It’s fair to say that Q2 didn’t unfold the way many had expected at the start of April. We came into the quarter on the back foot – tariff announcements out of Washington, tensions in the Middle East, and renewed questions about global demand. There was nervousness around earnings, central bank direction, and whether the late Q1 wobble would turn into something more prolonged.

But instead of sliding further, markets found their footing. And then some.

By June’s end, most major asset classes were not just positive – they were strong. Equity markets, particularly in the US and Europe, rebounded with force. Bonds regained relevance as yields eased and confidence returned. Gold broke new highs. Even the US dollar, after holding up stubbornly for much of 2024, finally lost ground. It felt like the “risk-on” switch had been flipped – but this time, with a bit more selectivity and a lot more data to chew on.

Macroeconomic Landscape: Less Panic, More Patience

United States: Despite the tariff noise, US macro data held up. Inflation cooled further – Core PCE continued drifting lower, and headline CPI fell back toward the Fed’s comfort zone. The labour market remained solid, but with just enough moderation to give the Fed room to breathe. All this paved the way for the central bank to maintain a dovish tilt, even as markets stopped expecting aggressive rate cuts. The US economy isn’t roaring, but it’s not breaking either. Q2 GDP prints are tracking a soft landing scenario – slow but not recessionary.

Europe: In contrast to the hand-wringing across the Atlantic, Europe felt surprisingly upbeat. The ECB delivered two rate cuts over the quarter – one in April, another in June – and fiscal engines kicked in, particularly in Germany and France. Inflation has been tamer here for longer, and business sentiment surveys (especially in the services sector) began turning upward. The UK, too, defied expectations. Inflation eased more than forecast, consumer data surprised to the upside, and the BoE signalled a possible summer cut.

Asia & Emerging Markets: China’s numbers remain patchy – some green shoots in retail and industrial production, but real estate remains fragile. What helped was a notable improvement in geopolitical tone between the US and China, which underpinned sentiment and supported capital flows. Elsewhere, Korea benefited from a tech export boom, India cooled slightly after a strong run, and EM economies in Latin America and Eastern Europe outperformed as rate differentials and FX dynamics worked in their favour.

Equity Market Recap: Risk Back On, but Selectively

United States: US equities rebounded decisively in Q2. The S&P 500 gained 10.41%, while the Nasdaq-100 surged 16.9%. But this wasn’t the kind of rally where everything flies. Investors focused on quality and earnings clarity. Nvidia, ASML, and Meta led the charge – not because of hype, but because they delivered. Meanwhile, speculative growth names without clear cash flow stories lagged. April’s tariff-related jitters gave way to May-June’s broader relief rally, helped by dovish Fed speak and strong Q1 earnings season follow-through.

Europe: Europe continued to surprise. The Euro Stoxx 50 rose 13.5% in USD terms, led by financials and industrials. UK equities delivered 8.76%, buoyed by consumer resilience and disinflation. The story here is less about tech and more about rotation. Cyclicals outperformed defensives, banks benefitted from steepening yield curves, and value names finally got some attention. Political risk (e.g. French elections) remained in the background but didn’t derail markets.

Asia & EM: China stabilised. Sentiment picked up on improving US-China relations and targeted stimulus. Korea saw a semiconductor-led surge, and Taiwan followed suit. India, after months of leading EM performance, consolidated somewhat as valuations caught up with growth. Overall, the MSCI Emerging Markets Index rose 11.05% in USD terms, outperforming developed peers.

Q2 2025 Index Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 30 June 2025.

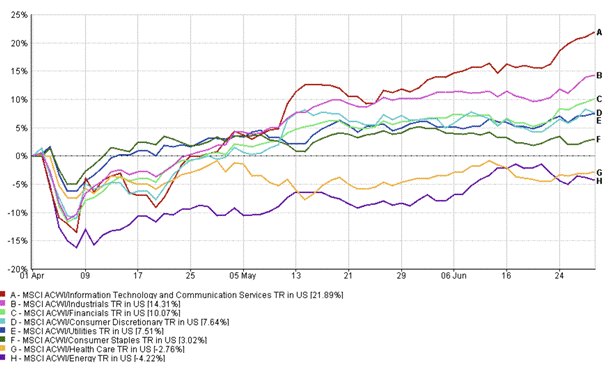

Sector Rotation and Market Themes

Growth Regains Leadership: Q2 marked a reversal from Q1’s value-driven rotation. Growth stocks outpaced, but it wasn’t a repeat of 2021. This time, quality mattered. Investors rewarded names with both AI exposure and earnings credibility. Nvidia, Meta, ASML – all stood out. Meanwhile, less-established players with stretched multiples didn’t fare as well.

Financials & Cyclicals Rebound: Stabilising yields helped banks. In Europe especially, steepening curves and improving loan demand boosted performance. Industrials caught a bid too, helped by infrastructure and reshoring tailwinds. Small caps also found a pulse after a long slump, aided by renewed risk appetite.

Defensives Under Pressure: Utilities and staples underperformed. With real yields falling and central banks turning dovish, the need for "bond proxy" equities waned. Investors shifted into higher-beta exposures.

Q2 2025 Sector Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 30 June 2025.

Fixed Income: Back in the Game

After a brutal 2024, bonds are quietly making a comeback. Treasury yields fell from their April highs, credit spreads tightened, and returns turned positive across the board. Investment-grade credit returned over 4% for the quarter, high yield added 3.6%, and global bonds regained their traditional role: diversification and income.

The biggest change was sentiment. After Q1’s wobble, investors began to believe again in the defensive properties of fixed income. Emerging market debt also posted solid gains – local rates declined, and FX appreciation added to returns.

Fixed Income Government Bond Returns

Source: Bloomberg, LSEG Datastream, J.P. Morgan Asset Management. All indices are Bloomberg benchmark government indices. Total returns are shown in local currency, except for global, which is in US dollars. Past performance is not a reliable indicator of future performance. Data as of 30 June 2025.

Commodities and Currencies: Gold Shines Oil Slips

Gold was the standout, with the Bloomberg Gold Subindex Total Return gaining 5.35% in Q2, it benefitted from falling real yields, a softer dollar, and continued central bank buying. It’s rare for gold to rally alongside equities and bonds, but Q2 was an exception.

Oil, however, struggled. After flirting with $80 early in the quarter, Bloomberg WTI Crude Oil Subindex Total Return fell 4.80%. Supply looked more secure, geopolitical premiums faded, and demand optimism around China failed to materialise fully. The structural case for energy remains – but this quarter wasn’t kind to the space.

Meanwhile, the MSCI World Metals & Mining Index rose 6.08%, reflecting stronger demand for industrial metals amid global infrastructure stimulus and re-shoring trends.

Q2 2025 Index Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 30 June 2025.

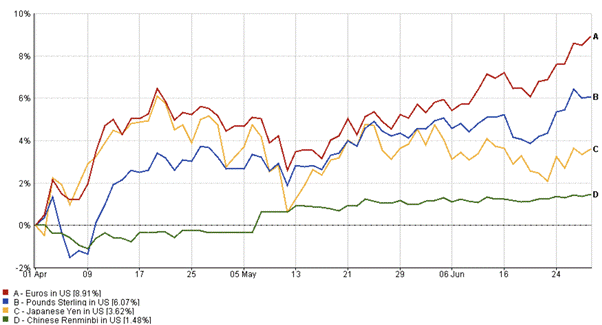

The US dollar had its weakest quarter since 2020, weighed down by dovish Fed expectations and stronger foreign growth.

The euro rose 8.91% (EUR/USD), while the pound gained 6.07% (GBP/USD) on improving sentiment.

Q2 2025 Currency Dynamics

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 30 June 2025.

The yen added 3.62% (JPY/USD) amid BoJ policy speculation, and the renminbi firmed 1.48% (CNY/USD) as China stabilized.

Stronger EM currencies also helped boost global investor returns.

Emerging Investment Themes

1. Central Bank Calibration: The easing cycle has begun – but it’s cautious, data-driven, and not one-size-fits-all. Markets are betting on cuts, but timing and magnitude vary widely. The Fed may wait until Q3; the ECB and BoE are already moving.

2. Policy Divergence: Europe is stimulating while the US tightens fiscally. That divergence could continue to drive relative equity and FX performance.

3. AI, yes – but measured: The AI trade is alive, but no longer indiscriminate. Investors want growth, but not at any price. Expect more dispersion within tech.

4. EM in Focus: Real yields, FX strength, and peaking inflation make EM assets attractive. But country-specific risks haven’t gone away.

5. Valuation Discipline: With markets having rallied hard, valuation matters again. There’s still opportunity – but less margin for error.

Conclusion: A Quarter That Surprised

Q2 reminded us that narratives can shift quickly. From April’s anxiety to June’s optimism, markets absorbed a lot – and still came out stronger. It wasn’t a one-way street, but the overall message was clear: the global economy isn’t breaking, and risk appetite is coming back.

That doesn’t mean it’s time for complacency. Earnings clarity, central bank language, and policy shifts will matter more than ever. But if the last three months are any guide, investors who stayed patient and diversified were rewarded.

The second half of 2025 is shaping up to be all about balance – between risk and safety, between growth and value, and between headline noise and real fundamentals.