Economic Overview

The latest US data gave a bit of a mixed signal. On one hand, the economy is clearly slowing down. But on the other, inflation – or the general rise in prices — is still hanging around.

The Fed’s favourite inflation measure, called core PCE, edged up slightly to 2.7% in May. That’s a sign that price pressures aren’t going away just yet, which means the Fed may wait longer before cutting interest rates.

Meanwhile, consumer confidence fell in June – more people are starting to worry about their job security. Although fewer people filed for unemployment last week, the number of people still on benefits reached a three-year high, suggesting it’s getting harder to find a new job.

Other data showed that the economy is still growing, but only slightly. Business activity picked up a little, but rising costs – especially from new tariffs – are starting to hurt.

Outside the US, growth is also sluggish. Europe and the UK are barely growing, and Japan is improving slowly. Inflation is still too high in many places, so central banks are staying cautious for now.

In short: The economy is cooling, but inflation is too sticky for central banks to relax just yet.

Equities, Fixed Income, and Commodities

US stocks had another strong week, with the Nasdaq-100 and S&P 500 hitting new record highs, driven by solid tech earnings and upbeat labour data. AI-focused stocks like Nvidia continued to gain momentum, helping push the broader market up roughly 1–2%.

In Europe, the mood was more cautious. The STOXX 600 slipped as banks and mining names came under pressure from global trade worries. The UK’s FTSE 100 was flat, with strength in energy stocks offsetting fiscal concerns.

Japan’s Nikkei hovered near record levels, supported by optimism around exports and global growth, though it ended the week little changed.

Bond markets made headlines, too. In the US, Treasury yields surged after a strong jobs report, with the 2-year at 3.89% and the 10-year reaching 4.35% – a sign that investors are pushing back their Fed rate cut bets. UK gilt yields also spiked to 4.68%, the sharpest jump since 2022, driven by election-related spending concerns.

In commodities, oil prices dipped, with Brent at $69 and WTI at $67, as traders weighed OPEC+ supply risks. Gold held near multi-year highs, supported by safe-haven demand, and gold miners gained nearly 3%.

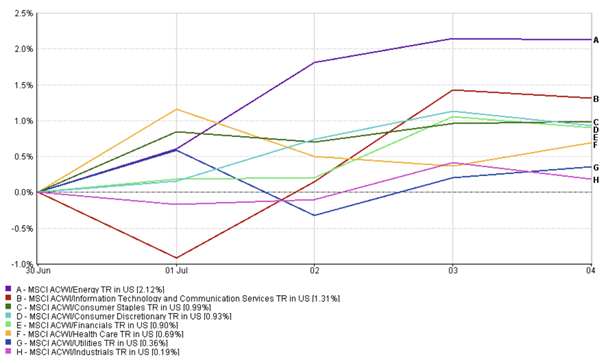

Sector Performance Updates

Growth and cyclical sectors held the spotlight this week, while defensive names mostly trailed.

Energy led the pack with the MSCI ACWI Energy Index up 2.12%. Despite mid-week volatility in oil prices, optimism around OPEC+ production and a stable demand outlook helped keep the sector in favour.

Technology and communication stocks followed closely. The MSCI ACWI Info Tech & Comms Index gained 1.31%, powered by the ongoing AI rally and strong performance from key players.

Sector Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 06 July 2025.

Financials added 0.90%, as rising bond yields and solid earnings sentiment gave the sector a boost. Consumer sectors also did well – Staples rose 0.99%, and Discretionary gained 0.93%, showing that investors were still embracing risk-on trades earlier in the week.

Defensive sectors lagged behind. Utilities inched up just 0.36%, and Industrials were nearly flat at +0.19%. These traditionally safer sectors were out of favour as equities rallied. Healthcare offered a middle ground, rising 0.69%, likely supported by its earnings consistency and low volatility appeal.

In short, investors rotated into growth and cyclicals – with Energy and Tech emerging as the week’s clear winners.

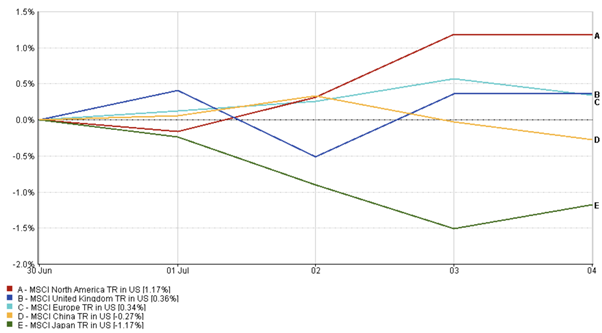

Regional Market Updates

It was a mixed week across global markets – and the numbers make that clear.

North America outperformed, with the MSCI North America Index up 1.17%, led by US equities. Optimism around AI, solid economic data, and resilient consumer trends kept momentum strong. Canada also edged higher, helped by firm commodity prices and a stronger loonie.

Europe saw modest gains. The MSCI United Kingdom Index rose 0.36%, and the MSCI Europe Index added 0.34%, supported by energy stocks. However, concerns around fiscal policy and weaker US earnings capped gains.

Regional Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 06 July 2025.

Asia lagged. The MSCI Japan Index dropped 1.17%, dragged down by a firmer yen and softer corporate sentiment. Meanwhile, the MSCI China Index slipped 0.27% amid renewed trade tensions.

Overall, while the US stayed in rally mode, global momentum was more uneven – reflecting the diverging macro and policy outlooks across regions.

Currency Market Movements

The US dollar had a rollercoaster week – starting off weak but finishing stronger.

It initially dropped to multi-year lows as concerns over fiscal uncertainty and new tariffs weighed on sentiment. That gave the euro (EUR/USD) room to climb, reaching as high as 1.1783, its strongest level in four years.

But stronger US jobs data and renewed safe-haven demand helped the greenback recover. The euro slipped to around 1.1754, while the British pound (GBP/USD) also pulled back – falling from 1.3725 to 1.3645 – as a rise in UK bond yields and political uncertainty pressured sterling.

The Japanese yen (USD/JPY) weakened slightly, rising from 144.0 to 145.0 against the dollar. The move reflected the widening interest rate gap between the US and Japan, especially after a BoJ official hinted at potential hikes – an unusual stance for the traditionally dovish central bank.

In the end, the US dollar index rose by 0.4%, closing near 97.1. Shifting interest rate expectations and global risk sentiment were the key drivers throughout the week.

Market Outlook and the Week Ahead

Looking ahead, investors will be digesting the latest US jobs report and watching for fresh clues on economic strength. The June payrolls report, released early due to the July 4th holiday, showed solid headline growth – 147,000 jobs added and unemployment ticking down to 4.1%. But a deeper look showed weaker private sector hiring, which could point to a slowly cooling labour market.

This mixed signal keeps the Fed in a tricky spot: the strong headline makes immediate rate cuts unlikely, but softer hiring beneath the surface still leaves room for easing later this year.

Eyes are also on the ISM Services PMI and consumer confidence numbers, which will show whether demand is holding up or slowing down. Globally, investors are watching Japan’s upcoming election and any announcements from China on new economic stimulus.

Geopolitical risks haven’t gone away either – especially in the Middle East – and trade tensions could flare as the US-China tariff agreement nears expiration on July 9.

Even so, sentiment remains positive. Global stock funds just saw their biggest inflows since November 2024 – a sign that many investors are still willing to bet on markets, even as they stay alert.