Economic Overview

Markets stepped into June with a cautious sense of optimism. Investors found some breathing room as US inflation showed signs of easing. The Fed’s preferred inflation measure, core PCE, ticked down to 2.8% year-on-year—not perfect, but enough to suggest that more rate hikes might not be needed. Then came the US jobs report on Friday. It wasn’t a game-changer, but it showed solid footing: 139,000 jobs were added in May, slightly above forecasts, and the unemployment rate held steady at 4.2%. For many, that mix of cooling inflation and steady hiring was reassuring – growth may be slowing here, but it’s not falling off a cliff!

Inflation in the Eurozone finally slipped below the ECB’s target for the first time in years, with headline CPI landing at 1.9%. That gave the ECB the green light to cut rates, trimming its deposit rate by 0.25% to 2%. While President Christine Lagarde didn’t close the door on more cuts, she also hinted that the bulk of the easing cycle may be done.

In Japan, inflation in Tokyo came in a bit hotter than expected, but the BOJ kept its policy unchanged. The central bank seems content to wait for more consistent signs of rising prices before shifting course. Wrapping up the week, a phone call between US and Chinese officials helped calm nerves. Both sides struck a more cooperative tone, easing concerns about a potential flare-up in trade tensions.

Equities, Fixed Income, and Commodities

Global stocks closed the week higher, with investor sentiment lifted by stable economic data and signals that central banks are shifting toward a more measured policy stance. In the US, the Nasdaq-100 continued to lead gains(1.26%), driven by ongoing strength in big tech and AI-focused names. The S&P 500 (rose approx. 1.09%) briefly broke above the 6,000 mark after Friday’s jobs report came in better than expected, easing fears of a slowdown. The Dow also ended the week in positive territory(1.08%), helped by a rotation into cyclical stocks as risk appetite improved.

In Europe, equities advanced after the ECB delivered a widely expected rate cut, its first in several years. The Euro Stoxx 50 climbed, while Germany’s DAX reached new highs as inflation trends softened. UK markets posted more modest gains, weighed down by weaker commodity-linked sectors. Japan’s Nikkei 225 took a breather after a strong run, slipping slightly as some investors locked in profits.

Bond markets saw yields tick higher. US Treasury yields jumped after the solid jobs data dampened hopes for an imminent Fed rate cut, with the 2-year yield moving back above 4%. UK gilts remained firm, while German bund yields edged down following the ECB’s dovish tone.

Commodities were mixed. Oil prices fell early in the week after OPEC+ signalled a ramp-up in production, briefly pushing Brent crude below $62. But prices later rebounded as optimism around US-China trade talks helped shore up demand expectations. Gold eased from recent highs as investors booked profits, with rising yields and a stronger dollar denting its appeal – though it continues to trade near historic levels as a hedge against uncertainty.

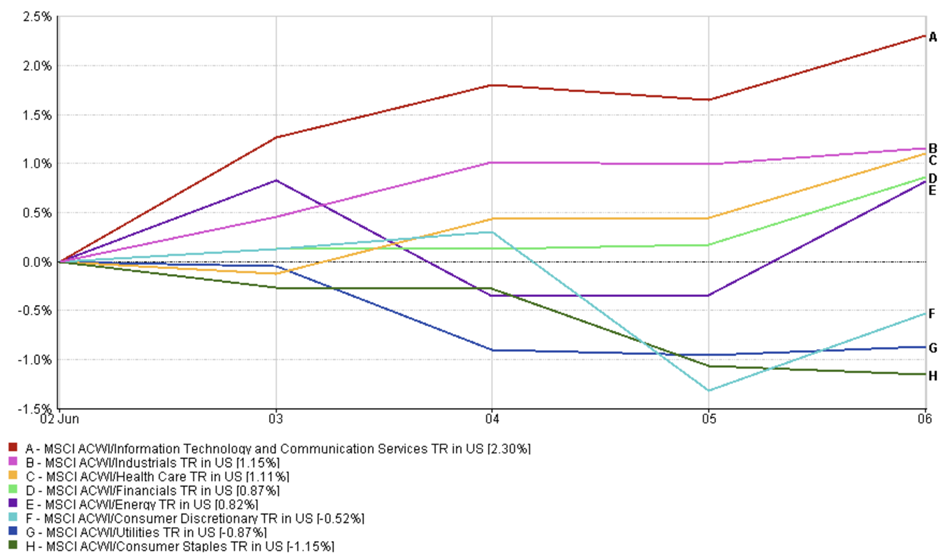

Sector Performance Updates

Technology stayed at the top of the leaderboard last week, with the MSCI Information Technology and Communication Services sector climbing 2.3%. Investors continued to favour innovation-led names, especially with AI and cloud computing staying firmly in the spotlight. Stocks like Meta and Alphabet helped drive Communication Services higher as well, riding that same wave of tech enthusiasm.

Meanwhile, more traditional growth sectors held their own. Industrials rose 1.15%, and Healthcare added 1.11%, both benefiting from investor rotation into segments with steady earnings and global exposure. Financials also gained ground, up 0.87%, supported by rising bond yields that tend to improve bank margins. Energy stocks edged up 0.82%, recovering some footing despite earlier pressure from OPEC+’s production hike announcement.

Sector Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 6 June 2025.

On the other hand, defensive sectors struggled. Consumer Discretionary slipped -0.52%, surprising given recent retail strength, while Utilities and Consumer Staples dropped -0.87% and -1.15%, respectively. As yields pushed higher, investors moved out of bond-proxy sectors and into more cyclical areas with stronger growth potential.

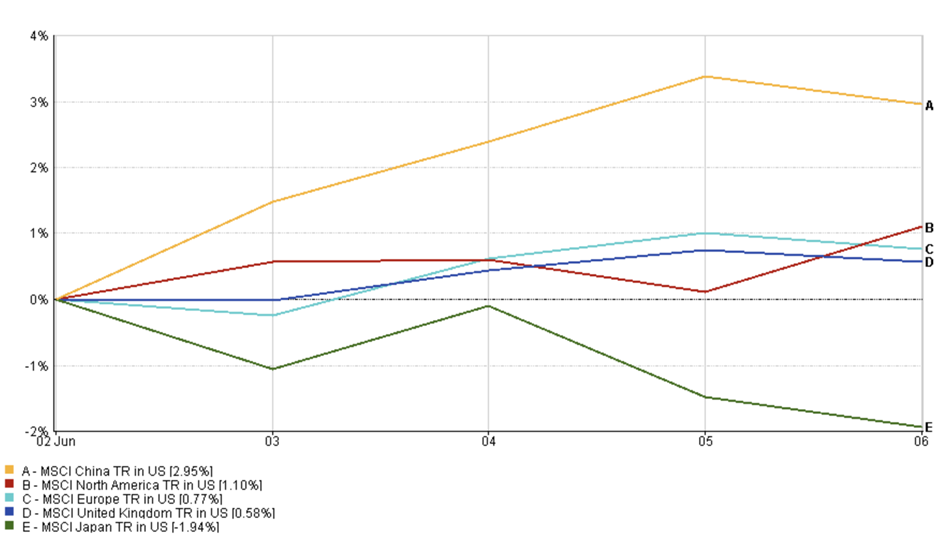

Regional Market Updates

Regional equity performance showed a clear split between emerging and developed markets. China took the lead, with the MSCI China index gaining a notable +2.95%, helped by renewed stimulus hopes and easing trade rhetoric with the US North American markets also extended their upward trend, with the MSCI North America index rising +1.10%, driven by tech sector strength and solid macro data.

European equities posted a smaller but steady gain. The MSCI Europe index climbed +0.77%, as investors welcomed the ECB’s rate cut and further signs of cooling inflation. In the UK, the MSCI United Kingdom index rose +0.58%, helped by resilience in large-cap consumer and healthcare names despite some commodity-related headwinds.

Japan was the only major outlier this week. The MSCI Japan index fell –1.94%, breaking its recent winning streak. A lack of fresh catalysts, along with profit-taking and softer sentiment around trade developments, weighed on Tokyo-listed stocks.

Regional Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 6 June 2025.

Currency Market Movements

Currency markets had a relatively quiet but telling week, as traders responded to a mix of central bank decisions, inflation data, and shifting rate expectations.

EUR/USD eased slightly, slipping to 1.1395 by June 6 – a weekly drop of -0.33%. The euro got an early lift ahead of the ECB’s rate decision, but that momentum faded fast once the expected cut and dovish tone landed, keeping further gains in check.

USD/JPY saw a stronger pusd; up +1.50% on the week. US yields bounced after Friday’s jobs surprise, and that gave the dollar the upper hand. Even a hotter Tokyo CPI print couldn’t save the yen, as markets still aren’t convinced the BOJ is ready to shift gears.

GBP/USD was more range-bound. It opened at 1.3544 and closed just a shade lower at 1.3525, down -0.14%. The pound got some support from strong UK services data and tariff relief headlines, but dollar strength after the US labour report kept it from breaking out.

GBP/JPY continued its quiet grind upward, starting the week at 193.30 and finishing at 195.94, gaining a solid +1.37% gain. The move reflected the broader theme – modest pound resilience paired with ongoing yen softness. The pair briefly hit its highest levels since 2015.

Market Outlook and the Week Ahead

As we move into mid-June, investor attention is squarely focused on two things: inflation data and the Fed’s next move. The upcoming US CPI report will likely set the tone – if inflation shows further signs of easing, it could solidify expectations that the Fed will keep rates on hold. That said, a hotter print or a surprise uptick in wage pressures could quickly complicate the narrative.

The Fed is expected to stay put at next week’s meeting, but with the economy still showing signs of resilience, markets will be watching the tone of the press conference just as closely as the decision itself. Meanwhile, fresh reads on ISM manufacturing and services should offer insight into how US businesses are weathering the current environment.

Globally, central banks remain in play. The Bank of Canada (BOC) and BOE are both facing mixed data backdrops, and any shift in tone could influence currency and rate markets. The BOJ is also on the radar, especially with the yen under pressure and inflation running warm in Tokyo.

Beyond economics, geopolitics could stir the pot. US–China trade talks are set to resume, and any unexpected breakthrough – or setback – could ripple through global markets. With summer trading kicking in and volumes typically lighter, sentiment could remain upbeat if the data cooperates. But investors aren’t letting their guard down just yet – volatility still lurks beneath the surface, and markets know how quickly the mood can turn.