, dropping 1.15%. The sector was dragged down by managed care stocks, including a sharp selloff in UnitedHealth Group after reports of a federal investigation. Profit-taking in biotech also weighed on the group.

Meanwhile, defensive sectors like utilities and consumer staples rose modestly – up 2.5% and 1.0%, respectively – but lagged behind as traders favoured more growth-sensitive assets.

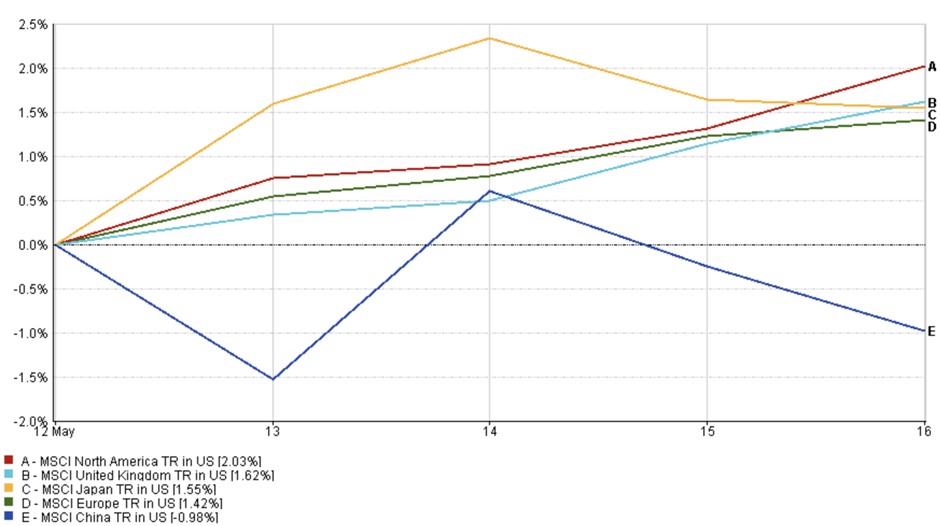

Regional Market Updates

Global markets mostly followed the US higher last week, as softer inflation data and progress on trade talks boosted investor sentiment.

North America led gains, with the MSCI North America Index rising 2.0%. Tech and consumer strength helped lift both US and Canadian stocks, as investors grew more confident that the Fed may pause rate hikes.

The United Kingdom MSCI Index rose 1.6%, supported by upbeat earnings and easing inflation concerns. A stronger pound capped some of the upside for exporters, but domestic sectors held firm.

Regional Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 16 May 2025.

Japan added 1.55%, rebounding after an early-week dip. The yen’s moderate strength weighed on exporters, but industrial and tech shares gained on global trade optimism.

Europe advanced 1.4%, as investors looked past weak German industrial data and focused on strong earnings from large-cap names across sectors.

China, however, underperformed. The MSCI China Index fell 1.0%, as optimism from the US–China tariff truce faded midweek. Regulatory pressure on tech firms resurfaced, weighing on sentiment and dragging mainland and Hong Kong markets lower.

Across the board, the tone remained cautiously optimistic – with regional equity markets tracking US momentum, but still sensitive to policy shifts and geopolitical headlines.

Currency Market Movements

Currency markets were mostly calm last week but reflected subtle shifts driven by interest rate expectations and global risk sentiment.

EUR/USD declined steadily over the week, starting at 1.1088 on May 12 and falling to 1.1164 by May 16. Despite some midweek volatility, the pair ended the week down approximately –0.75%, as stronger US data and easing rate cut bets supported the dollar.

USD/JPY saw mild swings. The pair opened at 148.46 on May 12 and ended at 145.63 on May 16, marking a weekly decline of –1.91%. A pullback in US yields and some haven demand for the yen contributed to the reversal from Monday’s highs.

GBP/USD began the week at 1.3176 and closed at 1.3275, rising about +0.75%. The pound was buoyed by better-than-expected UK GDP figures and broader dollar softness later in the week.

GBP/JPY showed mixed performance. After opening at 195.61, the pair dropped to 193.32 by Friday, ending the week down –1.17%, largely driven by yen strength in the latter half.

Overall, FX markets remained in tight ranges, but policy divergence and inflation outlooks continued to guide positioning. Traders stayed alert to rate commentary from the Fed, BoE, and BoJ, as well as developments in US–China trade talks.

Market Outlook and the Week Ahead

The week ahead will test whether last week’s optimism has staying power.

Investors will keep a close eye on fresh US economic data, including personal spending and employment figures. After last week’s surprise drop in producer prices, the market is hoping inflation continues to ease. A cooler inflation trend would support the case for the Fed to keep rates steady – but any upside surprises could quickly revive concerns about further tightening.

The ongoing US-China trade negotiations function as a primary market-moving factor. With a July 8 deadline looming to avoid new tariffs, every development will be closely watched. So far, the tone from Geneva has been encouraging, but a breakdown in dialogue could reverse market gains quickly.

The corporate sector will finish its earnings season but several major retailers and technology companies still need to report their results. Companies like Walmart have already warned about the impact of tariffs on consumer prices, so investors will be looking for signs that inflation is filtering into spending patterns.

The market continues to monitor geopolitical developments as its main focus. The President Trump visit to the UAE generated news through major defense and infrastructure agreements yet created doubts about how Middle East diplomatic efforts would impact energy market dynamics. The market closely monitors Iran nuclear talks for updates because sanctions relief and increased supply would impact oil prices.

Volatility has eased for now, but with so many moving parts – inflation, trade, Fed policy, and geopolitics – markets are likely to stay reactive. The tone is more hopeful, but not yet settled.