The EUR/USD currency pair stands at 1.1242 after rising from its lowest point in May at 1.1066. Market participants assess if the recent price increase indicates a new upward trend because of central bank differences or represents a brief market fluctuation.

Let’s now look at the technicals and the macro forces behind this move to gauge what might come next.

Big Picture: Diverging Central Banks, Diverging Paths

EUR/USD’s latest rally reflects growing speculation about a widening policy gap between the ECB and the Fed.

The ECB continues to maintain a dovish sentiment, indicating additional rate cuts as inflation cools in the eurozone. Meanwhile, the Fed maintains a hawkish stance, holding interest rates steady because of ongoing inflation and tariff issues, and a strong US labour market.

As of May 14, 2025, EUR/USD is trading around 1.1242, slightly below a key level of 1.1378 where the price has struggled to move higher in the past. If the euro rises above this point and stays there, it could climb further toward its April high of 1.1574 or even the important round number of 1.1600. But if it loses steam, the price could fall back to earlier support levels around 1.1065 – or drop even lower toward 1.0794, which is where the average price has been over the last 200 days.

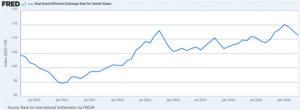

EUR/USD: YTD Price (Jan to May 2025)

The euro started the year below 1.09, rallied steadily through March and April, and is now trading around 1.1242 in May. This move reflects both weakening US economic momentum and recalibrated ECB expectations.

Source: Investing.com. Past performance is not a reliable indicator of future performance. Data as of 14 May 2025.

Recap of What’s Driving the Move

- Easing Signals from the ECB: ECB officials have suggested they might lower interest rates further. The euro would normally weaken when interest rates are lowered but investors believe the overall economic outlook is improving which offsets this effect.

- Weaker US Economic Data: The recent US employment and inflation data reports came in weaker than expected. The dollar weakened as a result of these reports which strengthened the euro.

- Stronger Business Activity in Europe: European business surveys delivered better-than-expected results which indicates that the economic performance of the region exceeds initial assessments.

- Investor Sentiment: The euro's expected rise indicates growing market confidence, but this optimism makes the market more vulnerable to sudden reactions if actual results differ from expectations.

Support and Resistance Levels to Watch

- Support Zones: 1.1065 (May low), 1.1028 (55-day SMA), and 1.0794 (200-day SMA)

- Resistance Zones: 1.1378, 1.1575 (April high), and 1.1600 (psychological level)

The current market situation is defined by these levels. A successful breakout above 1.1378 would draw new bullish market participants but a failure to break through this level could result in a price reversal.

Key Technical Indicators

- MACD (Moving Average Convergence Divergence): The MACD indicator demonstrates upward momentum, but this momentum is gradually decreasing. A further weakening trend could indicate that the euro will begin to decline.

EUR/USD: MACD and RSI Indicators (Snapshot as of 14 May 2025)

Source: Tradingview .com. Data as of 14 May 2025.

- RSI (Relative Strength Index): The RSI is currently around 39 suggesting that recent upward momentum is fading. A fall below 30 on the RSI indicator would mean that the euro has dropped significantly too quickly, and could be due for a bounce back.

- Volume: Trading volume has thinned as EUR/USD approached 1.1242. For a breakout at 1.1378, we’ll need confirmation via rising volume – especially from institutional flows.

Bottom Line: Euro’s Momentum Is Real – But Not Unstoppable

EUR/USD has rallied on a compelling narrative of central bank divergence and improving eurozone data — but it faces critical resistance just ahead. Traders should prepare for both a potential breakout and a consolidation scenario.

Key Takeaways:

EUR/USD is trading near 1.1242, up from recent lows of 1.1066.

Resistance lies at 1.1378 and 1.1600, with support near 1.1065 and 1.0794.

MACD momentum is fading, RSI is neutral, and volume is not yet confirming a breakout.

Watch for macro movers – particularly Fed and ECB speeches – in the days ahead.

As always, focus on levels, not predictions. Stay nimble and watch for confirmation. The euro’s next chapter could be just getting started.