Some of the most significant technology and growth firms in the world, including Apple, Microsoft, Nvidia, Tesla, and Meta (parent company of Facebook and Instagram), are included in the NASDAQ-100, one of the main stock indices in the United States.

Following an exceptional 2024 performance in which the index jumped by more than 27%, the NASDAQ-100 began 2025 on a high note. But the narrative has rapidly evolved. The NASDAQ-100 is currently down 7.38% so far this year as of April 28, 2025.

So, what’s changed – and should investors be concerned?

Quick Pause: What’s the NASDAQ-100?

The NASDAQ-100 is a stock market index, which consists of the 100 biggest non-financial businesses listed on the NASDAQ Stock Exchange. These are a few of the most well-known tech and growth names – like Apple, Microsoft, Nvidia, Amazon, Meta, and Tesla – but also include companies like Costco and PepsiCo.

· Tech-heavy but not tech-only

· Excludes banks and financials

· More focused than the NASDAQ Composite, which includes over 3,000 companies

Due to its composition, the NASDAQ-100 tends to react strongly to changes in interest rates, innovation cycles, and tech trends.

When Did Momentum Shift?

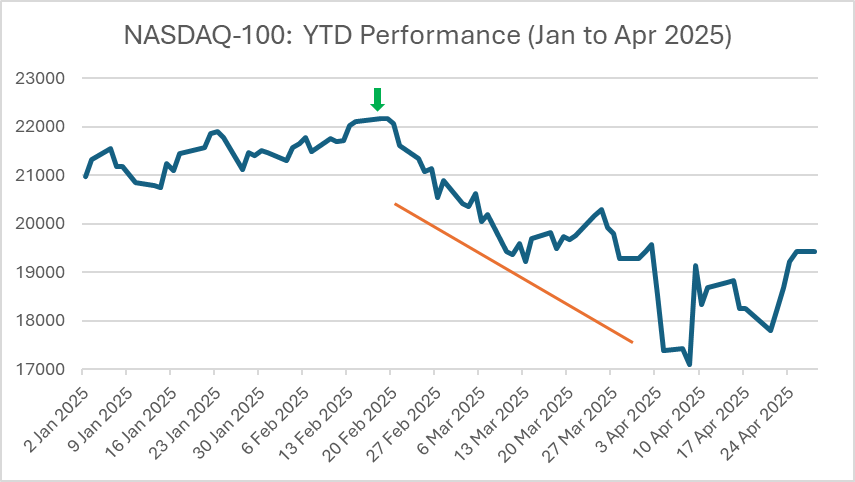

The NASDAQ-100 reached its 2025 peak on February 19, 2025, closing at 22,175.60 points.

At that point, the index had gained 5.72%YTD – fuelled by anticipation that the Fed will lower interest rates, good tech earnings, and excitement surrounding AI.

After February 19, though, the momentum faded.

Concerns over valuation, profit-taking, and growing macroeconomic uncertainties all contributed to the market's dramatic decline in March and April.

The NASDAQ-100 dropped 5.62% in March alone, bringing the YTD decrease to 8.09% by the end of Q1 2025.

NASDAQ-100: YTD Performance (Jan to Apr 2025)

Source: Nasdaq.com. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 29 April 2025.

Why the Drop?

Several factors contributed to the recent pullback:

- Valuation Concerns: After a nearly 50% gain over two years (as of April 2025), many tech stocks were priced for perfection. Even a slight slowdown in earnings or cautious outlooks from executives can trigger significant price drops.

- Narrow Leadership: A few mega-cap names had been doing most of the heavy lifting. When they stumble – even slightly – the index feels it.

- Macro Uncertainty: Rising concerns about trade tensions between US and China, inflation re-acceleration, and mixed economic data have all added pressure.

- Profit-Taking: After last year’s gains (27.01%), some investors are locking in profits – especially institutional players and hedge funds looking to reduce risk.

What the Charts Say

The NASDAQ-100 violated important support points when the market experienced its sell-off in March.

The Relative Strength Index (RSI) showed that the market reached "oversold" levels in early April which often signals a short-term rally unless fundamental factors support it.

The market experienced a small recovery in late April, but investors continue to show caution.

Upcoming Big Tech Earnings: A Crucial Test Ahead

The market volatility will increase because several major tech companies will release their earnings reports starting with Amazon and Apple on May 1, 2025, and Microsoft and Meta Platforms on April 30, 2025.

These businesses collectively represent a major portion of both the NASDAQ-100 and the entire market. Analysts have established high expectations because they forecast IT companies to achieve a 15% profit growth rate by 2025. Several analysts warn that economic conditions make these projections potentially too optimistic.

These businesses face performance risks from ongoing trade disputes and inflationary pressures and shifting consumer behaviour patterns. The supply chain of Apple faces potential disruption from Chinese import taxes while Amazon faces rising competition in its cloud services segment. The higher tariffs have forced numerous third-party retailers to exit the Amazon Prime Day sale.

Investors will pay close attention to these earnings reports to understand how these companies manage the economic environment and their ability to meet or exceed expectations.

Bottom Line

The trajectory of the NASDAQ-100 this year serves as a reminder that markets are not linear.

A cooling-off period was unavoidable following a spectacular 2024, particularly given inflated valuations and escalating macro uncertainties.

Even while there are still many long-term incentives for technological and artificial intelligence advancement, investors would be well to remain nimble.

The secret to handling situations like these wisely and coolly is knowing when excitement becomes too much.

In times of volatility, exploring alternative markets such as forex may offer more flexible trading opportunities. Learn more at EC Markets.