The Nasdaq-100 is back at all-time highs after a late-June tech surge. On July 9, the index climbed to 22,884 as chipmaker Nvidia soared — becoming the first U.S. company to cross the $4 trillion market cap mark amid renewed AI optimism. This rally has unfolded just as big-company earnings season kicks off and fresh Fed policy cues loom. The key question for traders: should we cheer the momentum, or start looking for cracks in the bull market?

But here’s the thing – whenever markets race ahead like this, it’s normal to ask: how much further can it go?

Looking at the Charts

On the surface, the Nasdaq-100 looks great. It’s broken past old resistance levels and is well above its average price over the last few months (what traders call the 50- and 200-day moving averages). That’s usually a sign of strength.

But dig a little deeper, and there are a few things worth watching.

One popular momentum indicator – the RSI, which helps track how fast prices are moving – is now above 70. That’s a zone where the market is considered “overbought.” It doesn’t always mean prices will fall, but it often signals that things have gotten a bit too hot, too fast.

There’s something else too: even though prices are rising, the number of people buying (measured by trading volume) has dropped off. In other words, fewer traders are getting involved – which can sometimes be a red flag.

Nasdaq-100 Daily: Breakout Above Trend Lines, But RSI Nears Overbought

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 16 July 2025.

So while the trend is clearly upward, there are some early hints that it might be time for a short pause.

Momentum Still Strong – But Not Without Risks

Let’s look at both sides.

The bull case: Tech earnings have been solid. The Fed hasn’t raised rates. And AI stocks – especially Nvidia – are still stealing the spotlight. Many investors believe there’s more room to run, especially if inflation stays low and company profits hold up. The optimism is real.

But on the flip side: Some signs suggest the rally might be running out of steam. The RSI hasn’t moved higher even as prices did – that kind of mismatch (called a divergence) often shows momentum is slowing down. And with fewer traders jumping in, it raises the question: is this rally being carried by just a few big names?

Nasdaq-100 Weekly: Momentum Slows as Volume Fades

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 16 July 2025.

It’s like watching a race where one runner is far ahead, but the rest of the pack isn’t following. Impressive, yes – but also a little lonely.

What Comes Next?

If the market does cool off, the next test will be around 21,700 on the Nasdaq-100 – that’s where it recently paused before jumping again. It also matches where the index has tended to find support in the past.

For the Nasdaq-100, the 50-day moving average (around 19,000) could be a key level. If prices dip there and bounce back, it’s a healthy pullback. But if momentum really fades – and tools like RSI drop below 50 – it might mean a deeper reset is on the way.

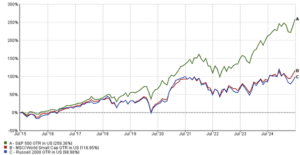

Nasdaq-100 Long-Term View: Trend Intact, But Key Support Levels in Focus

Source: TradingView. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 16 July 2025.

Bottom Line

This rally still has legs – but maybe not without a few stumbles. The trend is up, tech is strong, and AI is still the big story. But stretched momentum and slowing volume are reminders not to get carried away.

It’s not about calling the top. It’s about watching the signs. Markets move in waves – and right now, we may be near the top of one.