Economic Overview

Markets showed cautious optimism last week, supported by strong company earnings and signs of easing global tensions. Mid-week, progress in trade discussions and better-than-expected financial results helped lift investor confidence. However, ongoing concerns about inflation and the possibility of interest rate changes kept markets from making a full recovery. It was a week where positive signals were met with careful caution.

Equities, Fixed Income, and Commodities

The US stock market showed a small decline throughout the week. The S&P 500 index dropped 0.5% to finish at 5,659.91 while the Dow Jones Industrial Average decreased 0.3% to 41,249.38. The Nasdaq Composite showed minimal movement when it increased by 0.78 points to 17,928.92. Market sentiment remained cautious because of both trade disputes and the upcoming inflation data release.

The US Treasury yields showed minimal changes during the entire week. The 10-year yield stayed at 4.37% because investors maintained a balance between seeking safe-haven investments and taking risks while waiting for additional economic data.

Gold prices saw fluctuations, with spot prices closing at $3,314.74 per ounce on May 9, marking a 1.85% decline for the day. Despite the dip, gold remains a favoured asset amid economic uncertainties.

Oil markets experienced volatility due to global supply concerns and trade dynamics. West Texas Intermediate crude settled at $61.02 per barrel on May 9, reflecting a rebound from earlier lows in the week.

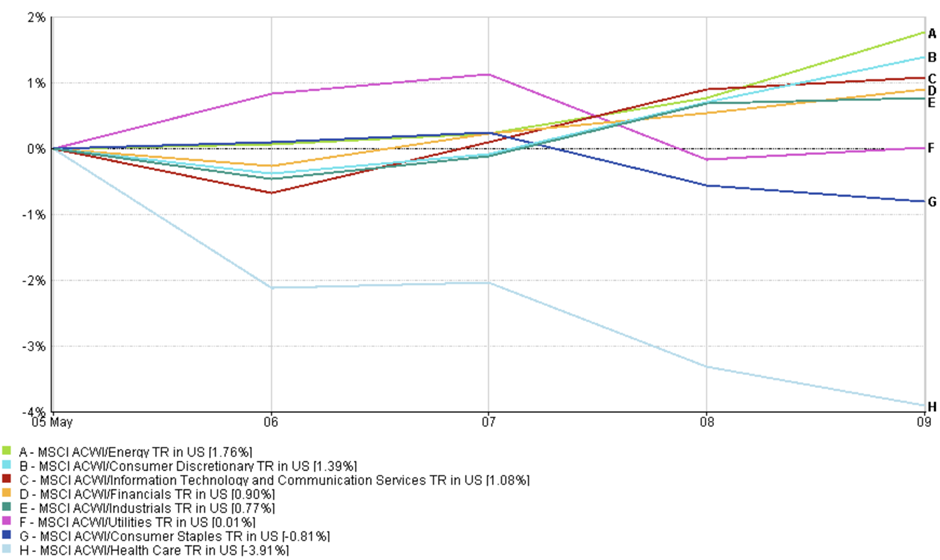

Sector Performance Updates

Energy maintained its position as the top performer after its 1.76% increase because oil prices recovered due to better demand expectations and reduced inventory levels. Consumer discretionary stocks rose 1.39% because of positive earnings reports from Lyft but Expedia and Sweetgreen faced challenges from consumers who cut back on spending.

Technology stocks increased 1.08% during this period because investors adjusted their AI and cloud valuation expectations but maintained their positive outlook on fundamental growth drivers. Financials (+0.90%) rose steadily ahead of inflation data and central bank updates, while industrials advanced 0.77%, supported by easing trade tensions and stable earnings from logistics and manufacturing firms.

Sector Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 9 May 2025.

The defensive sectors showed minimal movement during the week because utilities (+0.01%) and consumer staples (−0.81%) experienced limited changes as market risk appetite improved. The health care sector experienced the largest decline of −3.91% because biotech and pharmaceutical companies reported weak earnings and faced valuation issues.

The market experienced a small shift toward growth-oriented sectors during the week while investors maintained a hopeful outlook about earnings performance and international trade stability.

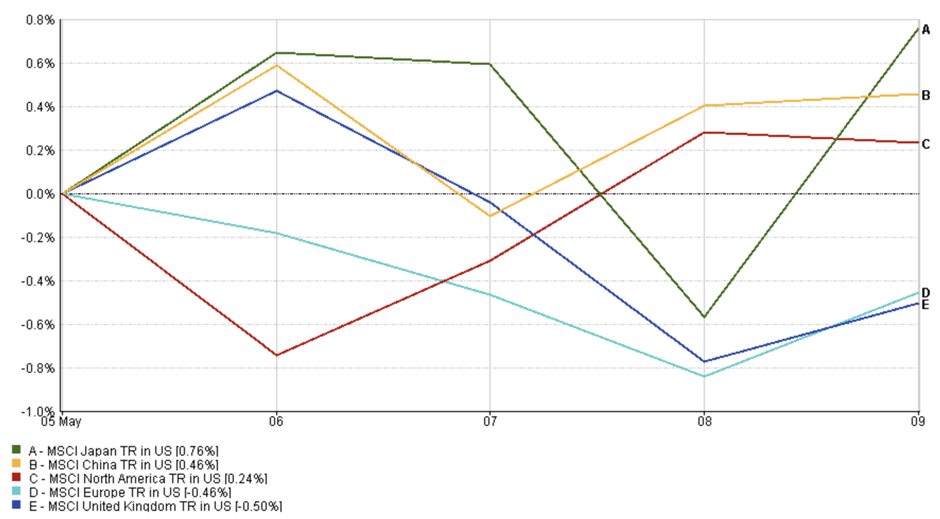

Regional Market Updates

The MSCI Japan Index demonstrated the highest regional performance by increasing 0.76% throughout the week. The Japanese yen's decline together with stable earnings growth in automotive and industrial sectors propelled market gains.

The MSCI China Index increased 0.46% because investors showed cautious optimism. The market showed slight improvement in sentiment because investors anticipated policy support and stable US-China relations despite weak trade and growth data.

The MSCI North America Index achieved a 0.24% increase because investors maintained limited risk tolerance. The US stock market showed mixed results because financial and consumer sectors gained strength, but technology stocks experienced profit-taking after their recent earnings peaks. The upcoming inflation data and Federal Reserve decision uncertainty maintained a cautious market sentiment.

Regional Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 9 May 2025.

The MSCI Europe Index slipped 0.46% as investors adopted a cautious stance ahead of macro data releases. Defensive sectors held firm, but weak industrial production in Germany and soft earnings elsewhere weighed on the broader market.

And the MSCI United Kingdom Index fell 0.50%, underperforming peers. A stronger pound and softer economic data weighed on UK multinationals, though select mining and energy names provided some support.

Currency Market Movements

Currency markets were mostly calm but showed underlying shifts tied to inflation expectations and central bank policies.

EUR/USD declined over the week, opening at 1.1315 on May 5 and falling to a low of 1.1228 on May 9, before closing slightly higher at 1.1248, marking a weekly decline of -0.42%. The drop reflected stronger US yield support and investor caution ahead of CPI data.

USD/JPY rose early in the week on widening policy divergence but retraced gains slightly by Friday. It moved from 143.71 on May 5 to a high of 145.92 on May 9, eventually closing at 145.36, up +0.28% for the week.

GBP/USD started the week at 1.3293 and ended at 1.3306, gaining +0.26%, with little directional conviction as markets awaited the BoE’s policy guidance.

GBP/JPY showed the clearest strength, rising from 191.04 on May 5 to 193.41 by May 9 – a +1.24% weekly gain, driven by yen weakness and stable pound support.

Overall, FX markets reflected low volatility but remained sensitive to yield spreads, central bank outlooks, and macroeconomic headlines.

Market Outlook and the Week Ahead

The market sentiment remains cautiously optimistic during May because of strong earnings reports and new trade developments yet inflation and interest rate concerns continue to affect market sentiment.

The upcoming week will focus on US inflation data which will be released in the middle of the week. The market seeks evidence that price pressures remain under control after receiving conflicting signals about inflation. The market will interpret a lower-than-expected inflation reading as evidence for a dovish Federal Reserve policy shift in the current quarter, but a sudden inflation surge will reduce expectations of short-term rate cuts.

The market will continue to monitor US-China trade negotiations throughout the week. The Geneva talks from last week restored optimism about the possibility of official de-escalation through the 90-day tariff truce. The market will immediately respond to any news about trade progress or increased tensions as the July 8 deadline approaches.

The earnings season continues to produce relevant results as Airbnb and Arm share their findings about post-pandemic travel patterns and AI market demand and consumer confidence. The overall corporate America performance shows resilience although it remains moderate.

Geopolitics and oil markets also remain on the radar. Investors will watch for updates on potential fiscal stimulus in Europe and any disruption in energy flows that could pressure inflation anew.

Volatility has pulled back – the VIX dipped to 21.9 – but with central banks, trade negotiations, and inflation data still in flux, the environment remains fragile. Markets have steadied, but confidence is tentative.

Stay tuned with EC Markets as we continue to break down the moves that matter.