Economic Overview

Last week, investors were navigating a delicate balance between relief and risk. On one hand, US inflation data brought some welcome news – prices are rising more slowly than expected, giving the Fed more reason to hit pause on rate hikes. The CPI Index rose just 2.4% from a year ago, while core inflation also cooled. At the same time, jobless claims ticked higher, hinting that the red-hot labour market might be losing a bit of steam.

The global picture offered no clear narrative. In Europe, policymakers at the ECB hinted that rate hikes might soon be done, with inflation inching closer to their target. The UK, meanwhile, surprised with a drop in GDP – raising doubts about how long it can stomach high rates. Over in Japan, inflation remained persistent. Then, just as investors began to settle into the idea of slower tightening, news of Israeli strikes on Iran rattled markets. It was a sharp reminder that even when economic data looks calm, global risks can cut through in an instant.

Equities, Fixed Income, and Commodities

The week in financial markets played out like a two-act drama. Early optimism fuelled by cooling US inflation data and hopeful US-China trade talks pushed stocks higher. The S&P 500 neared record highs mid-week, and the Nasdaq-100 continued its rally as tech stocks surged on upbeat forecasts from names like Oracle. By week’s end, the mood had flipped. A sudden escalation in the Middle East sent oil prices spiking and drove investors toward safer ground, pulling equities lower.

The bond market echoed that anxiety. US Treasury yields fell, with the 10-year sliding to 4.40% (its lowest in weeks) as traders grew more confident the Fed might pause, or even cut, if growth slows.

Commodities surged into focus as Brent crude jumped above $78 on supply fears, despite no direct damage. Gold rose too ($3,433.47 per ounce), drawing safe-haven flows. The week’s early optimism gave way to caution, with markets reminded that calm can be fleeting – and geopolitical risks have a way of surfacing when least expected.

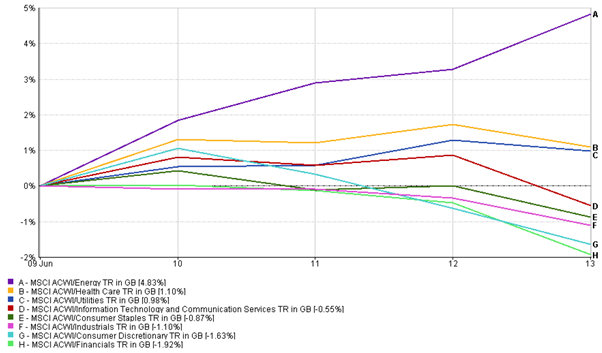

Sector Performance Updates

Investors rotated sharply across sectors last week in response to geopolitical flare-ups and cooling inflation. Energy led the pack with a +4.83% gain, fuelled by the surge in oil prices. Defensive sectors also saw renewed interest – healthcare rose +1.10%, and utilities added +0.98% as investors sought stability.

However, leadership in technology and communication services faded, with the combined sector dipping -0.55% as stretched valuations met a bout of profit-taking. Financials were the week’s worst performer, falling -1.92% as lower bond yields squeezed bank margins. Consumer discretionary slipped -1.63%, weighed down by mixed retail earnings and cautious spending outlooks. Industrials also ended in the red, down -1.10% despite strength in select defense names.

Sector Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 13 June 2025.

The rotation was telling: markets shifted away from growth and into resilience. With risks rising and economic momentum cooling, investors favoured sectors that tend to hold up better when volatility resurfaces.

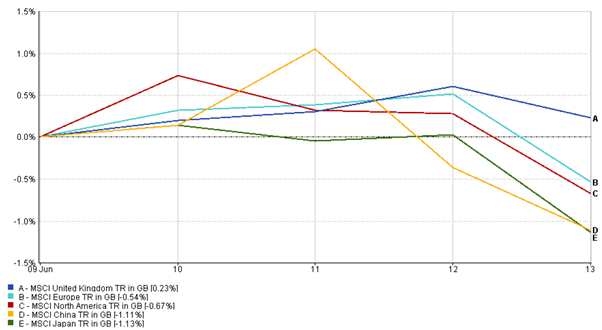

Regional Market Updates

Market performance diverged across regions last week, with rate expectations and geopolitical concerns shaping investor positioning.

In the US, early optimism from cooling inflation and tech strength faded by Friday. The MSCI North America index fell –0.67%, as safe-haven flows picked up and equities pulled back.

Europe also struggled. The MSCI Europe index slipped –0.54%, dragged down by soft retail earnings and renewed tariff concerns out of the US. Germany’s DAX and France’s CAC 40 both ended the week in the red.

The UK proved more resilient. The MSCI United Kingdom index gained +0.23%, supported by oil majors and large-cap defensive names. A weaker-than-expected GDP print strengthened the case for a BOE pause, lifting market sentiment midweek.

In Asia, the tone was cautious. The MSCI Japan index dropped –1.13%, hit by yen strength and auto tariff fears. Meanwhile, the MSCI China index fell –1.11%, as momentum from trade progress faded and tech stocks came under pressure.

Regional Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 13 June 2025.

All in all, global equities took a breather. Momentum from macro relief was ultimately overshadowed by renewed geopolitical risks.

Currency Market Movements

Currency markets reflected a familiar push-and-pull last week, as inflation data, central bank tone, and geopolitical tensions shaped FX flows.

EUR/USD advanced steadily, climbing to 1.1603 by June 14 – a +1.81% weekly gain. Softer US CPI data drove broad dollar weakness early in the week, while hawkish remarks from ECB President Lagarde helped support the euro near two-month highs. The pair briefly touched levels not seen since early April.

USD/JPY reversed course after testing multi-week highs. It opened at 144.89 and dipped to 143.00 by Friday, ending the week down -1.31%. Risk-off sentiment following Israel’s airstrike on Iran sparked haven demand for the yen, offsetting earlier pressure from US rate differentials.

GBP/USD rallied early but lost steam later. The pair rose to 1.3604 midweek before slipping back to 1.3551, posting a modest +0.05% gain. A weaker UK GDP print capped upside momentum, though a broadly softer dollar helped cushion the pound.

GBP/JPY tracked wider moves in both currencies. It opened at 193.84, spiked to a multi-year high above 196, but settled at 195.49 – still a +0.85% rise on the week. The move reflected underlying pound strength and late-week yen recovery as volatility picked up.

Market Outlook and the Week Ahead

Looking ahead, all eyes are on central banks. The US Federal Reserve meets this week, and while no interest rate change is expected, investors are hungry for clarity. Will the Fed simply pause – or hint that rate hikes are done for good? The tone of Fed Chair Jerome Powell’s press conference, as well as the updated “dot plot” of rate expectations, will be closely analysed for any shifts in strategy.

Overseas, BOJ and BOE also have decisions to make. Japan is likely to stay the course for now, but any signs of rising inflation could shake markets. The BOE faces a tougher dilemma – UK inflation is still high, but the latest GDP decline suggests the economy may be slowing too much to handle more tightening.

Economic data will also play a role. US retail sales, housing starts, and manufacturing surveys are all due. Globally, PMI data from Europe and Asia will offer more clues about economic momentum. And, of course, geopolitical developments remain a wildcard. If tensions in the Middle East escalate, volatility could return in force. For now, investors are hoping for a steady week – but staying alert to any surprises that might shift the narrative again.