Economic Overview

Investors stepped into the final week of May feeling cautiously optimistic. Inflation seemed to be cooling, and consumers were still spending steadily — a combination that gave markets a bit more stability. Early in the week, confidence picked up after the US decided to delay new tariffs on European goods, which many saw as a positive sign for global trade. But that boost didn’t last long. Midweek, the tone shifted as the US renewed threats of tougher action against China, bringing trade tensions back into focus and weighing on market confidence. Meanwhile, the US Fed kept its patient stance. A key inflation reading — the core PCE index — came in slightly lower than expected, reinforcing the idea that the Fed may lower interest rates later this year if inflation continues to ease.

In Europe, inflation also moved in the right direction. Both Germany and Spain reported slower price increases, strengthening the case for the ECB to consider cutting rates as soon as June. Japan, however, saw the opposite. Prices in Tokyo rose more than expected, leading some to wonder if the BOJ might need to tighten policy sooner than planned. Over in China, economic data remained weak, with signs of sluggish growth and little new stimulus from policymakers. Still, despite the uneven backdrop, the broader message to markets was fairly reassuring: inflation pressures are easing in many major economies, and while global growth isn’t particularly strong, it hasn’t come to a halt either.

Equities, Fixed Income, and Commodities

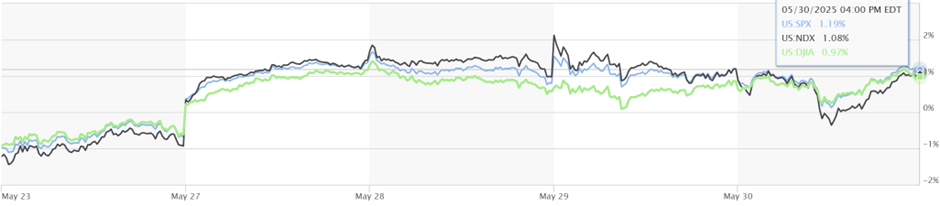

Stock markets saw modest gains last week, driven largely by strength in US technology stocks. The Nasdaq-100 climbed 1.01%, boosted by ongoing demand for AI-related names, with Microsoft hitting a new all-time high and NVIDIA extending its rally. The S&P 500 rose 1.19%, and the Dow Jones added 0.97%, though both eased slightly toward the end of the week amid renewed US–China trade concerns.

Outside the US, equity performance was mixed. Some developed markets benefited from currency moves and improving corporate results, while others struggled with softer sentiment. In Asia, investor caution persisted amid limited policy support and ongoing geopolitical concerns.

Index Performance

Source: MarketWatch. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 30 May 2025.

Bond markets strengthened as investors became more confident that interest rates could start coming down. In the US, the 10-year Treasury yield dropped to 4.40% and the 2-year yield slipped to 3.90%, reflecting growing expectations for a Fed rate cut later this year. UK bond yields also declined, as BOE officials hinted at moving slowly on any further policy changes. In Germany, lower-than-expected inflation led to falling government bond yields and stronger bets that the ECB could cut rates as soon as June.

Meanwhile, commodity markets were mixed. Oil prices dipped slightly, with Brent closing at $65.23 a barrel and WTI at $61.95, as rumours swirled that OPEC+ might ease production limits. Gold closed at $3,287 per ounce, helped by cooling inflation and a small drop in the US dollar, which brought back some interest in safe-haven assets.

Sector Performance Updates

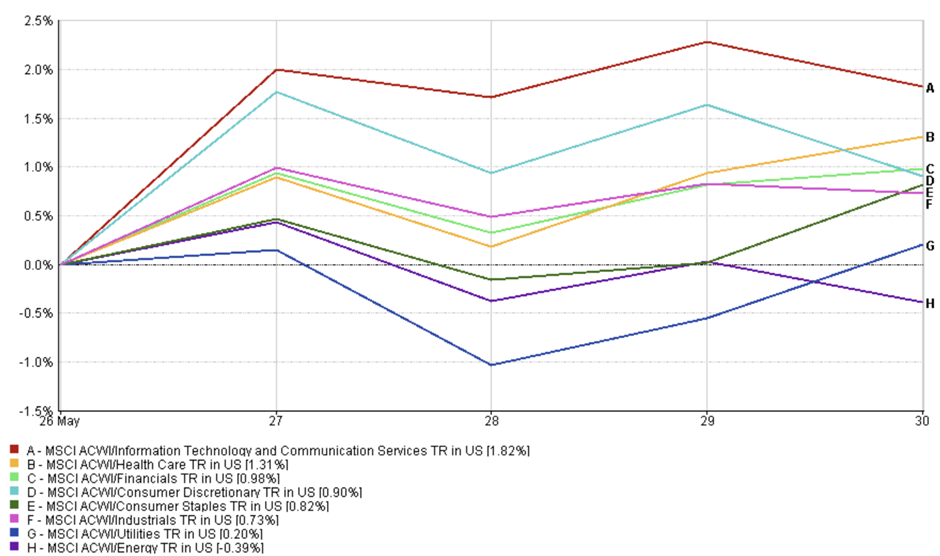

US markets showed a healthy mix of risk-taking and defensiveness last week. The biggest gains came from the Information Technology and Communication Services sector, which rose +1.82%. Investors continued to pile into AI-related names and digital infrastructure plays, reflecting ongoing enthusiasm around innovation and earnings momentum in big tech. Not far behind, Healthcare gained +1.31% — a classic defensive sector that tends to hold up well during uncertain periods. Its strength this week likely reflected investors’ desire for more stable, cash-generating companies amid a still-fragile macro backdrop.

Sector Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 30 May 2025.

Financials and Consumer Discretionary also posted decent gains, both up around +1%. Easing concerns about an economic slowdown likely supported these more cyclical sectors, as inflation cooled and recession chatter softened. Consumer Staples, another defensive corner of the market, added +0.82%, suggesting that investors were still hedging their bets despite the improved mood. Utilities only gained a modest +0.20%, perhaps due to their sensitivity to rising yields earlier in the month. The only sector that lost ground was Energy, down –0.39%, as oil prices wobbled and OPEC+ meeting uncertainty kept traders cautious. Overall, the market showed a preference for quality — strong fundamentals with stable earnings — while still participating in tech’s continued leadership.

Regional Market Updates

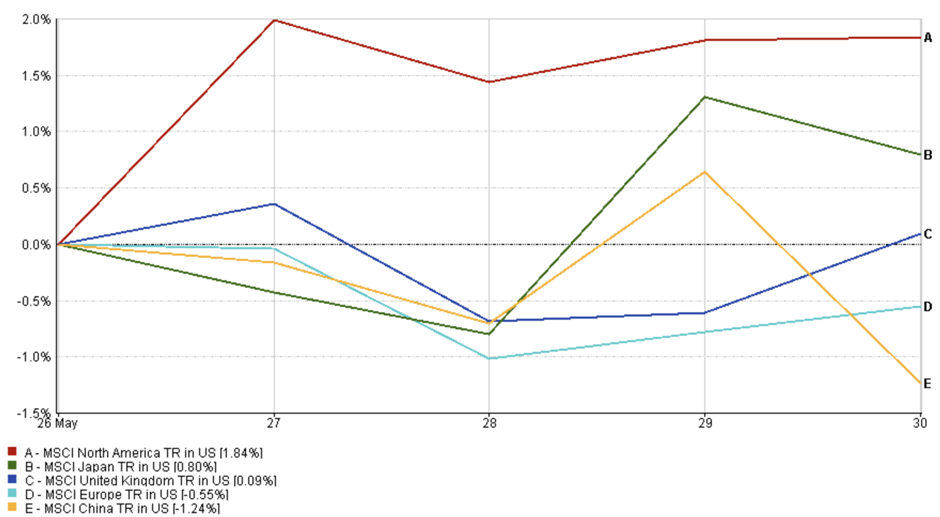

Regionally, North America led the way. The MSCI North America index climbed +1.84% for the week, helped by strong tech sector performance and improving sentiment around inflation. Japan also posted solid gains, with MSCI Japan up +0.80%, as a weaker yen and the BOJ’s patient policy stance supported equity markets. In the UK, the MSCI United Kingdom index inched up just +0.09%, reflecting limited movement amid mixed economic signals.

Europe underperformed. The MSCI Europe index slipped –0.55%, as softer inflation reinforced expectations for ECB rate cuts but wasn’t enough to lift overall market sentiment. China was the weakest of the group, with MSCI China down –1.24% for the week. Concerns over weak economic data and a lack of fresh stimulus continued to weigh on investor confidence.

Regional Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 30 May 2025.

Currency Market Movements

Currency markets were relatively stable this week, with modest moves reflecting diverging central bank outlooks and mixed inflation signals.

EUR/USD slipped mildly, opening at 1.0853 on May 26 and closing at 1.0820 by May 30 — a weekly loss of -0.30%. The euro eased as softer inflation data from Germany and Spain reinforced expectations of a ECB rate cut in June.

USD/JPY climbed from 156.55 to 157.30, marking a +0.48% weekly gain. Despite a hotter Tokyo CPI print, the yen remained under pressure as markets doubted the BOJ would tighten policy aggressively in the near term.

GBP/USD stayed largely unchanged, opening at 1.2735 and finishing at 1.2740 — up just +0.04%. The pound held firm after the BOE reiterated a data-dependent stance, with no new policy surprises.

GBP/JPY moved higher as well, starting at 199.40 and ending at 200.20, gaining +0.40% over the week. Modest pound strength combined with ongoing yen softness helped lift the pair.

Overall, currency markets remain in wait-and-watch mode, with central bank divergence, inflation data, and geopolitical risks continuing to shape direction across major FX pairs.

Market Outlook and the Week Ahead

Last week’s economic data helped calm nerves in the markets. In the US, the Fed’s go-to inflation measure showed price growth slowing again — with core inflation at 2.8%. That’s good news for investors hoping the Fed won’t need to raise interest rates again. At the same time, consumer spending showed signs of slowing a bit, even as incomes continued to rise, suggesting Americans are becoming more cautious. Jobless claims remained low, and consumer confidence improved slightly, pointing to a still-healthy economy. In Europe, inflation in Germany and Spain also cooled more than expected, which made markets even more confident that the ECB will cut interest rates in early June. Meanwhile in Japan, inflation in Tokyo came in hotter than expected — but the BOJ still signalled it’s not rushing to tighten policy anytime soon.

Looking ahead, investors are focused on several key events that could shape the next move in markets. The big one is Friday’s US jobs report — a strong number might delay rate cuts, while a weaker one could bring them closer. Earlier in the week, fresh updates on how American businesses are doing (through ISM manufacturing and services data) will also be closely watched. In Europe, attention turns to the ECB’s meeting on June 6th, where a rate cut now looks very likely. Canada’s central bank also meets this week and could surprise markets depending on how they respond to recent economic data. Finally, oil markets may see some early-week volatility as traders react to the outcome of the weekend’s OPEC+ meeting. While falling inflation and steady growth are encouraging, geopolitical tensions and the slower summer season could still bring bumps along the way. For now, though, the market mood remains cautiously optimistic.