Economic Overview

This week’s economic data showed a mix of cooling inflation and slow-but-steady growth. In the US, the Fed’s preferred inflation measure – core PCE – rose just 0.2% in May, bringing the annual rate to 2.7%. That’s close to the Fed’s 2% target, supporting the idea that price pressures are easing. However, Americans are spending more cautiously: personal spending dipped for the second time this year, and consumer confidence fell sharply in June as worries about jobs and the economy grew. Jobless claims edged down slightly, suggesting the labour market is cooling gradually.

Growth outside the US continued to look fragile this week. In the Eurozone, economic momentum stayed weak – services activity barely held up, and manufacturing output declined once again. The UK economy showed slight improvement as new orders picked up, but that wasn’t enough to stop businesses from cutting jobs. The US remained more resilient, with steady growth in services and an uptick in manufacturing. Japan showed the strongest signs of recovery, with output improving across the board. Central banks now appear more cautious – waiting to see how inflation and global risks evolve before making their next move.

Equities, Fixed Income, and Commodities

Markets had a strong week, driven by easing inflation fears and a welcome break in Middle East tensions. In the US, major stock indexes like the S&P 500 and Nasdaq-100 hit record highs, with the Nasdaq officially entering a new bull market. Investors were encouraged by signs that interest rates may have peaked – and by news of a ceasefire between Israel and Iran, which helped calm nerves after last week’s oil-driven volatility.

European markets rose more modestly. Weak economic data and a stronger euro held back gains, especially in energy-heavy indexes like the FTSE 100. In Japan, improving business activity and a stronger yen helped lift stocks, though exporter gains were slightly capped.

Interestingly, bonds rallied alongside stocks – a rare pairing – as investors grew more confident that central banks could start easing. US Treasury yields dropped sharply, especially short-term rates, reflecting growing bets that the Fed might cut rates by September. UK and European bond yields also dipped on similar hopes.

Commodities made big moves. Oil prices plunged approximately 12% last week – marking their steepest weekly drop since mid-2022. Brent crude tumbled from about $75.20 per barrel on Monday (24 June) to a low near $66.20 by Friday (28 June), before settling around $67–68. Similarly, US WTI crude fell from roughly $70.50 to below $62, ending the week near $63.50.

Gold pulled back slightly but remained elevated (around $3,310/oz by Friday), still supported by uncertainty and falling interest rates.

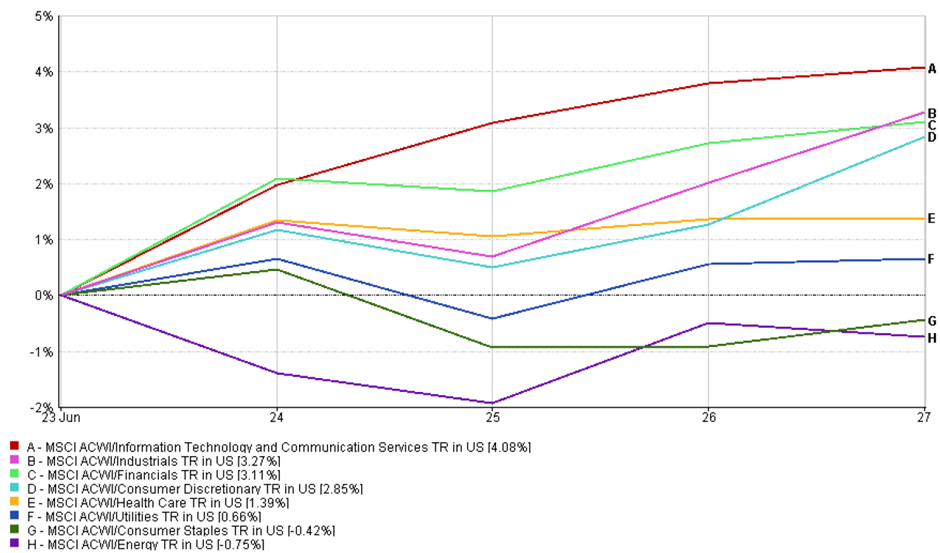

Sector Performance Updates

Growth sectors took the lead this week as investors rotated back into riskier assets. Technology and Communication Services were out in front, rising 4.08%. The drop in bond yields gave these rate-sensitive names a boost, while ongoing excitement around AI kept big tech firmly in favour.

Industrials climbed 3.27%, helped by stronger-than-expected US durable goods orders and easing geopolitical tensions, which lifted sentiment around global trade and infrastructure.

Financials gained 3.11% as equity markets rallied and yield curves steepened slightly – a trend that tends to support bank profitability.

Sector Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 29 June 2025.

Consumer Discretionary stocks added 2.85%, recovering from last week’s dip. Lower oil prices and upbeat corporate updates in retail and travel helped restore confidence in consumer spending.

Defensive areas were less popular. Healthcare rose just 1.39%, as investors focused more on higher-growth opportunities. Utilities edged up 0.66%, and Consumer Staples slipped 0.42% – both reflecting a classic risk-on rotation.

Energy was the clear laggard, falling 0.75% for the week. The sharp drop in oil prices – Brent crude fell over 12% – reversed last week’s war-driven gains and weighed heavily on oil and gas stocks.

Overall, the shift toward cyclicals suggests growing market confidence that falling inflation and cooling geopolitical risks could pave the way for a more supportive backdrop as we enter July.

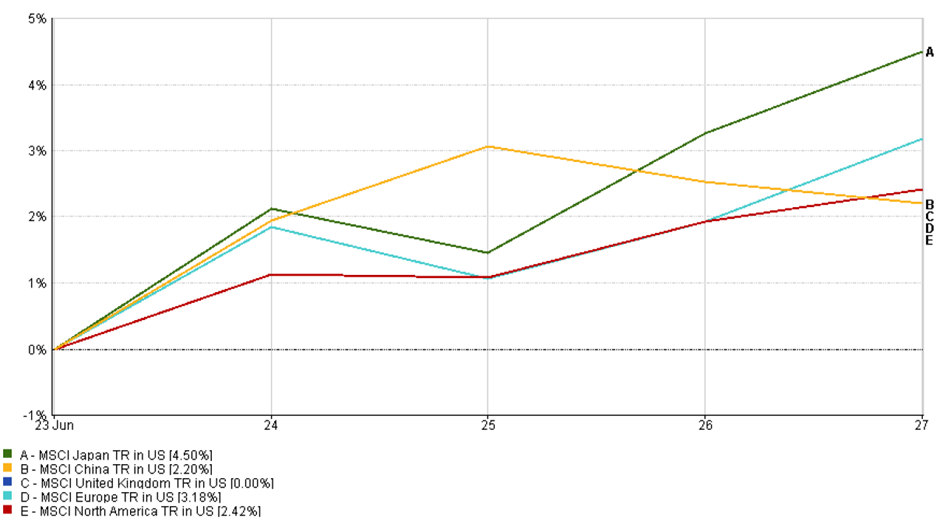

Regional Market Updates

Japan outperformed global markets this week, with the MSCI Japan Index rising 4.5%. Investors responded positively to better-than-expected factory data and reassurance from BoJ, which kept policy steady. The upbeat tone in global equities also helped boost sentiment.

Regional Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 29 June 2025.

Europe also put in a strong showing. The MSCI Europe Index rose 3.18%, helped by easing inflation signals and falling oil prices, which supported retailers and travel names. That said, the gains weren’t as sharp as Japan’s—ongoing weakness in manufacturing and a firmer euro held the region back from taking full advantage of the risk-on mood.

In North America, stocks continued to climb. The MSCI North America Index added 2.42%, as optimism around potential Fed rate cuts and receding geopolitical fears helped fuel another strong week, especially for tech and growth sectors.

China posted a more modest gain. The MSCI China Index rose 2.2%, helped by a weaker dollar and growing speculation that authorities could roll out new stimulus measures. However, concerns about the pace of China’s economic recovery kept gains in check.

The UK market was flat, ending the week unchanged. While global sentiment was broadly positive, falling energy prices and a stronger pound weighed on export-heavy UK stocks, limiting upside.

Currency Market Movements

The US dollar weakened sharply this week, as easing war fears and growing expectations of interest rate cuts pulled investors away from the safe-haven greenback. The dollar index dropped about 1.5%, hitting multi-year lows – a stark reversal from last week’s strength.

The euro (EUR/USD) was one of the biggest gainers, rising from $1.1578 to $1.1720 – its highest level in over three years. The move was driven by the combination of cooling US inflation, softer Fed messaging, and a shift in interest rate expectations. With the ECB signalling a pause after its recent cuts, traders now see the Fed as more likely to ease first, which eroded the dollar’s rate advantage.

The British pound (GBP/USD) jumped even more – up around 1.4%, finishing the week near $1.3716. The BoE’s decision to hold rates steady (while still warning about persistent inflation) made sterling more attractive. UK PMI data showing rising new orders also gave the pound a boost.

The Japanese yen (USD/JPY) strengthened to ¥144.67, up about 1% against the dollar. Lower US yields narrowed the gap between American and Japanese interest rates, helping the yen climb despite the risk-on mood in markets.

The GBP/JPY pair nudged slightly higher to ¥198.4, as both currencies strengthened against the dollar. Meanwhile, the Swiss franc and euro also gained ground, underscoring a broad theme: dollar weakness.

All in all, shifting rate expectations and reduced safe-haven demand sent the dollar sliding – lifting most major currencies in its wake.

Market Outlook and the Week Ahead

As we enter the first week of July, investors are preparing for a busy slate of economic data and keeping a close eye on geopolitical risks. The spotlight will be on US employment figures, due Friday (or Thursday – because of the July 4th holiday). A weaker jobs report could cement the case for a Fed rate cut as early as September, while a strong showing might push that timeline out.

Outside the US, China’s PMI and Eurozone inflation data will guide expectations around stimulus and ECB action. Meanwhile, traders remain alert to any flare-up in Middle East tensions or developments in US–China trade talks, both of which could jolt sentiment.

Overall, while optimism is building on Fed cut hopes and easing oil prices, any surprises – good or bad – could trigger sharp moves. Investors are staying nimble as July begins.