Economic Overview

The markets began the week with uncertainty because investors maintained a cautious stance due to ongoing trade disputes and weak economic indicators. Global trade flows and business confidence suffered from April's severe US tariff increases which led investors to buy safe-haven assets including gold and government bonds earlier during the week.

Mid-week, market sentiment started to turn a little more optimistic. Investors took comfort in reports from the White House suggesting that tariffs on automotive imports might be rolled back – a signal that trade tensions may not spiral further. Adding to the relief, China’s Commerce Ministry expressed interest in restarting trade talks, which helped ease some of the diplomatic strain. On top of that, a round of stronger-than-expected earnings from major US and European companies reassured investors that the underlying business environment was still solid.

The markets shifted from defensive to cautiously constructive during the final period of the week. Risk appetite showed signs of recovery because of the improved tone despite ongoing uncertainty about the absence of a formal trade agreement. Investors received positive news about potential worst-case scenarios being averted but they continued to doubt that US-China trade negotiations would produce meaningful progress. The market sentiment entered May with a mixture of cautious hope.

Equities, Fixed Income, and Commodities

The equity markets experienced their second consecutive week of growth because of declining trade tensions and positive technology sector earnings. The S&P maintained its upward trend by increasing its value from the previous week while the Dow Jones together with the Nasdaq showed positive movement. The market received positive signals from Microsoft and Meta's strong earnings but investors became cautious when Apple and Amazon shared their less optimistic outlooks during the week's latter half. The STOXX 600 together with European major continental indices reached their highest points in weeks because of positive corporate earnings reports and expectations about a US–China tariff agreement. The Nikkei 225 in Japan rose strongly because of a depreciating yen and positive automotive sector performance yet the Shanghai Composite in China maintained stability because investors remained cautious about domestic stimulus announcements despite renewed trade optimism.

The bond market reflected the changing level of risk exposure. The initial part of the week brought US Treasury bond appreciation which drove the 10-year yield down to its lowest point in two weeks because investors moved their funds to safer assets. The 10-year yield made a comeback in the latter part of the week because investors returned to risk-taking positions before the Fed’s meeting. The 10-year yield maintained its position at the beginning of the week. European bund yields reached their lowest point in months before Friday's increase because investors anticipated BoE’s interest rate cuts and additional ECB dovish monetary policies.

The commodity market produced conflicting market signals. Gold prices retreated from their historic peak above $3,300/oz during the early part of the week because market volatility decreased before the metal regained value because of ongoing macroeconomic uncertainties. Oil prices experienced significant volatility because weak demand and abundant supply pushed prices down before the market rebounded when US inventory drawdowns and improving trade sentiment increased demand expectations.

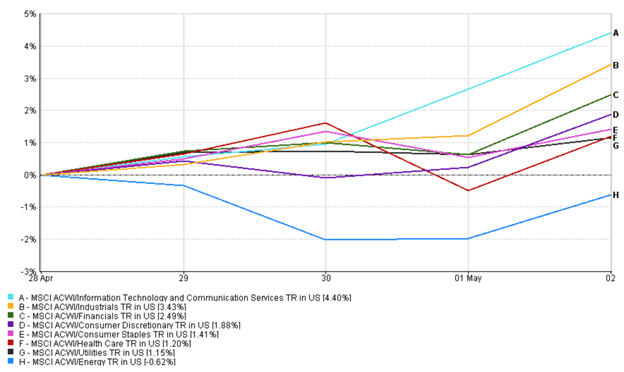

Sector Performance Updates

Investors experienced a major leadership change when they transitioned from being cautious to optimistic during the previous week. The early market trend toward risk aversion caused utilities (1.15%) and consumer staples (1.41%) to increase slightly because these sectors maintained stable earnings and had minimal exposure to worldwide trade. The health care sector (1.21%) experienced mixed results (as per the chart line below) because its safe-haven appeal first lifted the sector before Eli Lilly's stock price dropped significantly due to disappointing obesity drug updates and increased market competition.

The market sentiment shift during mid-week led investors to direct their funds toward cyclical and growth sectors. Technology, with a 4.4% positive returns last week, emerged as the market leader because Microsoft, Meta, and Alphabet delivered strong earnings which made investors feel more confident about their AI and cloud spending. The retail sector's positive results together with tariff relief expectations boosted consumer discretionary (1.88%) stocks but Apple and Amazon limited market optimism through their conservative guidance.

Sector Winners and Losers: Weekly Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 2 May 2025.

The initial market reaction toward industrials and autos involved volatility because General Motors halted buybacks because of tariff concerns and European automakers released profit warnings. The market experienced a positive shift (return of 3.43%) when trade tensions eased during the latter part of the week. Financial institutions (2.49%) experienced continuous growth because European banking institutions HSBC and Deutsche Bank produced positive earnings reports.

The market ended the week with tech and consumer discretionary sectors leading the gains while defensive sectors maintained stability which indicated growing investor confidence at a cautious pace.

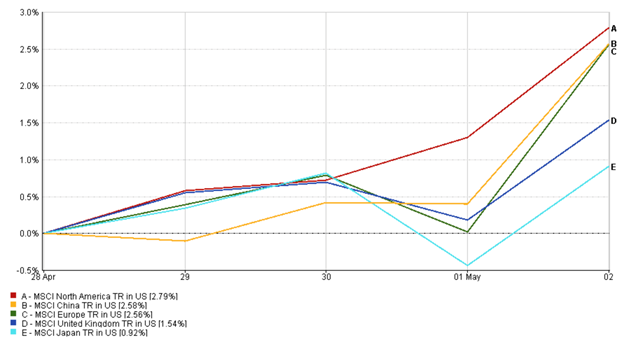

Regional Market Updates

The MSCI North America Index rose by 2.79%, making it the best-performing region during the week. Strong tech earnings from Alphabet, Meta, and Microsoft powered gains in US equities, with the Nasdaq extending its longest winning streak since 2019. Although Apple and Amazon offered more cautious outlooks, their solid results helped maintain investor confidence. Overall, the US market remained resilient, bolstered by upbeat corporate earnings and easing trade tensions.

The MSCI China Index climbed 2.58%, reflecting a rebound in sentiment after a slow start to the week. Renewed hopes for resumed US-China trade talks, combined with policy support signals from Beijing, encouraged flows into Chinese equities. However, caution lingered due to weaker domestic economic data and the absence of major stimulus announcements.

The MSCI Europe Index gained 2.56%, as investors welcomed strong earnings from major banks and industrial firms. Hopes of a tariff truce between the US and EU helped automotive stocks recover, while Deutsche Bank and HSBC delivered solid results, driving financials higher. The region’s equity gains also reflected expectations of continued central bank support.

The MSCI United Kingdom Index returned 1.54%, supported by upbeat retail sales and earnings reports. However, strength in the British pound and firming rate cut expectations capped gains toward the end of the week, particularly for multinational stocks on the FTSE 100.

Japan lagged other regions, with the MSCI Japan Index up just 0.92%. A weaker yen and strong corporate earnings lifted the Nikkei 225 mid-week, particularly in autos and machinery, but caution around domestic demand and global growth prospects limited the upside.

Regional Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 2 May 2025.

Currency Market Movements

Currency markets were mixed during the week, driven by shifting central bank expectations and geopolitical sentiment.

EUR/USD began the week at 1.1422 but trended lower as the dollar regained strength amid rising Treasury yields and improving US risk appetite. The pair declined steadily over the week, ending at 1.1296 on May 2 – a weekly drop of -1.1%, with the largest single-day decline seen on April 30.

USD/JPY initially fell to 142.01 on April 28 as geopolitical concerns supported yen demand. However, after the Bank of Japan reaffirmed its ultra-dovish stance mid-week, the yen weakened notably. USD/JPY surged to a high of 145.44 on May 2, closing the week at 144.95, up +2.1%, as the policy divergence widened.

GBP/USD was range-bound but showed a gradual decline, opening at 1.3441 on April 28 and closing at 1.3272 by May 2. Sterling slipped -1.3% for the week, pressured by firming expectations of a Bank of England rate cut.

GBP/JPY tracked broader FX volatility. After trading flat early in the week near 190.88, the pair rallied mid-week to peak at 193.17 on May 1, before easing slightly to 192.40 by Friday. It posted a +0.8% gain for the week, reflecting both pound stability and yen weakness.

Overall, FX markets saw a mild shift from safe-haven flows toward policy-driven volatility, particularly in yen crosses, as traders reacted to central bank tone and yield movements.

Market Outlook and the Week Ahead

After a relief-driven week, investor attention now shifts to a pivotal early May calendar that could validate – or challenge – the market’s optimism. The Fed meets on Wednesday, May 7, with expectations for no rate change. However, Powell’s tone will be critical. Any hint that the Fed is prepared to cut rates if trade-related weakness deepens could bolster equities and bonds. A surprisingly hawkish tone, on the other hand, could undermine confidence. The next day, the BOE is set to cut rates by 25 basis points. Still, Bailey’s guidance will drive UK asset prices, as investors weigh inflation concerns versus growth support.

Trade tensions remain the wild card. The 90-day US-China tariff truce is halfway through, and the July 8 expiry looms. With key issues unresolved, markets may become sensitive to headlines from any high-level meetings. China’s April trade report on Friday will offer fresh evidence of the tariff impact, particularly on exports to the US.

Earnings season continues with reports from AMD, Disney, Uber, and Palantir, offering insights into tech, AI, and consumer behavior. The VIX has dipped below 25, but volatility may resurface. In short, the coming week could either reinforce the rebound – or reignite caution – depending on how policymakers respond. Guarded optimism remains the prudent stance.