The dollar’s dominance has been baked into every global market story for years, but lately it feels like the headline may be changing. After a long stretch of strength, driven by Fed rate hikes and flight-to-safety momentum, things are cooling off. So, the big question: is the dollar still overvalued, or are we just settling into a new norm?

It remains the world's reserve currency, no doubt. But when the wind shifts, i.e. when inflation slows and central banks tighten similarly, the greenback’s premium is worth re-examining. And that’s exactly what analysts are doing now, sifting through numbers and asking: is it still too expensive?

How Do We Actually Value a Currency?

There’s no earnings report or balance sheet for a currency, unlike stocks and equities. So how do you know if the dollar is too strong? It comes down to real-world comparisons.

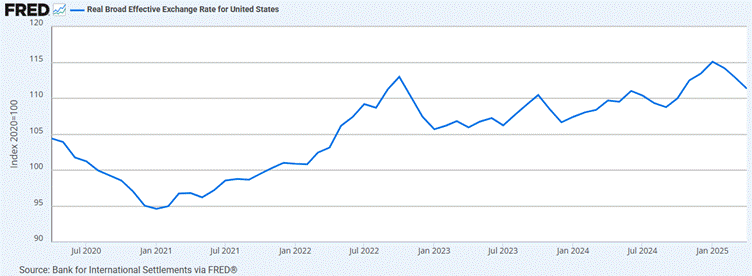

One way to check if a currency like the dollar is getting ahead of itself is to look at something called the Real Effective Exchange Rate, or REER. It’s a tool economists use to figure out how the dollar stacks up against other major currencies, but with some key adjustments – like inflation and trade relationships. Basically, it asks: how expensive has the U.S. dollar become in real-world terms?

Right now, the REER is at 111.4, which is still pretty high. It has come down a bit – March was 112.9 – but the dollar hasn’t fully cooled off. A strong REER might sound like a win, but it can be a problem too. If the dollar’s too pricey, U.S. goods become harder to sell overseas. And when that happens for long enough, investors start to think the currency might be riding too high and due for a correction.

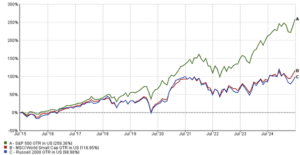

US Real Broad Effective Exchange Rate (REER)

Source: Bank for International Settlements via FRED® (Federal Reserve Bank of St. Louis). Index base = 100 (Year 2020). The REER adjusts the dollar’s value for inflation and trade-weighted averages against major partners. A value above 100 indicates strength relative to the 2020 benchmark.

Another way to look at currency value is through Purchasing Power Parity, or PPP. Think of it like this: if the same meal costs way more in New York than it does in Berlin, the dollar might be a little too strong. It’s a way to compare how much real stuff money can buy in different countries. Now, it’s not a flawless system – local wages, taxes, and even consumer habits can throw it off – but it gives a decent baseline. Right now, the dollar looks moderately overpriced against several major currencies, and even more so when compared to others like the yen or the pound. When that price gap stays wide for too long, it’s often seen as a signal that the currency is out of sync with economic fundamentals.

Put together, these indicators give you a feel for whether the currency has floated too far off course.

Has the Dollar Peeled Back Yet?

In 2025, the answer is: not by much – but yes, a bit. The DXY index, which tracks the dollar’s value against a mix of major currencies, has dropped around 10-11% YTD. That’s a decent move, especially considering how strong it’s been in recent years.

Right now, the DXY is trading at exactly 99, which puts it just below its long-term average of around 100. So yes, the dollar has come down – but not by much. It’s no longer sitting at inflated levels, but it’s not undervalued either. In short: it's softened, not slumped.

US Dollar Index (DXY) with Moving Averages YTD (Jan to May)

Source: TradingView. All indices are total return in US dollars. Data as of 26 May 2025.

Whether this marks the start of a broader decline or just a temporary dip depends on what happens next with inflation, interest rates, and global demand for safe-haven assets.

Why This Matters to You

If you’re exposed to foreign markets, a weakening dollar is great news. It boosts returns when overseas gains get converted back to USD. Exporters benefit too – US products become cheaper abroad, potentially lifting revenues.

Emerging market investors also breathe easier with a softer dollar. It reduces debt repayment pressures and encourages capital inflows. But a word of caution: the dollar could easily spike again if risk suddenly picks up (think geopolitical news or Fed surprises). It's still a volatile road ahead.

Views from the Top

Several institutional outlooks reflect a more measured view on the dollar’s direction. J.P. Morgan has noted that a softer dollar could be a theme to watch in 2025, particularly if rate differentials continue to narrow. Goldman Sachs has pointed out that the dollar’s valuation may come under pressure if fiscal risks remain elevated. Meanwhile, data from the Bank for International Settlements shows that while the dollar’s real effective exchange rate remains above its long-term average, recent movements suggest a gradual moderation rather than a sharp reversal.

Conclusion: What Comes Next

In summary, the dollar still appears slightly overvalued, but not significantly so. Its global role and relative economic strength continue to offer support, even as some indicators point to a gradual moderation in valuation.

For investors, this environment opens the door to selective opportunities – particularly in global equities, export-oriented sectors, and emerging markets that tend to benefit from a softer dollar. For currency traders, it presents a chance to capitalize on volatility and shifting rate differentials, especially as the dollar adjusts to evolving macroeconomic signals and central bank policies.

That said, short-term fluctuations shouldn’t be ruled out. Shifts in monetary policy, economic data surprises, or geopolitical developments could all influence the currency’s path in the near term. Over the longer horizon, the fundamentals suggest a more balanced dollar is likely to emerge.