Economic Overview

The global economy is still sending mixed signals, and last week was no exception.

In the US, growth is clearly losing steam, but inflation is proving hard to shake. The Fed’s preferred inflation gauge, core PCE, nudged up to 2.7% in May. That’s not the kind of number that pushes the Fed toward cutting interest rates anytime soon. At the same time, consumer confidence dipped in June, and jobless claims are inching higher, hinting that the job market might be cooling.

Over in the UK, the economy shrank 0.1% in May, catching markets off guard and fuelling bets that BoE might lower rates as early as August. Elsewhere in Europe, the pace of growth remains sluggish, while inflation is still running above target in several countries, keeping central banks cautious.

In Japan, growth remains modest but steady. Inflation is still a concern, and markets are watching closely to see how the central bank responds after this month’s elections. Meanwhile, China’s export numbers looked strong in June, but that seems to be the result of companies rushing orders ahead of potential new tariffs. Most analysts now expect China’s second quarter GDP to slow to around 5.1%, down from 5.4% in the first quarter. That’s adding to calls for more government support.

Put simply, the world economy is slowing down, inflation is still hanging around, and trade tensions are starting to cast a longer shadow.

Equities, Fixed Income, and Commodities

Stock markets eased a bit after recent strong gains.

In the US, the S&P 500 slipped by about 0.3%, with both the Nasdaq and the Dow also finishing slightly lower. Tech stocks held up better than most, but overall, investor sentiment took a hit as talk of new tariffs picked up again.

In Europe, the mood was fairly flat. The UK’s FTSE 100 fell around 0.4% on Friday but still managed one of its better weeks in recent months, thanks to strong performances from miners and energy companies. Other major European indexes finished the week more or less unchanged.

In Asia, results were mixed. Japan’s Nikkei dropped by about 0.9%, weighed down by a stronger yen. Chinese equities posted small gains, supported by expectations for fresh stimulus measures.

Bond yields climbed. The US 10-year Treasury yield moved up to around 4.4%, a noticeable increase from the week before. The move suggests that investors are adjusting their expectations and no longer betting on immediate rate cuts.

Oil prices bounced back strongly. Brent crude closed near $70 a barrel, up roughly 3%, while WTI followed a similar path. Traders cited concerns over tighter supply and speculation that tariffs could end up lifting demand. Gold stayed close to record highs, holding steady around $3,330 per ounce as investors continued to look for safety.

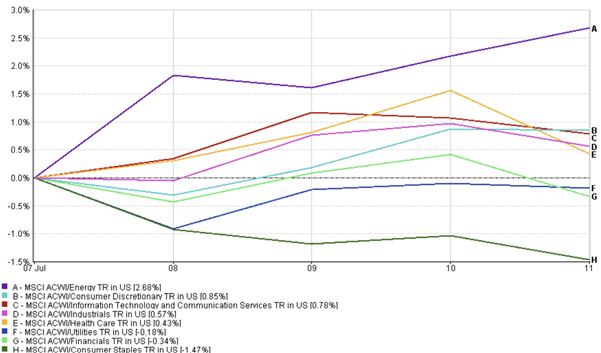

Sector Performance Updates

This past week, the spotlight turned back to growth and risk-sensitive areas of the market.

Energy shares led the charge. With oil prices on the rise again, the MSCI ACWI Energy Index climbed roughly 2.7%. Mining companies were also swept up in the momentum, helped by higher commodity prices and a rotation into cyclical plays.

Consumer-facing sectors like discretionary and tech held their ground. Both were up just under 1%, buoyed by the ongoing AI narrative and generally upbeat earnings expectations. Meanwhile, healthcare and industrials posted modest gains – steady but crazy!

Sector Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 11 July 2025.

It was a different story for the defensive names. Consumer staples came under pressure, dropping around 1.5%. Utilities and financials also drifted lower, as investors moved away from the safer corners of the market in favour of those offering more upside.

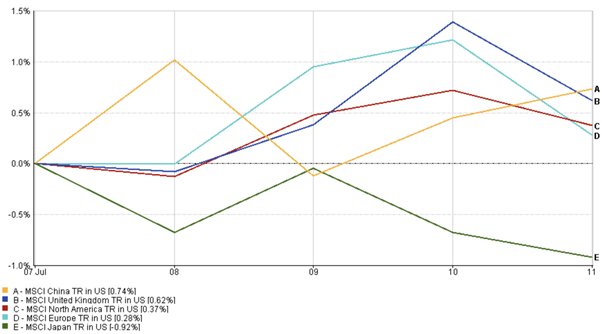

Regional Market Updates

Equity performance varied widely depending on where you looked.

North America came out looking strongest. The MSCI North America Index added just over a one-third percent, supported by solid US tech names and consumer confidence that’s holding together – despite rising macro concerns.

In Europe, results were more restrained. The MSCI Europe Index edged up by about 0.3%. Gains in energy and materials helped, but soft economic data and ongoing policy uncertainty weighed on sentiment.

Regional Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 06 July 2025.

Asia was mixed. Chinese equities fared relatively well, with the MSCI China Index up 0.74% on hopes that stimulus might be on the way. On the other hand, Japan struggled. The MSCI Japan Index dropped by close to 0.9%, as a stronger yen added pressure on exporters and business sentiment wavered.

Currency Market Movements

It was a firmer week for the greenback.

The US dollar index moved past 97.50, helped by investors looking for stability amid a flurry of new tariff headlines and macro jitters. That left the euro on the back foot, slipping below 1.17. Sterling also lost ground, landing closer to 1.35, after that weaker-than-expected GDP number rattled expectations around UK growth.

In Asia, the yen weakened slightly. The dollar rose toward the 145 level against the Japanese currency, widening the interest rate gap and keeping pressure on BoJ to respond cautiously.

Broadly speaking, currency markets reflected a cautious global mood. The dollar firmed as others faded – a pattern that tends to show up when investors feel less confident about the broader outlook.

Market Outlook and the Week Ahead

Looking ahead, the mood feels watchful – not fearful, but definitely on alert.

In the US, investors will be parsing the minutes from the Fed’s last meeting for any subtle clues about when (or if) a rate cut might come. There’s also new data on inflation and unemployment due, both of which could shift expectations.

The UK will stay in focus after that GDP surprise. More domestic data is due soon, and BoE’s next steps may depend heavily on whether this recent softness proves to be a blip or the start of a broader slowdown.

In Europe, inflation updates are coming that could sway the ECB’s timeline. Meanwhile, in Asia, several central banks are meeting – from New Zealand to Malaysia – with decisions that could hint at a wider move toward easing.

Trade policy remains a wildcard. The US deadline for another round of tariffs is creeping closer. Last week’s shock announcement of a 35% tariff on Canadian imports sent markets into a tailspin – and it served as a reminder that trade tensions can escalate fast and without much warning.

Still, it’s not all gloom. Flows into equity funds picked up, showing that plenty of investors are still willing to bet on a soft landing. The balance between caution and confidence continues to shift week by week.

Bottom line? The market isn’t panicking, but it’s definitely paying attention. This week will be all about the data, the tone from central banks, and whether geopolitics throws another curveball.