Economic Overview

Last week’s macro backdrop showed cooling inflation but softening demand. US retail sales unexpectedly declined by 0.9% in May — the biggest drop in four months — hinting at consumers pulling back amid high rates and lingering price pressures. Other reports, like slower factory activity and a dip in homebuilder confidence, added to the sense that the US economy is losing a bit of steam. Jobless claims also stayed on the higher side, suggesting the job market isn’t as strong as it was earlier this year. On the bright side, inflation seems to be cooling off — consumer prices in May rose just 2.4% compared to last year, and core inflation (which excludes food and energy) came in at 2.8%. That’s a big improvement from the highs we saw over the past couple of years and gave the Fed enough breathing room to keep interest rates unchanged for now.

In Europe, headline inflation returned to the ECB’s 2% target, prompting a June rate cut. However, eurozone growth remains sluggish. The UK faces more persistent inflation — CPI jumped to 3.4% — yet the BoE held rates, citing slowing growth and signs of labour softening.

Geopolitical uncertainty and potential energy shocks remain key concerns globally, with central banks adopting a more data-driven, cautious stance.

Equities, Fixed Income, and Commodities

Equity markets endured a choppy week, pressured by conflict in the Middle East and cautious central bank updates. The Nasdaq-100 and S&P 500 fell 1%, while Europe’s Euro Stoxx 50 shed nearly 2%, its worst two-month performance. The FTSE 100 dropped 1%, and Japan’s Nikkei retreated. Stocks plunged early in the week on rising oil prices and conflict escalation, but steadied midweek as the Fed paused rates.

In bonds, US Treasury yields ended mostly flat — the 10Y held near 4.38%, while 2Y slipped to 3.91% as markets priced in modest Fed cuts later this year. UK gilt yields fell after the BoE held rates and three members voted for a cut, signalling policy shift. Eurozone yields remained subdued post-ECB easing.

In commodities, oil surged early on Middle East tensions and a steep US inventory drawdown, before retreating late week on de-escalation hopes. Brent gained over 3.5% last week. Meanwhile, gold hovered near record highs ($3,450/oz), supported by haven flows and lower yields.

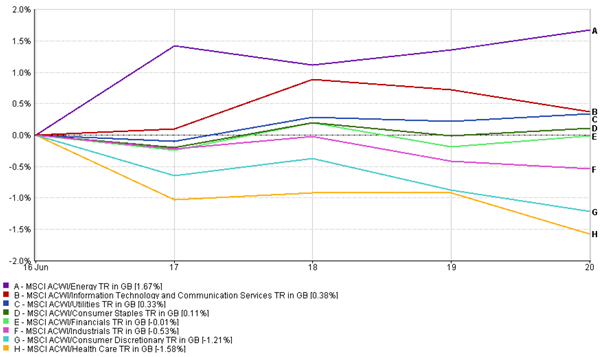

Sector Performance Updates

Last week saw a clear shift toward safety as markets reacted to geopolitical tension and oil price spikes. Energy stocks came out on top, rising +1.67% thanks to strong gains in crude and renewed interest in defense-linked plays. Utilities (+0.33%) and consumer staples (+0.11%) also held up well — typical go-to areas when investors get a bit more cautious.

On the flip side, higher-growth and cyclical sectors struggled. Consumer discretionary names dropped -1.21%, likely due to rising travel costs and oil-related pressure, while healthcare fell the most, sliding -1.58% on broad selling across the board. Financials and industrials were slightly in the red, down -0.01% and -0.53%, respectively.

Sector Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 20 June 2025.

Interestingly, tech and communication services managed a small gain (+0.38%) but didn’t lead the charge like they often do — a sign that profit-taking and valuation concerns are starting to kick in. Overall, it was a defensive week, with investors leaning more toward resilience and yield than growth and risk.

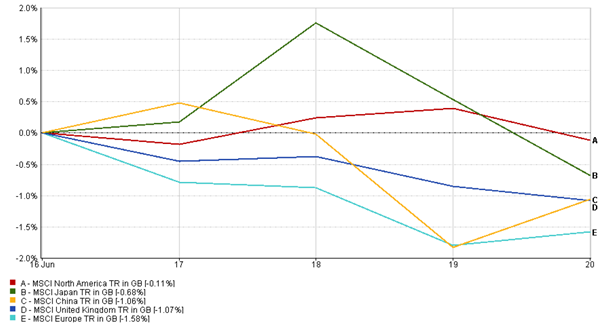

Regional Market Updates

US stocks outperformed peers last week, with the MSCI North America (-0.11%) Index holding relatively steady as investors favoured US markets during global uncertainty.

In Europe, the MSCI Europe Index dropped 1.58%, led lower by cyclicals and rising macro risks.

The MSCI Japan Index also fell (0.68%), dragged by geopolitical jitters and a pullback in exporters. Some late-week relief from easing Middle East tensions helped limit further losses, but rebounds were modest.

The MSCI UK Index declined 1.07%, pressured by a stronger pound and risk-off sentiment following the BoE’s policy meeting.

China underperformed too, with the MSCI China Index struggling (-1.06%) amid mixed data and soft sentiment.

Overall, regional equities ended the week in the red, but sensitivity to geopolitical events and policy signals varied across markets.

Regional Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 20 June 2025.

Currency Market Movements

It was another busy week in the currency markets, with war concerns, central bank updates, and shifting interest rate expectations all playing a part.

The US dollar gained ground as investors looked for safety during the midweek turmoil. Plus, the Fed’s message that rates will stay higher for longer gave the dollar even more support.

The euro (EUR/USD) slipped to around 1.147 midweek as the dollar strengthened, before bouncing slightly to 1.150 by Friday. It’s still under pressure after the ECB’s recent rate cut and signs it might pause for now.

The British pound (GBP/USD) had a tougher time. It dropped from 1.36 to 1.345 after weak UK data and a dovish BoE tone — three policymakers even voted for a rate cut, which weighed on the pound.

The Japanese yen (USD/JPY) moved in both directions. It briefly strengthened when tensions in the Middle East escalated but later fell sharply after Japan’s central bank stuck to its very loose monetary policy. By the end of the week, the yen was trading at 146 per dollar — its weakest point this year.

The GBP/JPY pair ended the week more or less where it started, around ¥196.5, as pound weakness offset the yen’s swings.

All in all, the dollar came out on top thanks to safe-haven demand and strong US interest rates, while other currencies struggled with more cautious or weaker outlooks.

Market Outlook and the Week Ahead

As we head into the final week of June, things may quiet down on the central bank front — but don’t expect markets to fully relax just yet.

The biggest wildcard remains the Israel–Iran conflict. Any signs of escalation or, on the flip side, progress toward peace could quickly shift market mood, especially when it comes to oil prices and investor appetite for risk.

On the economic side, all eyes will be on a batch of fresh data. Flash PMI reports from the US, UK, Eurozone, and Japan (due mid-week) will offer a real-time check on how businesses in manufacturing and services are holding up. In the US, we’ll also get updates on the Core PCE inflation reading on Friday. This is the Fed’s go-to inflation metric, and if it comes in low, it could strengthen the case for rate cuts later this year.

With markets still hovering near recent highs, even small surprises — whether from economic data or geopolitics — could trigger big moves. Investors will be keeping a close watch, ready to react quickly in what’s shaping up to be a data-packed and potentially volatile week.