How Inflation Impacts Your Investment Portfolio

The term inflation represents more than a simple buzzword because it functions as a vital economic force which reduces investment value through time. The current worldwide economic situation makes it essential to grasp inflation’s effects as of May 2025.

What Is Inflation?

The general rise in prices of goods and services over time leads to a decrease in the purchasing power of money. For example, if the inflation rate is 3%, an item that costs $100 today would cost $103 a year later. This gradual rise in prices means that the same amount of money buys fewer goods and services over time.

Use this calculator to understand how inflation affects purchasing power over time. For example, see how the value of $100 from a previous year compares to today’s dollars.

The Erosion of Purchasing Power

Investments face substantial damage from inflation because it reduces the value of money. High inflation rates reduce the actual worth of investment returns even when your investments generate positive returns. The real return on your investment becomes 1% when your investment earns a 5% return, but inflation reaches 4%. Over time, this can significantly impact your wealth accumulation goals.

Current Economic Climate

As of May 2025, the global economy is experiencing a complex mix of slowing growth and persistent inflation – a scenario often referred to as “stagflation.” The US Federal Reserve along with other central banks maintains constant interest rates because they want to address inflation growth while avoiding rising unemployment rates. The economic situation has become more challenging because of new tariffs which have raised expenses for both businesses and consumers.

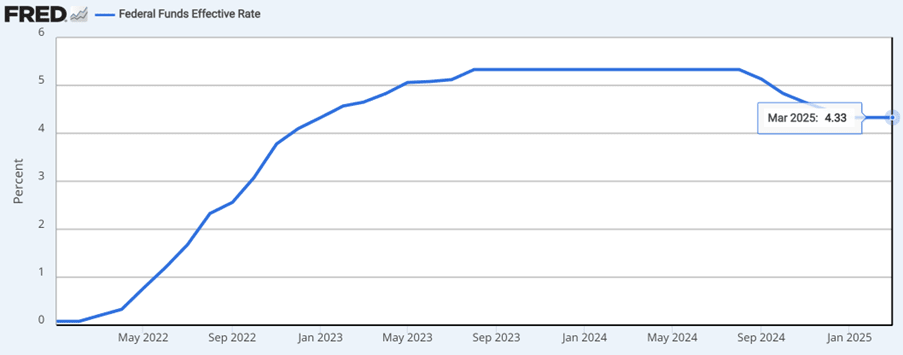

Federal Funds Rate Trends (2022-2025)

Source: Board of Governors of the Federal Reserve System (US) via FRED®.

Data as of 31 March 2025.

Impact on Different Asset Classes

Cash and Savings Accounts

Traditional savings accounts along with cash holdings face the highest risk from inflationary conditions. The low-interest rates of these savings options do not match inflation rates which causes their purchasing power to decrease gradually.

Bonds

Bonds with fixed income payments lose value during periods of inflation. The value of bond interest payments decreases when inflation increases because their fixed amounts lose purchasing power. The central bank’s inflation-fighting interest rate hikes result in lower bond prices for investors.

Stocks

Equities tend to provide protection against inflation through companies that successfully transfer elevated costs to their consumers. The rising inflation rates create two challenges for businesses because they increase both production expenses and interest rates which might reduce profit margins and impact stock market values.

Real Estate

Real estate functions as an excellent inflation protection mechanism because property values and rental rates increase which maintains the actual worth of real estate investments. Higher interest rates create increased borrowing expenses that could reduce real estate market demand.

Commodities

During inflationary times commodities such as gold and oil tend to increase in value. The rising prices of goods directly result in higher raw material costs which makes commodities useful for protecting against inflation.

Strategies to Mitigate Inflation Risk

The following strategies will help you shield your investment portfolio from inflationary damage:

- Diversification: Your investment portfolio should include different asset classes to manage risk and increase return potential.

- Invest in Inflation-Protected Securities: Treasury Inflation-Protected Securities (TIPS) function as inflation-indexed securities which increase their principal value according to inflation rates thus maintaining purchasing power.

- Focus on Growth-Oriented Investments: Invest in stocks that demonstrate strong growth potential because they tend to perform better than inflation during extended periods.

- Consider Real Assets: Investments in real estate and commodities can provide a buffer against inflation.

- Review and Adjust: Regular portfolio assessments should be performed to make necessary adjustments based on shifting economic conditions.

Conclusion

Economic cycles naturally include inflation but investors who understand proper strategies can effectively control its effects on their portfolios. Your financial future will remain protected from price inflation through proper asset understanding and strategic investment adjustments.